GET IN TOUCH

- Please wait...

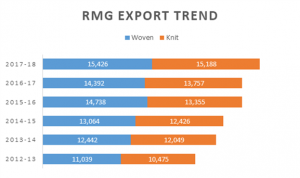

Bangladesh’s RMG sector has been playing a pivotal in facilitating the country’s export earnings, contributing 83.4% of total export (source: EPB), apart for generating employment to the tune of 4.4 million, 80% of which are women. (Source: WB). Considering the sector’s importance to the country’s economic stability, ensuring steady growth for RMG export in the short to medium term, is a key policy imperative. In the recent past, the sector’s growth has been marginal, with exports growing by 0.2% and 8.7% for 2016-17 and 2017-18 respectively. Future growth would be contingent on the outcomes of multitude of internal and external factors, which could potentially determine the sector’s competitiveness and performance vis-à-vis its closest competitors.

RMG Export Growth Rebounded in 2018

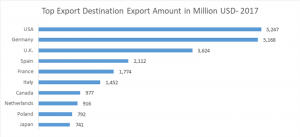

The sector got back on its growth trajectory in 2018, mainly due to a depreciating currency and growing export trend to the US market, which is the single largest importer of Bangladeshi apparels. The US government’s cancellation of Trans-Pacific Partnership (TPP) agreement with 11 partner countries- Australia, Japan, New Zealand, Canada, Mexico, Singapore, Malaysia, Vietnam, Brunei, Chile and Peru- have resulted in fresh imposition of tariff on Vietnamese apparel, which is directly benefiting its closest competitor, Bangladesh. Recovering US economy will also increase overall consumer spending and import, apparel included.

The near completion of remediation work by Accord and Alliance post the Rana Plaza industrial incident have improved perception of Bangladesh’s RMG sector among foreign buyers. However, RMG owners point to squeezing profit margins, which is forcing them to shelve plans on making further investments to make workplaces safer.

Although RMG sector players are tapping into emerging East Asian and Latin American markets, US, UK and EU countries remain the predominant export destinations. While Bangladesh is enjoying GSP facilities in the EU market, US market is proving more competitive, as the country enjoys no special trade privileges. While cancellation of TPP is a big respite, the country has to contend with growing competition from Africa, with Ethiopia leading the way. African apparel exporters enjoy cost competition due to trade privileges, through African Growth Opportunity Act (AGOA) and shorter freight time to the US and EU markets.

Apart from emerging players, regional competitors like Vietnam, Cambodia, India and Pakistan have been growing their export to major markets. Myanmar has recently joined the fray by slowly growing its apparel export, but recent political turmoil pertaining to Rohingya crisis will peg the country back, at least in the short to medium term.

US-China Trade War

Donald Trump, the US President, has long been correlating US’s large trade deficit with China as a major cause for the country’s economic woes. In line with the president’s protectionist worldviews, US government has started imposing protectionist measures on import from major trading partners like China and Canada. US has recently decided to slap 25% tariff on imports worth up to USD 200 billion from China. China has reciprocated in kind with a tit for tat measure imposing tariff on cotton and Soyabean.

Bangladesh can directly benefit in the event of escalating trade war between US and China, especially if the US imposes higher tariffs on imported Chinese apparel. Alongside, Bangladesh can benefit from capital flight, as some Chinese apparel manufacturers would be seeking to relocate operations to a country having normal trade ties with the US. The trade war is contributing to price volatility in the cotton market, which is a key raw material for the apparel sector. China’s stockpiling and procurement of cotton from regional cotton producers like Uzbekistan and India, instead of US, will cause a mismatch in the demand-supply scenario. Bangladeshi textile manufacturers may suffer, as a result.

Elevation to Middle-Income Status

Bangladesh has achieved the middle-income status, and will have to maintain the growth indicators till 2024 for successfully graduating to the next tier. Although this would be a landmark event for the country, the economy would have to eventually wean off from different preferential trade benefits. The European Union, which is the destination for 50% of country’s apparel export, has been providing GSP facility (since Bangladesh is an LDC) enabling tariff and quota free entry for all products. Revoking GSP would be catastrophic for the sector, as the apparel sector would immediately lose cost competitiveness. Industry leaders and policy makers would have to chart their strategies keeping in mind that Bangladesh would be ineligible for different preferential trade benefits within 5-7 years.

Minimum Wage Rate Hike

Based on the recent tripartite negotiations between the Government, BGMEA and RMG worker trade unions, the minimum wage rate has been revised upward to BDT 8,000, effective from Dec 2018. The expected 50% jump in salary costs would negatively impact the sector’s cost competitiveness. To tackle rising costs, some RMG owners have been automating operations by adopting technology to partially reduce human resource dependency.

The RMG factories would have to ensure financial viability, either by increasing worker productivity or by securing higher pricing from apparel buyers. Due to intense local and international competition, apparel prices are proving to be sticky upwards.

Medium Term Growth Horizon

The Apparel sector is at a cross-road and would need to break free from the low value-low margin market segment. Unfortunately, majority of the sector players are ill-prepared for transitioning to a higher margin segment. Recent compliance purge by Accord and Alliance has resulted in closure of at least 1,500 companies, while 2,500 thers are still operational. The surviving players need to be offered organizational development support by facilitating human resource development, in terms of designing, merchandizing and operations management. The government and development/donor agencies would have to collaborate extensively for supporting efficiency enhancement within the sector.

The government also needs to offer market development support for emerging apparel markets, utilizing the commercial wings of Bangladesh embassies worldwide. The main objective would be to facilitate the sector’s shift towards higher margin apparel segment, which can absorb incremental overhead costs.

This write-up was originally published here: https://databd.co/

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights