GET IN TOUCH

- Please wait...

The recent Finance Bill 2015, which was announced on 4th June, proposed some changes with respect to direct taxation (income tax). These amendments will be debated in parliament and ultimately become law as the Finance Act 2015. Historically, most proposed changes in the Bill remain unchanged in the final act. Below is a summary of the proposed changes.

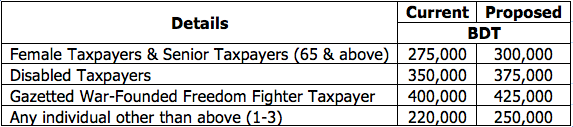

a) Initial exemption limits:

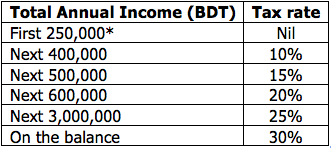

b) Proposed tax slabs for individuals and firms:

*Please refer to (a) above.

c) Non-residents other than Bangladeshi non-residents shall pay tax on total income at a maximum rate of 30%.

d) Minimum tax payable has been fixed at BDT 4,000 whereas previously it depended on the location of an assessee.

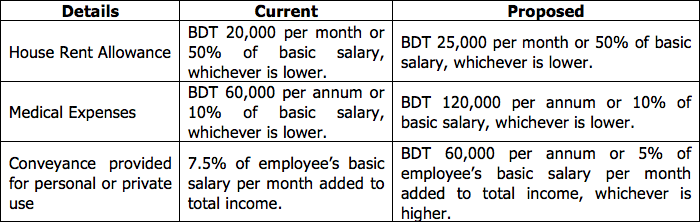

e) Tax allowable benefits (salaried individuals):

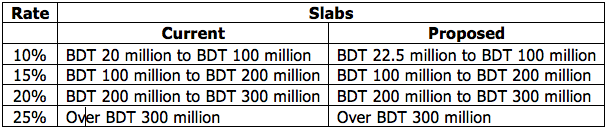

f) Surcharge – Surcharge is payable by an individual assessee on total tax payable if the total net worth exceeds BDT 22.5 million as stated below:

The minimum surcharge payable is BDT 3,000 if net worth exceeds BDT 22.5 million.

g) Investment Rebate – this has remained unchanged at 15% on 30% of total income or BDT 15 million or actual investment, whichever is the lowest.

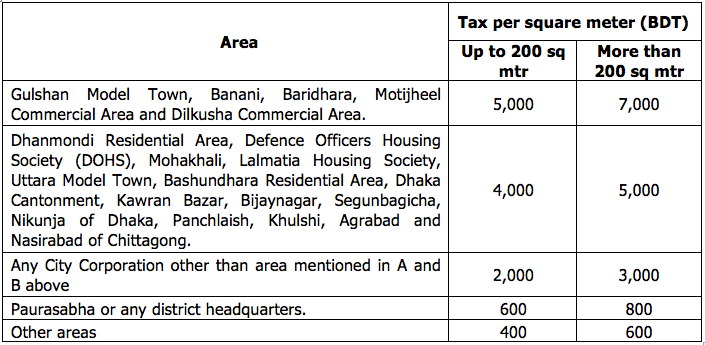

h) Unexplained Income – special tax treatment will be given in respect of investment in residential buildings and apartments and in landed property. Any sum invested by any person in the construction/purchase of any residential building/apartment, and in the purchase of any land shall be deemed to have been explained if tax is paid at the following rates:

The rates will be 20% higher if the assessee makes an investment in two or more buildings/apartments or already has any building or apartment in any City Corporation.

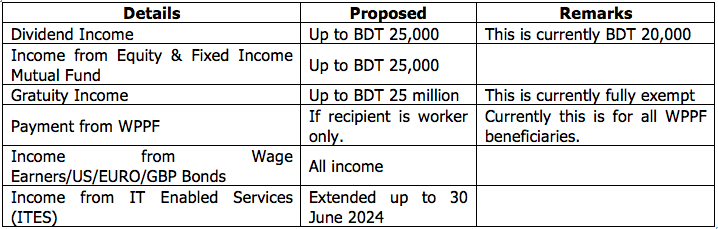

i) Amendment in exclusion from total income (6th Schedule Part A):

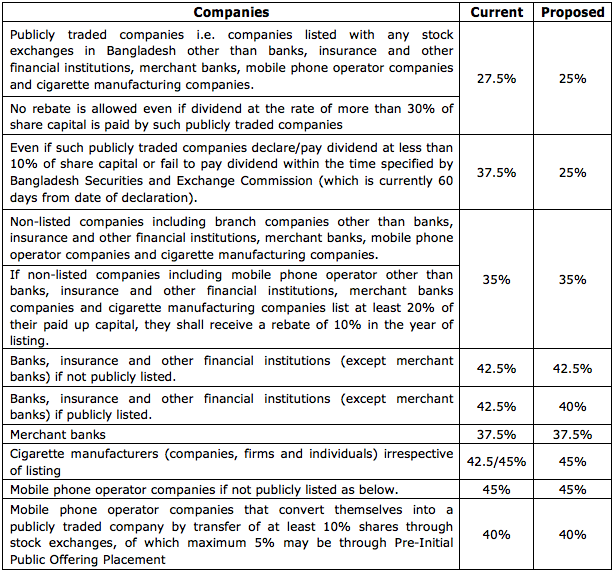

a) Income tax rates for different companies:

b) Definition of the income year – income year is now to end on 30 June. However, for banks, financial institutions, and insurance companies it will remain until 31 December. This is proposed to be implemented from 1 July 2016.

c) Additional tax – Employers of expatriate employees shall be charged an additional tax of 50% of tax payable or BDT 500,000, whichever is higher if prior approval from BOI or other competent authority of the Government has not been obtained for such employment.

d) Minimum tax for companies – Minimum tax rate on gross receipts remains unchanged for companies and firms i.e. 0.30%. However, 0.10% minimum tax shall be applicable for manufacturing companies for the first 3 years after commencement of commercial production.

e) Allowable Excess Perquisites – the allowable limit for excess perquisites has been increased to BDT 450,000 from BDT 300,000.

f) Imported Software – 10% depreciation allowance shall be allowed for import software. However, no obsolescence allowance shall be allowed for imported software.

g) Losses set-off – The assessee cannot set off any loss in respect of any income from any head against any income from the manufacturing of cigarettes.

h) Tax Holiday – Automobile manufacturing industry, bi-cycle manufacturing industry, tyre manufacturing industry, and brick made of automatic Tunnel Kiln technology will be treated as industrial undertakings for the purpose of Section 46B. Tax holiday shall be withdrawn if any industrial undertaking or physical infrastructure employs any expatriate employee without prior approval from BOI or other competent authority of the Government.

a) Time Extension – Upon application for a time extension, the DCT may extend up to 2 months instead of 3 months (current provision) and he may further extend up to another 2 months with the approval of the Inspecting Joint Commissioner of Taxes.

b) Universal Self-Assessment – In the case of submission of the income tax return under the universal self-assessment scheme, a scrutiny assessment procedure has been introduced maintaining a normal selection of audit procedures. An acknowledgment receipt provided by the DCT shall be treated as an assessment order as in previous years. However, the DCT shall issue a demand notice upon correction of an arithmetical error or incorrect claim stated in the submitted tax return after adjusting tax deducted at source, advance income tax paid, and income tax paid under section 74. This process shall be done by the DCT within 12 months from the end of the financial year of the return submitted.

c) Penalty for failure to file a return – Failure to file an income tax return may result in a penalty of 10% of the last assessed tax or BDT 1,000; whichever is higher. However, in the case of an individual, the penalty shall not exceed:

d) Penalty for failure to pay tax on the basis of return – Failure to pay balance tax under section 74 may result in a penalty at the rate of 25% on the total tax payable or on the shortage amount of tax payment.

e) Penalty for furnishing a fake audit report – A penalty of BDT 100,000 shall be imposed on an assessee if a fake audit report is furnished.

This article only contains the major changes indirect taxation (income tax) proposed by the Finance Minister. Other micro-level changes such as changes in various withholding tax rates, changes in VAT regulations have also been proposed and are not included in this document. Should you require further insight into any specific area, please feel free to write to us at the email address given below.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights