GET IN TOUCH

- Please wait...

The study was commissioned by the Partners for Water Program, an alliance consisting of the Embassy of the kingdom of Netherlands, Ministry of Foreign Affairs, Ministry of Infrastructure and Water, RVO and the Netherlands Water Partnership. The objective of the study is to gather strategic insights on the current status quo and future prospects of the Water Sector in Bangladesh, enabling The Netherlands Embassy to explore avenues for Dutch Private Sector companies, as well as drawing conclusions on the Embassy’s position in terms of the Multi-Annual Strategic Plan (MASP). This study has been conducted by reviewing existing literature as well as undertaking 30 plus in-depth interviews with government stakeholders, development partners, private sector enterprises, think tanks, research organizations, associations and sector experts.

Bangladesh’s ecological sustainability and economic development is dependent on a number of critical factors. Due to the country’s riverine nature with water flowing downstream, it faces a number of challenges: starting from flooding during monsoon season (44,000 metre Cubic feet per second flowing through Ganges) to experiencing drought during off-season (10,738 cubic feet per second). Although much of this variance is due to environment reasons, man-made barriers hindering natural water flow from neighboring country are also contributory factors.

Climate change induced sea water level rise is another major factor adversely impacting local ecosystem and livelihood in the Southern region of the country. The Southern division of Khulna is saline prone, which has resulted in lower agricultural yield and economic activities. As a result, the region is experiencing exodus of these climate refugees, seeking economic opportunities in other regions.

Water resource management features heavily in government’s development plans. The cabinet has recently ratified the Delta Plan 2100, which features 80 prioritized projects, which will be implemented within 2030 with the World Bank committing to source financing for these projects. From a broader perspective, infrastructure development, policy and governance related areas will receive financing in near future as Bangladesh gradually transitions into a middle income status.

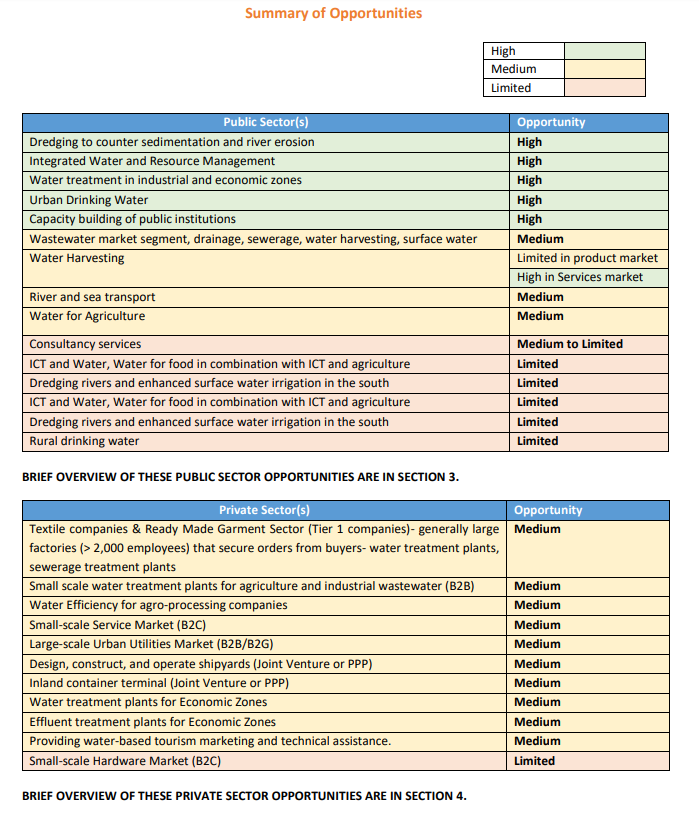

Dredging, land reclamation and Urban Water Supply are areas with the highest potential for Dutch organizations. With an annual sedimentation rate of 1.2 billion tons per year, dredging is a potential growth segment, particularly due to the need for improved waterways for managing domestic and cross-border transport. Potential opportunities include providing technical support, capacity building for dredger maintenance and operations, accessories and equipment support etc.

Due to large scale urbanization, city based water suppliers (DWASA, CWASA etc.) have been struggling to expand drinking water and urban waste management facilities. According to UN estimates, Dhaka’s population is expected to reach 27.4 million by 2030, with daily demand of 3.425 billion liters. Apart from drinking water, growing population will result in increased investment opportunities in waste water processing and fecal sludge management. Dutch companies can capitalize on existing digitization drive within the government, offering relevant

software like SCADA to WASA for optimizing performance. Opportunities also exist in terms of technical assistance in terms of consulting support and organization wide capacity development.

Although country specific economic zones are outside the purview of Bangladesh Economic Zone Authority (BEZA), rest of the economic zones are under the direct supervision of the government body. BEZA intends to setup 100 economic zones across the country and have direct authorization for setting up centralized STPs and ETPs in each of Page 10 of 92 these zones. Dutch companies can directly collaborate with the BEZA for setting up these treatment plants, as well as offering technical and capacity building support.

Funding for implementing government led development projects have traditionally been sourced from internal revenue sources e.g. direct taxes, or through soft loans or grants from multilateral lenders and foreign Governments. As the country gradually moves towards the middle-income status, grant funding is expected to reduce markedly and be partially replaced by PPP and G2G based funding. China and India have emerged as major development partners, offering funding (grants and loans) to the tune of up to USD 24 billion and USD 4.5 billion respectively. Although the tendering process for many of these projects is expected to be on a level playing field for all the countries, conditional financing terms, at times, are being used for many development loans. For example, the Line of Credit (LoC) agreements with India stipulates as closed tendering for Indian firms only, while Chinese loans have similar preconditions for hiring Chinese equipment and service providers.

As Bangladesh’s population grows with rising economic prosperity, demand for groundwater- currently catering to 98% if water demand- is expected to keep on increasing. The resulting urbanization and industrialization led by government sponsored economic zones, will require efficient water and industrial waste management. The country’s RMG and textile sector has significant economic footprint, contributing 83% of country’s export and 12% of GDP, having headroom for further growth. However, the sector (particularly textile sub-sector) has been generating toxic industrial waste, most of which are not properly treated before dissipation. The leather sector is another emerging economic contributor, which faces similar challenges in terms of managing industrial waste water. Although ETPs and STPs have been installed in a number of these factories (mostly RMG and Textiles) and relevant policies are in place, opportunities exist in terms of offering both hardware and technical support for setting up these facilities. World Bank predicts water management capital expenditure for waste water management to top USD 12-16 billion and USD 35-50 billion for textile and leather sectors respectively within 2030.

Garments & Textile and leather sectors have some opportunities with significant pressure for complying with environmental standards, particularly from international buyers and regulatory agencies. Many manufacturers are also aware of potential efficiency upside for adopting environment friendly technologies. However, most of these manufacturers are cost sensitive, opting to install inexpensive equipment with lower capital expenditure. For example, Chinese ETPs are popular among manufacturers due to lower pricing compared to European made ones.

In the textile sector, dyeing and washing are water intensive processes with waste-water treatment plants (ETPs) made mandatory for all factories. Currently, the ETPs are sourced from local sources having a price range of USD 470,000 on average. Apart from top-tier factories, most are price-sensitive preferring Chinese machinery and equipment due to affordable pricing. Similar trends have been observed in other market segments like agroprocessing and drinking water.

Dutch companies need to devise a marketing strategy focusing on long term benefits for procuring Dutch equipment at premium pricing. In terms of technical assistance and capacity building, Dutch players have some opportunities, though local and regional firms are gradually closing the gap in terms of service quality. Opportunities through exist with JV based project bidding and technology & skill transfer. Inland water including irrigation and fisheries, construction of Inland container terminals and Shipyards have limited opportunity being limited to providing

engineering design support and technical assistance.

In real estate, opportunities exist in specific zones and satellite cities near the suburbs, where large apartment blocks or condominiums are being constructed, which are few in number at this point in time. Construction ofsophisticated water purification and waste water recycling facilities for apartment complex and condominiums will become more popular with growing urbanization and expansion of major cities like Dhaka and Chittagong. For smaller apartment buildings, there is limited opportunity for Dutch companies, as local companies manufacture water tanks, reservoirs for water or sludge at very competitive pricing.

Dutch private sector firms can contribute to a rising economy like Bangladesh, which has its unique challenges in terms of the fall out of climate change, rising population, industrialization led pollution and inadequate infrastructure for water management. Dutch companies have a wide repertoire of relevant products and services offerings for water management, but are likely to be priced out in the local market due to availability of cheaper alternatives. However, establishing strategic relationships with local partners can help optimize costing, enabling Dutch players to create value for the end clients. Dutch companies can also offer equipment and technical assistance to government led infrastructure development projects, funded by multilateral donor agencies.

Download the report here https://databd.co/reports/bangladesh-water-network-study

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights