GET IN TOUCH

- Please wait...

Cost: as global economies are recovering from the 2008 recession cost savings are becoming more important than ever. CFOs are focusing on cost savings which ultimately lead to efficiency. Growth will primarily be fuelled by two streams of clients. First, new clients will turn to FAO looking for cost savings, efficiency, access to new talent, access to new technology, and process standardization. These clients will mostly engage in the FTE pricing model as suppliers will not have in-depth knowledge of their business or process to propose a transactional, let alone outcome-based pricing. F&A functions are one of the first functions that CFOs look to outsource as they are mostly considered noncore competencies. Telecommunication and technology companies are expected to drive growth in this sector due to their thin margins and constant quest for cost savings.

Value: the second stream will be from clients who have been outsourcing for some time and now wish to transform the FAO relationship into one which shares risk and creates value within the organization. These clients are expected to increase their FAO volumes in the 2014-2017 window to achieve this. These pricing methods will increase the revenue potential for suppliers who are able to deliver valuable outcomes to buyers through a gain share pricing increasing the overall volume of the market. A factor that is linked to this point is Risk. CFOs in the current landscape is looking to share risk with FAO suppliers in exchange for performance payments.

Technology: in practice, a key factor that has become key to FAO is clients looking to access new technology through the supplier. When an FAO deal is structured, it involves process consolidation. To elaborate it is where the supplier conducts a process evaluation exercise with the help of buyer management to identify:

All large suppliers (Accenture, Genpact, IBM, etc) primarily focus on technology implementation in FAO deals to achieve high volumes, accuracy and reduce manpower requirements. Needless to say, this also saves clients from investing in technology themselves.

Talent: this has always been a factor in FAO and will continue to do so in 2014 – 2017. Salaries and long-term benefits being a sizeable portion of OPEX for most companies make it difficult for a CFO to recruit a large number of professionals (as Finance Departments are usually treated as a cost center and non-core). FAO allows a buyer to:

Innovation – outsourcing is a way for buyers to access innovations of suppliers without any marginal cost. FAO providers spend millions innovating and creating new process flows based on technology which they ultimately transfer/implement to their clients.

Globalized delivery– the expanding global delivery reduces foreign exchange and inflation risks.

Smaller deals – major buyers are now willing to take on smaller deals (less than $20m TCV) due to increased competition which means more and more mid-market buyers will come into the FAO net.

Other quantitative data on market growth is provided in the above sections which will give a good idea of the specific type of growth to be expected.

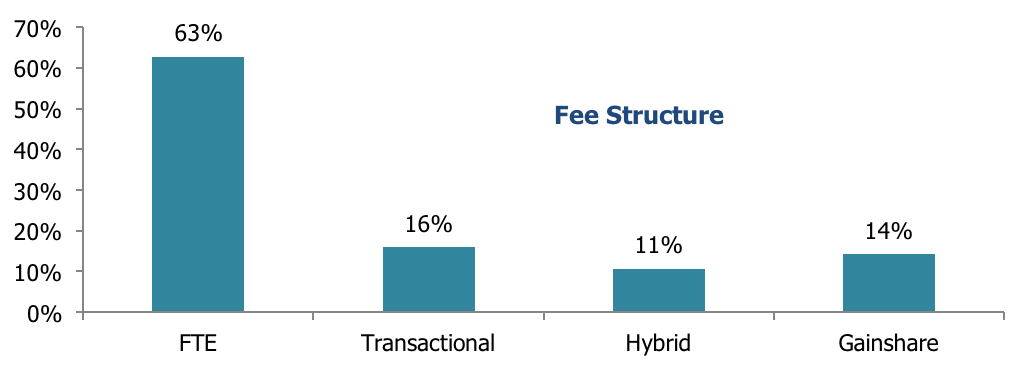

Primarily 3 different kinds of fee structures are used in the FAO industry globally:

1. Full-Time Equivalent

Otherwise known as FTE this is the most prevalent pricing model currently used due to its ease of application. This is based on the supplier’s units of resource input to provide services an example being an hourly rate per FTE. This pricing model has been used since the early days of the FAO industry in the 1990s and still seems to be the preferred method in most contracts.

Current research indicates that most buyers and suppliers still prefer the FTE model.

2. Transactional

This is based on the buyer’s units of consumption/volume of transaction in a billing period with an example being fee as per invoice processed, per expense claim processed, or per journal entry. Typically the contract sets a price for a baseline volume of transaction and if volume fluctuates below this baseline the supplier is paid an adjustment which is usually pre-agreed. A key variation here is that the payment in this case is linked to supplier output as opposed to the FTE model where it is linked to supplier input.

Increased buyer sophistication has led to a belief in value-creation in FAO with a focus on process effectiveness and business impact. While FTE-based pricing can deliver direct cost benefits such as labor arbitrage and one-time improvements, it does not align closely with business needs/outcomes making it difficult to deliver strategic impact. Transaction pricing also allows for effective risk-sharing with the supplier. In the current economic scenario, buyers are looking for more flexibility and variability in pricing as opposed to high fixed costs and wish to only pay for activities executed. Transactional-based pricing allows a closer linkage between business activity and costs.

3. Outcome-based/Gain share

Under this method, pricing is based on a pre-agreed business outcome which is normally a fixed + variable component where the variable ranges from 20-40% based on monetary tiers.

As markets mature some buyers are now asking suppliers to share risks with them. This attitude has seen a shift toward outcome-based pricing models which basically guarantee a payment to the service provider on achieving pre-agreed business outcomes. Most contracts currently start with an FTE model and progress towards an outcome-based or a combination (hybrid model) as the deal matures. This pricing strategy offers a higher revenue potential for service providers who can deliver business outcomes even though it involves more risk-taking.

Deciding a pricing structure is impacted by various factors such as nature of engagement, volumes and their predictability, key reasons behind outsourcing, and the risk appetite of both parties. As seen the project-based or FTE model can be considered the safest and most predictable which guarantees fixed revenue to the supplier and also allows the buyer to budget accurately. Here there is no guarantee of business outcomes, at best maybe a pre-defined penalty clause related to nonperformance. The transactional structure is a bit of a middle ground where payment volatility depends on transactions completed. Still, this has no real impact on business outcomes. At the outset, the outcome-based (gain share) model may seem riskier but has the potential for creating the maximum value for both parties involved. With times buyer outlook is changing and expectations are evolving and slowly but steadily the FAO sector will see a shift towards an outcome-based pricing structure in the next 5-7 years.

The first part of this article can be found here.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights