GET IN TOUCH

- Please wait...

In 2018, Bangladesh’s market capitalization to GDP ratio dropped down to 17% from 24% in 2014[2]. Rising interest rates, a growing number of non-performing loans, negative risk premiums, record current account deficits, and banking sector turmoil all seem to point in a direction of a financial sector in distress. However, despite all the negativity, there lies a silver lining as financial institutions seek alternative ways to invest their capital and produce stable returns in a sector that has a reputation for not paying its dues.

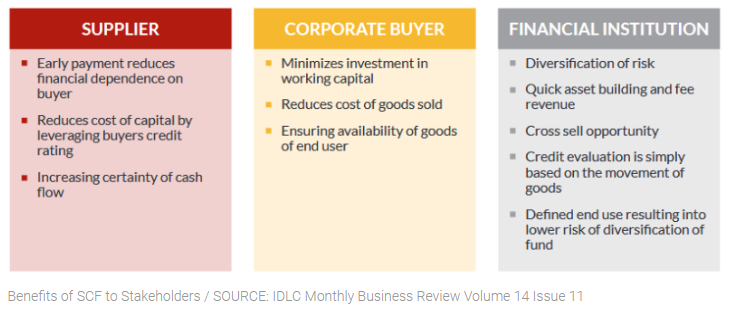

Meet supply chain financing (SCF), a financial product that has low delinquency rates, mitigates risk of misappropriation of funds, and assures money received by borrowers. Besides the monetary benefits, however, it also ensures greater synergy within supply chains as various stakeholders in the ecosystem benefit from its use. The question now arises that if this financial product is so beneficial, why has it re-emerged after attempts to introduce the mode of financing in the past? According to a report by McKinsey, fintechs are at the heart of this disruption[4].

Globally, large corporate buyers have tried to attain sustainability in their supply chains by managing their environmental, social, and governance (ESG) risks. Though this practices have been done to address the issues of profitability and sustainability, their returns are doubtful as suggested in a report by BSR[3]. These measures also do not address the financial challenges of bridging payment gaps in the sourcing of raw materials, a fundamental obstacle to achieving supply chain sustainability.

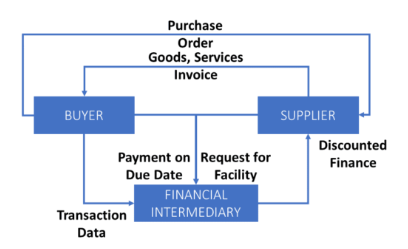

There are two main benefits of supply chain financing – increasing receivables turnover of the supplier, and increasing debtor turnover of buyer. This is possible due to the financial intermediary ensuring quick payments to the supplier by purchasing the worth of its receivable at the cost of a discount and increasing the length of period for payables due of the buyer. By doing so, it ensures steady cash flows to both buyers and suppliers, freeing up their working capital and allowing them to achieve greater levels of productivity.

Despite the potential for the service in the market, a lack of resources to mitigate operational risks of the process has stagnated its growth in the past, though now many financial institution are grasping the rediscovered opportunity in the market with NBFIs at the forefront. Although there is little regulation surrounding the product, recently initiatives have been taken to highlight its importance and the first Digital Supply Chain Platform is soon set to launch. At the moment there is an estimated total of $71.3 mn (600 crores) of supplier finance products in the portfolio of major market players.

| Financial Institution | Portfolio Size (BDT crores) |

| IPDC Finance | 180 |

| Lanka Bangla Finance | 155 |

| United Finance | 130 |

| IDLC Finance | 74 |

| Others | 61 |

| Total | 600 |

Source: IDLC Monthly Business Review Volume 14 Issue

Traditionally, SME suppliers lacked access to loans due to the difficulty in assessing their credit risk and working capital needs. As a result, those who did avail the credit services often did so at steep interest rates cutting into their margins and adding additional layers of risk to their everyday operations. Supply chain finance has revolutionized this process by digitizing the payment process as suppliers are able to receive funds in as short a period as it takes for banks to simply confirm invoices online. High credit risk is also mitigated as the size of funds provided to suppliers is later collected from, often large corporate, buyers. As a result it has increased the accessibility of funds, which is a critical key for success to SME suppliers as a lack of payment often means an inability to continue business. Transactional data obtained also allows for greater assessment of enterprises and industries.

Supply chain financing is achieved by either factoring (supplier financing) or reverse factoring (buyer financing). However, despite the fact that reverse financing is the most popular form in the world due to its benefits over the former method such as cutting costs for large buyers, lower interest rates, and suppliers receiving payments quicker, factoring dominates in the Bangladeshi market due to a lack of trust and healthy relationships between buyers and suppliers.

There are two main issues regarding SCF, preventing it from developing properly in Bangladesh: a lack of policy and support from corporate entities to suppliers (IDLC Report). Currently, IPDC Finance, a key market player in this field, is set to develop a blockchain powered digital platform for SCF and provide services such as factoring, reverse factoring, work order, and distributor financing. If completed it would greatly improve access to financing to MSEs as it would be introducing automation to the currently existing manual process. It would also ensure greater access to funds beyond the vicinity of formal institutions if integrated with digital financial services like bKash which is widely available throughout the country.

Mohammed Shehab, Junior Associate at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected].

This article was originally published here https://databd.co/stories/supply-chain-finance-a-consequence-of-developing-capital-markets-1740

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights