GET IN TOUCH

- Please wait...

Bangladesh’s economy has grown 6% per year since 1996 despite political instability, poor infrastructure, corruption, insufficient power supplies, slow implementation of economic reforms, and the 2008-09 global financial crisis and recession. The building construction industry is considered one of the fastest-growing and largest sectors in Bangladesh. In 2008-2009, the construction sector employed 2.024 million people which is expected to rise to 2.88 million by this year (2014) and 3.32 million by 2020 (Report by WCC).

After 1990, a construction boom started in the country owing to the necessity for industrial buildings, corporate offices, housing units, roads, and other types of infrastructure. Bangladesh has made major progress in recent years, with sustained macro-economic stability. The construction sector is poised to emerge as a new growth engine in Bangladesh, which now thrives on the USD 20 bn RMG sector and USD 14 bn annual inflow of remittances from expatriate workers. According to the Bangladesh Bureau of Statistics, the construction sector accounted for a record 9.1% of GDP (Gross Domestic Product) in the fiscal year 2012/13.

The private sector housing business started in 1970 in Bangladesh, where Dhaka (capital) was the main focus for the private sector investors. During the last two decades, it has grown, and now demand is rapidly increasing. Bangladesh is one of the fastest urbanizing countries as migration to the cities is very high.

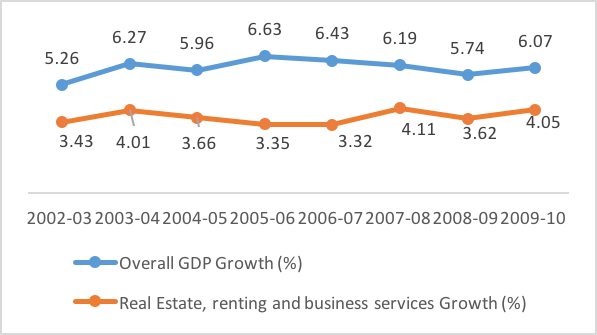

The following table shows the comparison between overall GDP growth and growth of Real estate, renting, and business services:

Source: REHAB

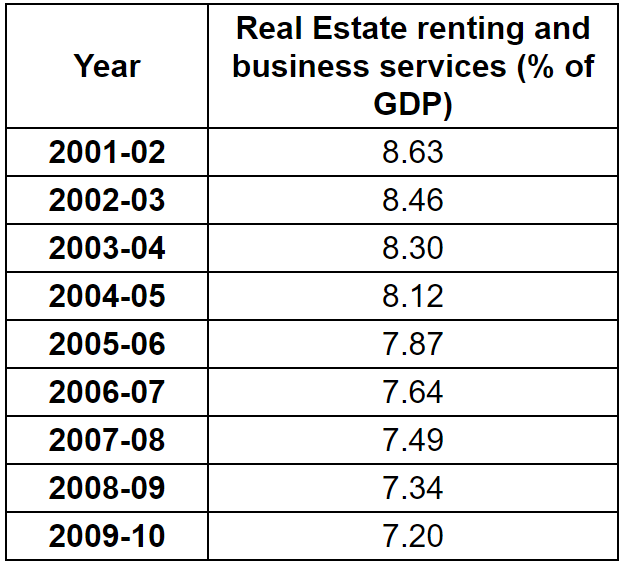

The growth rate of the Real Estate, Renting, and Business service sector has increased over the 2002-2010 period However, compared to overall GDP growth, this sector expanded at a slower rate, which explains the downward trend in real estate as a percentage of overall GDP.

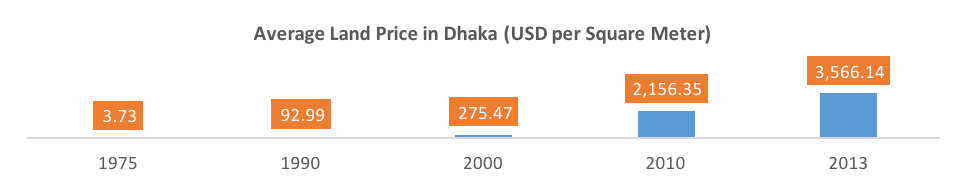

Source: Sheltech Survey

Trends in recent housing prices can be observed in urban markets (mainly Dhaka) where market data is more accessible and pricing trends here are normally advanced indicators of pricing trends throughout the housing industry of Bangladesh. Land prices in Dhaka have been appreciating since 1975 and currently, the price is USD 3566.14 per square meter on average.

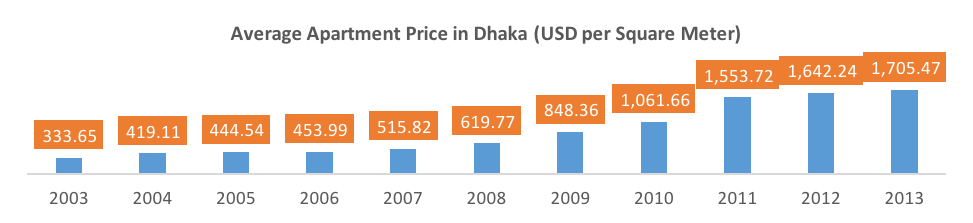

Apartment price in Dhaka has been on the rise since 2003 and according to the last updated statistics, it is USD 1,705.47 per square meter.

Source: Sheltech Survey

Dhaka is currently growing at an unprecedented rate, accommodating over 600,000 people per year. This means more than 120,000 household units are required to house the added population in this city. At present, the supply of housing in the city is only around 25,000 units, of which 15,000 units are provided by the private sector contributors like (real estate development companies). Most of the families are now nuclear ones (parents and one or two children) who prefer to dwell in apartments with two or three rooms. Nearly half of the apartments are found to be between 1,000 to 1,600 square feet. On the other hand, only 2% of the residential apartments are less than 700 square feet, which indicates that the real estate sector has not quite been able to address the low-income dwellings.

Price hikes in land and construction materials have added to the overall price hike. There is no control of the government over the price increase of land within Dhaka city. Increased land price has a direct impact on apartment prices. Also, after 2005, the price of bricks, granular sand, cement, rod,s, etc. had a rapid, almost exponential, increase. Both these factors have raised apartment prices.

The sources of housing finance in Bangladesh mainly are the state-owned BHBFC (Bangladesh House Building Finance Corporation), commercial banks, employee loans, life insurance policies, and informal means. According to homeowners of newly constructed houses, the primary source of housing finance is household savings (more than one-third). Loans from relatives and friends were the second most common form of finance, followed by the sale of other parcels of land.

The government and a large number of NGOs are providing micro credits to the poor. Moreover, there are now 23 private companies that extend housing finance in Bangladesh, among which the most prominent ones are the Delta-BRAC Housing Finance Corporation Ltd. and the National Housing Finance and Investment Ltd. These companies make loans for the construction of houses, acquisition of flats, and houses, extension and improvement of existing housing, and the purchase of housing plots. Most of the private sector players have very high-interest rates compared to BHBFC.

BHBFC provides credit facilities for the construction, repair, and remodeling of dwelling houses and apartments in cities, towns, and other urban areas. In general, priority is given to civil servants. BHBFC offers 15–20 year mortgages to individual households at commercial interest rates that increase as the loan amount increases.

Currently, BHBFC provides five types of loans:

Delta-BRAC Housing Finance Corporation Ltd. (DBH) is the pioneer, the largest, and the specialist housing finance institution in the private sector in Bangladesh. DBH has created homeownership among more than 7,500 families in Dhaka and other major cities of the country. Mortgage loans have a maximum term of 15 years and are discretionary adjustable-rate mortgages. The present rate is 16.5%.

National Housing Finance and Investment Ltd. (NHFIL), a private sector housing finance company, provides loans for the construction of houses, purchase of flats or houses, extension and improvement of existing houses or flats, and purchase of housing plots.

IDLC of Bangladesh provides real estate financing for individuals, developers, and corporate users. Among its services offered are financing facilities for the purchase of apartments, construction of houses, renovation and extension of houses, purchase/construction of houses for the employees under the corporate house finance scheme, an office chamber/space for professionals, constructions of a commercially viable project like schools, hotels, and hospitals, etc., and constructions of the industrial building like a factory, warehouse, etc.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights