GET IN TOUCH

- Please wait...

Globally, Bangladesh has been recognized as a success story in improving maternal, newborn, and child health (MNCH) outcomes. Between 2001 and 2014 –

However, even with such improvements, key populations and geographies remain underserved due to service delivery gaps, specifically in –

As Bangladesh is set to graduate from its LDC status in 2026, a decline in donor funding is anticipated. Additionally, in 2020, public sector expenditure on healthcare was 1% of GDP, meaning there is a greater dependency on private sector healthcare provision and high out-of-pocket expenditure. This decrease in donor funding and deficiency in public sector support signals the need for more innovative financing in the healthcare sector.

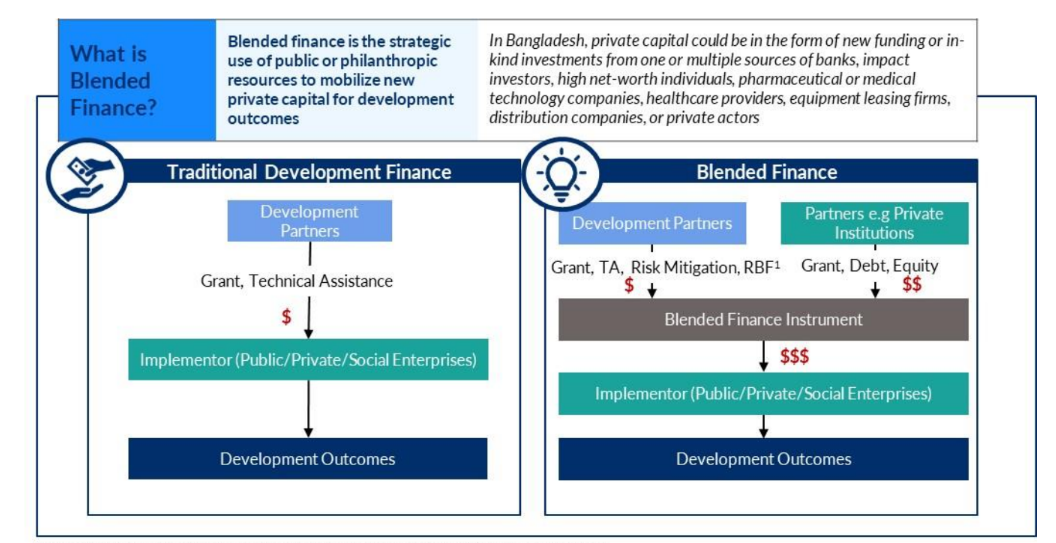

Blended finance, the strategic use of public resources to mobilize private sector investment to achieve development outcomes, shows the potential to fill this gap. It can help to de-risk investments and stimulate innovation in high-impact sectors. In Bangladesh, innovative products and services are needed to reach the underserved segments of the population; hence, blended finance can be a catalytic tool. Social Finance, contracted by United States Agency for International Development (USAID) and the Global Financing Facility for Women, Children, and Adolescents (GFF) housed by the World Bank, worked with LightCastle Partners to explore the potential for blended finance to enhance maternal and child health outcomes in Bangladesh.

To understand how blended finance models can be implemented in the Bangladesh healthcare sector, LightCastle Partners employed a mixed-methods approach that included consultations with relevant industry stakeholders as well as secondary research.

The consultations involved 20+ stakeholders from regulatory authorities, financial bodies, health sector private players, development partners, and local investors in gauging their perspectives on blended finance. Additionally, an in-depth analysis of national documents and annual reports by the Central Bank of Bangladesh to analyze financial flow into the healthcare sector from banks, micro-financial institutes, and non-bank financial institutes was also compiled through desk research.

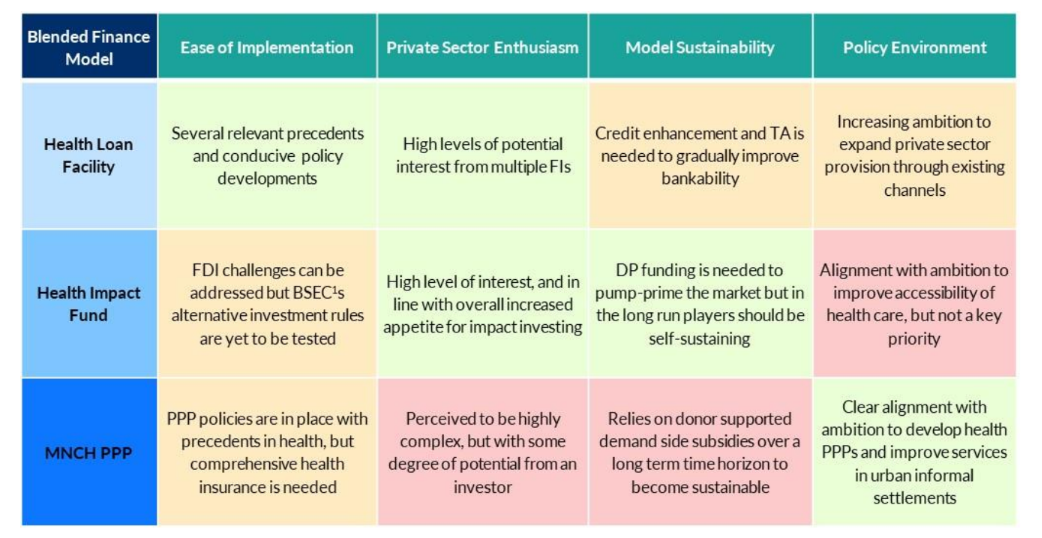

Throughout the project, the team evaluated three short-listed blended finance models: (i) MNCH PPP, (ii) Health Loan Facility, and (iii) Health Impact Fund. Initially, the models were developed based on a series of assumptions tested during stakeholder consultations. Following the interviews, the models were redesigned to better fit the current Bangladeshi environment, using a sentiment analysis framework to map the perspectives of 20+ top-of-the-line industry stakeholders.

While blended finance can accelerate healthcare provision in underserved markets, the concept is still relatively nascent in Bangladesh. As such, efforts must be made to create an enabling environment to ensure the proper implementation of the blended finance models in Bangladesh.

Based on the study’s findings, three recommendations were proposed as the next steps in crafting Bangladesh’s innovative finance journey. First, there is a need to deliver market education to increase awareness of blended finance in health. Second, support the development of demand-side facing instruments, such as healthcare insurance, to augment confidence and motivate private stakeholders to address the bottom-of-the-pyramid populations in their business models. Third, establish impact measurement and management practices to facilitate the growth of Bangladesh’s nascent impact sector.

These recommendations could foster a pathway for blended finance models to materialize in Bangladesh and contribute towards improved social outcomes.

Our experts can help you solve your unique challenges