GET IN TOUCH

- Please wait...

The aquaculture sector is a major contributor to food security and foreign exchange earnings and plays a decisive role in the Bangladeshi economy. In the fiscal year 2018-19, Bangladesh earned USD 505.58 million by exporting 73,171.31 MT of fish and fishery products. [1] This represents 1.23% of the country’s total export earnings. [1] Shrimp contributed to 75.8% of the total fishery export earnings and comprised 45.6% of the total quantity of fish exports. [1] Bangladeshi aquaculture products are exported to more than 50 countries worldwide, with the major importers being the European Union (EU), USA, Japan, Russia, and China. [1] However, fish produced for exports is less than 2% of the country’s total production. [2]

In the year 2020, frozen fish and frozen fish exports from Bangladesh together accounted for USD 55.48 MN, which also caters to the market of the Bangladeshi diaspora. Some of the fish exported to the 12 MN Bangladeshi living abroad (mostly in the Middle East and the UK) concerns primarily carp and hilsha. [3] It is estimated that over 95% of all finfish exports are white fish (with bones) of the local varieties mainly serving the Bangladeshi diaspora. This would imply that the Bangladesh finfish processors have not been able to capture the international palate for sea-based finfish as it has done with shrimp exports. [3] For chilled finfish, the largest export destination is India, which contributed to 71.4% of the total exports of chilled finfish from Bangladesh in the year 2019. [3] Amongst all the species of chilled finfish, our national fish hilsha is only authorized to be exported to India. Interestingly, many finfish processors are engaged in both shrimp and finfish processing, however, they do not report their annual exports to the BFFEA by segregating between shrimp and finfish.

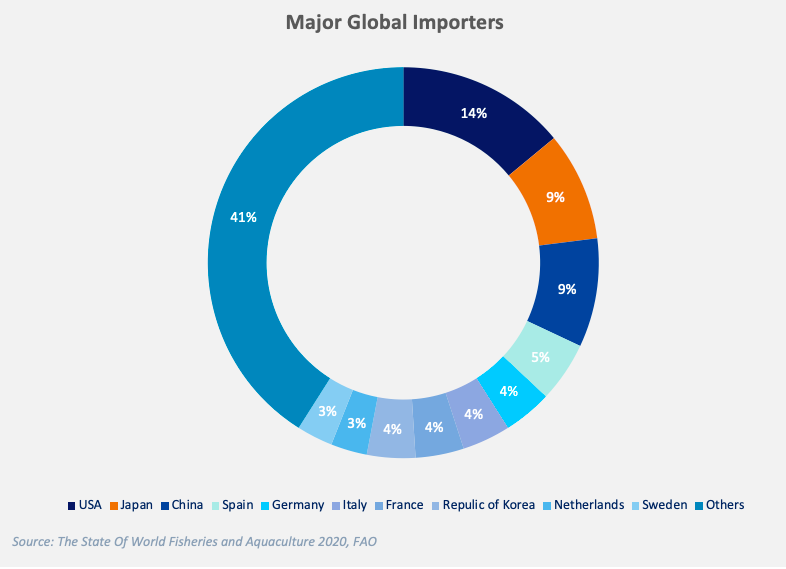

Due to the constant fish trade deficit, European Union, the U.S.A, and Japan have become the three major markets for global fish import. Japan is the world’s largest importer of fresh and frozen tuna in whole or loin form, whereas the markets of the United States of America and the European Union demand more canned tuna. African countries import cheaper small pelagic species such as mackerel or tilapia that represent an important source of dietary diversification. [4]

In the EU, the top 5 species consumed are tuna, salmon, cod, Alaska pollock, and shrimps, for which EU self-sufficiency averaged only 14% in 2018. [5] Molluscs (mainly squid and cuttlefish), crustaceans like shrimp, processed fish such as tuna loins, canned tuna, and fish fillets like pangasius dominate Europe’s biggest consumer, Southern Europe’s imports from developing countries. [6]

Diversification of aquaculture and development of species optimum for commercial production and export is constrained by numerous challenges.

One species that has growing export potential in the international market is Asian seabass, including countries like Taiwan, the USA, Japan, and Europe, and this species might yield better returns than shrimps. [7] But due to a lack of hatcheries, Bangladesh has to rely on naturally caught Asian seabass, and the local production scale is limited. Another popular fish item of import from developing countries is frozen fish fillets, but the major species produced in abundance in the country, including the carp species, come with a sheer amount of tiny little bones making fish fillet preparation difficult.

Although opportunities to venture into processing to capitalize on the growing ‘ready to eat’ segment exists, only a small number of players are active in fish processing. In the West of the country, there are two forms of processing-freezing and chilling, while in the Eastern region there is processing for ready-to-consume (fish fingers). In addition, there are only 25-30 finfish processors registered with the Bangladesh Frozen Fish Export Association (BFFEA), with the highest numbers of processed finfish exporters located in Chittagong, Khulna, while some are located in Sylhet too. [3] According to the exporters of BFFEA, the total production capacity of frozen fish units is 400,000 tons, but current utilization is only at 30,000 tons due to a shortage of raw materials. [8]

Even before the advent of the pandemic, geopolitical tensions between two of the world’s largest traders of fish, China and the USA, impacted export earnings of Bangladesh due to exceptional price volatility across multiple fish commodity categories. In 2019, prices hit record lows or highs for several key species, including tuna, pangasius, and salmon; while the FAO Fish Price Index fell by around 6 points over the year. [9] International buyers usually opt for cheaper alternatives to different varieties of fishes including Asian seabass, which have higher prices in our local market.

Bangladesh’s shrimp export volume has been plummeting over the past 3 years (-5.8% CAGR from 2014-2019). [3] One reason behind such shrinking export is consignments with adulterated shrimps that were detected by importers abroad. There have been allegations of injecting jelly, gum, water, rice starch, and other substances into black tiger shrimps, which comprise 71.4% [2] of the country’s total shrimp export to boost their weight and make them appear healthier. This taints the image of Bangladesh and might have a knock-on effect on the export of other fish, which will reduce export in overseas markets.

Non-shrimp aquaculture is developed mostly targeting domestic markets, which do not enforce food safety standards. Thus, meeting international safety and certification standards is a major challenge. Four-year research funded by Danish International Development Agency (DANIDA) from 2015 to 2019, found that low-quality production due to poor fish feed and water management is responsible for losing consumer interest in tilapia and pangasius in the local and foreign market, while other countries are banking on their export. [10] Bangladesh has immense opportunities for tilapia and pangasius exports due to their growing production and demand.

After the demarcation of the sea boundary leading to access of Bangladeshi fishers to the Area Beyond National Jurisdiction (ABNJ) of high seas, Bangladesh has a huge opportunity to harness tuna and tuna-like billfishes, some of the most popular species in the EU. However, the country is yet to extract tuna and similar pelagic fish in the deep sea due to the absence of Long-Lining and Purse Seining techniques and trained manpower. While neighboring Sri Lanka, Maldives, and India are earning a handsome amount from exporting such species, in 2019-20, tunas comprised only 0.13% (155.42 MT) of the industrial catch in Bangladesh. [11]

The aquaculture sector lacks the necessary incentives to realize its full potential in the international market. According to exporters at BFFEA, frozen fish is not enlisted as an agro-product, despite being one. Thus, while other agro-processed products get a 20% cash incentive, processed finfish exporters receive a cash incentive from the Government of Bangladesh amounting to 5% of the invoice value, up to a ceiling price of USD 1.97 per KG. This compares to a cash incentive of 10% for the export of frozen shrimp, up to a ceiling price of USD 4.90 per KG. [3] Channel margins from supermarkets and indirect taxes from the government account for at least one-third of the retail price, leaving little revenue for finfish processors. Price volatility in the international market also makes investment by processors unfavorable. The lack of incentives culminates in diminished investment in expanding finfish processing capability, thereby, constraining its expansion potential in the international market.

Many layers of middlemen combined with inefficient road infrastructure, complicate the aquaculture export supply chains calling for locations with multiple cold chains. Since specialized refrigerated vehicles are insufficient, finfish needs to be transported without cold chain facilities leading to food loss. Inefficiencies in the preservation of produce due to lack of cold chain facilities impede the aquaculture sector’s profitability and its ability to realize its full export potential. Investments in cold chain infrastructure are often deemed unprofitable due to too costly applications. [3] The individualistic nature of farmers and middlemen makes joint investments in cold chain facilities unattractive.

In the post-pandemic world, Bangladesh should re-evaluate its position with potential consumption markets to tap into this immense export potential of the aquaculture sector with necessary steps as outlined below:

Only 15% [2] of total fish production in Bangladesh is contributed by marine fishing. It is deemed necessary to explore new opportunities in marine aquaculture as a viable alternative for more fish production. Private sectors must be encouraged for ventures and expertise should be built up for longline fishing, to catch tuna and other fish species in the deep marine water, and exclusive economic zone in the Bay of Bengal.

It seems ideal to set up more registered hatcheries for the farming of quality export-oriented finfish like Asian seabass, and tuna. Private sector players could develop laboratory capacity and capabilities at the hatchery level to maintain stringent fish quality for export. This would help increase the supply of aquacultural produce that can be exported to the international market, and also contribute to maintaining standards required to acquire export certifications (such as HACCP) to tap the premium international markets.

To reduce the wastage of aquaculture production and to fulfill the hygiene and quality requirements of entering premium export markets, cold chain storage and transportation should be expanded in the main processing region, near the processors to avoid food losses. Besides developing low-cost solutions, shortening supply chains will make investment more profitable with fewer cold chain facility hotspots. Joint investments by farmer groups will be more feasible given that they would share the financial costs, and collectors will find it more attractive to source from such facilities that are likely to make high-quality products in bulk.

Rahnuma Binte Rashed, Content Writer and Tamanna Shahnowaz Sohanee, Business Consultant, at LightCastle Partners, have prepared the write-up. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights