GET IN TOUCH

- Please wait...

Recent reports have suggested that the world’s energy supply needs to be doubled. But in order to avoid the realities of climate change, carbon emissions need to be cut by at least 60%.

The odds aren’t really in the oil and gas industry’s favor, what with all the discussion of divestment and unburnable carbon, but if the severe impact of climate change is to be avoided, companies really need to change dramatically in order to lessen their footprint.

It’s highly unlikely that the entire world will get the necessary amount of energy without the help of fossil fuels. Sure, there are other ways to get energy through solar panels and wind farms, but renewable technology is far from perfect. The most advanced solar panel technology from the University of New South Wales can only gather as much as 40% energy from light waves, and wind farms need enormous spaces of land just to be able to generate energy for a small town.

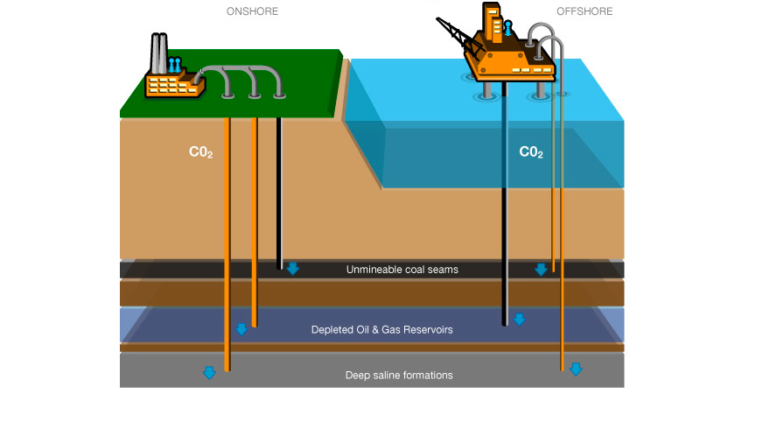

In order to prepare for the low-carbon age, the oil and gas industry’s best bet relies on three technology themes: nuclear, renewable in all forms, and carbon capture and storage (CCS) for both green energy and fossil fuels. So far, CCS is the best bet for a greener world.

CCS is based on proven technologies that have been around for several decades. It is ready to be implemented, scaled, and engineering companies are working tirelessly to support this technology. Sulzer, a long-standing partner of the recently-added member of the Iraq Britain Business Council (IBBC), Unaoil, believes that CO2 emissions from power plants contribute greatly to climate change, which is why it developed pumps and mass transfer equipment that can effectively compress and capture carbon dioxide. According to the Intergovernmental Panel on Climate Change, avoiding CSS could more than double the impact of climate change. In short, in order for the world to lessen its footprint, carbon needs to extracted, confined, and returned underground, which is what CSS is all about.

Of course, this technology will not be able to prosper without people backing it up.

According to Nathan Fabian, Chief Executive of the Investor Group Climate Change Australia, private finance can drive the energy transformation that is needed to meet global emission goals. Although the biggest sum of money is coming from governments, big companies, private equity and venture capital firms, and private investors of all financial levels can consider adding clean energy to their investment portfolios, and there are three ways to do that.

Green bonds

This is a type of investment that allows projects to be funded from borrowed money from investors for a limited period of time at an interest rate that is fixed.

Green bonds are used solely to finance new or existing green initiatives, which are defined by the International Capital Markets Association as “projects and activities that promote climate or other environmental sustainability.”

Equities

Equities are basically stocks that represent ownership of a company. People who believe that CSS will kick off can invest in a company that purveys the technology. Right now, equities are the riskier choice because CSS is uncharted territory. Although if no new better technology surfaces, companies that tap on CSS will most likely skyrocket in the future.

Index funds

Index funds exist as imaginary portfolios of securities that represent a particular market. They exist as “markers” for mutual fund and ETF investors who lack confidence in their prediction skills, which are perfect for something as new as low-carbon economy.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights