GET IN TOUCH

- Please wait...

Bangladesh is an agriculture-based country with a contribution of 14.2% to the country’s GDP. As an agriculture heavy economy, this country has gone through phases of mechanization. However, the agro-mechanization level has been inadequate due to a lack of affordability and inadequate access to finance. The Feed the Future Bangladesh Cereal Systems Initiatives for South Asia – Mechanization Extension Activity (CSISA-MEA) is a five-year project, funded by USAID and implemented by CIMMYT and its partners: iDE and Georgia Institute of Technology (GT). Through the CSISA-MEA project, the project stakeholders are trying to promote ways to increase access to finance for the different actors across the agricultural machinery value chain. Agricultural Machinery Market and mechanization of value chain insights are highlighted here.

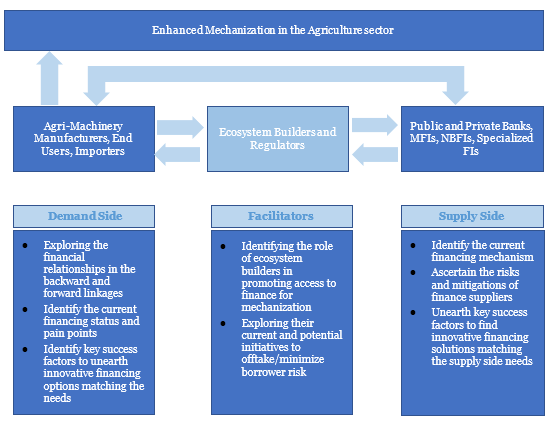

iDE Bangladesh, on behalf of the CSISA-MEA project, commissioned LightCastle Partners to jointly conduct a study to deep dive into the financing practices among the market actors in the agriculture machinery market. The core objective of the study was to unearth the current status of financing options of value chain actors, identifying their financing needs and suggesting innovative financing solutions for both agricultural machinery players and financial institutions.

To understand a comprehensive assessment of the study, the LightCastle Partners team has undertaken a mixed approach using both qualitative and quantitative data to obtain insights from the various players across the financial landscape, agri-machinery value chain actors, and ecosystem builders. In-depth interviews of financial landscape representatives including financial institutions, non-banking financial institutions (NBFIs), microfinance institutions (MFIs), agent bank wing, and digital finance services (DFS) of banks were conducted. Alongside, representatives of government regulatory bodies, industry associations, and international organizations were interviewed. The LCP team has also surveyed a representative sample of value chain actors that consisted of agricultural-based light engineering (ABLE) MSMEs, Dealers, and Machinery Service Providers (MSPs). Additionally, the LCP team has also engaged in FGDs of Machinery Service Providers and interviews with machinery importers.

While exploring the pain points of demand and supply-side actors, the LCP team has identified the existence of formidable challenges. Small players (MSMEs and MSPs) in the value chain often fail to establish their business viability due to their informal nature of business, while financial institutions find it difficult to provide loans to these players due to low-risk appetite, poor recovery rate, and lack of human resources. However, given the high-interest rate of MFIs, this compensates for the service delivery where human resource is the major cost head. Hence, these small players often acquire credit at a high-interest rate from microfinance institutions due to easier access.

With the findings from the study, the LightCastle Partners team has provided a number of alternative financing models that address the challenges faced by value chain actors and financial institutions. These financing models are developed with three strategic pillars that consist of a guarantee of recovery, policy-level changes, and technical and financial literacy training to value chain actors as guidance. The models explore assurance of buyback of products from financial institutions, a partnership among value chain actors and financial landscape players for collaborative service delivery, and an impact funding approach involving impact investors. The initiative of sharing the risk among stakeholders will eventually lead to improved mechanization of the agricultural sector of Bangladesh.

Our experts can help you solve your unique challenges