GET IN TOUCH

- Please wait...

The World Bank publishes quarterly reports on the state of Bangladesh’s economy. The latest report published in April 2015 highlighted the development of Bangladesh, the challenges, and the near to medium-term outlook based on the first three months of FY 2015.

1. Political turmoil costs Bangladesh USD 2.2 bn.

The field of politics was as turbulent as ever at the beginning of FY 2015. Since the start of January, the country has been under continuous blockade and strikes, leading to disruptions to business and economic activity. The country lost around USD 2.2 billion due to the escalation in political turmoil. This is in comparison to 2013 when it was estimated that the cost to business due to political turmoil was USD 1.4 billion. Escalating political turmoil coupled with the dry season, hampered rice crop (Boro) production, disrupted tourism, and limited inter-district transport. It is further suggested in the report that political violence coincided with the peak time of the country’s business cycle.

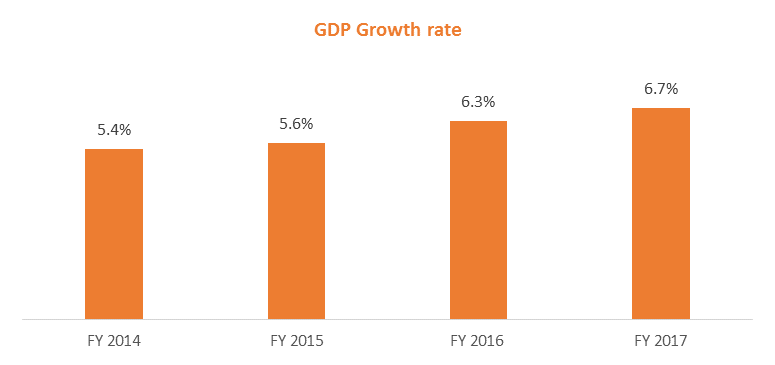

2. GDP Growth revised down to 5.6%

In line with the lower GDP Growth forecast, World Bank in this year’s report predicted the economy to grow at 5.6%, mainly due to the significant political unrest in the first 3 months of FY 2015, which cost the GDP one percentage point. However, the report also suggests that the GDP growth rate in the next two fiscal years will be 6.3% and 6.7% respectively. Without political instability, Bangladesh could have achieved a 6.6% GDP Growth rate, which is still lower than the required average of 7-8%, which is needed for achieving middle-income status.

Source: World Bank

3. Other Macroeconomic indicators remain stable

Despite political troubles, the prospect of recovery in the US and Euro Zone, strong domestic demand, and other macroeconomic factors such as the inflation rate and the Bangladesh Bank’s continued restrained monetary policy have all contributed to resilient growth. There is a low risk of nominal appreciation in the exchange rate due to the accumulation of foreign exchange. Reserves are at a comfortable level at over 6 months of imports, however, the competitiveness of export is shrinking due to the growth of USD against the Euro Zone, as evidenced by the appreciation of the Taka by 17.6% against the Euro in FY 2015. Bangladesh did well to reduce inflation, with the 12 months moving average inflation decreasing from 7.6% in February 2014 to 6.8% in February 2015. The primary reason for a fall in the inflation rate has been the favorable international commodity price and sound macroeconomic policies.

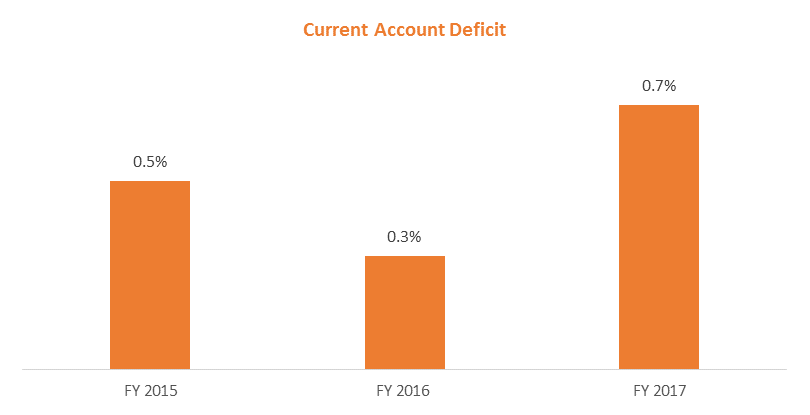

4. Low oil prices favorable to Bangladesh

The free-falling oil prices in the international market have led to Government being able to save the import subsidy fund. It has been helpful in price reforms in the energy sector. Increased attention toward policy reforms to compensate businesses in FY 2016 due to the losses incurred in FY 2015 might cut into the fiscal gains earned from lower oil prices in the international market. The Current Account deficit is currently 0.5% of GDP and is expected to fall to 0.3% of GDP in FY 2016, mainly due to a reduction in the oil import bills, before rising to 0.7% in FY 2017.

Source: World Bank

5. Challenges and Opportunities

Political violence is at the forefront of the challenges that Bangladesh faces in order to achieve sustained GDP growth, along with infrastructural developments and onerous regulatory policies. In order to be on track to achieve middle-income status, the GDP growth rate needs to move up into the 7-8% region, which is currently hovering in the 5-6% region. Various recommendations, based on the order of importance have been suggested in order to boost economic growth. Faster establishment of economic zones and adequate attention towards developing private-sector regulatory environment are recommended to boost private investment. Bangladesh is also facing a shift in demographic dividend as it has moved from a high mortality-high fertility regime to a low mortality-decreasing fertility one. The working population of 15-64 had an annual growth rate of 2.9% in 2000 to around 1.9% currently. However, the domestic economy has added 1.3 million jobs per year on average. Domestic employment increased from 54.1 million in 2010 to 58.1 million within 3 years, according to the Labor Force Survey.

Bangladesh is standing at a very key point in terms of economic growth and development. Political violence has to be dealt with, as it is the biggest hindrance towards growth. Major investment is required in order to improve infrastructural support for businesses. With stability in the majority of the macroeconomic factors, increased local demand, and a large workforce, Bangladesh has a very strong foundation that can be used as a launchpad for attaining middle-income status within the next few years.

Research for this article has been conducted by Ahraf Zaheer.

Sources:

http://www.thedailystar.net/frontpage/3-month-turmoil-costs-nation-22b-77049

http://www.worldbank.org/en/country/bangladesh/publication/bangladesh-development-update-economy-moving-forward-despite-challenges

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights