GET IN TOUCH

- Please wait...

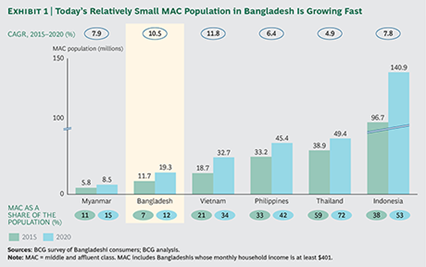

The universe of the middle and affluent class (MAC) in Bangladesh is growing both in terms of size and purchasing capacity. This provides businesses with an expanding opportunity – Bangladesh hosts the 8th largest population in the world and consumers spend around USD 130 bn+ annually with an annual 6% growth rate. Right now the MAC population is 7% of the total, compared to 38% in Indonesia. However, within 2025 another 30 to 40 million consumers are expected to join the middle or affluent class. This would mean that cities with a population of at least 100,000 MACs will grow from 36 to 63 over the next decade.

The Boston Consulting Group with LightCastle Partners as their local data and analytics partner recently released their report on Bangladesh titled, “The Surging Consumer Market Nobody Saw Coming.” The report brings insights into the consumer market with 2,000+ surveys conducted across Bangladesh.

Here are some of the key takeaways from the study about “Bangladeshi” consumers:

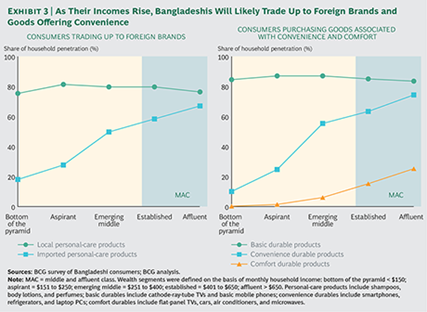

Consumers’ purchases of appliances that offer more convenience, such as refrigerators and smartphones, accelerate as their incomes rise. Consumption of goods offering more comfort and enjoyment tends to take off as households enter the established middle class. This is particularly true for durables such as air conditioners, flat-panel TVs, automobiles, and microwaves.

As the consumers enter the middle and affluent domain at a rapid pace – Bangladesh presents an expanding opportunity to businesses. The market leadership is still to be sealed and opportunities remain open across FMCG, consumer durables, e-commerce space, and consumer financial services. The key elements that would help businesses succeed would be Quality (as income rises, people would be more induced to pay higher), credit access and penetration (consumers should be able to avail of personal loans, especially for big-ticket items), strong brand equity (given reliance factor exhibited by consumers), supply chain infrastructure (since people are used to going to some retail shops as opposed to superstores) and mobile-centric digital channels deployment (95% of the internet user of the 50 million subscribers are on mobile devices).

————————————————————–

The Write-up originally appeared on Bangladesh Brand Forum on December 16, 2015

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights