GET IN TOUCH

- Please wait...

Bangladesh was one of the fastest-growing countries in Southeast Asia over the last decade, with an average of 6% GDP growth over time. However, due to the wrath of the great lockdown caused by the COVID-19 pandemic, the World Bank and IMF (International Monetary Fund) recast GDP growth to decline to as low as 2% in 2020.

In contrast, the pre-COVID-19 forecast was 8.2% for the same period[3]. So it is now evident, in sync with the rest of the world, the economy of Bangladesh is also in the face of a significant downturn, and recession looms near.

As this lockdown prevails, businesses in Bangladesh face tremendous trouble ahead, especially the Micro, Small, and Medium Enterprises (MSMEs) sector, which contributes 25% of the total GDP [1]. Bangladesh has around 10 million SMEs employing 18 million people, which is 25% of the entire labor force[1].

Almost all enterprises are now being affected because of disruptions in the supply chains and demand depression. These are being affected differently, and in different degrees depending on the type of activities, size & locations, and risk absorption capacity, many enterprises are facing challenges owing to supply chain disruptions, the rising cost of raw materials, limited cash flow & loss of earnings & profit. These will strain many of their capacity to pay rent, bills, and salaries – ultimately forcing countless to shut down, triggering a spike of unemployment in the country.

So we ask, how do the stimulus packages by the Government of Bangladesh plan to support the MSMEs to survive through and rebuild after this unprecedented crisis? To find out, let’s take a look at what the overall stimulus package offers compared to our neighbors in Asia.

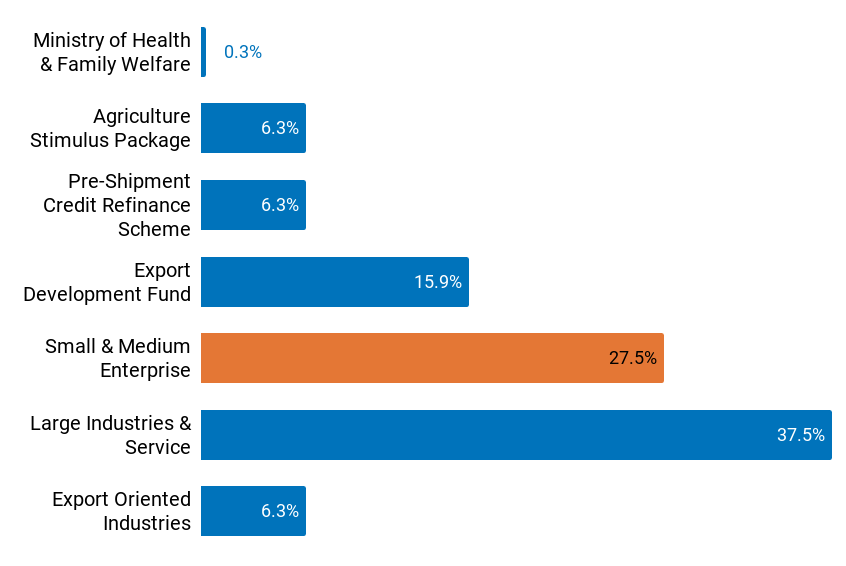

The Government of Bangladesh (GoB) has unveiled a set of stimulus packages to save the people and the economy. The accumulated financial stimulus packages and relief schemes announced, as of the 14th of May, stand at almost ~US$ 11.7 billion (~Tk 100,000 cr) [11], which is nearly 3.6% of the GDP of the country. The GoB has also reached out for soft loans of a total of US$ 2.6 billion (Tk 221,000 cr) from foreign donors to cushion the impact of this pandemic and recession that prevails[8].

The Central Bank has also taken several steps to inject liquidity into the banking sector (reducing the CRR & repo rate, and purchase of bonds & bills). It has taken measures to delay non-performing loan classification, relieve late fees for credit cards, extend tenures of trade instruments, and ensure access to financial services to deal with the urgent scenario.

The majority of the package will be channeled through the banking sector. Out of the total package, above 50% (Tk 50,000 cr) will be sourced from the sector directly; nearly 43% will be financed by Bangladesh Bank, while the rest will be supported by the country’s fiscal budget. From this, around 70% of the stimulus will be disbursed through commercial banks, while 22% will be disbursed by the Bangladesh Bank.

The largest program from the seven declared is worth Tk 30,000 cr, which will be provided as a working capital loan to the affected industry and service sector through the banking system[4]. Against this 9% designated rate, the Government will pay half (4.5%) as a subsidy to the banks while the particular consumer of this loan will have to pay the remaining half (4.5%) to the bank[7].

However, this program does not cover CMSEs as a separate program has been proposed directly worth Tk 22,000 cr at a 4.5% rate with an additional 5% subsidy supported by the Government. Following the above calculation on the combined Tk 52,000 cr programs, the Government’s net burden (subsidy rates) stands at Tk 5,287 cr (U$ 62.2 million).

The Government of Bangladesh has allocated 27.5% for SMEs out of the total COVID-19 relief fund as working capital finance for a duration of 3 years.

SMEs will receive the Tk 22,000 cr from commercial banks as loans against a 9% designated rate, from which the Government will pay 5% as the subsidy to the banks while the borrower will pay 4% to the bank[12]. Farmers who are suffering due to the lockdown will be provided loans at 4% interest from a Tk 5,000 cr agricultural stimulus package.

Micro and marginalized businesses will also be applicable for refinancing schemes of Tk 3,000 cr through MFIs. Banks will also be entitled to a refinance scheme from Tk 10,000 cr fund at 4% interest for up to 50% loan portfolio from Bangladesh Bank to provide this working capital for the next three years.

In addition, farmers who are suffering due to the lockdown will be provided loans at 4% interest from a Tk 5,000 cr agricultural stimulus package[12]. Micro and marginalized businesses will also be applicable for refinancing schemes of Tk 3,000 cr through MFIs.

According to the Bangladesh government’s guidelines, the working capital will be provided on the basis of bank-client relations and a maximum of 10% of last year’s portfolio can be disbursed to CMSME sector in a single fiscal year.

Enterprises in manufacturing, services, and trade-based firms would receive, respectively, 50%, 30%, and 20% of the annual loans, whereas Cottage, micro, and small industries will account for at least 70% of the total loans. In addition, 15% of the loans must be allocated to borrowers in rural areas, and at least 5% to women entrepreneurs[6].

Government Has Allocated 27.5% Of the Total Fiscal Stimulus Package for the SMEs

While the stimulus package brings hope for SMEs, disbursement of the hefty stimulus package remains a challenge. Interest rate fixed at 9% coupled with the increasing number of non-performing loans, the banking industry is going through an intensive stress test. The guidelines do not seem to take into consideration the challenges and are creating greater risk aversion by the banks.

Considering the average interest rate spread of 4.04[10], high overhead costs, and a greater probability of defaulting in SME lending, it is almost certain banks are going to take the risk-averse position and deny loans to commercial banks.

The liquidity crunch is further worsening since a good number of corporate and individual clients are withdrawing funds regularly.

Proper disbursement of the loans still remains the biggest challenge in addition to the risk of an upsurge of NPLs as the capacity of credit repayments decreases during the lockdown.

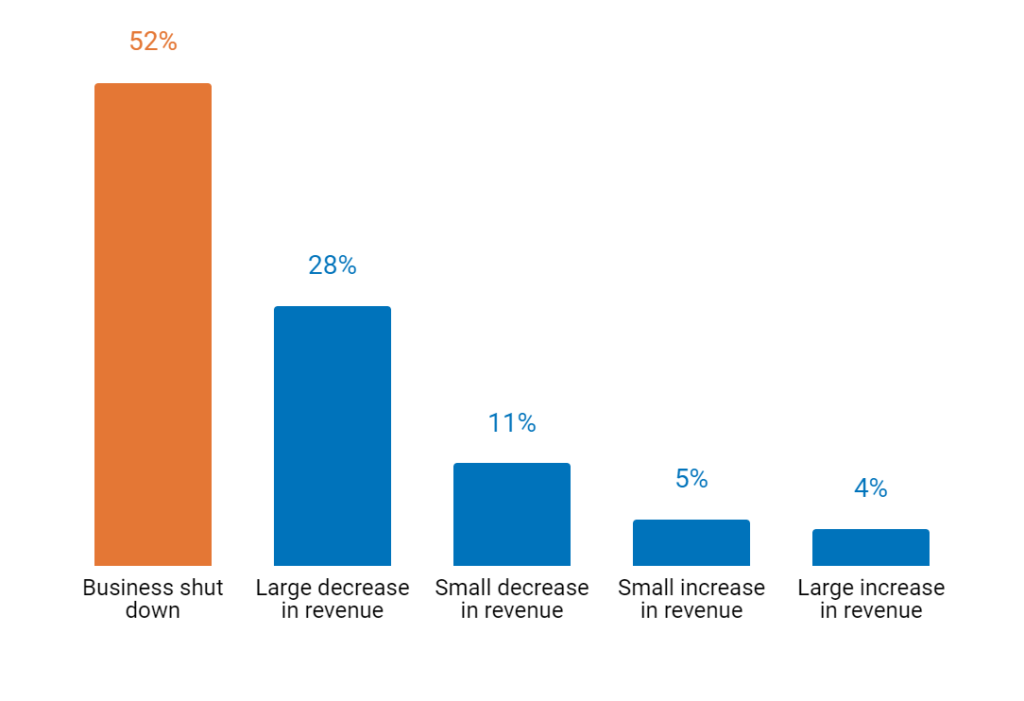

A recent study by LightCastle Partners and Sheba.xyz on 230 respondents from the Trading & Production sector and the Service Industry revealed that 52% of the SMEs have completely shut down their operations amid the ensuing lockdown.

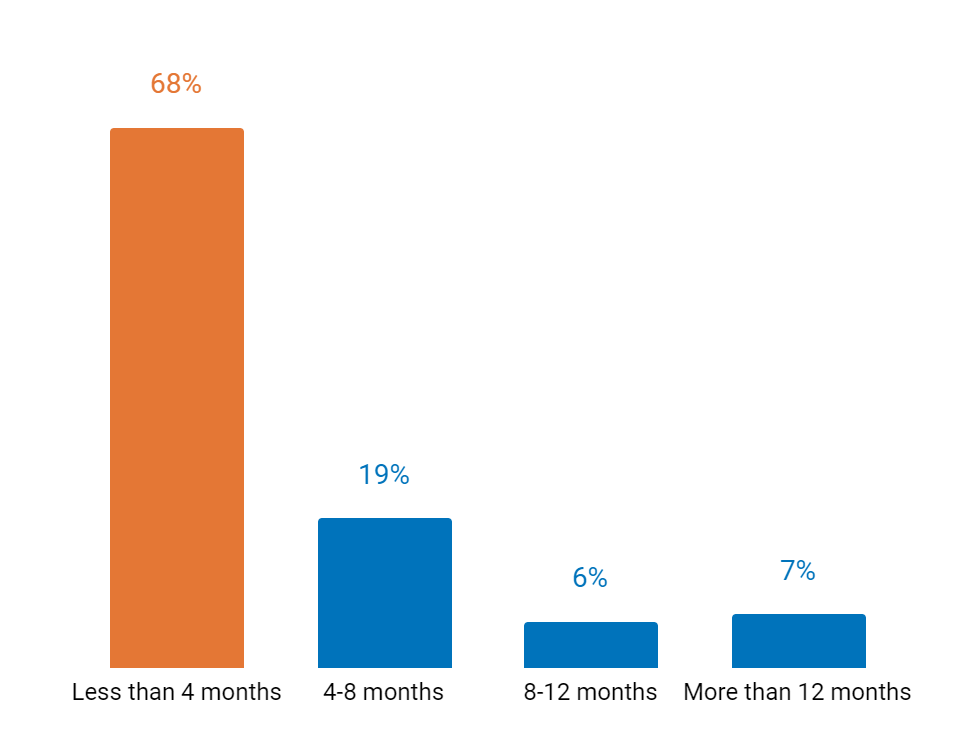

With no means of generating revenue, 68% of the respondents reported having only 4 months of runway. Enterprises are cutting corners massively by optimizing costs – 46% of SMEs are projecting to lay off over 50% of their Staff within four months.

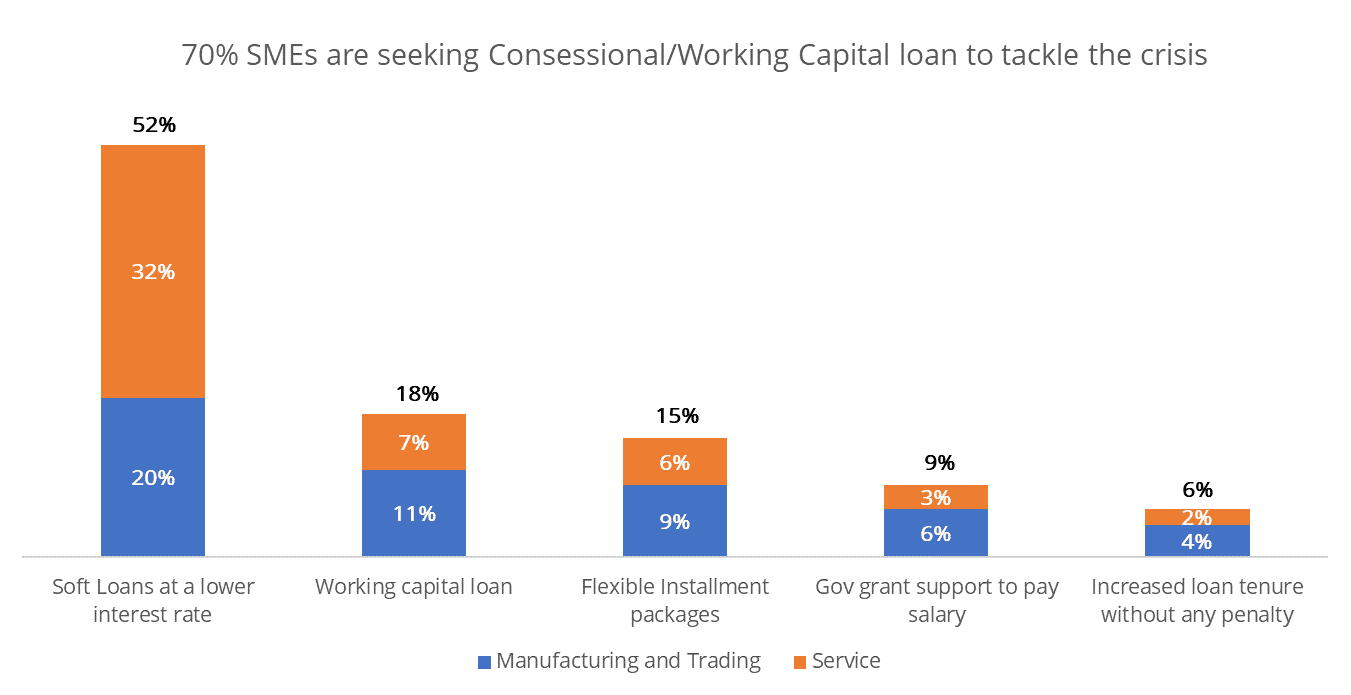

The study also showed more than two-thirds of the SMEs (70%) seek soft loans/working capital loans to tackle this crisis. However, other benefits such as government grants, relaxation of VAT & TAX, and unconditional loans from the government will shield many businesses further from capsizing.

The enhanced stimulus package by the GoB is undoubtedly a necessary step in the right direction, but the nature of the impact is such that even a stimulus package of this magnitude can only serve as a band-aid solution.

In order to strengthen the shield to fight this pandemic & the upcoming recession, new schemes such as rent subsidy, and relaxation of TAX and VAT are plausible options. In addition, introducing credit guarantee schemes and ensuring a fair disbursement of the funds- banking sector collaboration with MFIs, MFS, and specific guidelines coupled with utmost transparency and accountability should be put into place.

The NBR may consider a number of support measures which could include, increased depreciation of assets for the upcoming two years, a special reduced rate of VAT for the domestic purchase of goods and services for six months, relief from penalties and interest for tax-related payments till December 2020 and deferred payment of quarterly AITs till June 2020.

NBR may also consider raising tax exempted annual turnover limit for SMEs from Tk. 50 lakh to Tk. 1.0 crore for the year FY2020 and FY2021.

Food service establishments in the country are estimated to be around 60,000, where more than 15 lakh people are working[9]. In Dhaka alone, there are approximately 10,000 restaurants that employ 3 lakh people.

While the businesses are shut down, the restaurants are still liable for rent. Entrepreneurs of small businesses, with monthly revenue of less than Tk 5 lakh, may be provided with a rent subsidy during the lockdown period and for one month thereafter.

One of the proven tools to globally address the current challenges of the Banking sector is credit guarantee schemes. Since the government shares potential losses in case of a default, Credit/Risk guarantee schemes enable financial institutions to provide riskier loans[5].

The current package does not include any such support and this is an avenue the government could explore by allocating portions of the stimulus package to create the schemes. With such support, financial institutions will be able to provide ample access to finance for the vulnerable SMEs.

Since the country’s mobile financial services are highly sophisticated, a combined effort between the Government, non-governmental organizations, and informal sector organizations can highly assist in implementing this social assistance program.

Keeping in mind, 38% of the SMEs are not under financial inclusion, they will suffer to reach out to the banks as most do not have the necessary documentation or transaction history, and lack collateral.

Mobile financial services can ensure the transparency of delivering the stimulus to the right individual at a faster pace – resulting in a significant convergence of several low and middle-income individuals along with SMEs under financial inclusion. In times like this, mobile financial support should be promoted for promoting social distancing also.

The large number of small and medium industries operating across the country will create a paramount challenge for the Government or the banks to monitor and control this operation efficiently. As MFIs have grown over the years and become more professional, some have begun to move into the SME segment. Many see this gradual transition to SME finance as a natural shift, as the MFIs follow their customers’ development/journey.

According to the Microcredit Regulatory Authority (MRA) rules 2010, the ME loan outstanding of an MFI cannot be more than 50% of the total Microcredit portfolio. This rule can be relaxed in this dire time, and collaboration can be merged to reach out to the need, leveraging the experience and capacity of MFIs. Also, there can be a collaboration among the banking sector and SME Foundation, Palli Karma Sahayak Foundation (PKSF), and non-government organizations (NGOs) to create an authentic database of the most affected SMEs to ensure the proper deployment of funds.

Formulating specific guidelines for the proper management of the incentive packages is equally important as the fund itself. Since the Government has already lagged behind in the revenue collection of this fiscal year, efficient utilization of the rescue packages is of paramount importance.

Given the context of the country, there are countless ways to misuse funds when loans are disbursed based on bank-client relationships. Thus, the highest level of transparency and accountability must be put into place to ensure the loans are reaching the actual entrepreneurs who are in dire need of them. What is imperative is the Government’s honest political will to the supreme degree.

Habitual loan defaulters contribute largely to non-performing loans, and it is imperative to keep them away from the package. It is still persistent in the system that many subscribers take out loans only to delay the payments and reschedule continuously. Only the adversely affected entrepreneurs who have a sound financial transaction record must be made eligible to receive the loans.

In the current development paradigm of Bangladesh, SMEs have played a significant role in generating jobs and GDP growth. SMEs have the potential to change the face of Bangladesh’s economy and therefore the sector should receive more emphasis to keep afloat during this crisis and way forward.

Authors: Mehad ul Haque, Project Manager & Senior Business Consultant, and Ishtiak Mourshed, Trainee Consultant, LightCastle Partners

The LightCastle team has been analyzing the macro and industry level picture and possible impacts wrought about by the Covid-19 crisis. Over the following days, we’ll be covering the major sectors shedding light on the possible short and long-term ramifications of the global pandemic. Read all the articles in the series.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights