GET IN TOUCH

- Please wait...

LightCastle Partners in association with ACDI/VOCA has completed the first phase of the Business Scale up Program “Unnoty” providing business development support via accelerator programs and investment readiness training. This initiative helped women Ag-entrepreneurs and Ag-SMEs to become fully investable growing businesses. The program estimates a value chain development of 50+ Women lead SMEs over a period of nine months.

The consortium partners have successfully completed the event with a Demo Day on March 25, 2019 at RDF Tower, Barguna. The Demo Day concluded an eventful month-long Unnoty Accelerator Program.

Photo: LightCastle Partners personnel interacting with participants during a road show

The initial phase of the project was a 2-day Roadshow, the first of which was held on the February 19, reaching neighboring villages like Keoraboniya, Kodomtola, Payra ghat, Purakata bazar, Aamtoli bazar, Mohishkata, Golachipa, Candokhali, College gate, Kumrakhali, Kauniya, Kazirhat among others. The day-long roadshow attracted the community dwellers, with over 40+ participants signing up for the accelerator program. The second leg of the Roadshow was held on the following day, where 50+ women from areas such as Fuljhuri bazar, Sadar upozila, Boro Gourichonna, Bangabondhu Road and Mithai Potti, registered.

The project team handed out leaflets of the accelerator program and briefed the applicants about the project; participants showed great interest and eagerness. With support from SACO, the project reached out to 200+ female ag-entrepreneurs in 2 days. More than 120 female entrepreneurs agreed to take part in the Boot camp, which took place in RDF Tower, Barguna, on March 4. The event was attended by sector experts of the country, along with representatives from ACDI/VOCA, LightCastle Partners and SACO.

The boot camp was facilitated by LightCastle Partners, in association with SACO Enterprise at RDF Tower, Barguna. The event saw 60 female entrepreneurs attend with a noticeable enthusiasm to learn. The prime areas of discussion were ways to increase the productivity, promote business expansion, and division of capital, provision of financing and tactics which would help raise income. The consortium team, held key one-on-one interviews with the participants to help shape their business models into a more sustainable and fruitful one. The interview panel short listed 16 female entrepreneurs for the 45 days accelerator program.

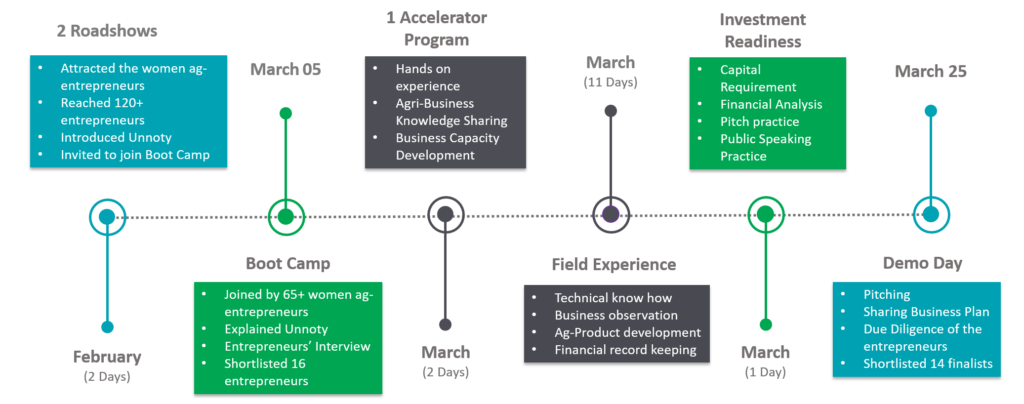

Timeline of ACDI/VOCA Unnoty Accelerator Program

Photo: Trainers taking sessions during the mentorship program

As a part of the accelerator program the first residential sessions were held in the first week of March. Workshops were conducted by industry experts, business consultants, and local market leaders for providing a holistic knowledge building and experience based learning. The workshops entailed both hands-on practical learning sessions and theoretical lessons. The hands-on learning sessions included:

Alongside, the theoretical sessions covered the following knowledge areas:

Second phase of the residential workshop was held in the 4th week of March from 24th to 25th. The first day was comprised mainly of practice pitches where the participants learned and practiced how to present their businesses in the form of pitches. The practice allowed participants to detect errors and correct them, as well as honed their public speaking and presentation skills.

The Demo Day of Unnoty Investment program season one for Ag-MSEs was held on March 25, 2019 at RDF Tower, Barguna. An esteemed panel of judges were present to grace the occasion. The panel consisted of representatives from ACDI/VOCA, Islami Bank Bangladesh, First Security Islami Bank, Veterinary Surgeon of Barguna and LightCastle Partners.

A participant presenting her business plan

The Demo Day started with a welcome speech by the consortium, followed by introductory speeches from the esteemed dignitaries and judges. The session began with the pitches from the participants. Through their pitches, the entrepreneurs described their profile, experience, business plan, current financial solvency, revenue and profit projections and capital requirement. After each presentation, the floor was opened to host questions, from panels and guests present, about entrepreneurs’ business plans.

At the end of the evaluation of 14 Ag-entrepreneurs were introduced with fund providers like banks and also were connected to forward market actors in rice and pulse wholesalers. The closing ceremony was followed by instructions from the consortium partners regarding the future proceedings of the program to become investable and expand their businesses.

The female entrepreneurs from this region were at a unfavorable position with lack of access to finance and both forward-backward market linkages. Due to having limited scope of formal education they were unable to access financial institutions for their working and growth capital. The patriarchal culture and gender power imbalance has caused the female entrepreneurs to be lagging behind their male counter parts. The female entrepreneurs were not able to stay overnight at the venues dormitory due to not having permission from their spouses and other family commitments. many of them had small children at home too.

Insights to key problem areas:

Ms. Sheuli Akter from Pathor Ghata, Barguna, is a moong pulses trader. She has been a former employee of SACO Enterprise which led her in becoming an experienced moong pulses trader. She currently processes over 120 kilograms of pulses and sells them to forward market linkages and retailers in nearby areas. Before attending the accelerator program she was unaware of provisions of capital from private commercial banks at interest rates lower than micro credit financing. The latter one being a much more expensive source of capital. She also did not consider indirect costs such as rent and utility bill while calculating cost of her product.

“I feel very privileged to have attended this training program and getting to know about the basics of business management which have opened up new opportunities for me to get access to loans at a lower cost and understanding the pricing process to include indirect costs while calculating the price of my products. I believe now I will be able to manage my business better and more efficiently” — Ms. Sheuli Akter

Post event feedback from the participants and guests were very promising, they applauded the initiative and were very enthusiastic to support and participate in such an event. The executives from the banks, Mr. Md. Amin-Ur Rashid from Islami Bank Bangladesh Limited and Mr. Muhammad Mizanur Rahman from First Security Islami Bank Limited stated that they would try their best to facilitate the financial needs of the participants starting from opening a zero deposit account to arranging SME loans for them upon evaluation.

The Veterinary Surgeon of Barguna District Mr. Benazir Ahmed highly praised the participants for their enthusiasm and entrepreneurial spirit. He assured them his utmost help with regards to giving advice on poultry farming, dairy farming and vaccination of domestic animals.

Mr. Mowlana Golam Kabir proprietor of M/s Munshi Traders and Mr. Abdul Khobir Mia proprietor of M/s Mitu Traders, two pulse and rice wholesalers, promised to provide credit for advance purchase of rice and pulses from the farmers. This will enable the female entrepreneurs to increase their processing output and earn higher revenue.

Our experts can help you solve your unique challenges