GET IN TOUCH

- Please wait...

Bangladesh is making continuous strides towards a sufficient supply of milk and meat, as protein sources, with the livestock populations increasing steadily. In the last fiscal year, the total ruminant population stood at 56.7 million.

Cattle and goats account for 43% and 47% of the total population, respectively. In this livestock segment, 93% of the farmers farm at the smallholder level, having no more than 5 cattle. In the case of successful scaling up of commercial farming, scientific and cost-effective techniques, availability of low-cost inputs, and market linkage are critical. Another important requirement for scaling up is easy and frugal access to finance.

Although the government has firmly established agricultural loan quotas and has supported farmers with refinancing schemes, access to finance and utilization of existing systems among smallholder farmers remains a grave challenge. For loans, these farmers prefer NGOs, family and peers, and informal money lenders over formal banking channels. Underlying reasons for such disconnect involve lack of documentation capacity (leading to credit risk management), lack of collateralizable assets, the burden of interest rates, time-consuming procedures, rigid installment schemes, and so forth.

Additionally, price volatility for inputs due to the pandemic and the Ukraine-Russia war also made farmers more reluctant to adopt financial services.

On the supply side, NGOs incur high operational costs due to regular monitoring and last-mile coverage. For these farmer segments, operational costs cannot be kept at a competitive standard by banks due to the aforementioned issues. Innovative financial products such as Mobile Financial Service based solutions or insurance-integrated schemes are largely missing.

Interestingly, market integrators such as iFarmer and WeGro are facilitating financing support with farmer centered model with input linkage and marketplace integration. Similarly, processors such as Aarong, MilkVita, PRAN, and Bengal Meat have sporadically engaged with embedded financing facilities under special development or support programs.

Nonetheless, it is startlingly evident that a product market mismatch persists in the case of access to finance for livestock sector farmers. As a result, we see the number of agricultural loans declining in recent years, while the average ticket size is increasing.

In addition, the use of credit for livestock farming is fairly insignificant at about 4.5%, as opposed to 43.3% for crop production. Improved access to credit for livestock farming is crucial for all segments of farmers, including poor and subsistence farmers. Hence, the formal sector is yet to develop diverse innovative products and services tailored to the needs of these groups of farmers.

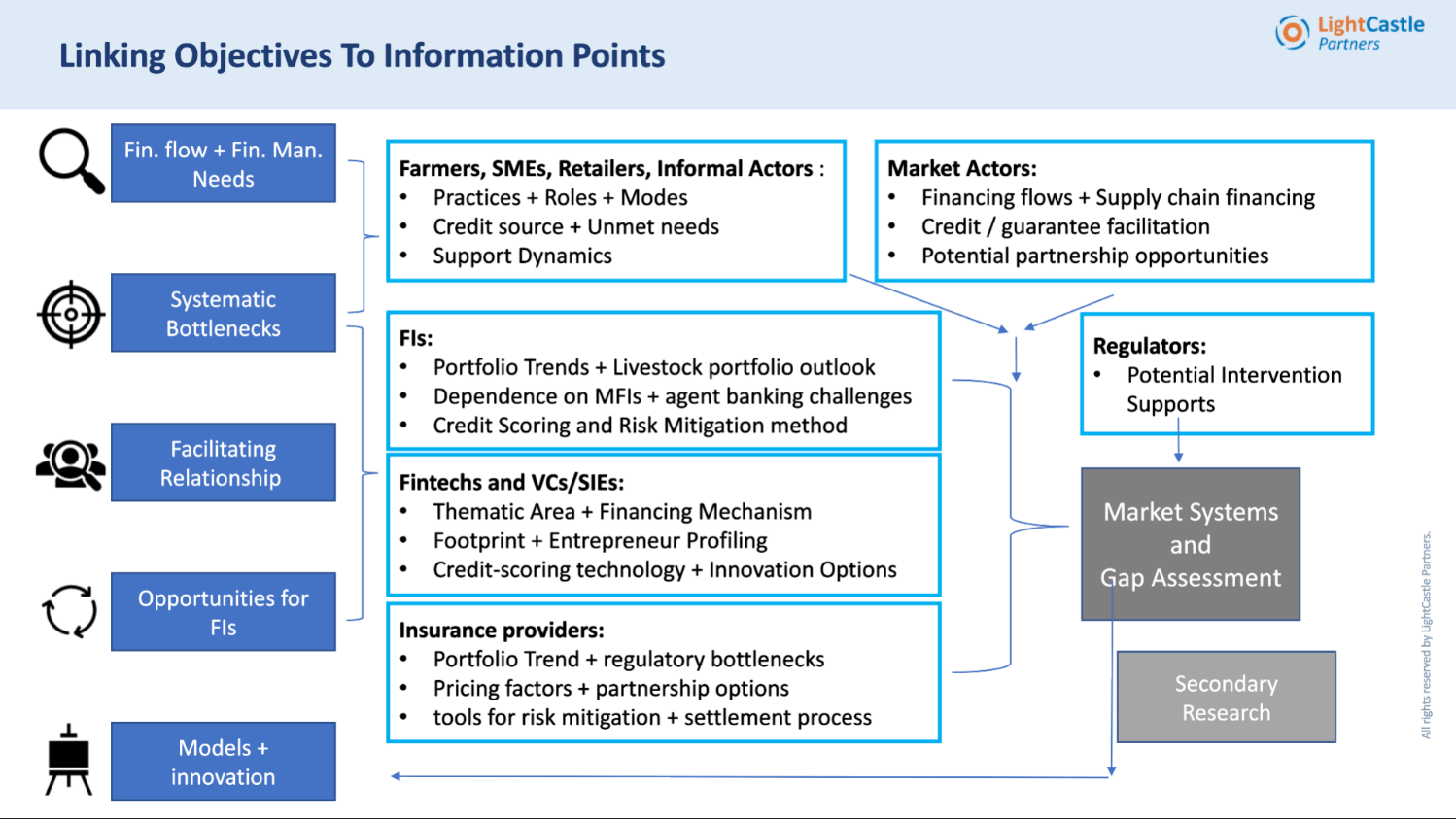

Based on this pretext, under the USAID-funded Feed the Future (FtF) Bangladesh Livestock and Nutrition Activity, ACDI/VOCA commissioned LightCastle Partners to conduct a Market Systems assessment (third quarter of 2022) to understand the gaps and untapped business opportunity(s) that financial institutions and stakeholders can address by providing tailored services to serve livestock businesses and building the capacity of borrowers.

Furthermore, the study focused on analyzing the facilitative role different actors across the value chain can play in advancing individuals or enterprises to obtain financial services including credit, savings, payments, insurance, remittances, and other risk management services, across all hierarchies of the livestock value-chain.

In order to understand the various intricacies that affect the livestock sector farmer’s access to finance along with the scope to create integration among value chain actors, a market systems approach was utilized. LightCastle mapped the financial, market, and industry stakeholders in the Livestock value chain to form a bird’s eye view of the sector.

Farmers of different levels, Input retailers, and informal money lender interviews were covered from rigorous sampling in three divisions. Their interviews helped to delineate the business practices, challenges, opportunities, and relationships among different actors.

Experts in the livestock sector from Commercial Banks, NBFIs, Insurance providers, Microfinance institutions, and Fintech Providers were involved to find out the market mismatch and chalk out potential integration and synergy. Milk and Meat processors and market integrators were also brought in to envision innovative solutions.

On the analyses and reporting front, LightCastle drove deeper into the various aspects of access to finance and the feasibility of product integration and innovation. The major frameworks for analyses were:

LightCastle Partners deciphered the unseen cost, revenue, and profitability factors at play in different markets at various levels. A set of eleven recommendations were suggested based on risk factors and opportunities from the angle of financial product development, new technology integration, and market system development with value chain actors. The project’s indications on embedded finance, credit scoring, and integration of market actors outlined potential interventions.

Our experts can help you solve your unique challenges