GET IN TOUCH

- Please wait...

Bangladesh is aiming at a higher GDP growth every year (7% in FY 2015-16), most of which is fuelled by increased government spending. For example, in the recent Budget for FY 201-2016, the government proposed a 23% increase in government spending, which in turn is to be financed by a 31% increase in tax revenue. The entire purpose of this rather mundane introduction is to suggest that the life of the taxmen is getting tougher and tougher; in some cases, their targets are higher than those of commercial bankers. All of this is leading to higher levels of scrutiny and strict enforcement when it comes to tax filing, payment, and compliance every year. Consequently, it is a good time to sort out one’s tax affairs to avoid falling on the wrong side of our tax authorities, and for the purpose of this article, let us focus therefore on personal income tax.

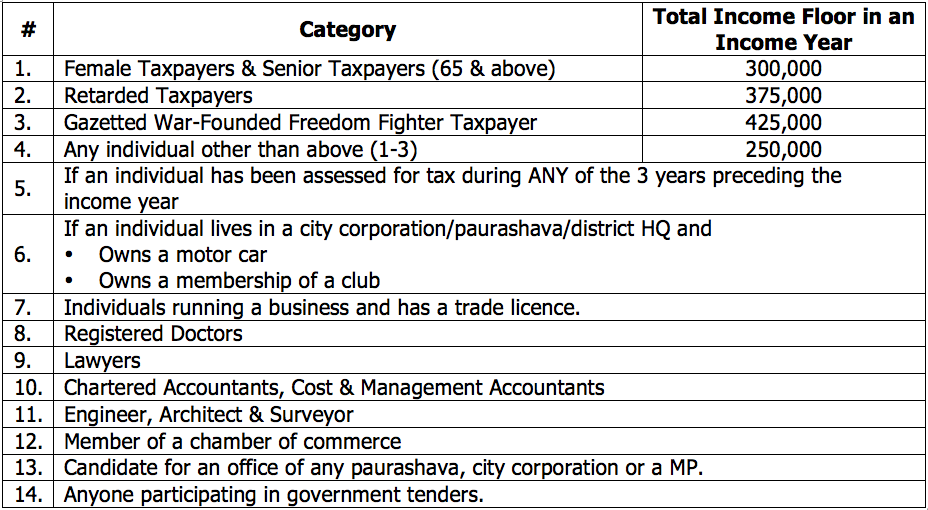

As much as we all would like to believe that we do not have to file a tax return, if you fall under any of the following, tax return filing is a must

Failure to file an income tax return may result in a penalty of:

Many individuals think that since they do not file returns, they do not fall under the purview of tax. This concept is incorrect and may lead to the above penalties.

Unfortunately, there is and it is Tk. 5,000 currently for those living in Dhaka City Corporation. Chittagong City Corporation residents have to pay BDT 4,000 and other City Corporation residents BDT 3,000. This minimum tax is levied on anyone whose total taxable income (after applicable allowances) crosses the tax-free threshold. For simplicity, let us assume the total taxable income of a female individual crosses BDT 300,000 and the tax liability comes to BDT 2,000 for that tax year. In this case, the individual must pay the minimum tax of BDT 5,000.

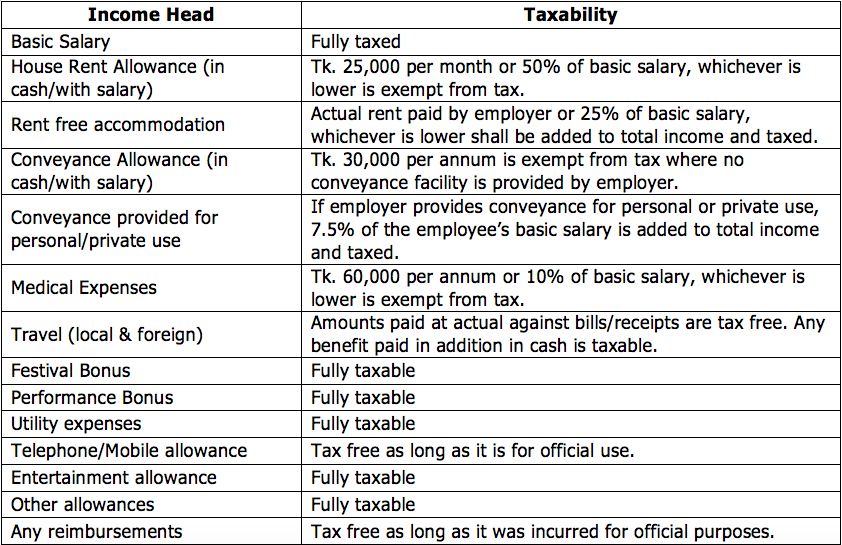

Individuals enjoying salary income are subject to tax on salary and all other benefits. A summary of taxability and allowances are as below:

Employers usually deduct taxes at source after providing for allowances from monthly salary. However, all employees are responsible for filing their own returns at the end of the tax year. If, however, an individual has other sources of income such as house rent, interest income, etc., he/she is responsible for filing accordingly and paying taxes at the time of filing. Once again, the authorities allow some breathing space, as outlined below.

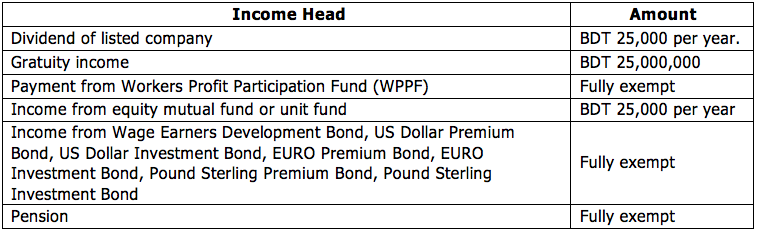

Individuals almost always have other income sources apart from salary such as income on savings securities, income on house rent, capital gains, etc. The Sixth Schedule of the Income Tax Ordinance 1984 outlines certain exemptions available for individuals:

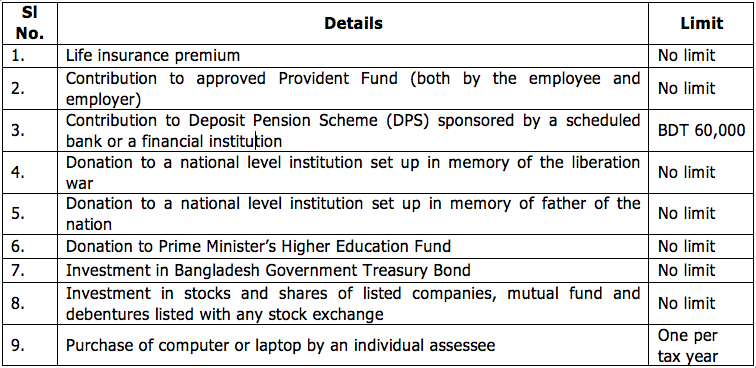

An assessee shall be entitled to a rebate from the amount of tax payable if he/she invests during the income year in the following items:

A tax rebate of 15% of tax payable will be allowed on investment of a maximum of BDT 15 million or 30% of the total income or actual investment whichever is lower.

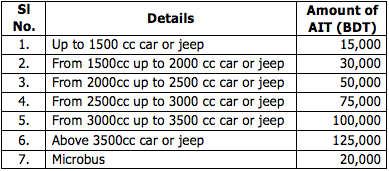

If an individual owns more than one car, jeep, or microbus in his/her name, they will be liable to an additional 50% tax in case of the second and subsequent vehicles.

This payment of tax is treated as an advance payment for the owner of the vehicle(s) and is adjustable against final tax liability. Salaried individuals can submit proof of payment of this tax along with a certificate of rebate from his/her respective tax zone to their HR department which will then adjust this amount with the monthly tax deducted from their salary.

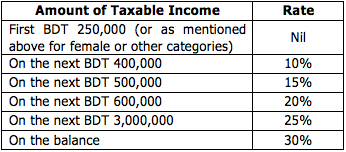

Income tax is charged to individuals on fixed slabs. The slabs of total income and corresponding tax rates are given below:

To conclude, this article only aims to point out the general rules and regulations surrounding personal income tax in Bangladesh. Individuals may often come across specific and complex cases which should be referred to a professional for advisory.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights