GET IN TOUCH

- Please wait...

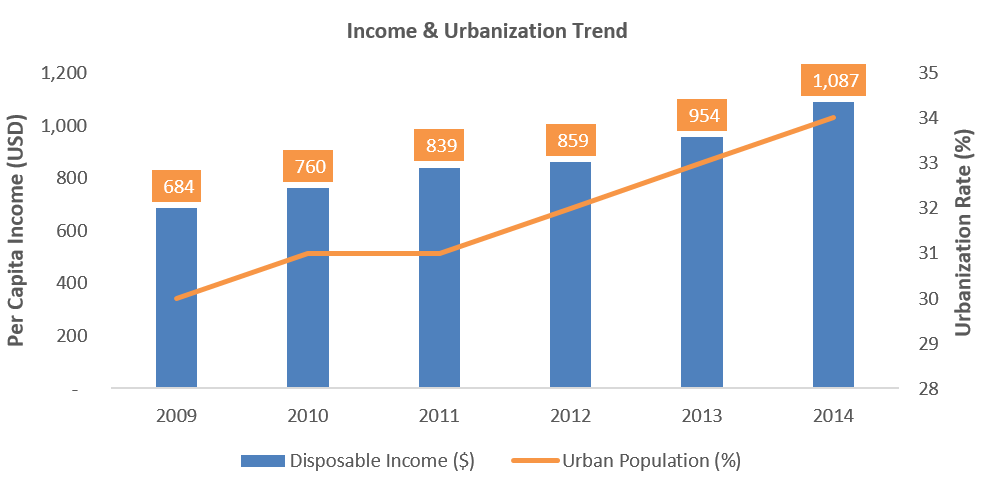

Bangladesh is one of the most densely populated nations in the world. With an average population density of 1,000 people per Sq Km, the country currently houses approximately 150 million people, while 70 million more are expected to join fray within 2050 (UNFPA). A large portion of this growth is attributed to urban areas. According to the CIA Fact book, urban population currently stands at 34.3%, while an average annual urban growth rate of 3.55% prevailed over the last five years.

Growth in urban population has coincided with a rising middle-class segment with growing income. This growth in Middle and Affluent class (MAC) population has been corroborated by the latest BCG report. The report states that the number of households with an annual income of USD5,000 or more is set to triple within 2025 from existing 11.7 million. MAC population, in general, are more concerned about the needs of their families, and are willing to channel spare funds for long term investments for ensuring financial security for their families.

With rising income, MAC population has been investing in real estate for generating regular income e.g. rent and for capital appreciation. A change in social structure has also triggered demand for modern real estate properties e.g. apartments. According to a survey conducted by UNICEF in 2013, the average family size in Bangladesh is 4.6. This shows that families are becoming more ‘nuclear’, resulting in higher demand for smaller apartments with 3-4 rooms.

Since 1970s, the Real Estate sector has been growing in leaps and bounds with growing urban population, growing income and change in demographics. Currently, 1,133 realtors are registered with REHAB, the apex body of real estate players.

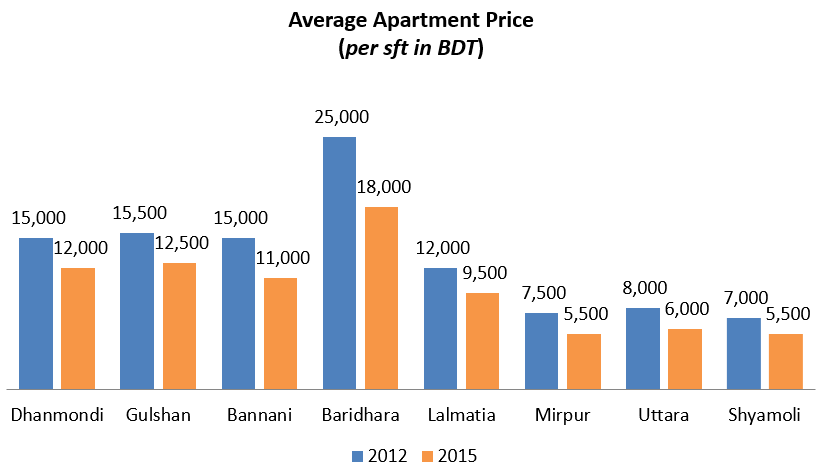

Despite tremendous growth potential for the sector, Real Estate has been suffering over last five years. Experts attribute this slump as the aftermath of the bursting financial bubble. Due to declining demand for apartments and residential plots, many real estate companies have been forced to lower prices and halt construction activities.

Prices of apartments in all major residential zones have been slashed for attracting more buyers. This pressure on the housing market has however eased, somewhat recently.

The following factors have been impacting the demand and supply dynamics of the Real Estate sector.

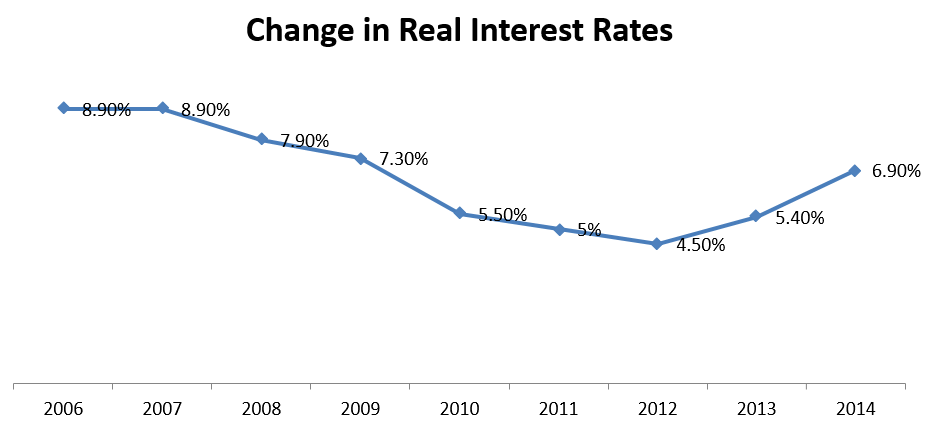

Interest Rates: Existing interest rates play a key role in real estate purchase decisions. According to REHAB, the majority of the people looking to buy flats are from the lower middle income group. These people usually rely on home loans for their purchases. According to World Bank, the average real interest rate in Bangladesh increased substantially in 2012. Such high interest rates discourage people from taking housing loans, decreasing the demand for apartments and thus driving down the price of housing.

Recently, home loan interest rates have fallen to 9% from existing 14%. (Source: BB). According to Nurul Amin, MD of Meghna Bank, decline in interest rates have been due to excess liquidity in the money market. According to the banker, apartment prices should thus start rising soon. Since the supply of land is perfectly inelastic, as income increases and the means for getting a home loan becomes more favorable, the real estate sector should be seeing a surge in demand soon.

Gas and Electricity: The availability of Gas and Electricity also plays a major role in deciding apartment prices. Usually, apartments which have direct gas connectivity are priced higher than the ones that don’t. Both these utilities have witnessed price hikes in September 2015 (BERC). Gas prices were raised by almost 50%, while electricity prices increased by BDT 0.18 per KW-Hour.

Government Regulations: According to the Bangladesh tax handbook (2013-2014), taxes for property purchase accounts for more than 14% of the total property’s price. Duties such as VAT, advanced income tax and stamp duties make it hard for realtors to price their products fairly.

Raw Materials: The primary raw materials used in the industry are cement, steel (rods) and brick. Cement prices have recently been lowered by BDT10-30 to around BDT420 per 50Kg. Most of the major brands, including Akij, Scan and Holcim, are lowering their prices.

Political unrest: Sporadic political unrest has negatively impacted sales of apartments. According to a REHAB report 1,200 of their members have lost over BDT 1,500 Cr in 2015 due to lower demand and disruption in construction and supply chain. However, the political situation is stable right now and is expected to sustain next year.

Cross Border Fund Movement: Over last 4-5 years, affluent class population has been slowly moving funds abroad through informal channels for making real estate investments. These funds movement is part of their investment diversification strategy. Canada and Malaysia are popular destinations for these investments.

The real estate sector in Bangladesh is expected to get some much needed injection in demand. With rising disposable income, lowering housing loan interest rates and growing urban population, demand for apartments is expected to increase. Apartment prices seem to have hit a plateau and industry experts predict pricing to increase in the coming years.

However, political stability, investor optimism and availability of utilities e.g. electricity and gas will play a pivotal role in orchestrating the recovery of Bangladesh’s Real Estate sector.

Research has been conducted jointly by Ishtiaqur Rahman, Junior Associate and Zahedul Amin, Director Strategy, LightCastle Partners.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights