GET IN TOUCH

- Please wait...

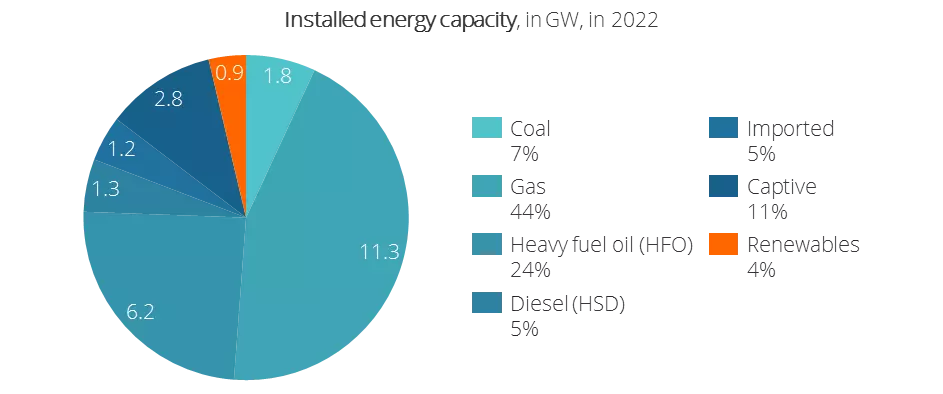

Bangladesh is currently experiencing a crisis as a result of both internal and international issues. Fossil fuels like natural gas and oil are used to create around 85% of the country’s power, with natural gas serving as the main fuel source. OPEC+ oil production cutbacks, the European Union’s embargo on Russian crude oil, and Russia’s energy war have all contributed to an exponential spike in oil and gas prices, which has led to unaffordable energy import costs and soaring inflation.

Bangladesh was compelled to cease buying gas and shut down many diesel-powered power facilities as a result. The lack of renewable energy sources in the country and measures like capacity payments have also made the situation worse. However, regardless of the low share of renewable energy in the country’s power mix, there lies immense potential for solar power electricity generation.

The country has begun focusing on the integration of renewable energy following the Paris Agreement. Numerous infrastructural projects are being developed that include mega projects and industrial zones. These industrial zones and parks are planned to be eco-friendly with the inclusion of solar energy and wastewater management. Additionally, organizations will also receive government incentives for using clean energy sources such as biomass, wind, and solar.

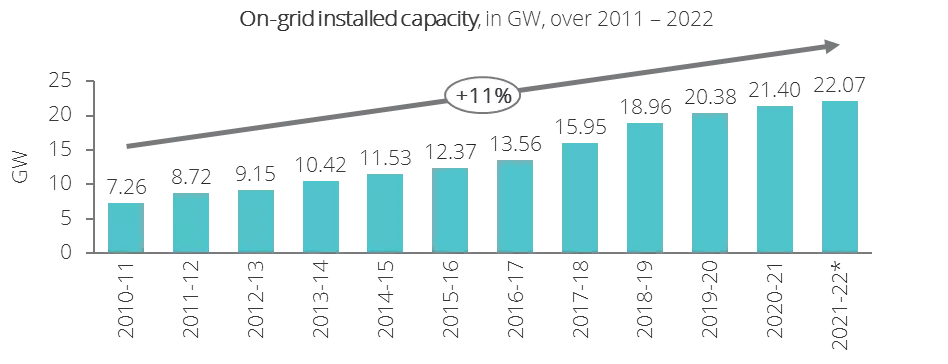

As of 2022, the country’s total power generation capacity (on-grid and captive sources) is 25.5 GW, and it has grown significantly over the past 5 years, and this has been a major cause of the increase in GDP.

The country has also achieved a 98% electrification rate in the year 2021, bringing the majority of the population under electrification. The on-grid maximum energy generated was 14.78 GW in FY 2021-22, while the on-grid generation capacity was 22.07 GW.

Natural gas has remained the primary and cheapest source of energy over the last decade. However, a reduction in the number of explorations and growing demand has depleted gas reserves. This has increased dependency on imported LNG and Heavy Fuel Oil (HFO).

The recent Russia-Ukraine conflict has increased the price of LNG by nearly 165%. The current fuel mix of Bangladesh’s power plants heavily depends on natural gas, oil, coal, and diesel (jointly >80%). Because of the current energy prices in combination with the expected depletion of natural gas resources within 10 years, the GoB plans to reduce dependence on domestic natural gas. This is done by increasing the use of imported liquified natural gas (LNG), importing more electricity from neighboring countries, and expanding the use of renewable resources, especially solar power.

Bangladesh has pledged to the Climate Vulnerable Forum to generate 40% of electricity from renewable sources by 2041. This would result in a 16 GW RE capacity (target of 30%) in 2031 and a 40 GW RE capacity (target of 40%) in 2041. At present, 3.7% of the total energy mix is contributed by renewable sources, of which approximately 75% (or 2.8% of the total energy mix) is contributed by solar energy.

Other renewable energy sources, such as hydro and wind, have shown limited growth due to geographical limitations. As a result, the prospects of wind and hydropower are relatively low. In contrast, the potential for photovoltaic (PV) is much higher and consistent throughout the entire country.

The Government of Bangladesh had envisioned that renewable energy would contribute to 10% of the total amount of energy produced by 2020. Yet, the present amount is only 3.7%. Hence, the 40% target has been reinstated till 2041. However, as per industry experts, the aspirations seem to be optimistic.

Nevertheless, the state prioritizes utilizing power generated from renewable over non-renewable sources. According to government officials, multiple solar projects with a combined capacity of over 3 GW are scheduled for the upcoming years.

The government has planned to prioritize solar energy in the long run. Difficulties in attaining land for solar parks and solar grid facilities have shifted the focus towards rooftop systems with net metering systems and DRE solutions.

Floating solar is given priority considering the enormous amount of water available. However, at present, floating solar is still in a nascent state as enough research has not been done on its prospects.

According to the SREDA, the split between off-grid and on-grid solar energy solutions is nearly 50% – 50%. The recent growth in off-grid solutions can be attributed to solar home systems, solar irrigation, and rooftop solar systems without net metering.

The overall renewable energy landscape is divided between small-scale projects and large-scale projects. But most capacity resides in large-scale solar projects, including solar-powered rooftops, irrigation, mini-grids, microgrids, nano-grids, and solar charging stations. Most small-scale renewable energy projects consist of solar-powered home systems and streetlights.

At present, 3 kinds of solar projects are taking place in the country: captive solar rooftops, solar IPPs, and solar home systems. Out of these, captive solar rooftops have the highest prospect among the rest as industrial players are reducing their reliance on diesel and gas due to the instability of prices.

Solar IPPs are being implemented as well. However, the scarcity of a prominent-sized landmass is hindering the growth of this avenue. Lastly, solar home systems experienced significant growth in the last 5 years due to IDCOL’s SHS program. However, with the current electrification rate being 98%, the rural population got access to electricity, and this caused slow growth in the sector.

The current market is dominated by Chinese-manufactured solar equipment. Local EPC contractors act as official dealers of the equipment and provide end-to-end turnkey project execution that includes both CAPEX and OPEX models. Demand for European products persists. However, unsatisfactory after-sales service has hampered the demand for the products.

The country’s aspirational goal of achieving the 30% renewable energy target is optimistic, given the current status quo. Additionally, the renewable energy policy was released in 2008 and is considered to be dated.

Even though the net metering policy was initiated in 2018, it only focused on the ability to transfer excess energy to the grid in return for a credit on the bill. The lack of specific policies for different projects has led to lower sector-wise adoption.

Strong mandates have to be set with proper incentives in order to increase the usage of renewable energy sources. In 2010, the government had set a mandate for all residential and commercial buildings to install solar panels in order to attain electricity connection. However, adopters have installed low-quality panels due to low awareness of their benefits. As a result, the majority of buildings now have unusable solar panels that are not properly inspected by the governing bodies.

The current grid connectivity does not allow DRE solutions (irrigation, water purifiers, etc.) to entail under the net-metering guideline. Additionally, multifold decades-old grid infrastructure does not properly support the variable renewable energy. Along with it, the last mile population does not have grid access due to geographical positioning, for which they rely on captive power plants that cannot benefit from the net metering policy.

On the other hand, domestic manufacturers have failed to sustain themselves in the market due to lower economies of scale and high demand for international products. The government has supported the domestic players by increasing taxes on imported panels. However, the tax structure remained the same even after domestic players left the market, causing increased market prices of solar panels.

Investing in solar solutions requires heavy financing that the majority of the banks fail to provide even after the central bank’s mandate to disburse 5% of their total loans as “green loans”.

Only Infrastructure Development Co. Ltd., a government-owned NBFI, has sufficient resources to understand this artificial income stream and to analyze the feasibility of the project before approving the loan. However, most organizations lack this capacity. As a result, it is difficult for companies to attain these loans.

As the growing RMG sector is following compliant criteria to capture more market share, demand for solar rooftops has been growing. Most of the apparel industry players use captive power plants to generate electricity. However, the current rise in fuel prices has opted them to shift towards renewable solutions. This growing demand will help Dutch players to capitalize on their advanced technology.

Furthermore, solar energy could be integrated into cold chain storage of perishable products (eg. agri-food, pharmaceuticals) and water desalination. Dutch R&D of high-tech solar panels with high productivity/yield can also be integrated into greenhouses to foster sustainable protected cultivation in Bangladesh.

Solar can also be integrated into the aquaculture sector, by fostering the development of large solar-powered fish farms and the development of floating solar parks combined with the sustainable growth of fish and other water species.

Since solar energy solutions are expensive, there is room for the OPEX model to grow and reduce dependency on CAPEX models.

Removing the financial burden on implementers will help them easily install solar energy. Awareness among smaller and medium-sized players regarding the potential business case and benefits of solar installation can be explored. This will reduce the dependency on low-quality PV panels, inverters, and transformers with high-quality equipment, leading to increased yields.

Lastly, the technical knowledge of financial institutions can be improved to allow more companies to have access to finance. The current refinancing scheme should increase the minimum loan amount of BDT 100 million for a net-metered rooftop system, as most of the industrial players are in need of more funds.

Additionally, the 5% ‘green loans’ target set by the central bank should be stricken through the penalization of banks for not meeting the set target.

This article was prepared by Fahmid Kaisar, a Business Consultant at LightCastle Partners. Advisory and editorial support was provided by Sanjir Ali, Senior Business Consultant and Project Manager at LightCastle Partners. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights