GET IN TOUCH

- Please wait...

LightCastle Partners in association with OXFAM Bangladesh, RDRS Bangladesh and Reveal Event Management, completed the first batch of the “Business Incubator for Youth Entrepreneurs” of Empower Youth for Work (EYW) Project to provide support via accelerator program and investment readiness training to selected youth entrepreneurs.

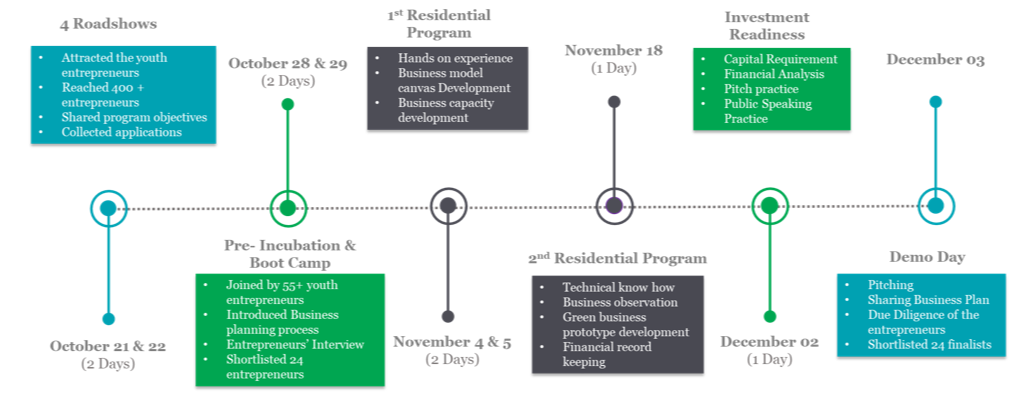

The consortium partners have successfully completed the event with a Demo Day on December 3, 2019 at BRAC Learning Center Rangpur. The Demo Day concluded an eventful four week long acceleration program.

Figure: 1. Timeline of EYW Accelerator Program

The program began with a 2-day Roadshow, which was held on October 21 and 22. The team conducted 4 roadshows in Rangpur (Ranipukur, Lotibpur, Payrabandh, and Kafrikhal). The day long roadshows attracted 400+ participants who were interested in taking part in the accelerator program. The project team briefed the participants about the project which was met great interest and eagerness. 400+ application forms were received from enthusiastic applicants. The roadshows were attended by representatives from RDRS along with LightCastle Partners and Reveal Event Management.

In the second phase of the accelerator program, a pre-incubation session and boot camp was facilitated by LightCastle Partners at BRAC Learning Center, Rangpur on October 28 and 29. Out of the 400+ applicants, 56 applicants were shortlisted and invited to attend these session. The sessions pertained to introduction to basic topics of business, entrepreneurship, accounting, and green business. Extensive discussions on how to increase productivity, tactics which would help raise income, provision of loans were the prime areas the participants looked forward to. It also discussed in details the next step of the competition which was the interview stage to be held on the next day.

The consortium team, held key one-on-one interviews with the participants, the next day, to help shape their business models into a more sustainable and fruitful one. The interview panel short listed 24 female entrepreneurs for the accelerator program. The interview panel contained of representatives of LightCastle Partners, Reveal Event Management and Engr. Md. Monjurul Islam, CEO & Chairman of SPARKY Electronics Industries Ltd.

As a part of the accelerator program, the first week of the accelerator training was held on November 4 and 5. The 2-day long workshop focused on equipping the participants with technical know-hows of running a business. Starting from introducing business planning to business model canvas to creating a green business model, participants were engaged through different class room activities and group work to provide a holistic knowledge building and experience based learning.

The second phase of the residential workshop was held on November 18. The sessions were mainly comprised of financial planning, analysis, record keeping, asset valuation and calculating net present value of assets. A session was also conducted by Md. Shafiqul Alam (Ramzan), Deputy Assistant Livestock Officer from District Livestock Office, on livestock handling and diary production. The session discussed in detail about how to take care of animals, what to do to prevent diseases and what to do if diseases are contracted.

The workshops, in two phases, entailed both hands-on practical learning sessions and theoretical lessons.

The hands-on learning sessions included:

Beside the above activities the theoretical sessions covered the following knowledge areas:

Prior to the Demo Day, a third day of training was held on December 2 where participants learned and practiced how to present their businesses in the form of pitches. The pitch practice allowed participants to find their flaws and way of correction, as well as honing their public speaking and presentation skills. Besides, the practice sessions bank representatives from Meghna Bank were present for the day. Participants were all helped to open up their bank accounts at Meghna Bank on spot.

The Demo Day of the “Business Incubator for Youth Entrepreneurs” of Empower Youth for Work (EYW) Project was held on December 3, 2019 at BRAC Learning Center, Rangpur. An esteemed panel of judges were present to grace the occasion. The panel consisted of representatives from RDRS, Meghna Bank, Bank Asia, Syngenta Foundation, Rangpur Metropolitan Chamber of Commerce and Industry (RMCCI), Velocity Asia Ltd.

The judging panel consisted of the following personnel:

The demo day started with a welcome speech from the consortium, followed by introductory remarks from the esteemed dignitaries and judges. The main proceedings began with a session on Conflict Management for Entrepreneurs and Gender Inequality in Business, conducted by LightCastle Partners. Following the sessions, the participants each went on stage to pitch their business ideas to the dignitaries present. Through their 5 minute pitch, the participants described their profile, experience, business plan, current fiscal solvency, revenue, profit projection and capital requirement. After presenting, each participant faced a Q & A session from the panel and guests where different queries were regarding their business plan. The participants had to defend their stance.

After the pitching session, participants were introduced with fund providers i.e. Bank representatives present and forward market players. The 23 participants were each evaluated by the judges and in accumulation to their overall performance over the program, dedication, business idea and capital requirement, LightCastle Partners awarded two selected participants with a seed investment of 10,000BDT each. The closing ceremony was followed a certificate awarding session and instructions from the facilitators regarding the future proceedings of the program to become investable and expand their businesses.

Overall, the shortlisted entrepreneurs were at a disadvantageous position as they lacked access to finance and both forward-backward market linkages. Due to having limited scope of formal education and business knowledge they were unable to access financials institutions for their working and growth capital. The prevailing patriarchal culture and gender power distance had caused some of the female entrepreneurs to be lagging behind their male counterparts. Many of the female entrepreneurs were not able to stay overnight at the venue’s dormitory due to not having permission from their spouses or other family engagements.

There was a general lack of the following among the participants:

Ms. Fensi Akter

Owner

Mayer Doa Khamar

Kafrikhal, Mithapukur, Rangpur

“I feel very honored and privileged to have attended this training program and getting to know about the basics of business management which have opened new opportunities for me in countless ways such as getting to know about these access to loans. Before this, I didn’t have a proper action plan for my future goals but after attending the sessions and creating my own BMC (Business Model Canvas) I believe that I will be able to manage my business better and more efficiently.”

Ms. Fensi Akter is the owner of Mayer Doa Khamar. She has been running the business of rearing and selling goats for 1 year.

Prior to attending the program she was unaware about book keeping practices and hadn’t maintained proper book keeping. She was unaware about the provisions of capital from private commercial banks at interest rates lower than micro credit financing the latter on being a much more expensive source of capital. During the program she pitched her idea of expanding her business to rearing 60 goats in three years. She also expressed her present need for capital to improve the space she uses to keep her goats. At the end of the program, she received a seed funding of 10,000 BDT to help meet her capital requirement.

Post event feedback from the participants and guests were very promising, they applauded the initiative and were very enthusiastic to support and participate in such an event. The executives from the Bank Asia and Meghna Bank stated that they would try their best to facilitate the financial needs of the participants starting from opening a zero deposit account to arranging SME loans for them upon evaluation.

The President of Rangpur Metropolitan Chamber of Commerce and Industry (RMCCI), Md. Rezaul Islam Milon, promised to help the participants to connect to wholesalers where he promised to arrange deals to be executed on credit. This will enable the entrepreneurs to work on a small working capital and enable them to run the business without immediate financial crunches.

Our experts can help you solve your unique challenges