GET IN TOUCH

- Please wait...

Bangladesh’s affiliation with cloth has a long history. From being renowned throughout the world and even conquered by the British for its high-quality muslin, silk, and pure cotton, to becoming the second-largest ready-made garments producer in the world [3], the country has long depended on the textile industry for its growth. The production of RMG dominates in contribution to Bangladesh’s GDP, exports, and conversations of development. In 2017 the industry exported goods worth $30 bn, which made up 83% of exports and 12% of the GDP, higher than any other industry [1]. It is also the industry that has seen the most scrutiny from global markets due to past incidents like the Rana Plaza collapse, which created waves throughout the world and pushed reforms for providing safer work environments and wages for its employees [6].

However, as business practices, consumer expectations, and information flow change radically around the world, the industry is at a crossroads. Sustainable production – preventing the sacrifice of productivity while protecting social, environmental, and ethical interests – is gradually taking precedence. How can factories become environmentally-friendly while maintaining production levels? Can the industry handle progressive employment laws without losing its edge of cheap labor? Should it sacrifice affordability for sustainability? These are questions that need to be answered, and soon.

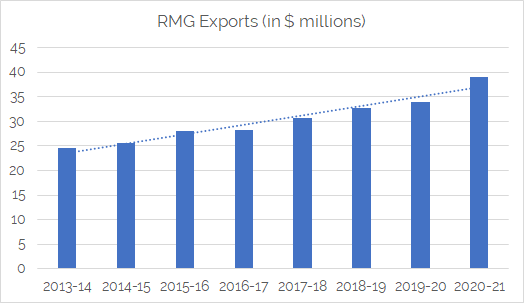

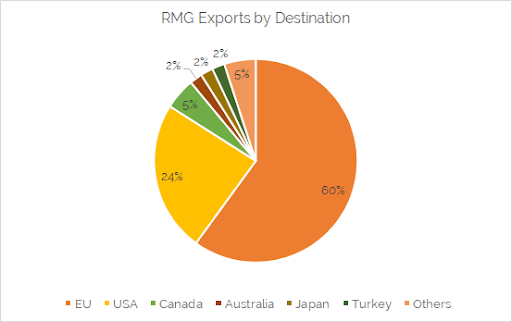

The global apparel manufacturing industry was valued at $658 billion in 2018, growing at a rate of 4.6% over the past five years [2]. Bangladesh holds a 6.4% share, second to China, which dominates with 36.4% 3. However, China’s share has been falling due to a shift in manufacturing to electronic goods and tariffs due to the recent US-China trade war. To capture this share, Bangladesh will have to compete with several other developing countries, such as Cambodia, Vietnam, and Myanmar, all of whom share the advantage of cheap labor. An important step in beating these countries will be improving the ease of doing business in the country, where Bangladesh ranked 177th out of 190 countries [3]. Bangladesh’s main export destinations are the EU, with whom Bangladesh has duty-free trade, and North America.

As the industry is export-oriented, trends and patterns in global demand affect Bangladesh directly. The global trend of fast fashion has greatly impacted the industry. These clothes are affordable, low-quality, and easy to purchase online. The “fast” image comes from how quickly new trends are incorporated and old designs discontinued. This necessitates speedy and cheap production. Brands are increasingly shifting to digital spaces from traditional brick-and-mortar shops, impacting storage and retail processes. New business models that challenge traditional ownership, such as by leasing or resale of clothes, will also impact the demand of the industry in the future [9].

Growing concern for sustainable practices, however, is the greatest potential threat to Bangladesh’s RMG sector. A growing youth population means a population that is statistically more inclined to be concerned about social and environmental issues [9]. This need is also pushed by a growing distrust by retailers regarding costs, supply chains, and employment practices, which may necessitate radical transparency.

The export-oriented garments industry boomed in the late 1970s. The Multi Fibre Agreement (MFA), operational between 1974 and 1994, set quotas on the textiles and garments exported from developing countries to developed countries, but Bangladesh was exempted. Daewoo, a Korean garments manufacturer, started a joint venture named Desh Garments Ltd. in 1977 to take advantage of this 1. The workers and managers trained by Desh left to open their own factories. This, followed by the privatization of the sector, lead to rapid growth.

The RMG sector is based on B2B relationships. Retailers, mainly MNCs, form contracts with factories to deliver a specific number of garments with appropriate specifications, which tend to be seasonal as retailers attempt to coincide production with spring, summer, fall, and winter collection releases. Many factories take contracts that exceed their production capacity and sub-contract to cover excess demand. Subcontracting is a controversial practice as although it allows large orders to be fulfilled, the smaller factories that take up the excess production may not meet compliance standards.

The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) is a national trade association whose duties include monitoring the safety of factories, lobbying with the government on behalf of the industry, and conducting research to improve production techniques.

The Tazrin Fashion fire and Rana Plaza collapse are the two most infamous industrial disasters in Bangladeshi history. The Tazrin Fashion fire (2012) was the biggest fire the nation had seen at the time it occurred. Just a year later, the Rana Plaza disaster took over 1,100 lives [6]. The collapse was caused by poor building materials, failure to follow safety regulations, and negligence of the owners. These disasters brought the distressed working conditions of Bangladeshi garments workers to the attention of the world. Compensation was paid to both deceased workers’ families and those injured. Those in charge of the building were arrested or sued. Since then, multiple steps have been taken to address workplace safety and practices.

The biggest push came from outside the country, with various international programs. The Accord for Fire and Building Safety placed a 5-year legally-binding contract between major European brands and trade unions to inspect factories and workplace practices, as well as train workers on safety policies and their rights. Over 90% of the inspection and training work is complete, and it was extended until 2020. The Alliance for Bangladesh Worker Safety, a similar pact, was formed soon after by major US brands such as Walmart and H&M, who wanted a non-legally-binding contract. Over 93% of the remediation process had been completed when the Alliance ceased operations at the end of 2018 [6].

Multiple local NGOs also responded by forming training programs to inform workers of their legal rights. All of these organizations and programs have brought about drastic change by shutting down non-compliant factories, encouraging worker awareness, and incorporating advanced safety policies into regulatory bodies.

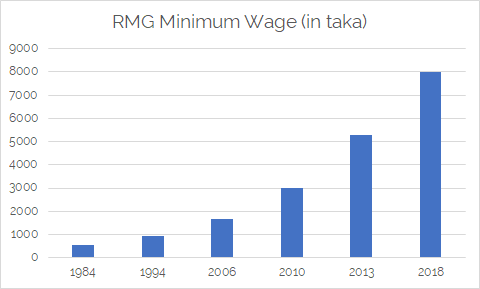

The sector currently employs around 3.5 million workers, of which 60% are female [4]. The minimum wage has been raised several times over the past decade, after strikes from workers and despite protests from the BGMEA citing an inability to remain efficient.

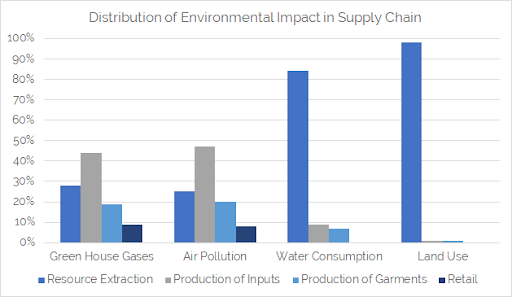

The 12th UN Sustainable Development Goal aims for ‘Responsible Consumption and Production’, with targets referring to efficient usage of natural resources, environmentally sound chemical and waste management, increased technology integration, and information dissemination regarding these practices. For the RMG sector, the biggest concern is in the production of textiles, which is resource-intensive due to the processes of washing, dyeing, and finishing. An average factory in Bangladesh uses 300 liters of water daily and, given the size of the industry, this creates significant pressure on the freshwater resources of the country [7]. The graph below shows how the environmental impact is distributed in the various stages of the production process on average and concentrated in the raw material extraction and input production processes.

The growth of LEED-certified green factories has been commendable in the recent past. Currently, 82 factories have the certification, and 320 factories have registered for it [7]. The criteria for the certification include floor area specifications, water efficiency, and energy usage. To support this transition, local private banks have pledged to give loans to factories that have effluent and water treatment plants.

Global retailers are taking drastic steps to protect their reputation, as the Walt Disney Company did by ceasing production in Bangladesh [8]. Transparency is a growing concern for consumers, and as a result, for retailers as well.

In 2019, over 180 international fashion brands disclosed their suppliers in an effort to bring greater transparency to global supply chains [5]. This trend may become a requisite for reputation, as companies who do not disclose their information are distrusted and are seen as not taking responsibility for their practices. To ensure supply chain monitoring, some foreign brands hire agents to ensure that production capacity is sufficient, or that sub-contractors meet safety and compliance requirements. However, the effectiveness of these is yet to be seen.

Another trend since the Rana Plaza disaster has been to form partnerships with NGOs and MNCs to collaborate on programs focused on sustainability targets. Not only does this include the relevant stakeholders, but it also ensures that the program is created by those with the appropriate knowledge and skills. Both the Alliance and the Accord are examples of this. Currently, BRAC University, the C&A Foundation, and the BGMEA are working to map all factories of the country to create a digital database allowing information to be accessed by workers, clients, and other stakeholders. This will be a major step in digitizing RMG and connecting organizations and authority bodies, increasing both accountability and accessibility.

The Bangladesh government has set a target of $50 billion for RMG exports by 2021. With only 2 years and a little under $20 billion to go, this is a steep hill to climb. This is an indication of how the industry may have overestimated its ability to rely on cheap labor instead of boosting productivity.

Currently, the government, BGMEA, and MNCs conduct audits on factories, but in an unorganized manner. On top of this, the government regulatory bodies are severely understaffed to monitor the estimated 3,500+ factories. With the new international collaborations, however, the industry has become a strong example of how international partnerships, such as the Alliance and Accord, and pressure on companies can lead to organized strategic change. The government needs to foster this growth in sustainability by encouraging investment and lobby for lower export tariffs. The discourse regarding labour laws is crucial to develop an ongoing dialogue about a significant portion of the population. The BGMEA needs to establish and follow up on clear compliance guidelines and can boost its credibility by continuing international partnerships.

Many may argue that consumers will not go out of their way to buy cheap clothes ethically, or that anything that hampers Bangladesh’s low production cost advantage cannot be beneficial in any way. Although this may be true today, it may not be true in the future as digitization continues to impact purchase decisions, or when Vietnam and Cambodia provide sustainable production at costs on par with Bangladesh. In addition, unsustainable practices undoubtedly raise costs in the long run as they use more resources, incur more wastage, and require more money for disaster management. To truly carry RMG as a strategic industry into the era of being a middle-income country, Bangladesh will have to look farther into the future than current costs and export targets.

Mondrita Rashid, Part-time content writer at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected].

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights