GET IN TOUCH

- Please wait...

With seven mega projects on way to fast track infrastructural development in Bangladesh, the market for steel, like cement, is one filled with both tough challenges due to the US China trade war and prospects given forecasted double digit growth. Large projects, increasing urbanization, living standards, and stronger purchasing power have all driven growth in the construction section, and steel as well. According to leading manufacturers, more than 4 Mn MT of steel was produced in 2016 representing a market value of $3.57 bn which is estimated to double by 2022 [4]. Bangladesh is one of the few countries in the world vastly outperforming global steel industry growth, and according to a report by EBL Securities, is set to achieve double digit growth for the next 2 decades [4]. Currently the country’s per capita steel consumption is 45 kg, up from 25 kg in 2012 and is forecasted to reach 73 kg by 2022 [5].

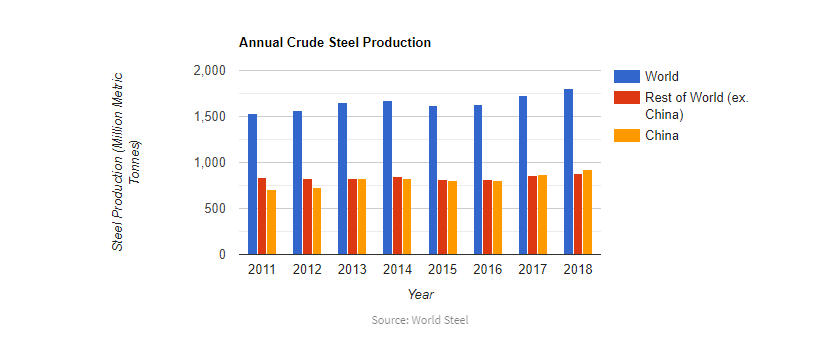

Global production of crude steel increased by 4.6% amounting to 1,808.6 Mn MT in 2018, with 1,271.1 Mn MT [7], or 70.3% coming from Asia. In 2017, capacity utilization was marked at 75.1% [8]. China continues to dominate the market for steel production with more than 50% of the market share [7] and although a few years ago had a decline in sales contributing to a fall in steel prices [6], efforts of reducing overcapacity and production has allowed for it to currently maintain a steady growth momentum.

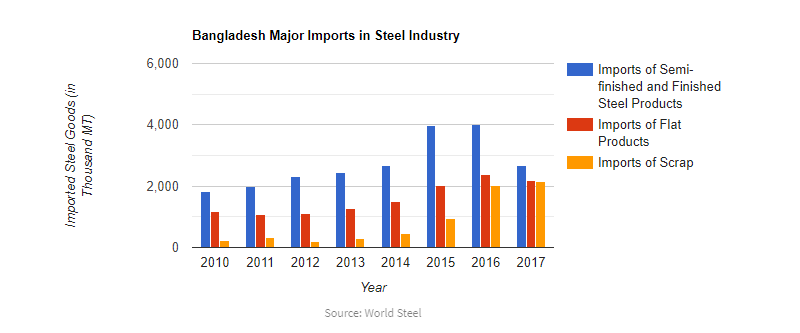

Bangladesh is one of Asia’s strongest emerging steel markets and with a growing need for raw materials and manufacturing technologies [1]. However since USA’s 25% and 10% tariffs announced on steel and aluminium imports [3], there has been a scarcity in the market for scrap imports required for steel production. This in turn has led to a significant increase in the price of rods, a vital material required for infrastructure projects. Scrap, sponge, and pig iron are major raw materials for steel smelting in Bangladesh with imports growing from 2.5 Mn MT in 2016 to 4-4.5 Mn MT in 2018. Mirroring the cement industry, the demand for steel is met mainly from individuals, government, and institutional buyers in the real estate market [4].

The demand for steel in Bangladesh is mainly driven by infrastructure projects in commercial, housing, and public sector. The public sector can be further broken down to implementation of the government’s annual development plans and infrastructure projects. It’s estimated that the sector turns over around $3.6bn every year [12]. In 2016, government projects amounted for almost 40% of total steel consumption [4].

Bangladesh is heavily reliant on imports of semi-finished and finished steel products as well as flat products while being strategically positioned next to the top two steel producers in the world, China and India. The majority of imports are scraps, flat products, and semi-finished and finished steel products making up a total of 6.992 Mn MT or over 93% of all imports [10].

Shipbreaking yards on the outskirts of the major port city Chittagong, are also a major source of steel for the country. It is also the largest shipbreaking center in the world [2]. Shipbreaking was formally recognized (and unregulated) before 2011. In 2016, it generated 10 Mn MT of steel, meeting 60% of the entire country’s consumption [2]. Unfortunately, of the many labor intensive industries in Bangladesh, shipbreaking is notorious for its dangerous practices and working environments leading to global regulatory bodies discouraging delivery of ships to the port.

Given the nature of steel businesses as heavy manufacturing, cost of production for goods sold can be as great as 80-90% of revenue. The business mainly relies on importing billet, the main raw material required for production. Although the local market is capable of meeting over 90% of demand for billets [4], a considerable amount of imports are still required due to the majority of production is used as a backward linkage for producer’s own re-rolling mills. Currently the majority of consumption is by government infrastructure projects, developments in real estate (mainly rural areas), and by commercials/public institutions.

There are around 400 steel mills in Bangladesh with a total production capacity of around 8 Mn MT [12]. Currently major steel producers Abul Khair and BSRM plan on significantly raising their crude steel production. KSRM, GPH, Anwar, Rani, and SSRM are also expanding. According to a 2016 report by EBL, Abul Khair, BSRM, and KSRM account for more than 90% of total capacity in manufacturing billet, and more than 50% of the country’s annual demand [4].

Japan’s largest steelmaker, Nippon Steel and Sumitomo Metal Corporation is also set to invest around $60mn through a joint venture with McDonald Steel Building Products, a local steelmaker [11]. The chinese are also set to creating a stronger presence with their own steel giant, Kunming Iron and Steel Holding Company (KISC) set to invest $2.3 bn [13]. It’s also estimated that over the next 5-7 years current market players will be investing an excess of $4bn into the industry [12].

Considering that the government’s lofty goals of achieving double digital growth in the economy, measures being taken to better facilitate the ease of doing business, and several mega projects, economic processing zones, and incentives for foreign investment, the macroeconomic factors to stimulate growth in this sector look bright and with due reason.

The cement industry a closely related industry to steel with respect to the topic of construction is also set to achieve double digit growth in the near future.

Given all these measure with a growing capacity of producers and technological enhancement of operations currently being undertaken, the steel industry in Bangladesh looks to be strong, but only if they are able to solve key troubles. This includes vertically integrating the supply chain to a greater extent to achieve greater margins, modernizing shipbreaking yards to lift global restrictions and provide better working conditions for its employees, adopting modern technology to enhance the efficiency of production to achieve lower costs and combat possible risks of dumping steel from foreign producers.

Mohammed Shehab, Junior Associate at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected].

This article was originally published here https://databd.co/stories/steel-industry-giving-strength-to-construction-1471

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights