GET IN TOUCH

- Please wait...

The security provided by a shelter goes beyond physical safety. Owning a house, an apartment, or land constitutes a significant portion of the average citizen’s wealth. As property prices rise, the value of their assets rises, giving them the financial security to increase consumer spending. Those who don’t own their residences and instead pay rent are impacted by the portion of their income that goes to rent. The safety of the economy is also often linked to the real estate market as, historically, high housing prices are often followed by global recessions, making it a key indicative industry to monitor the risk of a recession. As such, the market’s multiplier effect and impact on the economy make it an important industry.

Real estate refers to physical property, land, and buildings, as well as resources above and below the land itself, including residential, commercial, and industrial property. The industry includes the production, purchase, and sale of these properties.

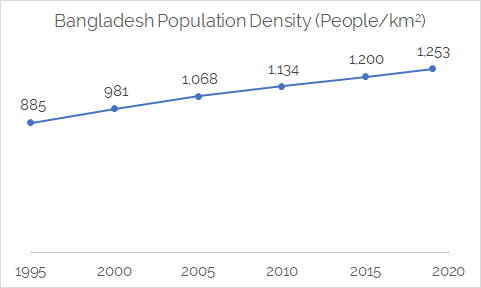

Bangladesh’s real estate market is considered to be stable and enjoys steady growth as incomes rise. Political and economic stability, falling interest rates, and larger construction projects have contributed to the mounting growth rates. The estimated size of the industry in 2018 was over $7 billion 1, and YoY growth was above 5% in 2017 [2]. Its direct contribution to the GDP was 6.49% as of 2017 [3]. However, scarcity of land and rising cost of construction have caused prices to shoot up. At the same time, there is a shortage of properties targeted to lower and middle income classes, indicating a housing crisis which may become severe.

As middle-income earners show eagerness to purchase, the market must ensure that appropriate properties are being developed with financing options in place. With a potential recession on the horizon and increasingly congested urban areas, the government is making moves to sustain the industry’s growth.

The crash of the housing market after the global recession of 2007 has not allowed complete recovery in The United States as of yet. Fears of another recession are expected to dampen the market in 2020 4. Global tensions – Brexit, the upcoming US elections, and trade conflicts with China – are also rising. These three factors, however, haven’t impacted rising housing prices yet, which are being sustained by historically low-interest rates in many countries [4]. The size of the market in 2017 was just over $280 trillion, with an annual growth rate of 6.2% [5].

The housing bubble and subsequent crash in the US in 2007 was largely caused by loans given to subprime borrowers with poor credit [11]. This created subprime mortgages on assets as housing prices rose at breakneck speed, and many mortgages and loans were marked with a more favourable credit rating than accurate. As borrowers began to default, the bubble collapsed. Financial institutions lost money and the economy came to a grinding halt. As a few shut down and others were bailed out, the US and global economies gradually came out of recession afterwards.

As businesses adopt non-traditional operations, the need for strictly commercial spaces is falling. More functional, multipurpose offices that allow omnichannel operations are becoming popular. The rising demand for green, environmentally-friendly places and technological advancements are making older properties obsolete, and mixed-use properties are rising in popularity. An additional effect of these changes is straying away from traditional 20-year leases, as businesses desire to be more flexible with a rapidly changing environment.

New practices, such as shared offices and co-living, are making it difficult to place values on property. Flexible and co-working offices are predicted to account for 30% of corporate office spaces by 2030, compared to 5% today [4]. These trends indicate the shifting of real estate from an asset class to service, merging with attributes of the hospitality sector [5]. Logistics real estate is another rapidly growing sub-sector. The growth in e-commerce services has increased the need for warehouses and distribution centres.

These changes will redefine the way the industry operates, starting from the way the properties are valued. With hybrid usage, the lack of a single direct consumer, and non-traditional leasing, the sector must choose new features to define the value of a building. Possible methods are estimating the experience enjoyed by the final users, or the technology invested in the property.

As Dhaka grows more congested and land prices rise, apartment buildings are replacing houses and bungalows. The city is also shifting to the creation of suburbs and residential areas away from the urban centre, which may relieve pressure on the roads and properties.

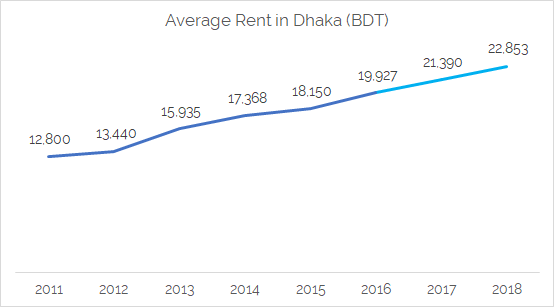

As the income of the middle class rises, the demand for housing is also increasing. Many consumers aspire to have their own property instead of spending a significant amount of their monthly income on rising rent prices. The rising availability of home loans increases the ability of consumers to afford properties, further increasing the convenience of purchasing a home.

Commercial real estate refers to offices, shopping centres, medical and educational institutions, and hotels among others. Factories, warehouses, and other manufacturing facilities are included in industrial real estate. The growth of this segment depends on business confidence, which has been bolstered by the rising economic growth of the country. Infrastructural improvements also have an impact as they increase the ease of trade throughout the country, allowing businesses to access locations that previously may have been too costly to operate in. As the rent of commercial spaces are rising, businesses are renting floors in residential areas as well, away from traditionally commercial districts such as Motijheel.

Related Authorities and Associations:

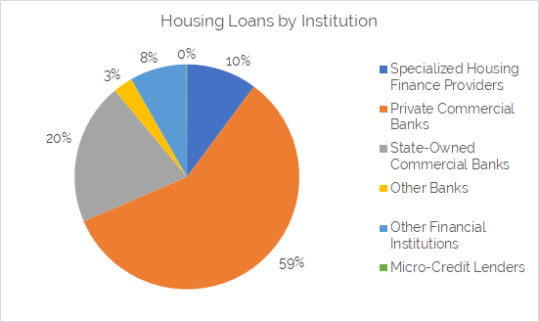

As purchasing a property is a huge investment that requires savings of a lifetime, financial support in the form of housing loans can help a consumer make that decision earlier on in life, boosting the industry as well as their own wealth. As of June 2018, total outstanding housing loans amounted to nearly $10 billion, making up 9.6% of the total credit to the private sector. Between 2016 and 2018, outstanding housing loans increased by 42% 3. The rising popularity of home loans indicates confidence in the economy and the real estate sector.

The range for interest rates is between 8 and 15%, and loans up to BDT 12 million can be offered. Private commercial banks provide the bulk of these loans.

Despite rising loan amounts, loan penetration is low at only 9.1% of total credit, whereas other Asian countries, such as India and Thailand, have rates in the double digits – 12.5% and 19.9% respectively 2. This is due to the fact that not only are the housing conditions poor for low and middle-income consumers, but most of them are ineligible for the loans. Over 70% of urban-dwellers fall in the ‘inadequate’ category for financing 2. The Bangladesh Bank is aiming to make the loans more accessible to the middle class.

The potential recession and the liquidity crunch, although affecting funding in other industries, are unlikely to have a strong impact on housing loans for two reasons. Firstly, the real estate market is not plagued by the uncertainty of other industries, as people tend to invest in properties even when other investments are unsafe. Secondly, only 3.12% of the housing loans were defaulted in 2016, indicating a good recovery rate 6. This makes housing loans a safer option for banks than business loans.

The rate of urbanization in Bangladesh is 1.69%, the highest in South Asia. It is estimated that 120,000 additional units are needed to house this increasing population annually, but the current supply is around 25,000 annually [2]. The real estate industry is not only indicative of investments and the wealth of a country, but also the basic standard of living of its people. The unplanned growth of the industry, however, is currently leaving the lower and middle-income population behind.

Rent inflation was higher than the general inflation rate by 2.3% in 2016. Approximately 82% of residents in Dhaka paid over 30% of their monthly income on rent and utilities, which is considered to be above the affordability limit [10].

Approximately 40% of Dhaka’s population is forced to live in slums or squatter settlements. These same tenants are forced to pay rent that can be up to double the rate per square foot of high-end apartments [7]. Frequent fires, crime infestation, and uninhabitable, unsanitary environment make these places less than ideal to live in. On top of that, the homeless population of Dhaka is now estimated to be higher than 50,000 [7]. The situation is only slightly better for the middle-income class, with 57% of the group unable to afford a house in Dhaka [7].

Most new constructions are of spaces more than 1,000 sq. ft., making them inaccessible to lower income home-seekers [2]. This, along with rising rod and cement prices, has created a shortage of affordable homes for the lower and lower-middle-income groups. There is an estimated deficit of 4.6 million housing units in the urban areas of the country [2].

The biggest challenge facing the industry is the scarcity of land. This is especially felt in the cities, as urban sprawl keeps the city boundaries expanding. With the existing infrastructural problems, this is increasing the difficulty of day-to-day life with commute and congestion dominating the average citizen’s daily life. The cost of construction is also rising as most materials are imported, and the Bangladeshi taka has devalued against the US dollar. For a property developer to get a project approved, permission must be obtained from over 10 organizations for water and electricity connections. This, in addition to the scarcity, is leading to rising property prices. To keep investments accessible to the lower and middle-income classes, these issues must be addressed.

As in all other sectors, technology is invading real estate and has the potential to transform it. Dubbed ‘Proptech’, property technology can help real estate firms improve their services to be more accessible to consumers. In Bangladesh, the usage of big data can be expected to make the biggest difference as developers can identify trends in preferences as well as how to target younger consumers. The Internet of Things and artificial intelligence will also have an impact, but these technologies are yet to truly permeate regular business in the country.

The recently announced government policy to allow the whitening of black money by investing in real estate has been met with mixed reactions [8]. The budget for FY20 allows for a 5-year plan where people may invest money in Special Economic Zones, high-tech parks, or real estate without having to disclose its source by paying a certain level of tax. On one hand, this will reduce capital flight from the country and money will enter the mainstream economy instead. The size of the black economy in 2015 was estimated to be $58 billion [8]. On the other hand, critics are suggesting that the money would have entered the mainstream economy by way of consumption or investment in financial instruments, and this policy is unethical as it permits black money and discourages honest taxpayers, allowing criminals to keep and profit off of their illegally-earned assets.

Changes in financing options, confidence in the economy, and the rapid urbanization of Bangladesh are starting to push the previously stable real estate market into an era of growth, making it an attractive investment option. In addition to this, government initiatives to boost the industry with black money flows mean that this growth will be sustained.

Increasing the ceiling of home loans from the current Tk 12 million and reducing the interest rate will encourage investment. Registration costs, which can be up to 16% of the property price, also act as disincentives [9]. Changing these policies can facilitate middle-class consumers to invest in real estate.

A priority for the government should be keeping housing affordable so that consumers can actually invest in housing without losing their life savings or take unsustainable loans. Decentralization can be the key to this, by moving residential areas to the suburbs. This would relieve pressure and congestion from the core business areas of the city, and allow residents to purchase affordable housing in suitable locations. Creating affordable housing options for the homeless or poverty-stricken populations of Dhaka will be a crucial step in development, and incentives must be provided to developers to make properties targeting middle-income consumers. Public-private partnerships have been successful in this sector in other developing countries and may be the answer to this growing concern.

An illustration of this would be India, which also struggled to accommodate the lower-income groups but now has an affordable housing market that makes up one-fifth of the real estate market 2. Full tax exemptions for developers in this segment and housing loan subsidies all helped boost its growth.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights