GET IN TOUCH

- Please wait...

Crab Industry is Added to the Special Development Sector as per the Export Policy Act 2018-21

The crab sub sector in Bangladesh provides livelihood support to many families residing in the southern belt of Bangladesh. In FY 2017-18, Bangladesh produced 11,787 MT [1] of Crabs of which 97% were exported across the globe for an estimated export value of $42.9 Million. China is the major export destination for crabs with an estimated 85% of total export volume being shipped to the Chinese market annually. [2]

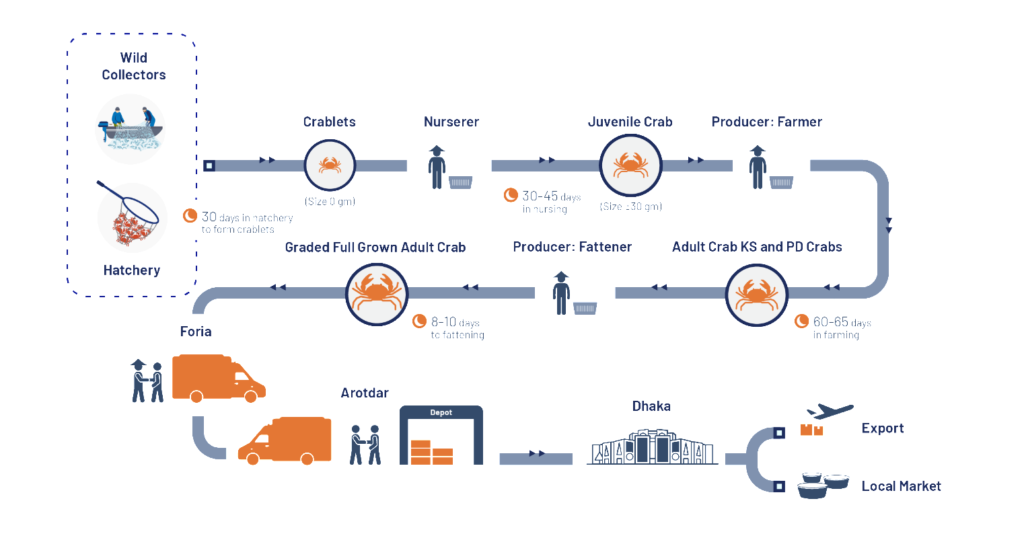

The industry is taking baby steps towards the right direction with an annual historical increase in both demand and supply. While still at its nascent stage, the sector relies heavily on the collection of crabs from the wild for business and with the increasing annual demand, this dependency on nature needs to be diverted to hatchery based production in order to maintain ecological stability and supply end sustainability. Only one commercial hatchery by NGF is currently in operation and the production volume for the hatchery is 350,000 crablets in 2019, which is a small fraction of the total demand.

On an intra-level, the sector competes between the option of live crab and soft shell crabs. While the former is restricted to just being exported in Asian belt because of logistical limitations of exporting live products, the latter i.e. soft shell crabs are exported to not only Asia but also in Australia, United Kingdom, and United States. However, soft shell farming requires the collection of young crabs from the wild before they have reproduced. This is resulting in severe population depletion and if major interventions are not taken, the industry will supposedly crumble in the future years.

On an inter-level, the crab sector is competing with the already well-established shrimp sector. Based on the grading of a crab, each kilogram of crab can be sold at three times the price in comparison to each kilogram of shrimp. The primary findings also found that crab has better immunity to diseases in comparison to shrimp. However, the biggest difference between crab and shrimp market is the demand in local market. While shrimp is considered a household commodity, crabs are only gaining attention of the urban population through unique restaurant based dishes.

With regards to international arena, the Bangladeshi produce is competing with major neighboring export players like Vietnam, India and Philippines. Vietnam represents 0.4% of the $3.52billion global export market share and has 250 crablet based hatchery across the country to facilitate the export. India exported $17.1 million worth of crab in 2017 with United States being the major export destination. Philippines exported $60 million worth of crab in 2017 with South Korea being its major export destination. None of the major neighboring export players shipped their products to China in significant proportion.

In order to ensure a sustainable crab sector for the future, it is necessary to address the systemic challenges facing the sub-sector.

The major bottlenecks for the industry can be divided into three categories: Macro-level risks/limitations that focus on policy and trade risks that affect the industry; meso-level risks/limitations that highlight the existing challenges in the market system; and micro-level risks/limitations that refer to risks associated with actors across the value chain.

The following framework summarizes the macro, meso, and micro-level risks and limitations that the crab industry faces:

| Category | Risk/Limitation |

| Macro Level | Breeding Policy: It is important that the Government of Bangladesh finalize a particular window regarding the ban on the wild collection of crabs. While the current ban is in January and February of every year, academicians claim this ban period to be inaccurate, resulting in business loss during the peak export season. |

| Diversity Risk: As per EPB, Bangladesh exported $36 million worth of crabs to China in 2018. This refers to 85% of total crab exports for that fiscal year. This significantly increases the diversification risk as any fallout in the bilateral relationship between the two countries or economic recession in China would negatively impact the industry. | |

| Wild Crab Collection: There are policies on the type of crab that can be collected from the wild. However, these policies are yet to be properly implemented. The government needs to prepare a wild collection mandate in order to control the population depletion, particularly of the young crabs that are being collected from nature for the soft shell farms before these crabs can reproduce. | |

| Meso Level | Crab Supply: The supply is well below demand in the export market. The development of hatcheries is imperative for further developing the value chain. According to primary sources, the quality of crab generally tends to reduce during peak season. |

| Ecosystem: The crab market system is still not mature enough to facilitate the value chain. There are no alternate live feed options other than Telapia, and the industry also lacks the proper medicine necessary to control viruses and other diseases. | |

| Lack of Infrastructural Facilities: The Padma Bridge would definitely reduce the shipping time from an Arot in Khulna to an exporter in Dhaka. However, there are still many infrastructural developments that can facilitate the growth of the sector. Iced warehouses close to airports would reduce the mortality rates of exported crabs significantly. Proper roads within districts would reduce mortality during transport. The industry may also look toward crab processing infrastructural capacities in order to deal with rejected broken or dead crabs and create a profitable by-product. | |

| Micro | Technical Expertise: The industry lacks sufficient technical experts, particularly at the hatchery level. Furthermore, expertise in feed and disease management needs to be developed further across the value chain |

| Crablet Pricing: As long as the collection of crablets from the wild still persists, the demand for crablets from hatchery will be lower as the current subsidized price is still four times more than the price of a crablet from the wild. |

The Bangladesh crab industry is dependent upon systemic changes within its value chain. For streamlining the production of crab, it’s imperative to strengthen the value chain across all levels. The sub-sector’s dependency on crablets sourced from the wild can potentially restrict medium-term growth opportunities. Hatcheries can strengthen the sourcing of crablets, which, in turn, would increase crab production.

Potential entrepreneurs will only be willing to establish crab hatcheries if the business ensures profitability and long-term prospects for growth. In order to ensure sustainable growth, it is necessary to work on the opportunities available to elevate the existing market demand and improve the current business processes for ensuring higher efficiency. There needs to be sufficient demand for crablets from hatcheries at a price point that ensures profitability for the hatchery while providing readily available crablets for the farmers. In the coming years, the following opportunities may be tapped upon in order to maintain the sustainability of the industry:

The crablets produced in the hatchery are of similar quality in comparison to the crablets collected from the wild. This means a shift in the sourcing of crablets from wild to hatcheries won’t adversely impact the farm’s productivity.

Furthermore, because of the higher survival rate among hatchery-based crablets during the nursing phase in comparison to crablets from the wild, the value chain actors often end up making higher profits despite wild crablets being available at a cheaper price.

But the challenge regarding hatchery is to produce a consistent volume of crablets in order to ensure profitability. To attain consistent outputs, the industry first needs to develop a successful scientific formula facilitated by a sufficient number of technical experts available to conduct the processes required to achieve the desired outcome.

The hatcheries can look into integrating its operation with other value chain actors in order to ensure sustainable revenue for their operations.

Instead of selling crablets at a subsidized price, a crab-based hatchery can include nursing within its services in order to sell juvenile crabs instead of just crablets. A standard juvenile crab is sold at 15tk/piece while a crablet is sold at a subsidized price of 2tk/piece. The additional margin in this regard is significant and can secure higher profitability for hatcheries in comparison to just selling crablets.

In 2017, NGF nursed the produced crablets to juvenile crabs in order to attract buyers across the value chain. This confirms that the practice has been in place but was not used for commercial purposes to date.

The US-China trade war resulted in a $60 Million volume deficit of crab imports by China from the United States in comparison to the previous year. This has created a vacuum on the supply side that the Bangladesh crab industry may capitalize on.

However, 85% of the exported crabs in 2018 were shipped to China. This puts the sector under severe diversification risk, and the sector might be impacted by the economic downtrend in China. Therefore, it is necessary to diversify the export basket and particularly focus on alternate markets.

One opportunity is to increase export to Australia. As per EPB, Bangladesh exported more than $3 million worth of frozen crabs to Australia. However, the demand is mostly based on soft shell products, and in order to consider Australia as a new major export destination, the sector needs to first sort out the soft shell farms’ dependency on the wild.

A major reason behind the success of the shrimp sub-sector in Bangladesh is due to the demand in the local market. Even though there has been an annual growth in demand among the urban population of Bangladesh, crab is still not a commodity that is purchased by households. Major demand originates from restaurants that serve unique crab-based dishes.

One opportunity of tapping into the domestic market is through frozen food companies like Golden Harvest, a company that makes frozen snacks ready to be fried at home, and introduces crab-based finger food in order to accustom the target group to the taste and quality of the product, but through smaller portion size. This could also be an opportunity to capitalize on the byproducts of broken and dead crab meat which are currently disposed of but can now be used by these frozen food companies by bringing the product to the market at an affordable price in order to cater to a larger consumer group.

The government of Bangladesh included the crab sector in its special development sector in the Export Policy Act 2018-2021. This shows the government’s acknowledgment of the potential this sector has, but it also means that proper policies need to be developed in order to nurture the industry from its nascent stage into a mature one.

Primarily, policies need to be reformed regarding the ban on the wild collection period. Secondly, policy should also be formulated on the types of crabs that can be collected from the wild in order to protect the population from getting depleted.

Lastly, the government should formulate export policy mandates for the exporters in order to ensure the quality and brand are not compromised in the international market. But formulating policies will only be effective if these policies are stringently implemented.

This article was written by Sanjir Ali, Business Consultant at LightCastle Partners. For any queries, you can reach him at [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights