GET IN TOUCH

- Please wait...

One of the most persistent and enduring problems for developing countries is improper water sanitation. In Bangladesh, according to WHO, 97% of homes have access to water, but only 40% have proper sanitation (see endnote). That means the remaining 60% have to endure the dangers of unsafe drinking water.

Most of our drinking sources contain a high level of toxic materials due to spillage of heavy industrial and agricultural activities. This paints a dire picture for our population. Currently, 1 out of 10 diseases and 6% of all deaths occur due to improper sanitation (see endnote). There is a clear need for safer drinking water that needs to be addressed on a national scale.

To that end, the water purifier industry plays an important role in catering to these powerful latent needs. Water purifiers remove contaminants such as parasites, viruses, metals and manmade chemicals from water, making it safe for drinking and consumption. Some purifiers also improve water odor, taste and appearance.

Although there is significant activity in the water purifier market at the moment, it is underdeveloped compared to the state of its counterparts in India and other neighboring countries.

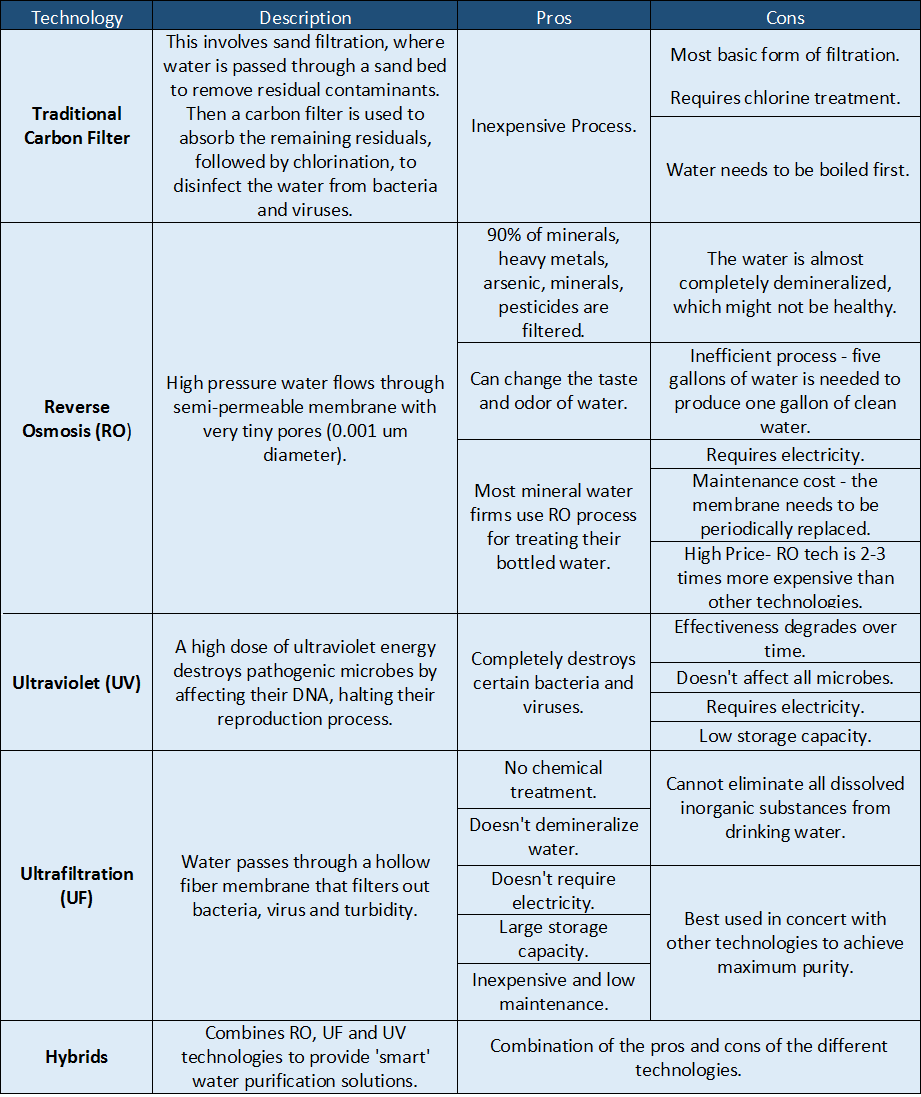

Traditionally, water purifier markets are segmented according to product category, as shown below. These categories are largely defined by the distinct technologies, which are used for the purification process.

While these five categories are quite different and distinct from each other, at the moment most of the market share is occupied by traditional carbon filter purifiers from Chinese brands such as Nova and Miyako. This is mainly due to the fact that they are inexpensive and easy to maintain. However, the fact that customers are largely unaware about the other technologies surfaces as the prime obstacle for a greater acceptability among the masses.

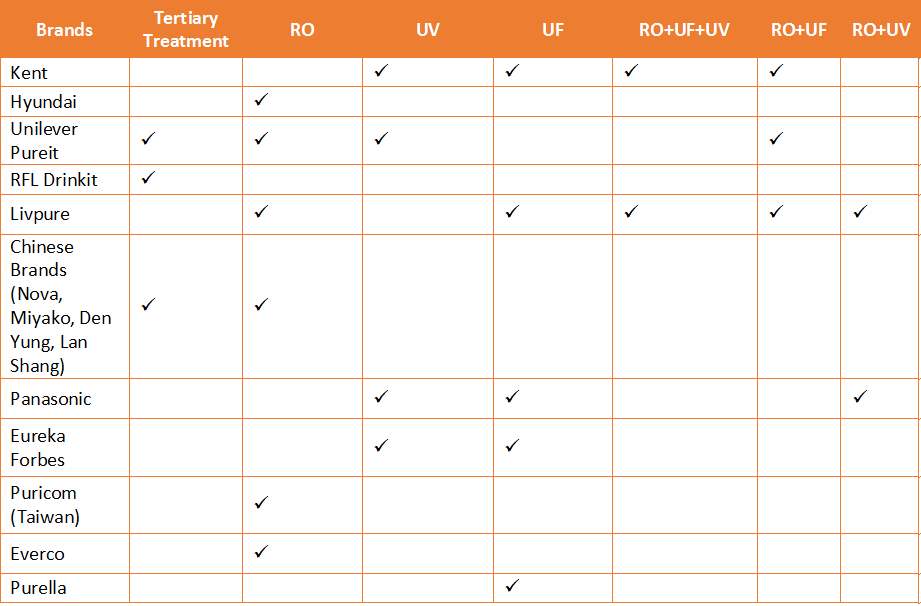

Some of the most prominent brands operating in the Bangladeshi water purifier market are outlined below, along with the product categories they are operating in.

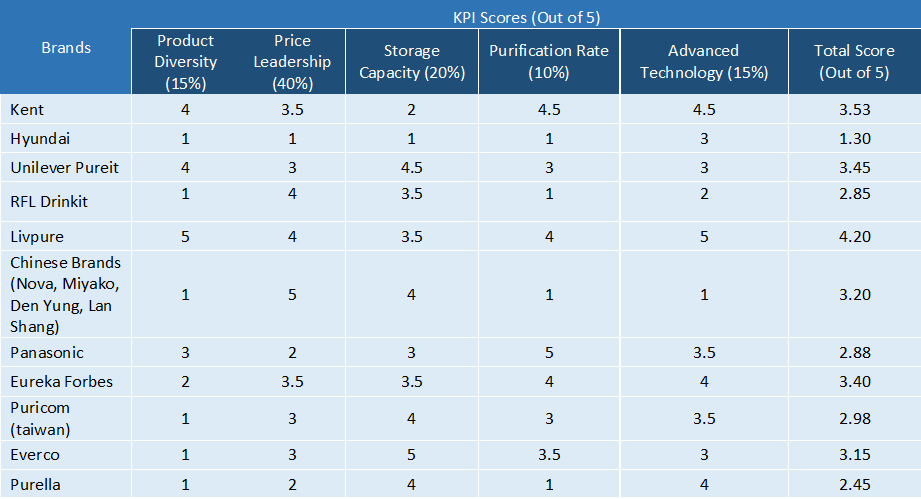

The nature of water purifier products at the moment is such that globally firms mostly compete on the basis of quality of the technology, durability, price sensibility and after-sales services offered. For Bangladesh, due to lack of consumer awareness, mostly price sensibility and durability influence the purchase decision rather than technology. There is also the added factor of storage capacity; many homes that use water purifiers follow the custom of filling up glasses straight out of the purifier as opposed to storing the water separately beforehand.

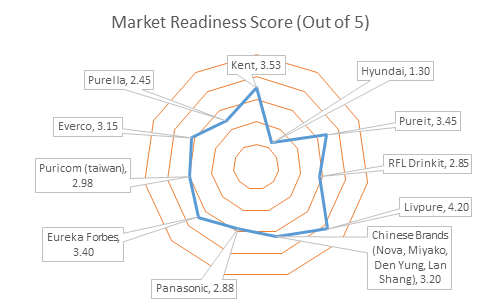

Considering the above, we have created a grid that factors in certain weights in order to fairly gauge the overall ranking of the current brands. We ranked these brands on their market readiness.

From the above diagram, we can infer that Indian brands such as Livpure (4.20) followed by Kent (3.53) have ranked very highly. They are followed by other global brands such as Unilever Pureit (3.45) and Eureka Forbes (3.40). In contrast, Hyundai (1.88) scored the lowest, followed by Purella (2.45) and RFL Drinkit (2.85). While the Chinese brands have scored a respectable grade, it’s clear that the Indian and global brands are better equipped to give them stiff competition.

The table below outlines the ranking results in details.

At the moment, the water purifier market in India is worth 1600 Crore Rupees (see endnote) and is forecasted to grow at a CAGR of 23% during 2015-2019. If the right strategies are undertaken in Bangladesh, it would not be unreasonable to expect similar momentum in the purifier industry in the near future.

This research was conducted by Muhtasim Sarowat Rayed, a Junior Associate of LightCastle Partners.

References:

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights