GET IN TOUCH

- Please wait...

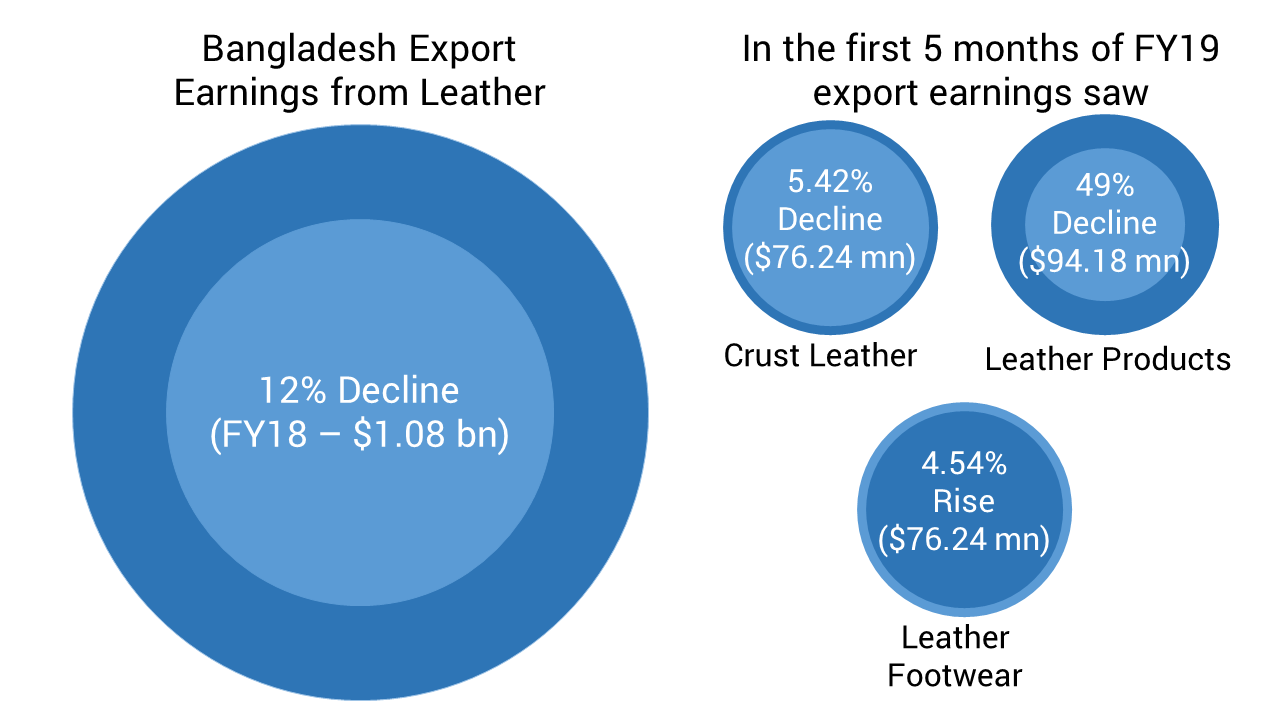

The leather industry has been developing on a large scale since the 1970s and is currently worth around $1.90 bn with 40% of the total demand being met from imports [2]. However, the leather industry has recently been facing a gradual decline in export earnings. In FY18, exports of leather, leather goods, and footwear were $1.08 bn, down from $1.23 bn in FY17[2]. Currently there are 165 footwear and leather factories in Bangladesh with an additional 161 tanneries that process the raw hide to finished leather [2]. Investments have been on the rise with a focus on factories that meet environmental compliance laws and produce high quality goods. However, the industry is currently facing sharp decline due to non-compliant factories in the recently built Savar Tannery Industrial Estate.

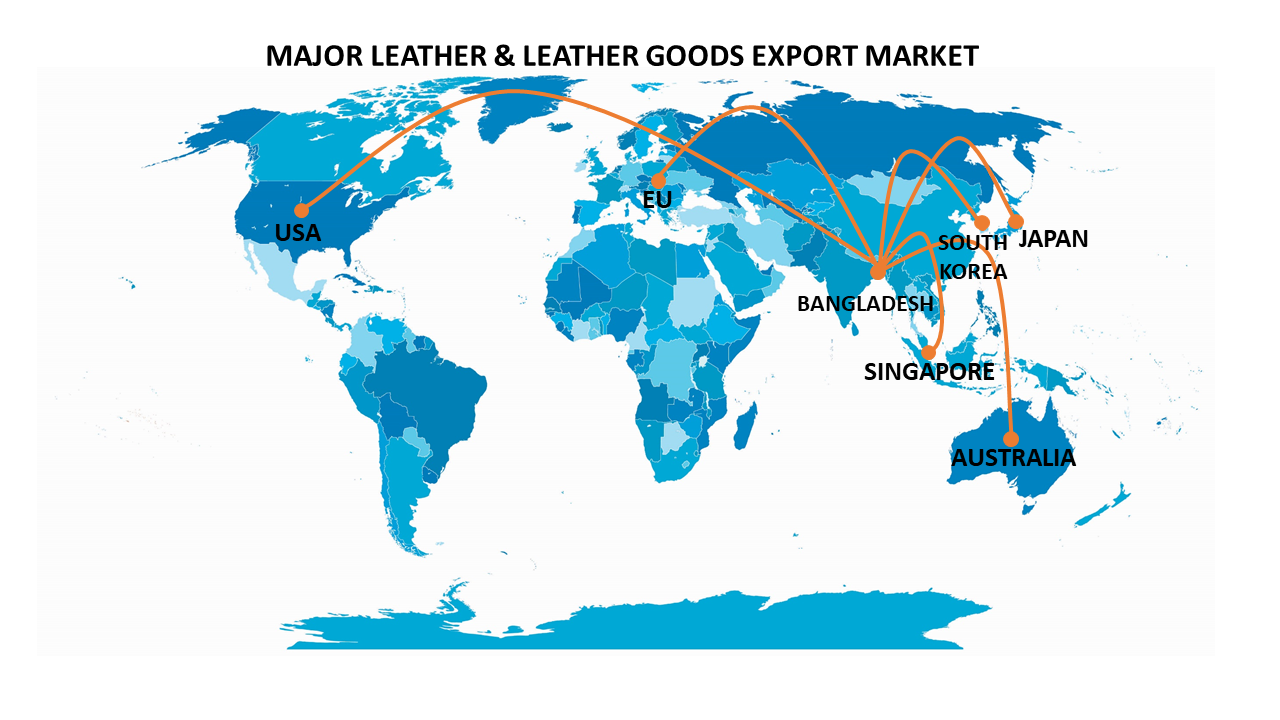

The leather industry products include leather-based garments, shoes, belts, bags, jackets, suitcases, wallets and other items with footwear at the forefront of the market. Around 85% of leather and leather products exported are in the form of crushed leather, blue wet leather, finished leather, leather garments, and footwear. Key export destinations are the EU, USA, Australia, Japan, Singapore, and South Korea.

Although China is the largest leather product sourcing country in the world, leather footwear faces a 17% import tax from the Chinese government (export tariffs in Bangladesh are at 0%). In peer countries, wages have also been on the rise leading to many manufacturers closing down due to their inability to cope with rising costs, placing Bangladesh at a cost-competitive edge.

In the first 5 months of the current fiscal year, Bangladesh’s export earnings from leather and leather products went down by 16.11% to $434.7 mn from $518.15 mn in the same period last year [1]. Export earnings from crust leather fell by 5.42% to $76.24 mn and leather products fell by 49% to $94.18 mn, and leather footwear posted a 4.54% growth in export earnings of $264.28 mn [1]. Although many tanneries are also yet to complete their shift from Hazaribagh, causing delays in production, manufacturers cite non-compliance at the Savar Leather Industries Park as the major deterrence of buyers from placing work orders. The under construction Central Effluent Treatment Plant (CETP), the reason behind non-compliance, is set to be completed by June 2019. As a result of this, local manufacturers have been unable to capture the opportunity of the US-China trade war as well. Besides CETP there are also concerns of solid waste management which is causing considerable pollution in the area. Due to a lack of proper waste management facilities, tanneries have turned to discharging their untreated waste into a nearby river in Savar.

Recently, around 155 tanneries were moved to the 200 acre Tannery Industrial Estate in Savar (selected in 1994 for shifting) in efforts to save the Buriganga river which has been polluted due to industrial waste dumping from manufacturers. It was also done in efforts to raise the standards of manufacturing by providing better production facilities. However, workers have yet to receive proper work gear to protect them from the various toxic fumes and hazardous chemicals used in leather production.Work-related sickness and death remain a common occurrence.

| Dominant Leather Trade Associations |

| Bangladesh Tannery Association (BTA) (est. 1958) |

| Bangladesh Finished Leather, Leather goods and Footwear Exporters’ (BFLLFEA) (est. 1986) |

| Leather Goods and Footwear Manufacturers and Exporters Association of Bangladesh (LFMEAB) (est. 2003) |

“Due to lack of environmental compliance at Savar Leather Industrial Park, global buyers are not placing work orders. As a result, export earnings from leather and leather products, the second largest export earner, have seen a downward trend,”

– Md Shakawat Ullah, General Secretary of Bangladesh Tanners Association

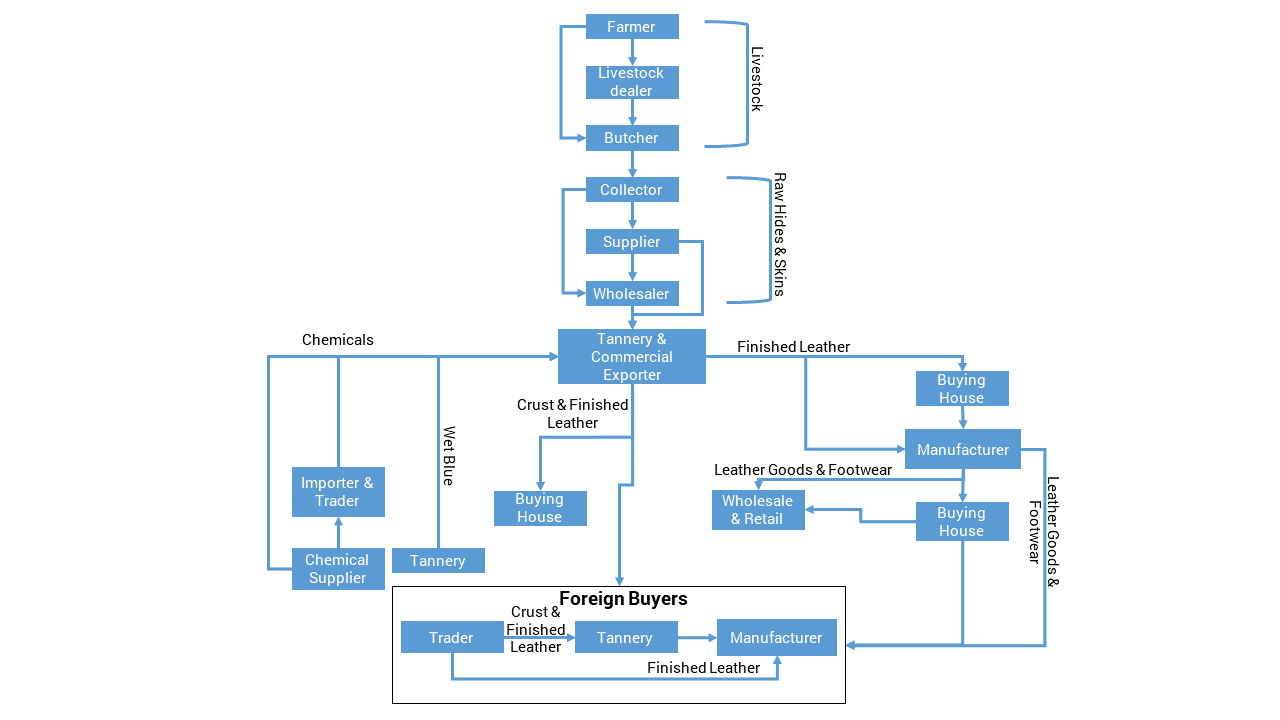

Besides recent troubles, the leather and tannery industry faces a fundamental problem of a lack of developed backward linkages causing them to face regular shortages in raw hides and skins, and leather processors being dependent on importing machinery and inputs for production (chemicals). A large majority of tanners and commercial leather exporters are also heavily reliant on brokers who connect them with buyers, preventing processors from expanding their reach within the supply chain. The picture is further complicated considering that the market is dominated by a few local firms who subcontract to MSMEs.

As a result of a stagnant social, environmental, and economic conditions, many large international buyers also avoid sourcing goods directly from Bangladesh to avoid negative publicity. As a result, the market in Bangladesh has been focusing on lower-end users though efforts to move in the value chain are being taken by a few market players, particularly those in LFMEAB.

There are 3 key areas with a strategic importance to leather processors who want to enter the global market: chemical imports, leather exports, and environmental regulation. Overall in the industry, there are an excess number of forward and backward linkages in the supply chain, preventing current market players to scale up unless they begin investing in both their production facilities and human capital. Although the many trade associations have acted as central hubs to facilitate means of knowledge sharing and production improvements, implementation of existing policies governing the industry must be strictly enforced. If Bangladesh is to make its leather industry a major thrust sector in the future and increase its weight in exports, it will have to overcome the issues of inefficient supply chains as well as increase its quality standards to provide higher value offerings to capture the global markets.

Mohammed Shehab, Junior Associate at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected].

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights