The Renewable Energy Imperative in Bangladesh Apparel Industry

Originally published on the LightCastle Partners website.

Environmental Impact of the Global Fashion Industry

Bangladesh’s apparel industry has been pivotal to the nation’s economic development in recent decades. As the world’s second-largest garment exporter, the country has become an integral part of the international apparel market. Currently, industry leaders are focusing on fortifying the sector for the upcoming decade by adapting to the 4th Industrial Revolution, evolving geopolitics, circularity trends, and increasing automation.

The global fashion industry contributes significantly to environmental issues, as the preference for man-made fibers, such as polyester polymers, increases—currently accounting for 72% of global textile production compared to cotton’s 28%—this figure is likely to rise further.1

Over the last two decades, worldwide garment production has almost doubled, reaching 50 billion units. This surge is attributed to consumers purchasing 60% more clothing than in the past. Should this pattern persist, global apparel consumption would be leading to a 50% increase in greenhouse gas emissions, as per the Ellen MacArthur Foundation.

The Driving Forces of Change

In the backdrop of global changes, two elements increasingly have pushed manufacturing companies to seek green energy sources. Firstly, new regulations, particularly in Europe, and secondly, increasing Customer Consciousness about Climate Impact leading to change in Brand vision.

The European Union (EU) has taken steps to implement a carbon tax across various sectors, as a component of a comprehensive, long-term effort called the EU’s Green Deal. This initiative outlines a roadmap for achieving climate neutrality with the overarching goal of transitioning Europe into a continent that is free from carbon emissions by 2050.2

CBAM or Carbon Border Adjustment Mechanism, is a groundbreaking policy initiative proposed by the European Union, to prevent “carbon leakage”, a scenario where companies transfer their operations to countries with less stringent carbon regulations, thereby undermining the EU’s ambitious climate goals.

The CABM entered into force in October 2023, but it will be applicable to import only certain goods in the beginning. The mechanism is seen as a tool to encourage other nations to adopt robust carbon pricing policies. By imposing a carbon cost on imports, countries outside the EU might be motivated to implement their carbon pricing systems, allowing their exporters to avoid the CBAM charges. Even though there is no provision for CBAM to be applied to the apparel sector at this point, it might soon be the case.

Consumer Tastes have evolved over the last decade to become more concerned with climate change, global warming, and the impact of unbridled consumerism on the environment. This, in addition to the new regulations, has pushed a lot of companies to align with a greener energy agenda for their Brands.

H&M has set a vision to become climate-positive across its value chain by 2040. Levi’s has set a target of becoming net zero by 2050. Other brands like Primark, Zara, etc are also setting similar targets. As manufacturers, this inevitably means having to lower the carbon footprint in Bangladesh’s Apparel industry.

60% of the apparel brands’ GHG emissions come from apparel-producing countries. For goals like the net zero target by 2040 by H&M, the GHG reduction must happen in production countries like Bangladesh. For that, the brands are emphasizing the importance of process innovation in lowering energy, water, and chemical usage, as well as overall greenhouse gas emissions. Investing in and expanding new technologies in Bangladesh could be a viable approach.

Simultaneously, addressing the challenge of dependency on fossil fuels and an unstable grid is crucial. Renewable energy would be a great enabler in the path to decarbonization. Without sufficient change in the energy ecosystem in Bangladesh, the country runs the risk of losing competitiveness in keeping up with global changes.

Energy Mix in Bangladesh

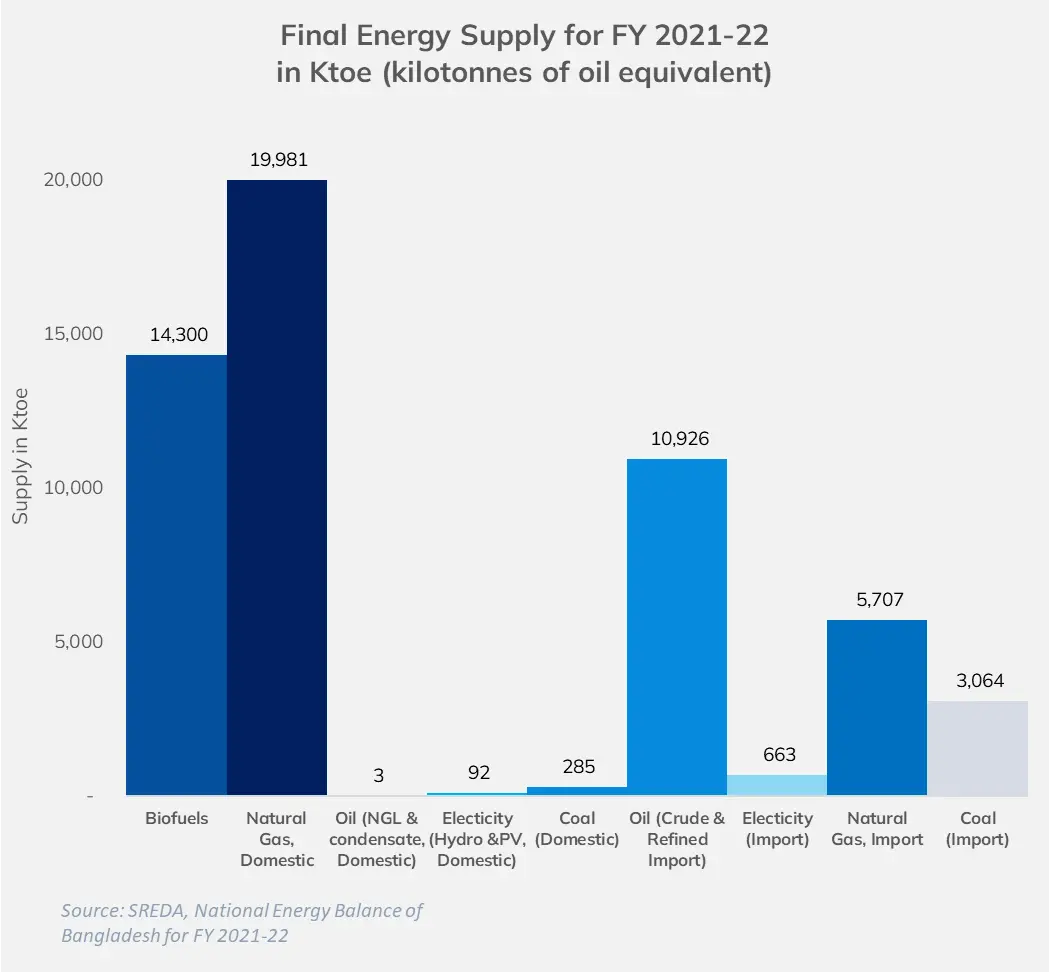

According to SREDA’s 2021-22 National Energy Balance preliminary report, Bangladesh’s total energy supply (TES) stands at 55,020 ktoe, predominantly consisting of 25,687 ktoe from natural gas and 14,300 ktoe from biofuels. Of the total, 34,660 come from domestic production, largely from natural gas and biofuel. Energy imports contribute 20,757 ktoe, almost 40% of the total.

A significant portion of this imported fuel is used for generating electricity from LNG and HFO-based power plants. The country imported 11% of its total electricity demand in June 2023, a number that has been growing in recent years.3 LNG, Coal, and Oil are also imported.

Price increases in electricity directly impact the profit margin, which the manufacturers’ association has been vocal about. The country’s sourcing from renewables is also lagging behind,4 with just 4.5% of the total production being sourced from posing a threat when the carbon impact of production starts being taken into account according to upcoming EU policies. Further investments in renewables might be a good way forward.

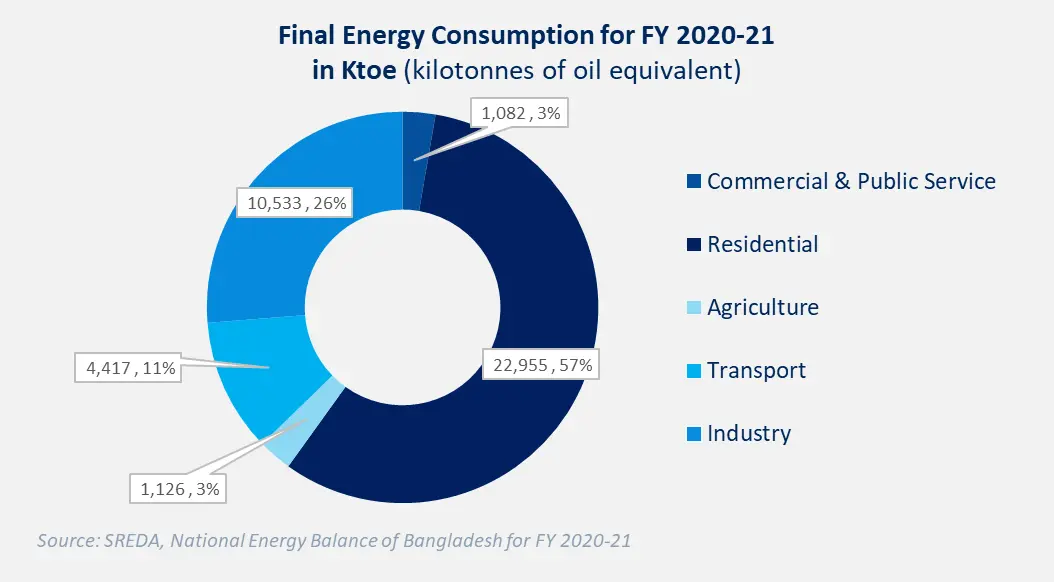

Bangladesh’s second largest demand for energy comes from the industry sector taking 26% of the total energy supply.5 It mainly consumes natural gas (45%) and coal (42%) while electricity consumption (12%) is increasing.6 30% of the industrial energy supply is taken by the textile and apparel industry.7

Bangladesh’s apparel industry has been hit by disruptions in power supply in the past, where reports in 2022 suggested even big players in the country, having to shut down production half of the time due to load-shedding.8 Using diesel to generate electricity also drives the profit margin down.

The industry, which includes spinning, dyeing, washing, and weaving mills, heavily relies on an uninterrupted electricity supply. Historically, many factories used captive power plants run on gas to meet their energy needs. The mills having captive power generation facilities annually use 169.1 billion cubic feet of gas to produce 1,700 MW of power as stated by BTMA in 2022. The captive plants are heavily reliant on gas supply, whereas the country has had gaps in gas supply in recent years. Natural gas has traditionally been a key energy source, but its reserves are dwindling.

Measures such as reactivating onshore fields and exploring new offshore blocks have been proposed. Despite these efforts, natural gas production is expected to decline, even considering the development of high-risk offshore prospects. To meet the increasing energy demand, the country has been importing Liquefied Natural Gas (LNG) to bridge the gap between supply and demand.

The Bangladesh government is strategizing to make solar energy a long-term priority. However, challenges in securing land for solar parks and grid facilities have shifted the focus to rooftop solar systems, and wind power, with net metering and Decentralized Renewable Energy (DRE) solutions.

Floating solar technology is being considered as a viable option due to the country’s abundant water resources. Yet, this technology is still in its early stages, with considerable research needed to fully understand its potential and implementation.

As per the Sustainable and Renewable Energy Development Authority (SREDA), there’s an almost equal distribution between off-grid and on-grid solar energy solutions in Bangladesh. The recent surge in off-grid solar solutions is driven by the adoption of solar home systems, solar-powered irrigation, and rooftop solar systems that do not utilize net metering.

At a private level, the companies are trying to embrace green energy with solar panels, using efficient lighting and manufacturing units. Bangladesh has some of the top Leed Certified factories in the world. 54 of the world’s top 100 ranked factories are now located here (December 2023).

One example is AR Jeans Producers, the 14th project in Bangladesh to receive LEED Platinum level. It has a 45 K.W. solar power plant with extremely effective monocrystalline panels. It saves 43% more energy than a traditional building by using energy-efficient light, window planning that allows more natural light, and advanced sewing machines. Plummy Fashion’s LEED Platinum-certified factory has solar panels that support 13% of the total energy, and also the building and manufacturing process saves 50% more power.9

Due to space constraints, solar panels cannot adequately support the full demand for energy. As factories mostly are growing vertically in Bangladesh, solar capacity cannot put up with that movement. There is a potential to see the use of solar panels across the surface area of the factory, enhancement and more efficient solar panels, and other innovations that will still enable our use of renewable energy.

Steps Taken By Bangladesh Toward Green Transition

Bangladesh is actively advancing its economic growth with the Vision 2041 initiative, targeting high-income country status by its 70th independence anniversary. The nation’s economy is projected to grow over five times its current size.

To support this ambitious goal, a significant increase in energy demand is anticipated, despite extensive efforts in energy efficiency and conservation. By 2050, final energy consumption is expected to rise by 3.75 times from its 2019 levels, and in scenarios of slower economic growth, the increase will still be over three times.10

The industrial sector, being a key driver of this economic expansion, will see a particularly rapid growth in energy consumption. According to the Integrated Energy and Power Master plan, Bangladesh aims to become a “Decarbonization-ready” country by 2050 and reach the eventual achievement of carbon neutrality in 2070. By 2041, the plan is to reduce fossil fuel dependency to below 60% in the power generation mix.

According to the Power Development Plan, energy-related CO2 emissions will increase from 57 Mt CO2e in 2012 to 170 Mt CO2e in 2030, and 305 Mt in the ATS PP2041 case. Bangladesh has initiated policies and plans to ensure sustainability and advance its clean energy:

The Mujib Climate Prosperity Plan (MCPP): The MCPP is a comprehensive strategy that addresses Bangladesh’s climate change resilience, aiming to counteract a potential 6.8% annual GDP decline by 2030 due to inadequate global climate action. This plan involves ambitious adaptation efforts and significant investments, aligning with the nation’s 2041 goals.

By transitioning from vulnerability to resilience to prosperity (VRP), the MCPP targets economic growth, green job creation, well-being promotion, energy independence, and becoming a net green energy exporter. The MCPP aligns with the Paris Agreement, emphasizing international support and long-term sustainability. It’s designed to evolve with changing technology and resources, with an expected investment of USD 90 billion in resilient pathways over the next decade.11

Grid Modernization Plan: This plan focuses on accelerating grid technology, enhancing flexibility, and integrating various energy resources. It includes the development of storage technology, distributed energy resources, and the creation of new markets for ancillary services. The phases of VRE integration will address fluctuations in power demand and supply as renewable energy penetration increases. A 10% increase in renewable energy generation would necessitate a 2% rise in reserved VRE capacity.

Transition to a Climate-Resilient Economy: The current renewable energy goals aim to increase renewable energy’s share in electricity generation, with a target of 40% by 2040. However, the current contribution of renewable energy stands at 3.7%. An optimistic approach that considers grid modernization, financing, and investment can help achieve these goals, contributing to energy savings and aligning with Sustainable Development Goals.

Net Metering Policy (2018): The net metering policy introduced in 2018 promotes distributed renewable energy solutions by allowing excess energy to be fed back into the grid in exchange for credits on electricity bills. This policy has boosted investor ROI and improved access to renewable energy.

Component quality standards set by the Bangladesh Standard and Testing Institution (BSTI) ensure that components in the net metering program meet the required quality criteria. It has to be noted that the effective implementation of net metering policy is contingent on modernized power distribution infrastructure.

A study by a consortium of the German Solar Association (BSW-Solar) emphasizes the critical role of utilities in ensuring the success of net metering through the provision of reliable infrastructure, particularly the bidirectional meter. A revision of current meter standards is necessary to align with evolving net-metering requirements and addressing data security is crucial to prevent potential risks associated with meter manipulation.12

Competitive Renewable Energy Zones: The identification of competitive renewable energy zones in various locations, matched with incentives and grid development, offers the potential to exceed renewable energy targets rapidly, enhance energy access, reduce costs, and create employment opportunities.

Way Forward

Investment in Renewable Energy Sources: Transitioning to green energy requires substantial investment in renewable energy sources like solar, wind, hydro, and biomass. This includes not only the installation of renewable energy infrastructure but also research and development to make these technologies more efficient and cost-effective. Bangladesh Bank had set 5% as the minimum amount to be invested into green finance from January 2016, based on the bank’s selected criteria.13

However, all public and private actors are yet to come to an agreement about standardizing definitions, methodologies, and supporting efforts.

In terms of the future outlook, the key sources for power remain with fossil fuel, where additional sources remain to be explored. In Bangladesh, the Rooppur nuclear power plant is under construction 140 km west of Dhaka with (1,200MWx2) capacity.

By 2025, both units of the plan are expected to start operating. As for solar PV and wind turbines, technology and economic viability are there, but with a limited land and resource base, Bangladesh needs to find effective methods on how to roll out practicable projects.

A Corporate Power Purchase Agreement (Corporate PPA): It is a long-term commitment wherein a company agrees to directly purchase electricity from an energy producer. This could be supported by a wheeling policy as well. Wheeling of electricity is transporting energy from a generator to an end-user situated in a different area using existing distribution or transmission networks.

Essentially, wheeling enables the transmission of privately generated power across the national grid to customers interested in a willing buyer/willing seller model. This process facilitates the distribution of renewable energy from locations with favorable wind and solar conditions to corporate, industrial, and residential customers located in less conducive areas for renewable energy production. This will facilitate the transportation of privately generated renewable power across the national grid to interested buyers, including industries like RMG, promoting sustainable energy use.

Enhancing the power supply infrastructure is crucial, given that electricity is set to be the primary energy source driving robust economic growth. This necessitates a consistent approach to upgrading and modernizing existing power stations, alongside constructing new ones and improving the transmission and distribution networks.

Investing in energy-efficient Machinery is another aspect that would have a positive impact on the rate of energy use and water use. The best LEED-certified factories are saving almost 50% of energy due to adopting better practices.

Policy Support and Incentives: Incentives for renewable energy use, subsidies for green technology, and regulations that encourage or mandate the reduction of carbon emissions. Effective policy frameworks can accelerate the adoption of renewable energy, in addition to the existing policies. The 1% customs duty on solar panels and the 37% customs duty on solar inverters need to be rethought to encourage change.

Educating and Engaging Stakeholders: A successful transition to green energy involves educating and engaging various stakeholders including businesses, consumers, and policymakers. Efficient evaluation of green loan applications by the banks would also be crucial. Public awareness campaigns, educational programs, and stakeholder consultations are crucial for gaining support and ensuring a smooth transition.

Author:

Radi Shafiq, Portfolio Manager & Principal Business Consultant at LightCastle Partners, has prepared this write-up. For further clarifications, you may contact [email protected]

References:

- Fashion on Climate.

- Integrated Energy and Power Master Plan (IEPMP) 2023.

- Bangladesh Power Development Board, 2023. Key Statistics.

- Electricity Generation Mix | National Database of Renewable Energy

- National Energy Balance of Bangladesh for FY 2020-21 (sreda.gov.bd)

- Integrated Energy and Power Master Plan (IEPMP) 2023.

- REEEP II (sreda.gov.bd) 2021.

- RMG and textile industries buckle under energy crisis – The Business Post.

- 14 factories leading the green revolution in Bangladesh’s RMG sector | Apparel Resources.

- Integrated Energy and Power Master Plan (IEPMP) 2023.

- Mujib Climate Prosperity Plan | Ministry of Environment, Forest and Climate Change, Government of Bangladesh.

- Bangladesh’s Net-Metering Policy: Jump-Starting the Solar Rooftop Market?

- GBCSRD Circular No. 04-2014[1].doc (bb.org.bd)

LightCastle Analytics Wing

LightCastle Analytics Wing