GET IN TOUCH

- Please wait...

Fostering entrepreneurship development is critical for the growth of Bangladesh. To that end, we strive to impact the ecosystem in parallel with developing both the startups and the SMEs. Regardless of the type, our model comprises a holistic approach that is flexible to the changing needs. Working at the intersection of business knowledge, access to markets, access to finance and digitalization, the Accelerator 3.0 program curriculum can be easily customized to cater to the needs of the entrepreneurs and enterprise development projects.

Having worked with 700+ SMEs/startups and investors (from angels to venture capitals to private and public equities), we understand how to help entrepreneurs/SMEs frame the right answers to some of the key questions such as – What’s going on in the market and how to design the right business model? How to analyze risks? What are the ways to build a customer-centric business and how to scale? What kind of market fundamentals do investors feel comfortable with? How do they measure founder conviction? Through the Accelerator 3.0 immersive program, we take the startups/SMEs through an immersive four-step journey – investing in them to become scalable and sustainable.

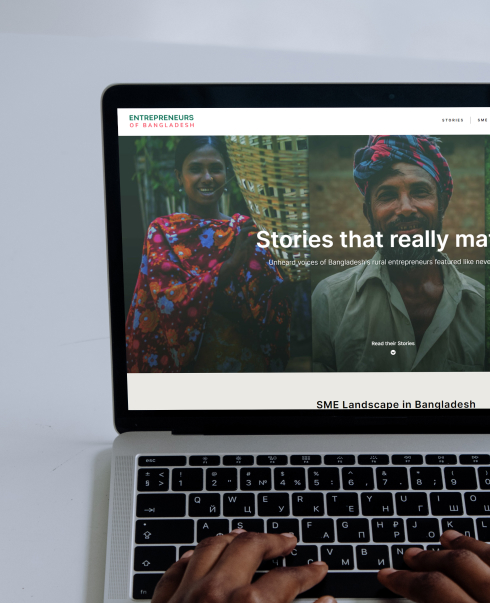

The rural SMEs play a dominating role in Bangladesh’s growth story, contributing 25% to the country’s GDP and creating employment for over 7.8 million people. Entrepreneurs of Bangladesh (EoB) features the unheard voices of our rural entrepreneurs, whose stories of hope, resilience, and dreams against all odds, in effect, emerge as real gems from the soil, driving economic and social advancements in our beloved Bangladesh.

Visit the ServiceOur experts can help you solve your unique challenges