GET IN TOUCH

- Please wait...

Tea is a non-alcoholic drink that has been an inseparable part of the life of Bangladeshi people for ages. This beverage has always been associated with happiness, refreshment, and rejuvenation. Additionally, tea even has numerous medicinal values. Exporting tea has been one of the major sources of earning foreign currency for Bangladesh for many years. However, as Bangladeshi people started having higher disposable income with an increased tendency to have tea as part of their daily drinking habits, domestic demand proliferated intensely. A record amount of 96,500 tonnes in 2021 production of tea wasn’t enough to fully meet the local demand, let alone export any significant portion of it [1].

Recently, the tea industry of Bangladesh has faced some volatility due to the tea workers’ protests regarding the daily wage issue and various other challenges. That said, this industry certainly holds numerous opportunities for growth and innovation which can scale up the production of tea and contribute to increasing export volume.

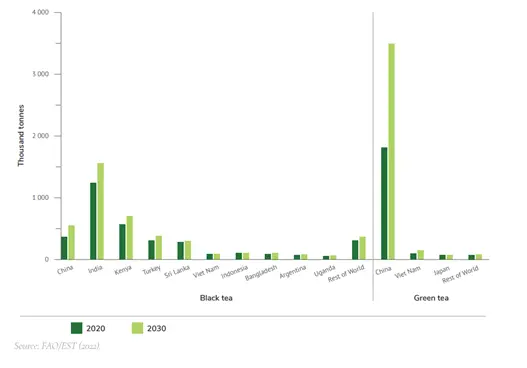

The tea industry on an international level has been growing during the past years due to increased customer interest in a variety of tea flavors, premium tea products, practical and perceived health benefits of tea, and higher disposable incomes. According to FAO, the value of the world tea trade is around USD 9.5 billion while global tea production amounts annually to more than USD 17 billion [2]. There have been marked expansions of tea production in the major tea-producing countries. Simultaneously, many emerging and developing economies have been driving the growth in demand. While doing so, these countries have also been able to provide working opportunities and empowerment to their rural households and communities. The estimated world tea production in 2021 is 6.5 million tonnes which are slightly more than 2020’s production of 6.3 million tonnes. China had the largest contribution of 47% to world tea production while India holds the second position in this regard. These two countries reached 3.1 million and 1.33 million tonnes of tea production respectively in 2021 [2]. Now apart from the challenge of recovering from the disruption created by the Covid-19 pandemic that had impacted the global tea industry as a whole, a newer obstacle of this industry is the Russian-Ukrainian war since Russia has been one of the key importers of Indian tea for years. The country’s also a major producer of three main types of fertilizers- nitrogen, phosphate, and potash (NPK). [12] So, countries that relied on Russia for the supply of fertilizers are suffering right now due to the war.

The production of tea in the region of Bangladesh has a history of more than 180 years. According to popular belief, the first commercial tea garden was initiated as the “Malnicchara Tea garden”, near the current airport road of Sylhet. The number of commercial tea estates and gardens is 167 at present, covering an area of 2,79,507 acres which produce an average of 67,400 tonnes of tea every year [3]. Even though 15,00,000 people are directly employed in the tea industry, the number of people indirectly associated with the related industries is a whole lot more [4]. The level of domestic consumption of tea is increasing at a very fast pace. In 1990, the local consumption was only 18,190 tonnes which in 2016 turned into a whooping 67,031 tonnes [5].

However, the production of tea also increased with time (from 45,190 tonnes in 1990 to 58,050 tonnes in 2016) but that certainly wasn’t enough to cover the whole local demand and still be able to export to foreign countries [5]. As a result, while Bangladesh exported 26,970 tonnes in 1990, after 26 years, the number dropped down to only 77 in 2016. The import of tea also increased in the meantime, which had been 2,000 tonnes in 2010 and 8,200 tonnes in 2016 [5]. Currently, this second cash crop of the country is contributing to 1% of the GDP and makes up 1.89% of global production. Apart from Moulvibazar, Habigonj, Sylhet, Chittagong, Panchagarh, and a few more areas of the country right now contribute to the majority of the production.

Bangladesh Tea Board or BTB is the main regulatory body of the tea industry of the country along with its two organs namely the Bangladesh Tea Research Institute (BTRI) and the Project Development Unit (PDU).

While the tea workers have been exploited by plantation owners for a very long period, the issue was brought in front of the mass only recently when these workers started a massive protest demanding 300 BDT (USD 3.15) as their wage per workday, which previously had been BDT 120 (USD 1.25) only [6]. This extremely low level of daily wage along with rising inflation and price hike has been diminishing the lifestyle of the tea garden workers miserably. On top of that, they live in some of the remotest areas of the country for which they barely get any sort of medical and educational facilities. These workers, during the initial period of plantations, were recruited from the famine-afflicted underprivileged tribal demographics, by alluring them with a promise of a better life, although the true motive was to ensure a captive labor force with low wages. Since then, tea garden workers have been working for five generations throughout the last 170 years and the current situation of these workers requires the attention and support of the authority.

Even though the tea garden owners argue to provide USD 4 a day in the form of facilities like a medical fund, retirement benefits, and so on, in reality, tea workers are getting hardly 3 kg flour of ration per week to keep them half-starved most of the time while 46% adolescents are victims of child marriage and 15% females suffer from cervical cancers [7]. The protest of these workers did end with the daily wage being finalized at 170 BDT per day with the intervention of Prime Minister Sheikh Hasina [8], but the question remains, that if this amount is still sufficient for these workers, described as “modern-day slaves” by journalist and director of SEHD (Society for Environment and Human Development) Philip Gain, to have required health facilities or a sustainable lifestyle.

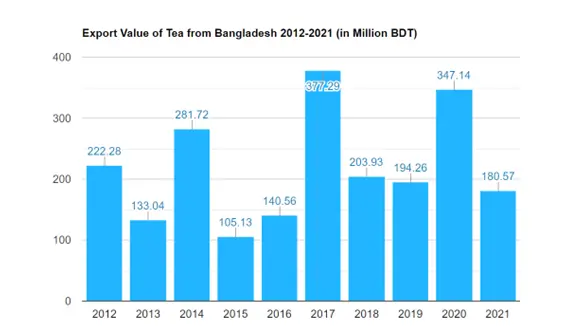

Presently there are multiple brands in the industry such as Ispahani Mirzapore Tea, James Finlay Bangladesh, Kazi and Kazi, Duncan Brothers Bangladesh Limited, Abul Khair Group, Orion Group, Transcom Group, Fresh Tea from MGI, and so on. The market leader, however, is Ispahani Mirzapore, with a market share of 50% in the market of nationally branded tea and an 80% share in the branded tea bag market [9]. The market size of the industry was BDT 3500 crore in 2021 and in the same year, the export earnings were BDT 180.57 million [3].

In the previous year, the country exported tea worth USD 4.33 million, being the 56th largest tea exporter in the world. In that year Pakistan was the country with the highest amount of tea imported from Bangladesh valued at USD 2.27 million. The other destinations of Bangladeshi tea were United Arab Emirates (USD 1.15M), the United States (USD 6,25,000), Kuwait (USD 67,000), and Canada (USD 63,500) [10]. The basic five types of tea that are produced by these companies are black tea, green tea, oolong tea, white tea, and instant tea.

The tea industry in Bangladesh is facing multiple challenges at this moment. The fact that the amount of export is continuously decreasing has already been discussed earlier. Apart from that, there are various other issues to deal with.

The country’s current irrigation system is almost ancient which scales down the level of production to a great extent. While countries like Kenya and Sri Lanka have per hectare productivity rates of 2321 and 1763 kg respectively, that of Bangladesh is even lower than the world average, being only 1245 kg [5].

The country’s tea industry labour force is composed of only the tribal casts who have been in this workforce for several generations. But since both the local and global demand is increasing, if the source of labour is not diversified, then very shortly there will be an acute shortage of labour. Even the existing labour force receives a very low level of daily wage, deals with social issues like child marriage, and has access to almost no medical or educational facilities. The substandard lifestyle of theirs makes them demotivated to work and reduces their productivity to some extent.

Finally, global warming is a major concern since maintaining the optimum weather condition is absolutely crucial but in recent times, global warming repercussions appeared either in the form of excessive rainfalls, thunderstorms, and increased air humidity, or no rain at all as droughts. Both these situations result in low yields of tea production.

While local customers are becoming more and more habituated with tea drinking habits, they have little interest in high-quality tea variants due to the premium pricing of such products.

That said, the market of premium quality tea is quite different when it’s in the international context. In regions like Europe and America, these premium teas have very promising demand. Apart from that, the tea industry of Bangladesh has many other growth potentials and scopes for innovation.

The tea industry, despite dealing with some challenges, does offer some amazing opportunities to grow further in the future. Both the local and global demand for traditional and high-quality tea is on the rise so if the country manages to scale up the production, that would result in a high return on investment since the demand is higher than the supply at this point.

The governmental policy regarding the tea industry has also been favourable since the beginning. With its assistance, tea production has already been initiated in the plain lands of the northern region of the country including Panchagarh and Thakurgaon [11]. Utilizing unused and idle plain land which cannot be used for any other agro-based production anyway, if those lands can be used for tea production instead, then this would definitely contribute to the meeting increasing demand for tea, both in the home and global market. The government now is expected to facilitate the innovation of new variants of tea, while enhancing production, marketing, and auctioning. The transformation of flat lands as cultivable for tea prediction has been extremely promising so far since 12% of the current total production is from these areas.

Since the demand is increasing at a very fast pace, utilization of flat lands for tea production is crucial. One contemporary innovative approach in this industry is promoting tea as a skincare and beauty product. Using the by-products of tea leaves and using them for making skincare products can be a whole new industry that could not only cater to the home demand for beauty products but also be exported as well since tea is internationally known for its medicinal and health values.

Finally, proper marketing strategies for the newly introduced tea variants such as ginger, matcha, turmeric, cumin, etc. could contribute more to the local sales of these products.

The current focus at this point should be to figure out ways to increase domestic production as much as possible so that tea products can be exported even after meeting the local demand properly. For that, there is no alternative to modern and artificial irrigation systems to deal with unpredictable or hostile weather conditions that cannot create any impediments. The ancient tea bushes with plunging production ability should be replaced with new trees because tea plants usually lose their peak productivity rate after a certain period of time. Moreover, using natural fertilizers in the plantation gardens should be prioritized as well. The other tea-producing countries are currently having a huge competitive advantage due to the low cost of production and high productivity.

In Bangladesh, the existing labour force should be provided with higher daily wages to enhance their quality of lifestyle and adequate training facilities to level up their skills and productivity. The present cultivable land is insufficient to increase both the export amount and satisfy the local consumption, so the authorities should patronise and encourage more the utilization and expansion of such land as well. Modernization of the supply chain, minimization of impurity, and magnification of the marketing efforts for the newly introduced variants of tea could be the way to maximize the production of the tea industry in this country.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights