GET IN TOUCH

- Please wait...

Whether it’s milk, chocolate, plain, or cream-filled, Bangladeshis love biscuits, and it’s been driving a 15% annual growth rate in the country. [1] A burgeoning middle class, in particular, fueled by greater purchasing power, has turned to biscuits as the go-to snack demanding both quality and low prices, leading to businesses turning to automation in order to scale and meet growing demands. Currently, the market size of biscuits and confectioneries in Bangladesh is around $597-717 mn with big-name brands holding 40-50% of the total market share. [1] Net export earnings of biscuits stood at $80.41 mn in the first 6 months of the FY18-19, almost double of last year’s annual figure ($43.09 mn), and is forecasted to triple in the next few years. [2]

Of the total market value of the industry, around $358 mn belongs to big-name branded biscuits [1] such as Olympic, Haque, Danish, Nabisco, and Bangas. According to Bangladesh Auto Biscuits and Bread Manufacturers’ Association (BABBMA), the total annual production of biscuits currently stands at an excess of 65,000 MT. [2] The biscuit and confectionery market is forecasted to grow at 15% over the next 10-15 years [1], 5% greater than the government’s target for GDP growth.

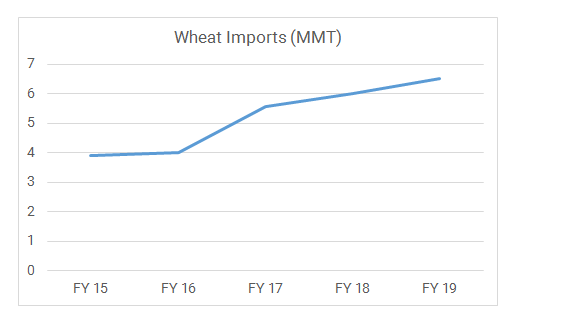

Over 80% of Bangladesh’s wheat consumption comes from imports of which the private sector currently purchases over 90%. [7] According to the Ministry of Food, the stock of wheat, a key raw material for the market, has also more than doubled from 177,710 MT to 364,390 MT from 2017. [7] Consumption is forecasted to grow to 7.7 MMT in FY 19 driven by increased consumption of processed foods from wheat flour.

Recently the country saw a reduction in the 40% duty on sugar imports from India, the world’s second-largest producer. [8] The sugar mills in Bangladesh currently hold 139,000 MT of sugar in stock[8]. As a result, prices of sugar may decrease at a greater rate than last year estimated at 8.7% according to the Trading Corporation of Bangladesh. In FY 18, consumption of sugar was 2.695 MMT, a 20% growth from the year before, in FY 19 it’s expected to rise to 2.98 MMT. [8]

|

If you are interested to learn about the Startup Ecosystem of Bangladesh

|

Like the other two key ingredients, consumption of edible oils is also on the rise with an overall increase in consumption for the country. 90-92% of requirements are currently met through imports averaging 2.3-2.4 MMT. [9]

Falling Overall, an increase in the key ingredients, alongside an increase in domestic consumption in the country powered by a growing GDP per capita point to increased demands for biscuits and confectioneries in the future. Falling prices further reduce costs of production which is key to ensuring long-term survival in the industry given current market players are investing in automation to meet growing demand.

Historically, the market was highly labor-intensive and dominated by small bakeries, but today it has grown to one filled with an estimated 5,000 bread and baked goods makers, and around 100 automated factories[2]. Despite the many market players, it is mainly dominated by big brands due to their competitive advantage in being able to provide greater quality and lower prices through automation. This has also resulted in driving out imported biscuits from India, Malaysia, and Indonesia. Currently, domestic manufacturers meet 90-95% of the demand for biscuits [1], while catering to a burgeoning export market.

The biscuit industry in Bangladesh is comprised of organized commercial manufacturers with major players being Olympic Industries, Haque Food Industries, Danish Foods, Bangas, Nabisco Bread and Biscuits, Bangas, and other unorganized small and local producers.

Olympic Industries is currently the largest manufacturer, distributor, and marketer of biscuits in Bangladesh. [2] Its key brands include Energy Plus, Nutty, Tip, Chocolate Plus, Digestive, Cracker Jack, and Lexus among a total of 33 others. [2] In FY18, total revenue added up to $154.4 mn, with net margins on the decline from last year primarily due to a change in accounting policy and a corporate reorganization of sales and marketing departments, causing selling expenses to increase by $2.03 mn to achieve greater performance in the long-term. [3] Biscuits, confectionery, bakery, and snacks made up 97.05% of FY18 total revenue compared to last year’s 96.80% [3] with this segment of products expected to continue accounting for a great majority of revenues in the future as new product lines are introduced by the company. Compared to last year, sales grew 8.28% YOY in volume, with a 14.08% increase in sales of the biscuits and confectionery segment. [3] Exports made up 1.01% of revenues for FY18 ($1.56 mn, a 127.04% YOY increase). [3]

According to an EBL report, Olympic Industries has around 30% market share in the organized and industrialized biscuit market. [1]

Olympic Industries had a 13.72% CAGR in net profit margin and a 7% CAGR in gross profit margin from 2012 to 2016[1], mainly due to strong efforts of enhancing production efficiency and capitalizing on economies of scale. In an effort to maintain these profit margins while expanding and introducing new product lines, the company has been making efforts to vertically integrate its supply chain to overcome the challenges of achieving full automation.

Haque Food Industries was founded in 1947 as a family business, dominating the local market than with its flagship brand of biscuits, “Mr. Cookie”. Haque Food Industries is a concern of A.T. Haque and exclusively deals with food products. Currently, the company has 26 biscuits & cookies and 3 products in their confectionery line.

Danish Biscuits is the concern of Partex Group and a leading biscuit company in the country. Despite the market is being highly competitive, Danish has been able to maintain a strong market position by providing quality products at low prices. Lexus biscuits are one of its flagship products.

Nabisco is a leading and one of the oldest biscuit brands in Bangladesh with a presence in the market before the country’s independence. It was highly popular during the 80s and the 90s. Like other major competitors in the market, the company has a wide variety of products and Nabisco Glucose is its flagship brand. Compared to other brands, Nabisco maintains a low price strategy, making it highly popular in the rural areas of the country.

Established in 1979, Bangas experienced steady growth with their signature product Bangas Biscuit. However, they faced difficulties in survival due to decline, but revived in 2009 through new investments in a modern manufacturing facility and diversifying its product portfolio by introducing noodles, chips, and other products. In FY17, the company saw a turnover of $1.40 mn, revenue growth of 3.02% YOY, however, experienced a net loss in FY16 and FY17 mainly due to lack of capacity utilization due to falling demand and increase in the prices of raw ingredients. [6] In FY17, the company produced 555,597 kg of biscuits and 674,780 kg of bread. [6] The company currently exports its products to countries throughout Asia, the USA, and parts of Europe. It occupies less than 5% of the total market share.

| Companies | Popular Brands |

| Olympic | Nutty, Energy, Tip, Milk Marie, Queen Marie, Malai Cream, Orange, Nutty Real Peanut, Dry Cake Biscuit |

| Pran | Special Toast, All Time Cookies, Dry Cake Biscuit, Sweet Toast |

| Goldmark | Orange Cream, Milk Cookies, Coconut Cookies, Low Sugar Biscuit, Chocolate Chips, Butter |

| Ifad | Tea Time, Kaju Delight, Butter Delight, Choco Delight, Jeera Biscuit, Cheesy Bites |

| Kishwan | Toast, Chocolate Cookies, Horlicks Biscuit, Ovaltine, Fiore Biscuit |

| Bangas | Grand Choice, Choco Cream, mango Slice, Pineapple |

| Danish | Toast, Dry Cake Biscuit, Doreo, Danish Lexus, O La La Potato |

| Nabisco | Glucose, Milk Cream, Crunchi, Elachi |

| Al-Amin | Orbit, Cosmos, Deena, Pineapple, Racie |

| Cocola | Sweet Toast, Chocolate Biscuit |

| Multi | Marie Gold, Nimki |

| Haque | Digestive, Mr. Cookie, Ding Dong, Milk Chocolate, Mr. Coconut, Mr. Milk |

| Bengal | Orange Cake, Big Bite |

The industry currently faces 3 major obstacles:

Due to a lack of facilities to ensure cheaper and quality goods, it is unlikely that smaller market players will be able to compete with larger name brands given their higher costs of production as most of them still use labor-intensive production processes. Their purchasing power is lower further adding to costs. However, they may be able to find a space in meeting local market demands if they are able to produce unique products in the market. In the near future, we may see fewer biscuit brands hosted by large market players in order to achieve greater operational efficiency and cater to a growing export market with varying tastes.

Mohammed Shehab, Junior Associate at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected]

1. Brief Analysis of Olympic Industries – EBL Securities

2. Biscuits bring bucks – The Independent

3. Olympic Annual Report 2018 – Olympic

4. AT Haque – Haque

5. Biscuits | Partex Star Group Corporate – Partex Star Group

6. Annual Report 2016 – 2017 – Bangas

7. Bangladesh Grain and Feed Annual 2018 – USDA

8. Sugar import from India to be duty-free – Daily Star

9. Edible oil import grows – The Financial Express

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights