GET IN TOUCH

- Please wait...

Bangladesh is a fast growing economy, poised to be the next Asian Tiger. Bangladesh has multiple factors that favor continued strong economic growth –a steady inflation rate of 5-6% in the last five years, and a record high FX reserve of USD 33.5 billion. With a GDP growth rate of 7.3% in the fiscal year 2016-17, the economy has kept up an impressive annual average growth rate of more than 6% over the last ten years. However, stagnation of the RMG sector, lower oil prices adversely impacting remittances, and current account deficit have all proved significant barriers to growth. Other factors such as inadequate infrastructure have proven to be major growth dampeners. Embarrassingly enough, a combination of these factors have landed Bangladesh at a ranking of 177 in the World Bank’s recent list of “Doing Business Report 2018”.

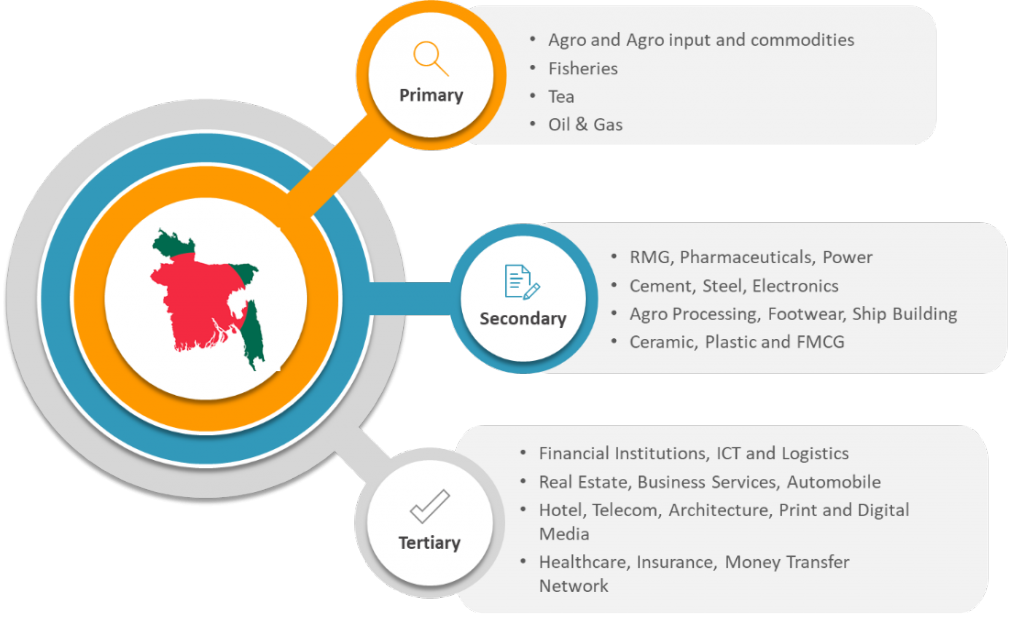

Keeping these factors in mind, as well as rapid technological advancements and the threat of looming uncertainty – with the upcoming election in 2019, LightCastle Business Confidence Index 2017-18 aimed to gauge business sentiments of private sector players representing a variety of industries across the economy. A survey of 102 CXOs/Leadership Team were conducted to assess the factors that influence the overall direction and growth trends of the economy. For research, the approach was to select only those industries that have the highest level of contribution to the country’s GDP and segregated into three categories – Primary, Secondary, and Tertiary. Firm representation was carefully calculated to be reflective of their respective industries. The aim was to capture the entire spectrum of enterprises by covering small, medium and large-sized firms, considering a blend of both local and foreign entities.

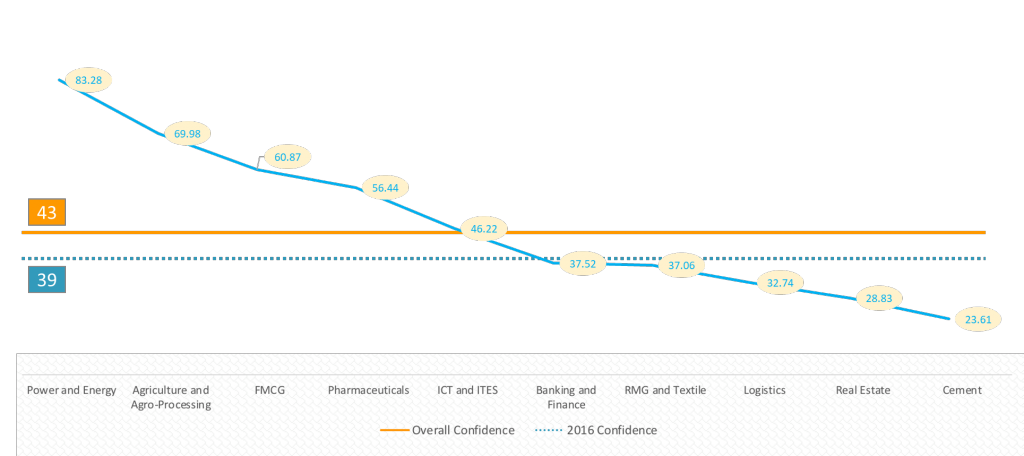

The responses using harmonized business confidence index were used to calculate the final confidence score. The analysis yielded a score of +43 on a scale of -100 to +100, marking a 4 points increase from last year’s score of +39. In other words, the score sends out a cautiously optimistic vibe among the business community. Five key factors that contributed to the rise in confidence cited by the business leaders have been: increased investment in power generation, green revolution & mechanization in the agriculture sector, higher disposable income and consumer spending, growing health awareness, and the government’s increased focus on ICT. Despite the positive outlook, there were concerns regarding creation of fault lines by the classified loans condition, bureaucratic red tapes in opening and conducting businesses, recent slump in RMG prices, transportation & logistical hassles and infrastructure bottlenecks such as port congestion.

The findings further suggest that Bangladesh’s top business professionals agree on the issues that impede progress. This includes business operational challenges such as import dependency of raw materials in cement and pharmaceutical industries, fall in value of RMG prices, and working capital management in ICT; regulatory challenges like government bureaucracy and lack of unity among public entities. It also includes challenges due to poor infrastructure and logistics. For instance, port congestion is a major barrier to shortening lead times. Moreover, power outages have increased production costs and final prices, as manufacturers have to rely on backup captive power generation.

To summarize the sentiments, the future of the Bangladeshi economy hinges on three main themes:

Discovering the Third Engine:

Majority contribution to our forex is made by remittance and RMG exports, making up around 80% of our total export basket. Moving forward, it is important to figure out the third engine for growth.

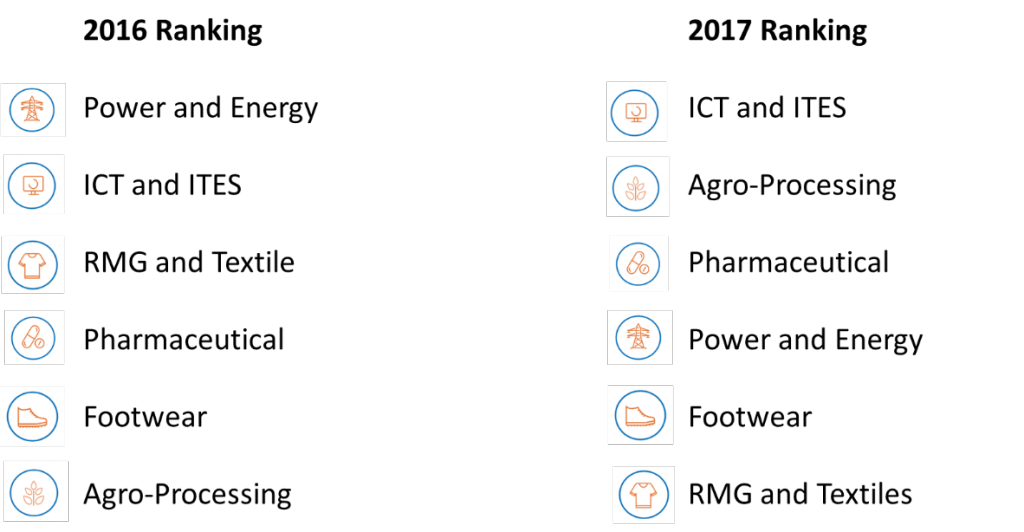

This year’s ranking shows an increase in confidence in ICT and ITES industry. Nearly half of the respondents claimed profits will soar in 2018. ICT & ITES, FMCG and Pharmaceutical industries are expected to be the most profitable, chiefly due to increasing consumer spending on FMCG, and higher projected export in Pharmaceuticals. Export expectations in the Agriculture, ICT & ITES and Pharmaceutical industries are substantially higher compared to the rest. Leaders in the ICT & ITES industry anticipate larger outsourcing tasks. Moreover, Pharmaceutical leaders expect new export frontiers to emerge very soon.

Agro is the new Tech:

Confidence in agro processing has moved up, landing in the second position this year. The government’s substantial budgetary allocation, and subsidies have proven a boon for this sector. Agro processing can provide the much needed stability for correcting demand-supply mismatch. Mechanization and technologies for high yielding Ag-inputs, private satellite imaging for better crop management are also playing a critical role. Accelerator and incubation programs focused on the Agro sector, as well as innovative financial instruments will drive growth.

Talent at our Core:

To develop capacity of human resources, skill development has become a necessity. This will not only enhance the quality of final goods but also reduce waste and increase labor income. A comprehensive strategy for talent development needs to be formulated. This involves formal and informal training along with improvements in the quality standards of basic education. Bangladesh has a demographic dividend of 2.1 million people entering the workforce every year, who if skilled can contribute vastly to the economic growth of the country.

According to industry experts, there are ways to help improve the current drawbacks, along with investor confidence. The actions that can be taken include – diversifying export basket and reducing dependence on RMG, facilitating the ease of starting and conducting business, improving infrastructure and logistics, enhancing the skill of human resources, streamlining the financial sector and scaling up the use of alternative capital avenues. When asked to rank the top sectors in the coming decade, business leaders – by and large –painted a unanimous picture. According to them, the industries that will have the highest possibility to drive larger impacts in Bangladesh are – ICT & ITES, pharmaceuticals, agro-processing, power & energy, footwear, and ready-made garments (RMG).

As way forward, the business leaders made five recommendations for upcoming years.

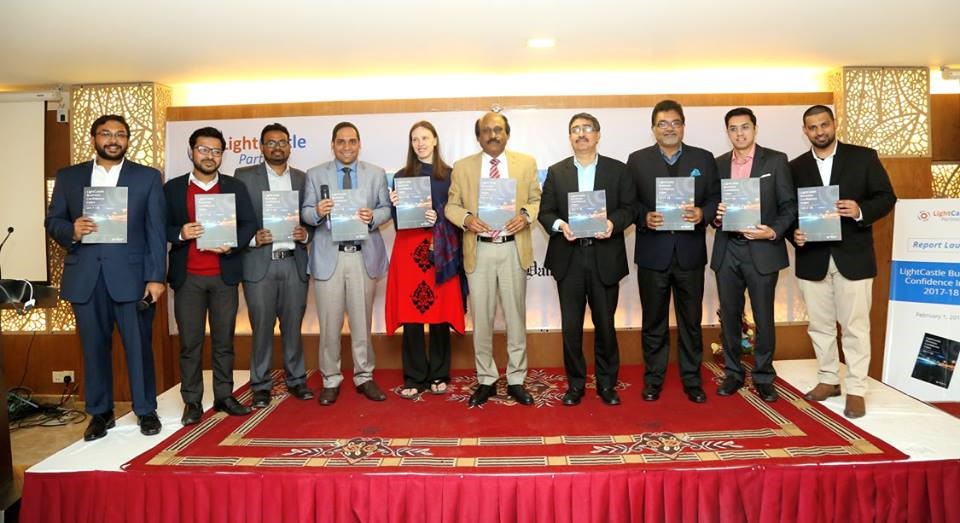

Along with these findings, the LightCastle Business Confidence Index 2017-18 was unveiled on February 1, this year at Dhaka’s Lakeshore Hotel. The program was organized by LightCastle Partners with Daily Star as strategic partner. A welcome address to 150 business professionals from around the country was made by Mr. Ivdad Ahmed Khan Mojlish, Managing Director of LightCastle. The welcome address was followed by a presentation on key findings of the study by Mr. Zahedul Amin, Director, Strategy and Consulting Engagements, LightCastle. The presentation highlighted current business confidence and steps of moving forward, including considerations to uplifting the agriculture sector to mitigate rising inequality, accelerating discovery of the third growth engine, and solving the jobless growth conundrum.

A panel discussion moderated by Mr. Bijon Islam, Chief Executive Officer of LightCastle was also part of the program. The esteemed panelists were Mr. Asif Ibrahim, Founder & Chairman, BUILD, Mr. Mamun Rashid, Managing Partner, PwC Bangladesh, Mr. K.M. Ali, CEO, Partex Star Group, and Ms. Maria May, Program Head, Executive Director’s Office, BRAC. The panelists discussed and deliberated on a few issues such as industry verticals that are expected to experience highest growth in the coming decade and how these sectors will impact our human capital. Some of the major challenges for Bangladesh in leveraging its demographic bulge and density dividend, the difficulties in finding skilled human capital and what can be done about it. The steps businesses should take towards diversifying the export basket. The discussion also included infrastructure reform, panelists’ thoughts about building satellite smart cities in Bangladesh. Other topics such as impediments in doing business in Bangladesh, inclusiveness in businesses, financing, and role of industry data like business sentiments in the future were also discussed.

Regarding mitigation of education and skills gap, Mr. Asif Ibrahim noted that there needs to be a shift of gears – industry needs should be identified and that should be matched with teachings of private universities and business schools. Looking towards the future of businesses Mr. Mamun Rashid remarked that the third engine for growth for Bangladesh is going to be ITES, infrastructure, backed by consumer spending in the FMCG sector. On overall reforms and changes needed, Mr. K.M. Ali Proper planning and strategy is needed, there needs to be end to end thinking for making good use of resources recommended that proper planning and strategy is needed, there needs to be end to end thinking for making good use of resources. About impact investments, Ms. Maria May asked to define what impact investment means for Bangladesh, and what does it mean to be good and how to measure that.

Although there has been marginal progress in terms of business confidence, Bangladesh has shown an immense potential to recover from the biggest crises. Business representatives believe the public and private sectors can work in coordination with each other for the economy to achieve higher growth in the near future. LightCastle looks forward to analyzing the economy and business prospects once again next year.

This article first appeared in Bangladesh Brand Forum March 2018 issue.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights