GET IN TOUCH

- Please wait...

In part I, we looked at two factors that VCs analyze while considering an investment. In this section, let’s assess the remaining three and some practical ways in which entrepreneurs could impress VCs.

Innovation – Novelty and uniqueness matter. Regardless of tech or non-tech products, a core differentiator is vital. Its premise has to be straightforward and intuitive. If the new value tags along a heavy dose of education to convert customers, then it’ll probably end up as a bad deal. VCs would also check the innovation’s elasticity – could it be pivoted for quick fixes and future iterations or not? Universally, simplicity sells, complexity hinders. Additionally, VCs are sensitive to the business model and intellectual property (IP) considerations. Is the technology legally protected from being copied by competitors? If yes, chances are you will get VCs approval due to attaining technology distinction. Do further considerations revolve around how the innovation will penetrate the market? Will this make a profit? A deeper look reveals the cost structure, and how much margin can be realized from the innovation. A careful assessment of all these components will shed light on the viability of the investment.

Customers – Gone are the days of upfront business plans. Demonstration of products with a starting customer base is the way forward. The two most important questions to face are: a.) is there someone who is willing to pay for the product/service? b.) is there a clearly defined path to reaching out to customers? VCs will get super excited if yes is the call. Moreover, they’d also like to know the intricacies of customers validation. Whether through a tried-and-tested model or a beaten path, as entrepreneurs, you’d have to show a clear roadmap to obtaining validation from customers. In the end, having a set of ready customers in the bag along with a proven channel is likely to acquire a green tick on the VCs assessment sheet. Customer = Money!

Execution – Perhaps the single most important decision parameter in a VCs book is execution. Inability to execute is the largest barrier to success. Entrepreneurs who are driven, passionate, willing, and able to shed blood, sweat, and tears will be preferred over those who aren’t. VCs would demand a lucid tangible, achievable, near-term set of milestones. Working from a dorm room is a far cry from operating in an office space. In line with that, how flexible and comfortable is the team to accept an operations-oriented environment? How soon can they achieve a state to increase volume and reduce cost? Most important, can they generate cash flow from the business to execute? That’s what start-up life is mostly about. Investments from VCs are meant to be a foundation for entrepreneurs to lean on, but the long-term success of the company cannot depend on that money solely. Entrepreneurs have to hustle, experiment, be decisive, be relentless, and do anything and everything they can in their power to go out and blanket the market. Ones who can showcase that level of optimism and commitment to the VCs will ultimately get the nod because that’s what separates grand vision and realistic execution.

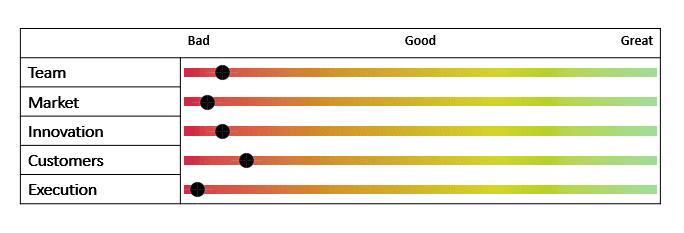

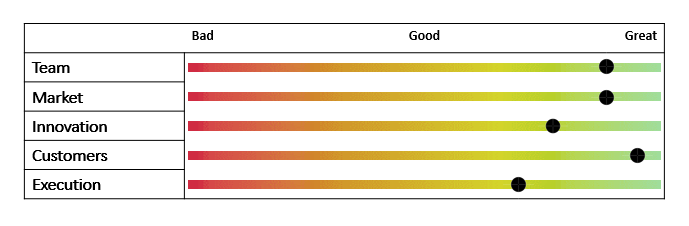

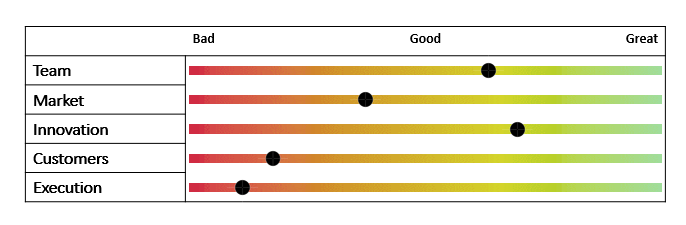

With respect to the notes above, find below three graphical illustrations that depict a bad, good, and ideal investment scenario, respectively.

Here’s a snapshot of a deal killer:

A snapshot of a deal-breaker, but it’s highly rare:

A snapshot of a case that is admirable yet achievable:

Start-up founders should keep in mind that when negotiating with VCs, it’s moot to argue about valuation. VCs will not buy whatever entrepreneurs say at face value as the business has not even picked up. What’s rather important for entrepreneurs is to show a limited perception of risks. Proof of concept, growing sales, positive market feedback, realistic long-term expansion modes, and protection of technology/innovation are attention arresting indicators for VCs to buy in. Likewise, VCs will evaluate you on your rationale and thought process than whatever figures you have projected in your valuation. Consequently, this shows that VC investments are not solely a numbers game.

Remember Mikail from the first part? Just like him, there are tons more Mikails out there with fantastic ideas but limited finance to grow. In parallel, there are investors waiting to pour money in exchange for certain equity in such companies. If a marriage needs to take place, perhaps figuring out a way around the above-mentioned points will be a good place to start. In a later post, I’ll share what entrepreneurs should look for in investors. Until then, good luck raising money!

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights