GET IN TOUCH

- Please wait...

Micro-insurance results from the combination of microfinance and insurance to provide security to the low-income community. It is a unique sector due to its size, technicality, and diversity. The intangibility of financial products is brought to the fore in the case of insurance since the investment pattern requires an initial payment and an uncertain pay-out in the future.

Health and illness, death, crop, land, aquaculture and livestock, dowry payments, and forced relocation are among the more critical unsystematic shocks that cause the poor and ultra-poor to face an increased vulnerability to further poverty. Subsequently, micro-insurance is a comprehensive risk control technique that can shield individuals or families from severe financial crises caused by these unexpected occurrences. It further promotes investment among the poor, avoiding the use of investable resources in times of crisis, in addition to stabilizing income and protecting human and physical capital.

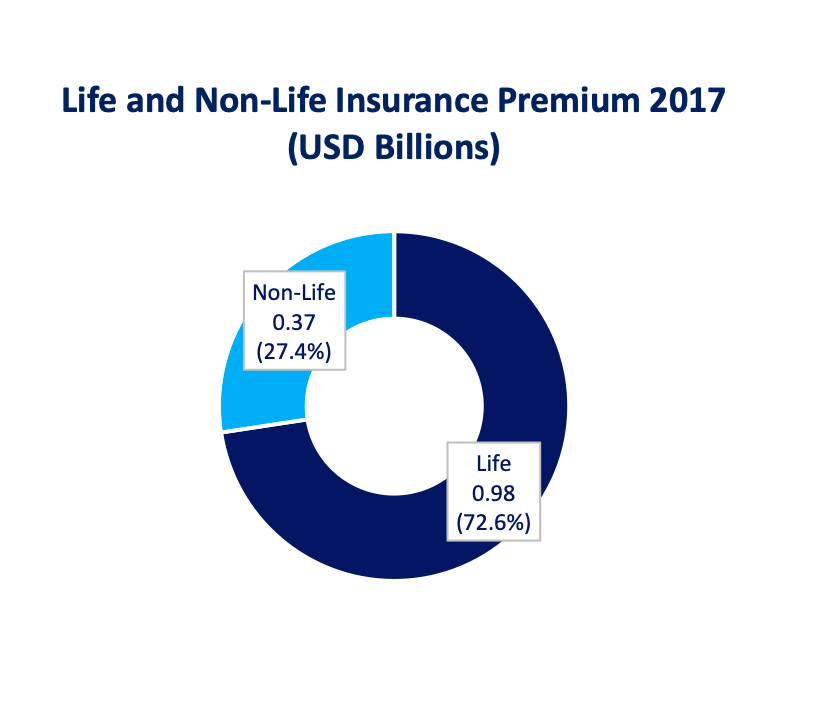

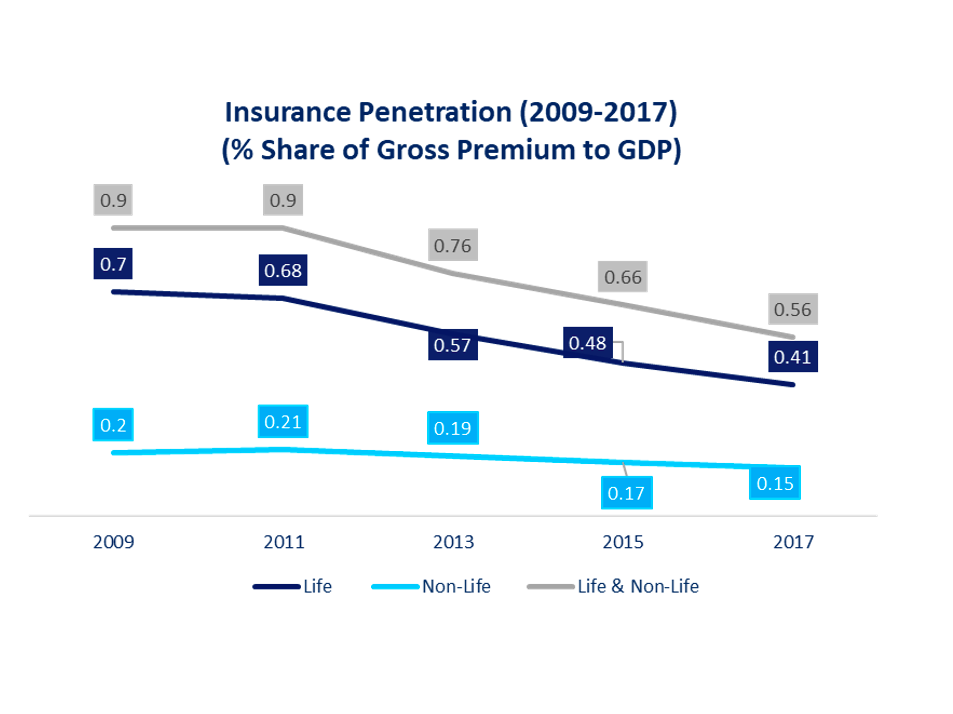

Overall, the country’s insurance sector has been witnessing slow growth. According to a background report for the Bangladesh government’s Seventh Five Year Plan 2016- 2020, most people in Bangladesh across multiple product segments (life and non-life) remain underserved by the insurance market. However, the two state-owned insurance companies have a better outreach than the others. The low insurance penetration in Bangladesh compares unfavorably with other South Asian countries. In 2007, the insurance premium in Bangladesh was slightly less than USD 3.0 per capita (0.51 percent of GDP), and although this had risen by 2012 to USD 7 per capita, this still represented only 0.94 percent of GDP. This compares with 1.15 percent of GDP in Sri Lanka, 3.46 percent of GDP in India, and a high of 4.51 percent of GDP in Malaysia. [2] [11]

Being a low-lying delta, Bangladesh is highly vulnerable to severe events, such as floods and cyclones. Meanwhile, a significant portion of this deltaic nation is only above sea level, exposing coastal populations to tropical cyclones and storm surges regularly. Those most affected by natural disasters like floods, cyclones, and earthquakes are low-income households with limited resources and coping mechanisms to deal with any sudden loss of income or assets. Traditional disaster-recovery strategies, such as borrowing from family, selling land, using microcredit, and saving, are often insufficient in climate-vulnerable countries like Bangladesh. Structured measures for the management of disaster threats and their impacts are not always successful for Bangladesh and other countries with extensive exposure to disasters – including climate-related extreme events. Non-structural risk management measures, like microinsurance, including crop insurance microinsurance, customized to specific needs of the poor, is an effective instrument to address the risk.[13]

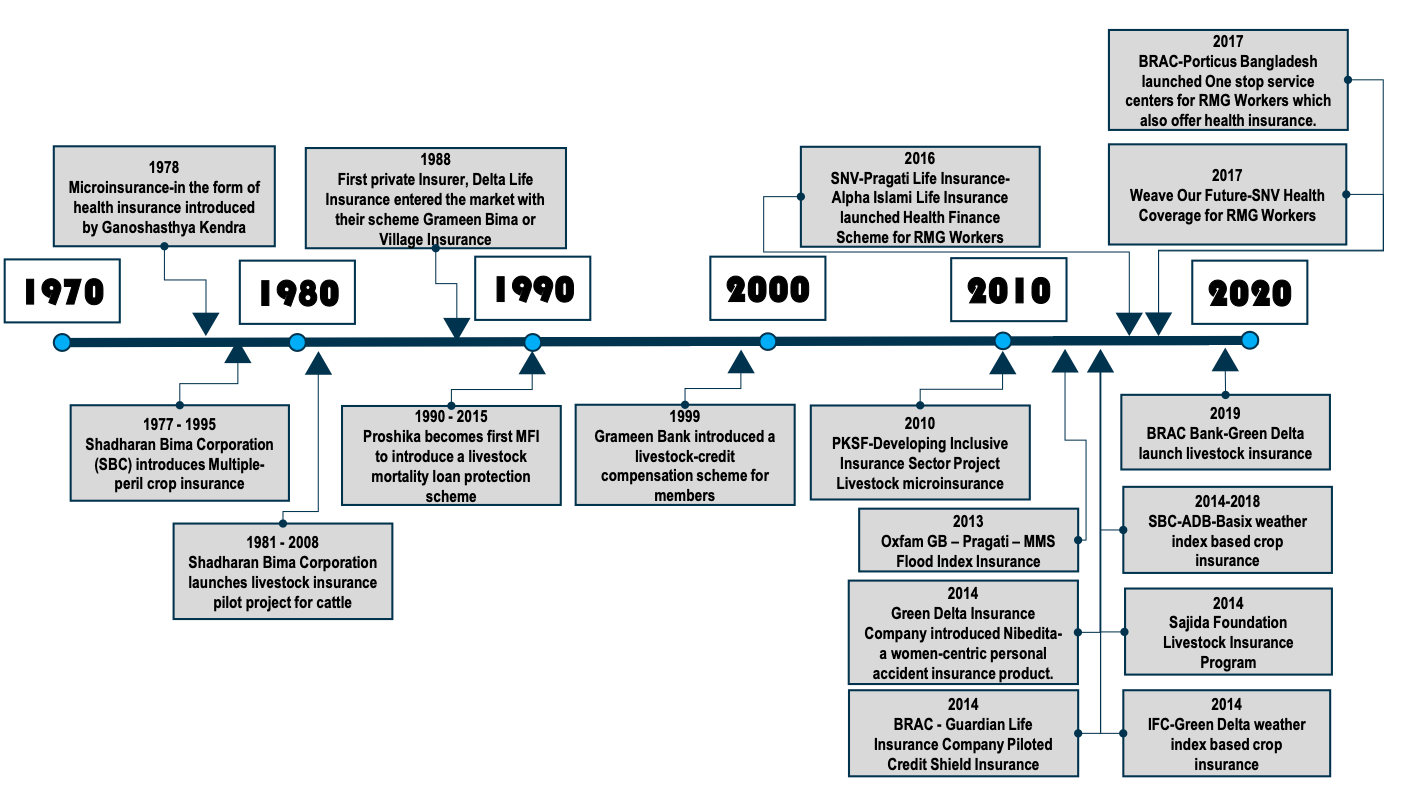

Microinsurance – in the form of health insurance – was first introduced in Bangladesh in the by an NGO called Ganoshasthya Kendra in 1978. Currently, there are three types of organizations offering micro-insurance services: Non-government organization microfinance institutions (NGO-MFIs), private insurance companies, and the two state-owned corporations: the Sadharan Bima Corporation (SBC), a general insurer, and the Jiban Bima Corporation (JBC), a life insurer.

The NGO-MFIs that dominate Bangladesh’s microinsurance sector can be divided into smaller, often regional organizations and large national institutions. As of 2013, BRAC, Grameen Kalyan, and Proshika were the three largest national NGO-MFIs, accounting for the majority of the country’s microinsurance clients. While smaller, regional-level NGO-MFIs account for a much smaller proportion of the microinsurance market, they generally offer a wider variety of microinsurance products and have a more significant amount of policy-holders from low-income groups. [13]

Though Bangladesh has made significant progress in agriculture since independence, it still faces significant challenges in sustaining food security due to its high population growth rate and high vulnerability to natural disasters and climate change. Agriculture receives many subsidies from the government, but support in terms of agriculture insurance is still limited. Agricultural insurance coverage in Bangladesh remains extremely poor, despite the initiatives, and very few farmers have any information, understanding, or access to crop, livestock, or fisheries insurance. Several MFIs are providing micro-insurance products linked to credit, including livestock-credit insurance, but these schemes will not be able to cope with shocks that destroy large numbers of animals if reinsurance agreements are not in place. [7]

Peril Crop Insurance, Sadharan Bima Corporation (SBC) (1977 – 1995): Agricultural crop insurance was first introduced into Bangladesh on a pilot basis in 1977 by the state-owned insurance company Sadharan Bima Corporation (SBC). It offered a conventional individual-grower multiple-peril crop insurance (MPCI) yield-shortfall policy that provided coverage against a wide range of climatic perils, including the potentially catastrophic climatic risks of floods, droughts, winds, and natural threats of pests and diseases. From 1977 to 1995, the individual grower MPCI program was insured exclusively by SBC, which retained 100 percent of the losses without external reinsurance protection. There was no premium subsidy or other financial support from the government. [7]

Livestock Mortality Loan Protection Scheme (1990 -2015): Proshika was the first MFI to introduce a livestock-mortality loan protection scheme in 1990 under its Participatory Livestock Compensation Fund (PLCF). Proshika’s revolving credit fund for cattle, sheep/goats, and poultry-rearing enterprises were required to be linked to the PLCF. During the loan repayment term, the PLCF policy paid for the “sudden death” of covered animals and poultry (usually 12 to 24 months). On the other hand, the policy did not cover the insured’s bad management practices or carelessness. Between 1990 and 2009, Proshika achieved significant coverage under its livestock-credit insurance program and positive underwriting results. Proshika’s microcredit and microinsurance operations were suspended due to severe financial losses in 2015. [7]

Livestock Insurance Program, Grameen Bank (1999 – Present): Starting in 1999, the Grameen Fisheries and Livestock Foundation (Grameen Motsho O Pashusampad Foundation, GMPF) introduced a livestock-credit compensation scheme for Community Livestock and Dairy Development members Project (CLDDP). Livestock producers who accessed dairy cattle investment loans were protected under a livestock mortality compensation scheme provided by the Livestock Insurance Fund (LIF). The LIF program insured against death of the dairy cow where this was “outside the owner’s control” and was an all-risks livestock mortality policy. The program’s liability was limited within GMPF, and the program did not carry any form of catastrophe reinsurance protection. [7]

Weather Index Based Crop Insurance (WIBCI), Sadharan Bima Corporation (SBC)-ADB (2014- 2018): Asian Development Bank (ADB), in 2014 has entered into a three-year agreement with Government of Bangladesh (GOB) and SCB, the state insurance company, to develop a pilot weather index-based crop insurance, WIBCI, project initially to cover excess rainfall or rainfall deficit for selected crops and districts in Bangladesh. According to ADB, the project formulation was adequate in achieving the envisaged results. The project has been likely to remain relevant even beyond the project completion as exploring agriculture insurance continued even after the pilot project timeline. [23]

Weather Index Based Agriculture Insurance, Green Delta Insurance Company, (2015-Present): Green Delta Insurance Company Limited had its first footstep in the agriculture sector jointly with International Finance Corporation (IFC), in 2015. The goal of Weather Index Based Agriculture Insurance is to reduce the risks that farmers face throughout the cultivation process as a result of bad weather. Weather Index Based Agriculture Insurance seeks to reduce the risks that farmers and agri-lenders suffer as a result of various climatic changes and natural calamities. [10]

Livestock Insurance for Cattle Farmers, Green Delta Insurance Company and BRAC Bank (2019-Present): BRAC Bank Limited and Green Delta Insurance Company Limited jointly launched Bangladesh’s first-ever livestock insurance coverage facility for cattle farmers. The initiative is supported by BFP-B (Business Finance for the Poor in Bangladesh) Challenge Fund, a Department for International Development (DFID) project, and managed by NATHAN Associates, London. The unique scheme will immensely benefit the cattle farmers. It aims to mitigate the risk of livestock loss caused by accidental death, diseases, partial disability, or even death during calving. The new facility is a part of the two organizations’ continued commitment to bringing innovative products for their valued customers. Green Delta introduces a unique NFC-enabled collar tag for cattle identification and monitoring to facilitate smooth claim settlement. [19]

Flood index-based crop insurance for Haor, Sadharan Bima Corporation and OXFAM (SBC) (2020-Present): Sadharan Bima Corporation (SBC) has launched flood index-based crop insurance for haor (wetland) areas in 2020. Under a pilot project sponsored by OXFAM, the SBC has launched the scheme at Mithamoin sub-district under Kishoreganj district. Under this risk coverage, haor farmers will get compensation for their Boro crops if they (paddy) get inundated by floodwaters. [22]

Health Finance Scheme for RMG workers, SNV and Pragati Life Insurance (2016- Present): To provide better healthcare service for the RMG workers in Bangladesh, Pragati Life Insurance Limited and Alpha Islami Life Insurance Limited paired with SNV to implement a project to create a comprehensive and easily accessible healthcare system for garment workers. Under this initiative, workers of the factories concerned benefit from cashless access to medical consultations, diagnostics services, family planning services, and maternal care. The project is paired with four local health care providers (Centre for Women and Health, Apollo Clinic, Mawna City Hospital and Al Hera Hospital) for ensuring sustainable healthcare provision for garment workers. [9]

Health Coverage, Weave Our Future (2017 – Present): Leading French retailer Auchan’s foundation called Weave Our Future (WOF) initiated two four-year long health coverage projects for RMG Workers in 2017. In the first project, SNV is providing the technical support of the project while Ganoshasthya Kendra is implementing it on the field. Similarly, for the second project, Weave Our Future has partnered with BADAS (Diabetic Association of Bangladesh) to implement it. [15] [16]

Empowering the Readymade Garments Workers Living in Urban Slums of Dhaka (ERMG), BRAC (2017 – Present): BRAC has instigated one stop service centers (OSSCs) with funding from Porticus Bangladesh in 2017. The program offers essential services like healthcare, legal aid, skill development training, etc. to RMG workers. One of the services is a health insurance program from the workers. It is being implemented with the support Pragati Insurance and a few partner hospitals. Workers are able to take healthcare services by paying an annual premium of BDT 600, shared between them and BRAC. [21]

Private insurance companies currently offer a variety of microinsurance products, such as Gono-Grameen Bima (general rural insurance), Grameen Jibon Bima (rural life insurance), and Daridra Bimochone Jibon Bima (rural health insurance) (life insurance for poverty alleviation). Nonetheless, the majority of these schemes offer products with very similar terms and conditions. Micro-health insurance plans have also developed as another product provided by NGO-MFIs to guarantee loan repayment, as health issues account for around one-third of all microcredit defaults. [13] Over the past two decades, the focus of micro-health insurance shifted from being a means for safeguarding loans to providing a better access to healthcare system for the poor and disadvantaged people of the country.

Grameen Kalyan (1996 – Present): In 1996, Grameen Kalyan (GK) was launched when Grameen Trust handed over ten clinics to the newly registered NGO. Membership of its health scheme is open to all Grameen Bank borrowers and their families and poor villagers living within an 8 km radius of a GK health center. GK has been working to make the micro health insurance as an integral part of its primary healthcare since launching the healthcare program. [5] [14]

Health Program, Society for Social Services (SSS) (1996 – Present): SSS, as a distinctive part of inclusive sustainable development, adopted health program to implement officially in 1996. The organization launched SSS Hospital on its own building at the hub of Tangail sadar in 2000. This hospital, registered with the Government, has 50 beds and provides proper healthcare to the people at a nominal cost. Its health card scheme is open to all families living in the urban and rural areas of SSS’s operation. [5] [18]

BRAC Micro Health Insurance for Poor Rural Women in Bangladesh (BRAC MHIB) (2001– Present): The BRAC Micro Health Insurance for Poor Rural Women in Bangladesh (BRAC-MHIB) started as a pilot project in Madhabdi in Narshingdi District in July 2001. The project, managed by BRAC, functions as a separate company. For a yearly premium and a co-payment, the system enables voluntary participation in the General Benefits Package, which includes subsidized necessary services such as consultation, pathology tests, and medications. Family size and Village Organization (VO) membership determine the premium amount, while MHIB membership determines co-payment charges. Each BRAC MHIB policyholder is issued a card, which serves as evidence of insurance coverage. The program has referral service links with a few government and private hospitals for cases that BRAC’s Health Clinics are not equipped to handle. [5] [19]

Shomosti, CARE Bangladesh Pragati Life Insurance (2019- Present): CARE Bangladesh introduced a Micro Health Insurance (MHI) scheme in partnership with Pragati Life Insurance Limited. Shomoshti, a Swiss Agency for Development and Cooperation (SDC) funded project, creates access to better health services for rural communities. Through this insurance coverage, enrolled households will get both indoor and outdoor health facilities from private health service providers within their reach at a low yearly premium. [8] [20]

Microinsurance Projects, Green Delta Life Insurance (1988 – Present): In 1988, Delta began its experiment, Grameen Bima or village insurance, as a project under the Delta Life corporate umbrella, inspired by the rising success of the Grameen Bank and other microcredit programs in Bangladesh. At the end of 1993, Delta launched a second microinsurance project, GonoBima (urban insurance), designed for the urban slums. Besides the different geographic focus—rural vs. urban—the main distinction between the two is that Grameen Bima (rural insurance) collected weekly premiums while the Gono Bima requested them monthly. Delta’s board of directors agreed to spin out Gono and Grameen Bima into a non-profit organization in 2002. However, following an actuarial analysis later that year revealed that the microinsurance programs were profitable, the board decided to keep them and rearrange them for improved efficiency. [1] [3]

To complement the endowment policy, the corporation began offering loans in 1991. The loans were designed to provide policyholders with additional income, assisting in their economic growth while making it easier for them to pay their premiums. Delta got into the act by providing loans of its own, inspired by the phenomenal success of microcredit in Bangladesh. Consequently, Delta was essentially offering savings, credit, and insurance all rolled into one product. They were providing microloans without any donor money; all of the money that was being loaned out came from the poor themselves. [3]

Credit Shield Insurance, BRAC, Guardian Life Insurance (2017 – Present): BRAC, in partnership with Guardian Life Insurance Company, joined the micro-insurance market of Bangladesh in 2017, making its credit shield insurance product available nationwide to a further 5 million of its clients across the country. Under this scheme, when applying for a loan, BRAC’s current microfinance clients will be able to opt-in for credit shield insurance by paying a one-time fee. The household would not be responsible for any unpaid loan sums if the insured passes away while having a loan with BRAC. The family would not be liable for any outstanding loan sums if the insured passes away while having a loan with BRAC. They will also receive the principal amount of the loan that they have already paid back and a USD 64 ‘death benefit’ to help cover funeral expenses and ensure that their savings are not harmed. Meanwhile, the third-party insurance company pays the equivalent loan outstanding amount to BRAC to cover its losses. [6]

The Developing Inclusive Insurance Sector Project (DIISP), PKSF (2010-2014): The Developing Inclusive Insurance Sector Project (DIISP) was launched by PKSF in January 2010 with the goal of safeguarding the poor, especially women, from death, illness, livestock loss, crop loss, and other risks through low-cost insurance services. Key innovative aspects of the project were addressing the needs of the poor through reducing vulnerability, building protection against shocks by developing affordable insurance services and expanding insurance service outreach through the network of MFIs in a sustainable approach. Under this program, SAJIDA Foundation offered credit, life, health (with free paramedic service) and livestock (cattle) microinsurance. The project which has been successfully completed in December 2014. [17]

Nibedita, Green Delta Insurance Company (2014-Present): In 2014, Green Delta Insurance Company the company launched Nibedita—a comprehensive accident insurance product for both urban and rural women that now serves all income levels. In addition to covering a woman policyholder for accidental death and disability, the Nibedita policy compensates women for trauma resulting from rape, sexual harassment, robbery, or an acid attack. The Nibedita policy also offers extended coverage for death during childbirth and loss or damage to household goods and personal belongings from disasters—fire, lightning, riots, typhoons, cyclones, windstorms, floods, and earthquakes. [4]

Generally, microinsurance schemes take the form of four models:

Most of the microinsurance schemes in Bangladesh run by the NGO-MFIs are either full-service or provider models. The partner-agent model – mandated for all microinsurance entities by the government of India – may provide new opportunities to meet consumers’ needs cost-effectively and feasibly for providers. Partnerships with private insurance companies might, in some instances, allow NGO-MFIs to secure the actuarial skills and capital reserve base required to make such microinsurance schemes affordable. In contrast, private sector partners would gain access to the NGO-MFI’s vast network of local agents. [13]

With the support from NGO-MFIs and private insurers and their collaboration with international donor agencies, microinsurance has witnessed remarkable progress in Bangladesh. However, even though there had been significant innovations addressing the needs of the specific sectors, the prevalence of similar schemes and granular scale outreach has made it formidable to reach the ultimate goal of providing distinctive microinsurance programs all across the country. Nevertheless, the rise in pioneering ideas to strengthen the sector over the past decade has been a beacon of hope for the future that lies ahead.

This article is a part of a two-part series. In this article, we have covered the history and evolution of the Micro-insurance sector in Bangladesh. The next and final article of this series will provide an overview of the challenges of this sector and present recommendations that might help strengthen the sector in the upcoming decade.

This article was authored by Dipa Sultana, Business Consultant at LightCastle Partners, and Fahmid Kaisar, Business Analyst at LightCastle Partners. Advisory and editorial support was provided by Saif Nazrul, Project Manager and Senior Business Consultant at LightCastle Partners. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights