GET IN TOUCH

- Please wait...

This is the first of a three-part case study on the SMART Blended Finance Program. This first part will provide context for the project and our overall approach.

Building Skills for Unemployed and Underemployed Labour (B-SkillFUL) aims to improve the well-being of poor and disadvantaged men and women by increasing their access to the labor market and income while safeguarding their fundamental labor rights. Almost two million workers join the Bangladeshi workforce each year and settle mainly in the informal sector. Workers and employers in the informal sector, where around 80% of jobs are created, lack knowledge of legal and regulatory frameworks and are largely unaware of what decent work practices entail. As a result, workers in the informal sector are subject to dangerous working conditions and exploitation. To help address and mitigate this problem, the B-SkillFUL program was enacted.

From September 2020, B-SkillFUL commenced Phase II operations focusing on skills and enterprise development, funded by the Embassy of Switzerland and implemented by Swisscontact. The program contributes to Switzerland’s overall goal in Bangladesh, which is to bring about a more equitable society that enjoys inclusive and sustainable growth, aligned with the 2030 Agenda of the United Nations.

LightCastle Partners, who share the project’s vision of promoting inclusive growth in Bangladesh’s MSME landscape, collaborated with the B-SkillFUL team to increase the productivity and competitiveness of MSMEs across three high-value sectors (Leather Goods, Light Engineering, and Furniture Making) by designing a SMART Blended Finance Program.

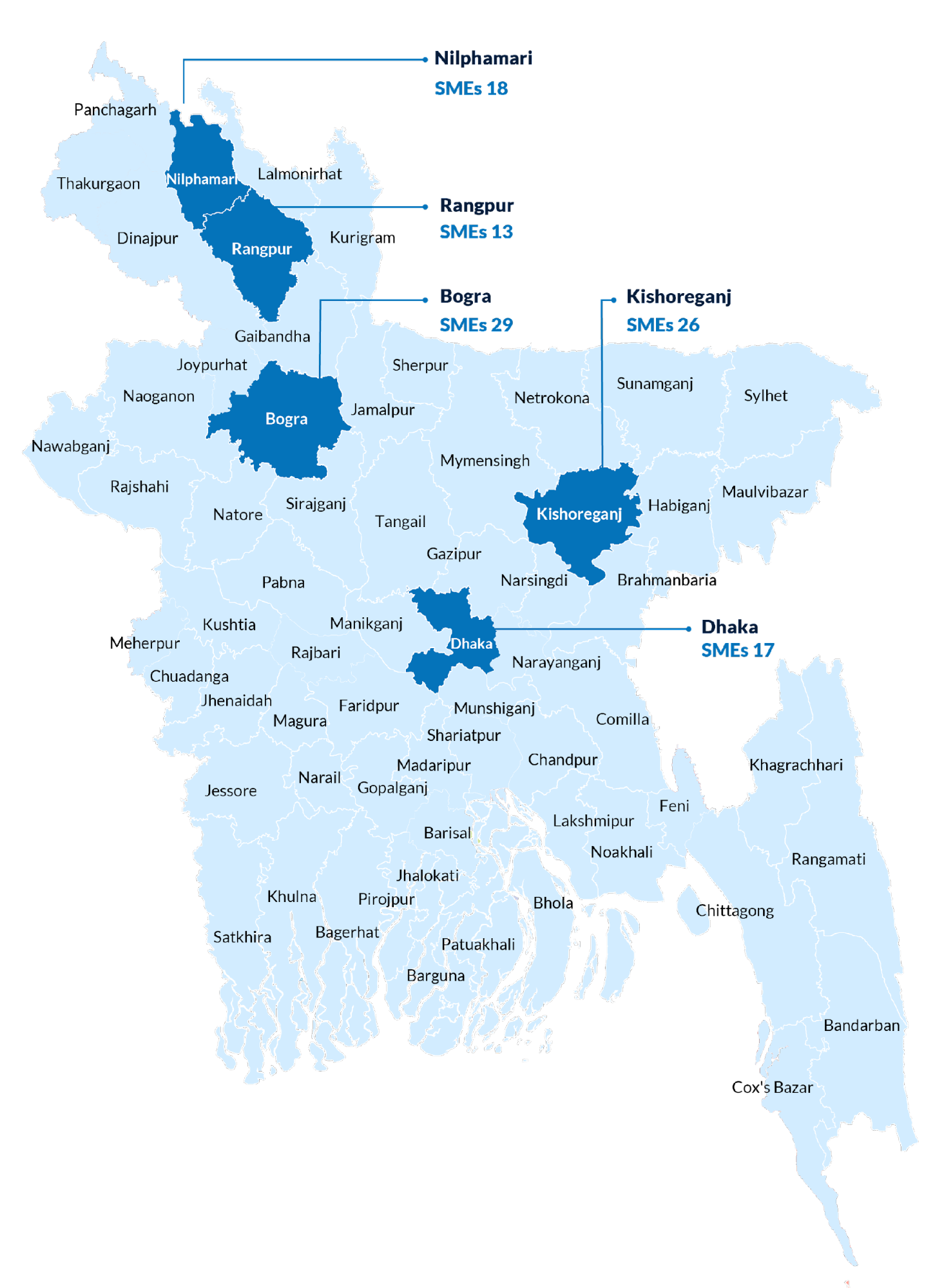

As part of the program, LightCastle Partners sourced 100+ MSMEs across the three aforementioned sectors, spread across districts: Dhaka, Rangpur, Nilphamari, Kishoreganj & Bogura. The approach from LightCastle Partners was primarily focused on blended finance – introducing a novel, equity-linked instrument alongside typical sources of MSME financing – to help promising enterprises graduate from one step to the next. Similarly, we provided additional business development support (BDS) services to assist MSMEs in developing a better understanding of accounting for their finances, marketing, and decent working practices and conditions.

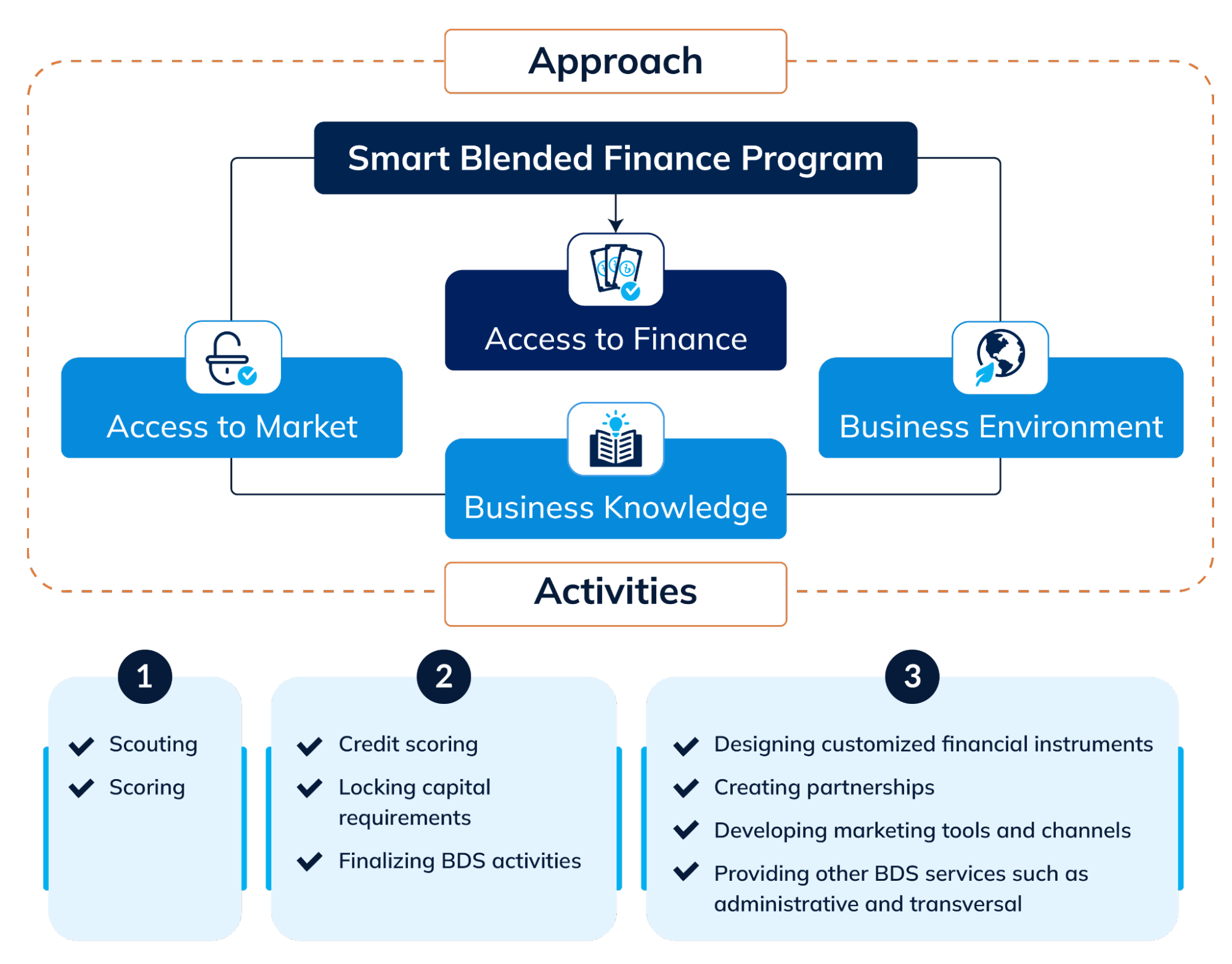

As such, we identified 100+ MSMEs and ran detailed needs analysis and credit scoring to determine the financing and market-related support services that the MSMEs required. The efforts were not expected to be limited to providing capital support solely; instead, to augment the enterprises further, we ensured that they had the proper knowledge, tools, and network to grow. The approach is illustrated below:

We created a Blended Impact Fund of USD ~59K in collaboration with Dana Fintech and contributions from the MSMEs. While the blended finance program promised to provide growth capital to 5-15 enterprises from the program, the model also considered other financial institutions to address the access to finance gaps in the ecosystem. Hence, LightCastle partnered with six different financial institutions to link them with the MSMEs and provided the necessary support to enable growth capital from other financial avenues such as Banks, Fintech, and NBFIs. Based on previous experience and interaction with the financial partners, we inferred tremendous interest among the financial partners to invest/lend to these MSMEs. However, the challenge is that the entrepreneurs of the MSMEs, in their current situation, were unable to be eligible for receiving bank/NBFI financing. This is where LightCastle Partners sees an opportunity to tap into: helping the enterprises become more ready with more specific tools and support for unlocking these debt instruments in the future.

As for the other support services – Business Environment, Access to Market, and Business Knowledge – considering the universe of ~100 MSMEs selected for the program, our work entailed conducting financial literacy programs, marketing literacy, and transversal-themed training. For this, we carried out batch-wise and bespoke sessions, providing the MSMEs with tools and advice for better business management. By working alongside the private market actors, LightCastle Partners discern a unique opportunity to further leverage the private firms’ interests and strengths into bringing more value-added services for the MSMEs, such as productivity improvement and workforce capacity development, alongside establishing forward market connections. All in all, the model takes into account all the necessary pillars that are required for self-sufficiency.

To be continued.

Our experts can help you solve your unique challenges