GET IN TOUCH

- Please wait...

At the time of writing, The Covid-19 pandemic has already had a profound impact on the supply chain and demand for the apparel sector. Top exporters like Bangladesh have started feeling the heat due to raw material sourcing challenges and canceled orders.

The performance of the RMG sector is more critical for an economy like Bangladesh, since apparel contributes 84% of the country’s export, employing close to 3.5 million people. While gauging the possible impact of the pandemic on the apparel sector, it is imperative to look into the demand side scenario by analyzing the European, US, and emerging markets for apparel export.

Major global fashion brands have taken prompt responses to help in flattening the Coronavirus curve and this has left significant impacts on worker employment, revenues, and overall operations.

Nike has released a statement that outlines their halt in operations and closure of stores in the United States, Canada, Western Europe, Australia and, New Zealand to limit the spread of the Coronavirus (COVID-19). However, Nike-owned stores in South Korea, Japan, most of China, and in many other countries remain open as per the current stage of the outbreak. [1]

UNIQLO had initially shut down nearly 350 stores in China in late February. In the current stage of the pandemic, about 30 still remain closed, while most of its shops outside Hubei province, the epicenter of the coronavirus outbreak, have reopened. Globally, Uniqlo outlet closures have exceeded 100, with 27 in Europe. All 50 outlets in the United States have closed, following in the footsteps of other major fashion brands. [2]

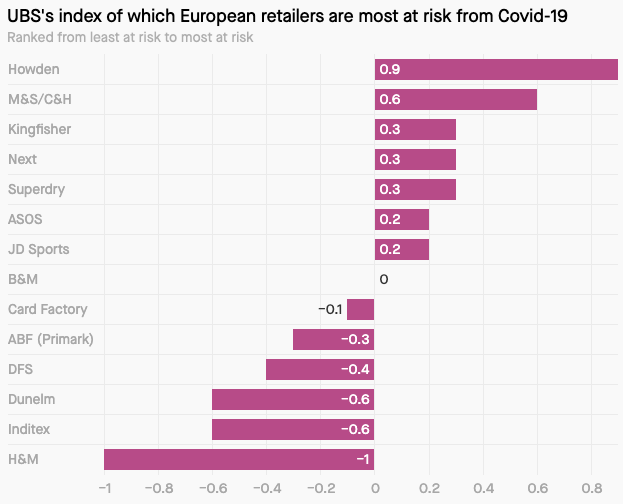

The above figure, generated by UBS, is based on the company’s share of sales from China, the total value of products it manufactures in the country, and how quickly inventory turns over. [3]

The highest risk is observed for H&M which sources about 50% of its materials from China. Inditex, and its largest brand Zara, is also at high risk due to its highest rate of inventory turnover despite sourcing only 10% of materials from China.

Due to the large-scale closure of stores owing to the lock-down enforced by different governments, apparel sales for Bangladesh have plummeted, leading to brands postponing or canceling orders. Bangladesh Garments Manufacturers and Exporters Association (BGMEA) has claimed that USD 1.5 billion worth of orders have already been canceled or put on hold by the buyers.

Global production of Cotton is largely dominated by India, China, the US, Pakistan, and Brazil.

The fall in cotton demand from China has led to a demand-supply mismatch. Along with this, a decrease in yarn exports for India to China will mean an even greater excess supply of yarn and lower prices in the international market. Raw (unginned) cotton in the Gondal (Gujarat) market shed almost 10 percent to trade at Rs 4,280 a quintal in the first week of March from a level of Rs 4,755 a month ago. Cotton yarn lost 2-3 percent over the last one month, while synthetic yarn declined by 4-5 percent during the past one month, following a fall in crude prices. [4]

Although Bangladesh had been a victim of yarn-dumping from India, with import prices quoted to be up to 30% lower than local production costs by India, before the Coronavirus outbreak[5], domestic prices have since rebounded. Bangladesh Garment Buying House Association (BGHA) has complained that spinners are now charging 15% higher compared to last month due to yarn import disruption from India. Supply chain disruption due to the Chinese lockdown has had negative repercussions across Bangladesh’s textile and Garments value chain, as Chinese imports account for a significant portion of the sector’s total import (46% of USD 34 billion as of FY 2018-19). [6]

While short-term sourcing destinations have not undergone dramatic changes as of yet, employment layoffs as a result of government-mandated shutdowns and quarantines are inevitable.

While countries that have incorporated some form of automation in their apparel industries may be slightly cushioned from this impact, countries such as Bangladesh may suffer greatly given their apparel and textiles sector.

With China’s situation being on the road to recovery, it will require at least the first half of 2020 to bring itself back to pre-outbreak capacity levels.

With the goal of full recovery to pre-pandemic levels, seeming to be a process that might stretch beyond 2020, the question then remains of how long global buyers are willing to wait before looking to other sourcing markets or opting to near-shore supply.

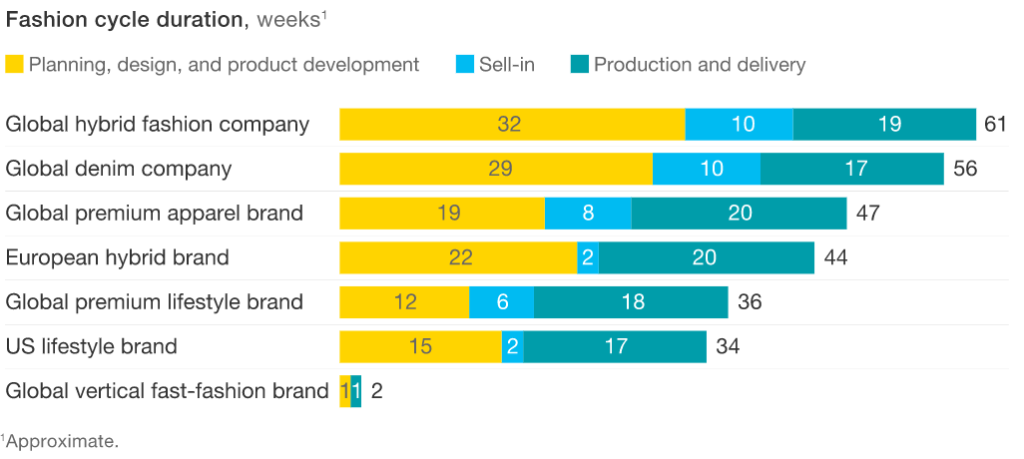

As can be judged by the fast-fashion cycle, COVID-19 since being declared a pandemic (in early March), has not yet spanned the cumulative of the Sell-in and Production Delivery Phases for the average global brand. Thus a hypothetical cut-off point for these companies has likely not been reached as to when they will switch supply sources.

It is expected with the progress of healthcare responses globally that the road to recovery may begin as soon as mid-April. However, there will likely be a price hike for global apparel products until global healthcare responses improve, which will persist until equilibrium can be re-established. over the coming months.

Bangladesh’s overdependence on apparel export might prove to be its Achilles heel. Large-scale order cancellation and deferment are causing a liquidity crisis across the sector, prompting the BGMEA President to appeal for support, both from international buyers and the government. The government has responded by announcing a stimulus plan of BDT 5,000 crore, explicitly geared towards the export-led sectors. The primary goal of the stimulus package is to protect jobs, facilitate regular salary payment and ensure the survival of the financially weak apparel factories. Details of the plan are still being worked out and timely deployment of the fund would be imperative to stabilize the sector.

The current lock-down would come to an end on 4th April and the government’s next directive on further extension of the closure will be dependent on the extent of contagion of Covid-19. By looking at the trajectory of the infected numbers in comparable countries, it’s likely that the number of infected patients in Bangladesh might increase sharply over the coming weeks. This would likely disrupt the production process further in apparel factories. Alongside this, the continued spread of Covid-19 in the EU and US–, the new epicenters of the disease, would further dampen demand for apparel and lead to another round of order cancellations.

This article was originally published on March 29th, 2020.

Zahedul Amin, Co-founder & Director, and Sartaz Zahir, Content Writer at LightCastle Partners, have co-authored the write-up. For further clarifications, contact here: [email protected].

The LightCastle team has been analyzing the macro and industry level picture and possible impacts wrought about by the Covid-19 crisis. Over the following days, we’ll be covering the major sectors shedding light on the possible short and long-term ramifications of the global pandemic. Read all the articles in the series.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights