GET IN TOUCH

- Please wait...

Blessed with the demographic dividend since 2007, with more than half of the population in prime working ages (15-54), the ICT outsourcing sector in Bangladesh has tremendous potential in driving the economy of the country. The ICT sector in Bangladesh has grown by 40% annually since 2010.[1]

The presence of a high number of young entrepreneurs and their enthusiasm and the government’s high focus on ‘Digital Bangladesh’ are the main driving forces of the ICT industry in Bangladesh.

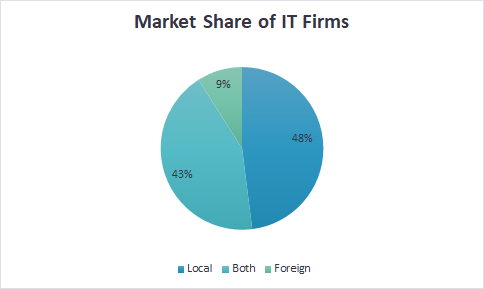

The domestic IT and Information Technology Enabled Service (IT-ITeS) industry in Bangladesh is currently valued at close to USD 1.1 billion.[2] There are over 4500 registered software and ITES companies in Bangladesh.[3] 43% of the firms are present in both the local and foreign markets, where 48% are present exclusively in the local market and 9% in the foreign market only.[3]

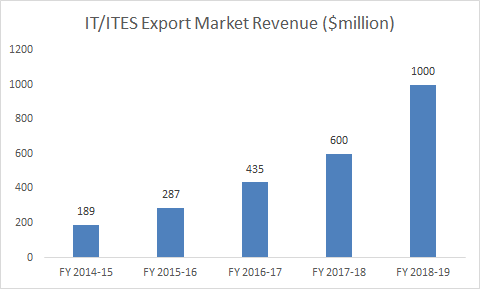

Over 400 IT companies currently export to over 60 countries, with North America being the main export destination. Bangladeshi IT and ITES firms generate almost 35% of their export revenue from US buyers, 15% from the UK, followed by a number of EU countries such as Denmark and the Netherlands.

A number of local enterprises also export IT-ITES services to UAE, Saudi Arabia, South Africa, Malaysia, and Singapore.[4]

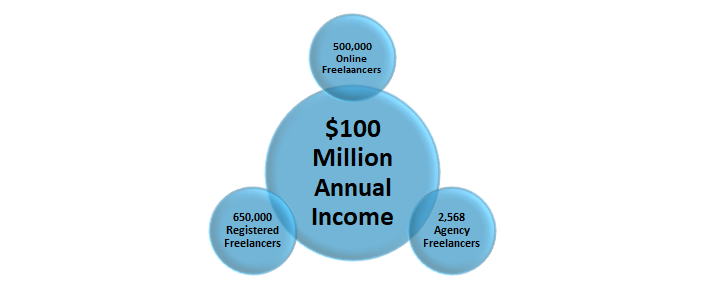

At present, the IT-ITeS industry is primarily focused on IT products and services. However, as technology advances on the back of Big Data Analytics, the Internet of Things (IoT), 3D Imaging, and Robotics Process Automation (RPA), the scope for Business Process Outsourcing (BPO) industry will keep growing. On top of that, with more than 650,000 registered freelancers, there is a huge potential for the growing online labor market in Bangladesh.

With the rise of the gig economy, freelancing has turned out to be a popular career choice in Bangladesh among the youth primarily who are in their 20s.[2]

According to the Oxford Internet Institute (OII), Bangladesh has already become the second-largest supplier of online labor. Out of 650,000 registered freelancers in the country, about 500,000 active freelancers are working regularly with a combined total earning of USD 100 million annually.[5]

The neighboring country India is the prime competitor of Bangladesh as it is the largest supplier of online labor, with close to 24% of total global freelance workers, followed by Bangladesh (16%) and the US (12%).[5]

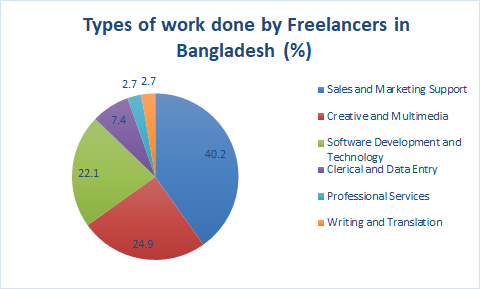

The current working trends among freelancers are shown in the figure below:

The figure shows that about 40%, the majority of Bangladeshi freelancers, work in sales and marketing support, representing 6.8% of the total number of online freelancers in the world. Around 22% of freelancers work in software development and technology, followed by about 25% working in creative multimedia.

However, jobs that require relatively lower skills such as writing and translation and clerical and data entry employ around 10% of freelancers.[5] More people can be trained to get involved in these works.

The software development and technology category is dominated by workers from the Indian subcontinent, who command a 55% market share. The professional services category consisting of services such as accounting, legal services, and business consulting, is led by UK-based workers with a 22% market share.[6]

The Government of Bangladesh has exhibited a determination to train potential talent through its IT initiatives. Key ongoing initiatives taken by the government and the private sector to enhance the quality of young talent include the following:

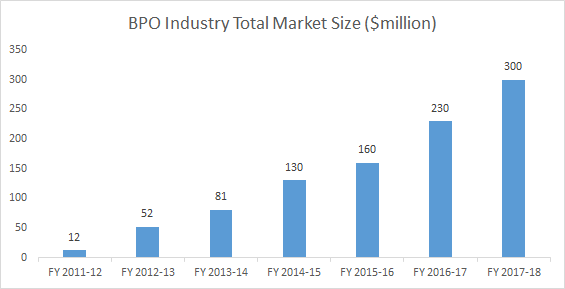

The BPO industry started its journey in Bangladesh in 2009 and maintained a 20% growth year-on-year to about USD 300 million in 2017, currently employing 40,000 employees.[7] BPO refers to the practice of contracting business-related operations that can be technical or non-technical to some external service providers.

The leading local BPO operators include Digicon Technologies, Graphic People, Tiger IT, and Genex Infosys. There are currently three types of jobs in this sector- data entry, customer service, and information analysis. The jobs regarding big data, Artificial Intelligence (AI) machine learning, and the Internet of Things (IoT) are still unexplored due to a lack of skilled human resources.

To ensure sustainable growth, the BPO sector requires an emphasis on four pillars – legal documents, IT infrastructure, skilled human resource management, and international business development.

Despite making progress in enabling legislation and establishing IT infrastructure, domestic BPO companies still have a long way to go in building vastly skilled human resources. Lack of proficiency in the English language is a hindrance in taking this sector forward as it is a major requirement for communicating with international clients.[8]

As technology in the IT sector advances at full tilt, intensive training programs for building skilled human resources and keeping them updated about the changing demands of the global market, is the utmost requirement to keep up with the industry.

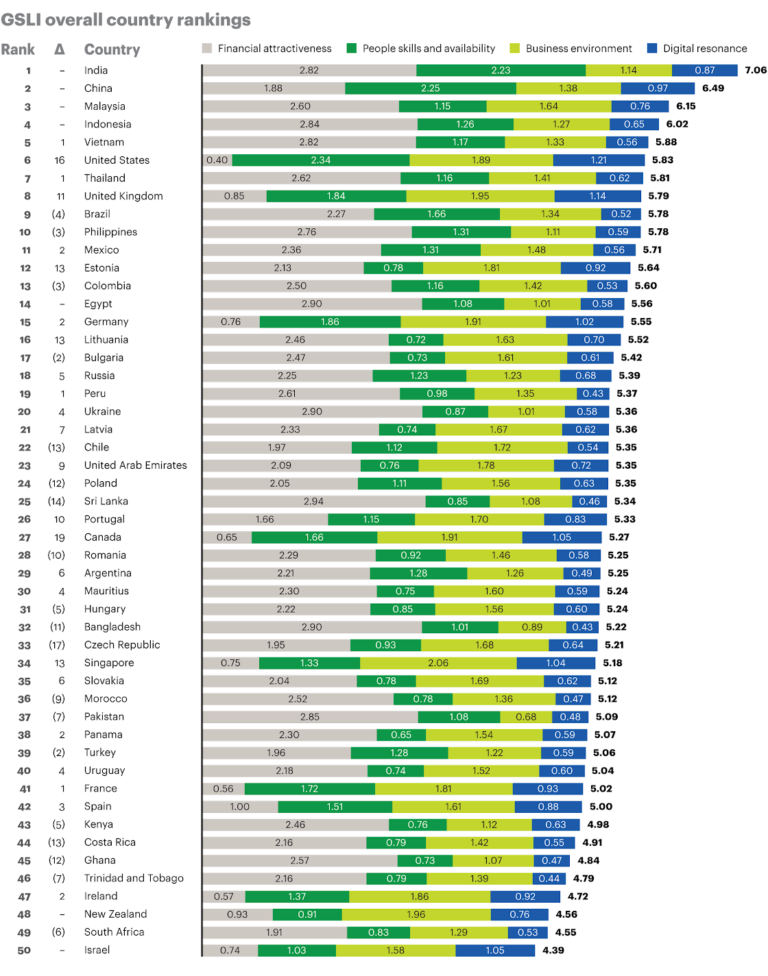

According to A.T. Kearney’s Global Services Location Index, Bangladesh fell from its place at 21st in 2017 to 32nd in 2019, which is even lower than its position at 26th in 2014.[9]

Even though Bangladesh scored well in the ‘financial attractiveness’ category, it scored less in the ‘business environment’ and scored the lowest in the fourth major category, the latest addition to the 2019 GSLI Index: digital resonance. This new digital resonance category was added to address the rising impact of automation and cybersecurity as it incorporates metrics in four areas – digital skills, legal adaptability, corporate activity, and outputs.

Bangladesh scored the lowest in corporate activity metric indicating that the amount of capital invested in start-ups and the number of deals by VCs in 2018 was very low in comparison to the top 50 countries.

Lack of focus on the development of these metrics can threaten the future of the ICT outsourcing industry in the country as the impact of automation in technology remains on increase.[9]

The biggest problem the freelancers face is in the money transaction process as PayPal, the most preferred and widely accessible transaction tool worldwide, is still not available in Bangladesh.

Bangladesh has comparatively more costly and slower internet compared to its prime competitor, India. The average speed of mobile internet in Bangladesh is 9.06 Mbps, and broadband internet is 25.08 Mbps. Whereas, for India, the numbers are 11.02 Mbps and 30.02 Mbps, respectively.[10]

Even with one of the highest numbers of freelancers in the world, Bangladesh fails to compete in certain categories of work such as writing and translation, professional services, and data entry. This indicates the extent of the existing skills gap in the industry.

The government’s initiatives primarily focus on increasing the number of freelancers rather than the quality which will soon lead the freelancers to fall short in terms of quality of work.

Access to well-developed infrastructure facilities, a strong internet system, and an uninterrupted power supply remain major concerns for Bangladesh. However, with the establishment of high-tech, software, and IT parks, these issues are likely to be resolved and will play a crucial role in attracting foreign investment.

BPOs in Bangladesh should collaborate with IT institutions and also focus on on-the-job training and deployment to build an efficient workforce that is capable of delivering future service needs using sophisticated technology. In addition, there should be quality assurance mechanisms for the IT training initiatives.

Since Bangladesh can provide cheaper labor than the top BPO destinations (India, Philippines), technology-related investments should be made by the government for building a ready-trained talent to take advantage of this competitive edge.

The ICT division should mediate with Bangladesh Bank to launch hassle-free payment gateways for freelancers. Furthermore, the embargo on PayPal should be lifted to facilitate international transactions.

As the global outsourcing industry is being progressively disrupted with automation, digital capabilities will be considered an integral part of decisions about offshoring operations locations. Hence, Bangladesh being placed lower in rank from its previous position in the GSLI index 2019 should be addressed with serious concerns.

Bigger investments should be made by the government to resolve the existing skill gap issues immediately in order to increase the scalability of the industry and help the country exploit the full potential of its demographic dividend.

Ishrat Jahan Holy, Trainee Consultant at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected].

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights