GET IN TOUCH

- Please wait...

LightCastle Partners collaborated with Auto Rebellion to conduct a study on the automotive industry of Bangladesh, with a particular focus on the passenger vehicle segment, which encompasses sedans or private cars, sports utility vehicles (SUVs), and microbuses or multi-purpose Vehicles (MPVs). LightCastle conducted a number of interviews with exclusive automobile importer-dealers which covered brands that captured more than 75% of the market share for new passenger vehicles, as well as a number of reconditioned car sellers. LightCastle also conducted a rapid online survey of prospective customers who intended to purchase a passenger vehicle.

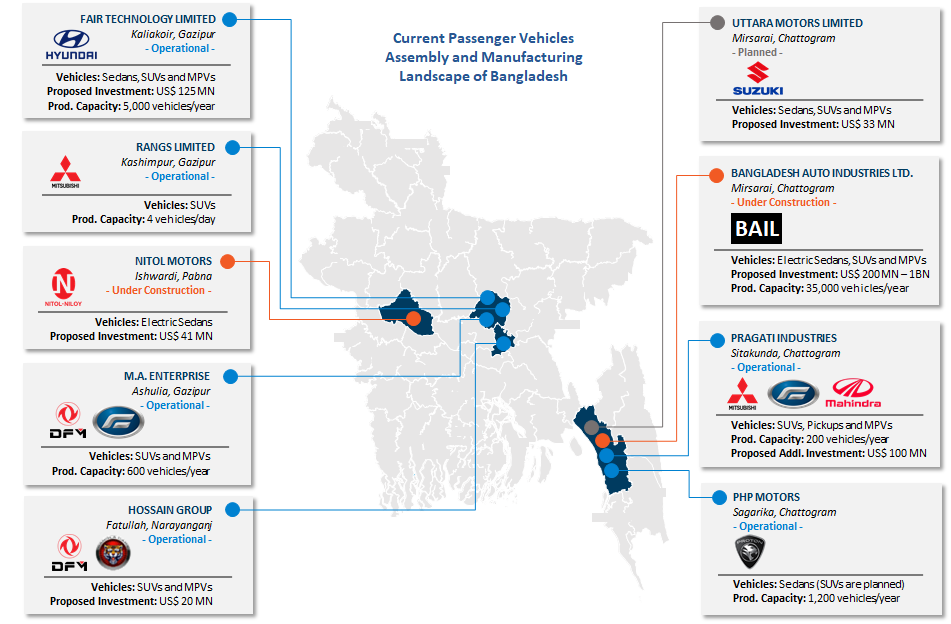

The Bangladeshi automobile industry is at a crossroads. Although the industry had reached several major milestones – such as the setting up of the very first automobile assembling operations, Pragati Industries Ltd., through a government joint venture in 1966, the operation of the first-ever private sector-owned assembling plant for passenger vehicles by PHP Group in 2015[1], and when the size of the passenger vehicle segment temporarily crossed the 32,000 units barrier in 2017[2] – the industry never truly took off.

With the imminent finalization and approval of the Automobile Industry Development Policy, the industry is approaching yet another watershed moment. There have been several recent investment commitments in recent years (see Figure 1 above), plans for which have only been accelerated with the forthcoming policy. This collaborative study, which takes into account the views and opinions of both automobile sellers and potential buyers, aims to put finger on the pulse of where the industry may be headed in the future. This article explores the trends that are likely to shape the industry in the coming years and identifies factors that can make or break the future of this industry.

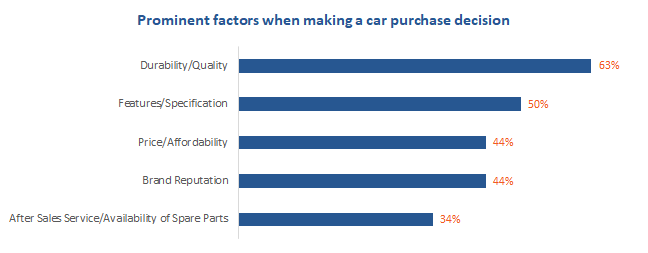

Demand for Japan-made cars remains strong in the market. Consumer survey responses showed that for their next purchase, two-thirds of potential customers would opt for a Toyota, the clear frontrunner in terms of brand over the years for quality, durability, availability of spare parts and brand recognition. However, brand reputation is no longer the top factor in consumers’ mind. Consumers today place more emphasis on the durability and quality of vehicles and the specifications they offer, over brand reputation. As a consequence, consumers today, led by the younger generation are opting for more and more non-Japan made cars – as can be seen with the emergence of Chinese brands such as Great Wall Motors and Korean brands such as Hyundai – which will lead to a much more diverse market composition in the future. Effective online advertisement and success in organic marketing have contributed to these brands gaining a greater foothold in the market. Japanese brands, especially Toyota will, however, continue to outperform and dominate the numerous smaller non-Japanese brands in the mid- to long-term.

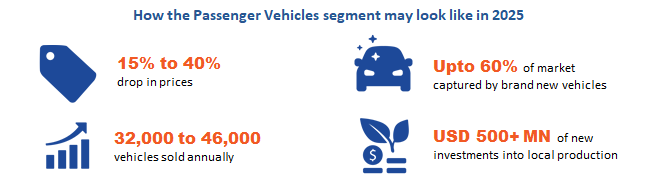

On the other hand, reconditioned cars will continue to lose their market share, as more and more customers choose to switch to brand new cars. In fact, nearly 22% of the consumers surveyed who wished to purchase a car within the next 12 months, intended to purchase a brand-new vehicle. Brand new cars offer longer lifespan and minimal need for maintenance in the first few years. After-sales service and the availability of spare parts were important factors of consideration to one-third of prospective buyers. Authorized importers of brand-new vehicles now guarantee supplies of authentic spare parts – the lack of which used to be a barrier to purchasing brand new vehicles – augmenting customer confidence. These shifts in consumer preferences signal a take-off for the brand-new car segment, which can account for as much as 60% of all passenger vehicle sales by volume by 2025, in an optimistic scenario. Even in the most pessimistic scenario, the brand-new segment is expected to hold its market share of approximately 20% of the volume of passenger vehicles until 2025.

SUVs were traditionally sought after for use by either government officials or the most affluent classes of consumers. But as of late, SUVs have been growing in popularity among family buyers too, as customers desire the sportier look, the higher ground clearance and ease of driving in Bangladeshi road conditions, facilitated by the availability of more affordable models hitting the market, especially from Chinese brands. As a result, crossover-style models and SUVs have become the main growth drivers for the importers and sellers of passenger vehicles in Bangladesh, particularly for sellers of brand-new vehicles. This trend in favor of SUVs is supported by LightCastle’s consumer data as well; surveys of prospective buyers conducted showed that 28.1% of them intended to purchase an SUV in the coming year, whereas historical data from Bangladesh Road Transport Authority (BRTA) attributed 24% of the passenger vehicle market share in 2020 to SUVs[2].

The automobile policy strongly encourages the local assembly and manufacturing of cars with tax rebates for importing semi-knocked down (SKD) and completely-knocked down (CKD) parts and fiscal incentives for building assembly plants. This would naturally lower the price of the cars compared to imported CBU (Completely Built Up) vehicles, which are arrested by the heavy-duty structure. LightCastle’s analysis and seller interview findings indicate that local production of passenger vehicles can lead to an industry-wide price reduction within the range of 15%-40% by 2025.

A reduction in price will be particularly impactful as it will induct a completely new segment of car buyers – the country’s lower-middle income population. According to a study by the Boston Consulting Group[3], the “emerging middle” population in Bangladesh – the number of people belonging to households with a monthly income of between BDT 25,001 – 50,000 – are expected to increase from 22 million in 2020 to 27 million by 2025, while the population of “middle and affluent” class are expected to increase from 19 million in 2020 to 34 million by 2025. Undoubtedly, much of the demand for cars among the middle-income segment remains latent and if a price reduction of as much as 30%-40% can be achieved, many more consumers will purchase family cars and a segment of these new customers will even leapfrog directly to purchasing brand-new cars instead of purchasing cars from the secondary market. Low-interest car loan schemes, that are under active consideration by multiple importer-dealers, can only accelerate such a trend, unlocking massive untapped demand in the market that can dwarf the present-day sales.

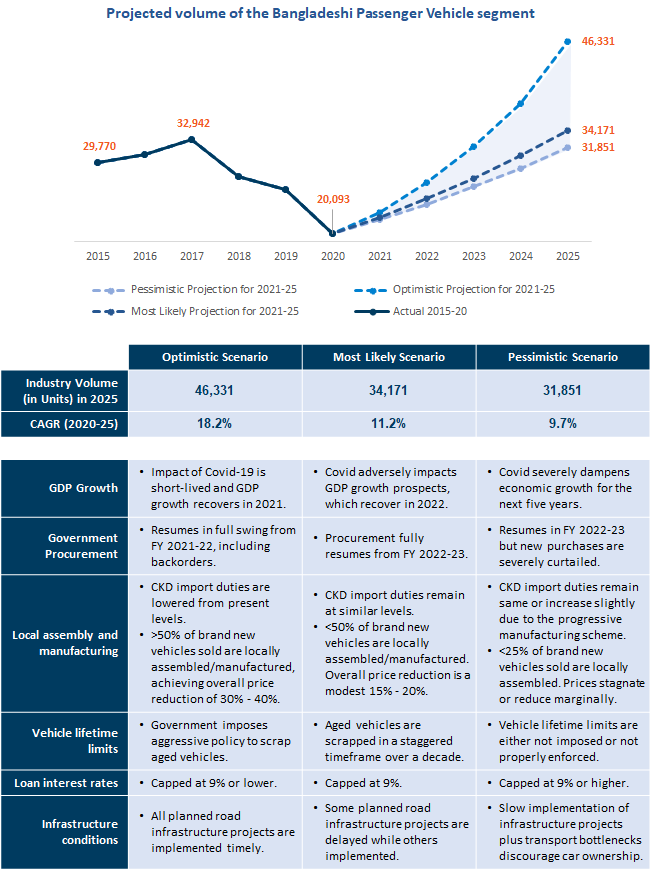

In an optimistic industry outlook, LightCastle anticipates the volume of the passenger vehicle segment to almost double in size to exceed 46,000 units annually by 2025 (representing an 18.2% CAGR) if the high economic growth persists, the impact of Covid-19 is short-lived, if the growth of consumer spending power continues and if the local vehicle assembly and production picks up at a rapid pace, leading to a dramatic industry-wide price reduction in the 30% – 40% range. On the other hand, in a pessimistic scenario, a 9.7% CAGR is projected between 2020 and 2025, leading to an annual market volume of 31,851 in 2025. This scenario assumes post-pandemic economic recovery to be slow, and the emergence of an improved public transport system paired with the ever-growing popularity of ride-sharing services will dampen the demand for new cars among young professionals. In the most likely scenario, LightCastle projects industry volume to reach 34,171 units in 2025, representing an 11.2% CAGR.

However, as projected in the most optimistic scenario, even a doubling of the annual sales volume of passenger vehicles may not make for a lucrative market for investment into full manufacturing. Interviewees still find it doubtful whether the foreign brands would like to invest in such a small domestic market, as it is generally believed that a total industry volume of 100,000 units (including not only passenger vehicles but also smaller commercial vehicles such as pick-ups and light trucks) is the point where local manufacturing becomes viable. Most interviewers believe that the vast majority of the investment by 2025 will go towards plants for SKD and basic CKD assembly of vehicles.

Multiple factors will shape market growth over the next decade and thus need to be considered for active policy support. Some of the most prominent factors identified include:

Procurement by the public sector is a major portion of annual sales for many of the brands that participated in the interview. Whether it is procurement for government projects, or for the transport of government officials, or through various low-interest loan facilities extended to high-level government officials and defense personnel, procurement by and for the public sector contribute greatly to the annual sales of the automobile industry. Owing to the pandemic, to shift public monetary resources to more urgent needs such as healthcare spending, the Government had suspended vehicle procurement for most projects until June 2021. The recovery of the automobile sector hinges greatly on how soon the moratorium on purchases is lifted and how many of the orders foregone during the moratorium are actually placed when government orders resume fully. The draft automobile policy’s intention to limit government procurement to only locally-produced vehicles can be a shot in the arm for assemblers, while an expansion of eligibility for the special low-interest loans to include mid-level government employees can benefit the overall automobile sector.

Due to the country’s consistent economic growth, disposable incomes are on the rise and more and more families are climbing the economic ladder. Notwithstanding the temporary setback due to Covid-19, this upward social mobility means that an ever-increasing number of families will be able to afford cars in the coming days for their personal needs. And, as economic development spreads beyond the metropolitan cities such as Dhaka and Chittagong, demand for cars in the divisional cities will increase rapidly.

As the economy grows, so too does business activity. Businesses will not only demand more commercial vehicles for goods transportation, but also passenger vehicles for moving their people. However, the adverse financial impact of Covid-19 cannot be ignored, and arguably the two biggest casualties of the disruption – the lower-middle income population and small and medium businesses – are those that could have spearheaded the growth of the automobile sector in the next decade.

The Bangladeshi automobile segment is heavily impacted by the exorbitant import duties placed on imported vehicles, both reconditioned and brand new. The draft automobile policy plans to phase out reconditioned cars followed gradually by the phase-out of completely built-up (CBU) cars. But until they are fully phased out, the viability of the reconditioned car segment will be dictated heavily by the tax rates set by National Board of Revenue (NBR). Any further increase in import duties would have negative consequences on the reconditioned car segment, especially as reconditioned sellers already feel unfairly targeted by the current method of duty calculation for imported reconditioned vehicles.

On the other hand, a heavy reduction in import duties for the import of SKD and CKD components, brought forth by the automobile development policy, can significantly boost the prospects of the local automobile industry.

Many Bangladeshi customers rely on bank loans to finance their purchase. Over 28% of the prospective buyers from LightCastle’s online survey indicated that they will be financing their car purchases with loans, while another 28% were contemplating loans as an option. In a market that is expected to be dominated by hire purchases, à la the motorcycle and consumer electronics industries of Bangladesh, the government’s deftness in maintaining manageable interest rates will dictate the future of the industry. If the present scenario of excess liquidity in the banking sector and historically low interest rates (capped at 9% since 2020, with some banks seen disbursing loans as low at as low as 7-8% interest rates) persist, they can be a boon for the automobile industry[4]. Notwithstanding any major shocks to the financial system, the current market conditions are conducive for importer-dealers and prospective assemblers for introducing hire purchase facilities sooner rather than later.

With the consistent escalation in prices of compressed natural gas (CNG) and a stagnation in the price of fuel oil with little likelihood of price increases in the mid-term, car CNG conversion is no longer viable for most car buyers. Therefore, fuel prices are no longer a decisive factor for car buyers.

But on the other hand, the cost per unit of electricity can emerge as a major dealbreaker, especially as electric vehicles (EVs) take hold in the market. The automotive development policy already alludes to a future dominated by EVs and environmental policies and tax breaks are likely to incentivize the purchase of EVs going forward. But before purchasing EVs, consumers are likely to weigh the variable costs associated with operating an EV. Presently, although high-voltage electrical lines can be extended to households for EV charging, consumers have to pay out-of-pocket for the installation of this special line and the electricity consumed is charged at commercial tariffs, which are significantly more expensive than residential tariffs[5]. If the price of electricity continues to rise as it has been consistently for the last several years, the cost per kilometer for operating an EV (which is now estimated to be as low as half the cost as when operating fossil fuel-based cars , even at commercial tariff rates) will go up and will act as a disincentive for buyers to upgrade to EVs from fossil fuel-based vehicles – especially as operations and maintenance of EVs, particularly in the case of battery replacement, are substantially higher than their fossil fuel-based counterparts. This may jeopardize the government’s target of having at least 15% of all registered vehicles to be powered by “environment-friendly electricity” by 2030[6].

Cities in Bangladesh do not generally have an efficient public transport system. But the status quo might change with the inauguration of the mass rapid transit projects and the convergence of the myriad bus routes into a franchise system in Dhaka city. An improvement in the public transport system can reduce the need for cars among the more environmentally-conscious youth, leading to lower than anticipated demand in Dhaka.

Ridesharing is another major alternative to owning cars. However, interview respondents were mixed in their opinion of ridesharing services. More than a third of interviewees believed it had had a negligible impact on the automobile sector i.e., the reduction in demand from households were balanced out by the purchases from ridesharing drivers and operators. Some interviewees even opined that ride sharing has helped increase sales along the budget segment of reconditioned cars. Two interviewees felt that with the emergence of Covid-19, consumers will shun ridesharing services and suggested that it has already led to many families purchasing their own car. Only one interviewee believed that ride sharing has had a definitive adverse impact on the sales of passenger vehicles, which led to a decline in the sales of lower-end reconditioned cars priced at BDT 2 million or below.

Worsening air pollution is a major concern in Bangladesh, with vehicle emissions – particularly those from aged vehicles – contributing to Dhaka becoming one of the top-most polluted cities in the world[7]. The automobile policy addresses the need to retire and scrap vehicles operating beyond a certain lifetime by revising the Motor Vehicle Ordinance 1982 but does not prescribe any lifetime limits. Currently, Bangladesh does not have any cap on vehicle age, which paves the way for a used cars (secondary) market to flourish. It is common for cars being used in metropolitan cities to be used for extended periods and then sold for use in smaller regional districts, flouting fitness standards. This practice essentially keeps cars circulating within the market for decades and obstructs the growth of the primary car market, while the exorbitantly high new car prices act as a disincentive to upgrade. If the government can set and strictly enforce an age limit for cars, it can be a windfall for the brand-new car segment. But such a move is likely to be politically unpopular and may face protests from transport workers.

Going forward, the government may also choose to implement traffic restrictions for environment preservation purposes such as the odd-even scheme, which allows cars with odd and even number plates on the street on alternating days, as seen in New Delhi in India. But ironically, such a move may increase the demand for cars, at least from the affluent class population, who can afford multiple cars to circumvent such a restriction.

Bangladeshi roads are generally narrow, often gridlocked and of poor quality, but this is not thought to have adversely impacted the car purchase decision for most buyers. Indeed, the poor-quality roads are a key reason why consumers opt for SUVs. With the government undertaking a vast number of road infrastructure development projects, the adoption of cars is expected to increase in the future, especially within smaller divisional and regional cities as their number of affluent families grow, and as they become better connected to the national road network. But to truly become car-friendly and avoid the levels of congestion seen in Dhaka city, there is an urgent need for constructing more public parking facilities, widening roads and ensuring better road signages. Setting up of EV-friendly infrastructure such as a national network of charging points is also going to be critical in driving up the adoption of EVs.

Given the many tailwinds, LightCastle Partners takes a cautiously optimistic outlook on the future of the automobile industry of Bangladesh. Although the country’s automobile sector has so far vastly underperformed its true potential, it is believed that with careful planning and participative dialogue among stakeholders, the proposed automobile development policy can introduce the right blend of incentives to have a transformative effect on the local production and assembly of passenger vehicles. Done right, the automobile industry can mirror the policy success of the local two-wheelers industry, which has led to investments from multiple household brands into local vehicle production and culminated in the development of a local components industry. The industry can also take inspiration from neighboring India, where the automobiles industry contributes to a staggering 49% of manufacturing GDP[8] and 4.3% of the country’s exports[9]. But to prevent the proposed automobile policy from being yet another false start, there is undoubtedly a need for strategic foresight and precise execution of policy.

This article was authored by Saif Nazrul, Senior Business Consultant at LightCastle Partners, Asif Hossain, Founder of Auto Rebellion and Samira Rasul, Trainee Consultant at LightCastle Partners. Advisory and editorial support was provided by Zahedul Amin, Director at LightCastle Partners. For further clarifications, contact here: [email protected] and [email protected]

1. Our Story – Proton Bangladesh

2. Number of Registered Vehicle in Bangladesh – Bangladesh Road Transport Authority

3. Bangladesh: The Surging Consumer Market Nobody Saw Coming – Boston Consulting Group

4. Announced interest rate chart of the scheduled banks (lending rate) – Bangladesh Bank

5. Retail Tariff Rate – Bangladesh power Development Board

6. Bangladesh plans to attract EV manufacturers – pv magazine

7. Dhaka: The world’s most polluted city – DhakaTribune

8. Automobile – Make in India

9. Automobile – Invest India

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights