GET IN TOUCH

- Please wait...

SMEs are the bloodline of Bangladesh’s economy creating employment for 7.8 million [2] people directly and providing a livelihood for 31.2 million. [3] SMEs contribute 25% to our GDP but have the potential to contribute more. In our peer economies – Vietnam, Srilanka and Cambodia, SME contribution to GDP is 40%, 52% & 58% respectively.

The COVID-19 pandemic has affected all spheres of life and business, but the hardest punch hit the already vulnerable SMEs. The economic distress has added to existing problems such as lack of access to finance, poor market linkage, absence of skilled labor, and lack of export market.

According to the Asian Development Bank, the SMEs in Bangladesh account for 70 to 80% of the non-agricultural sector employment. 40% of the manufacturing output is also by SMEs. Presently more than 6 million SMEs and micro-enterprises are operational in Bangladesh and they are constantly striving to upgrade the lives of many. (RRP Sector Assessment, ADB) [4]

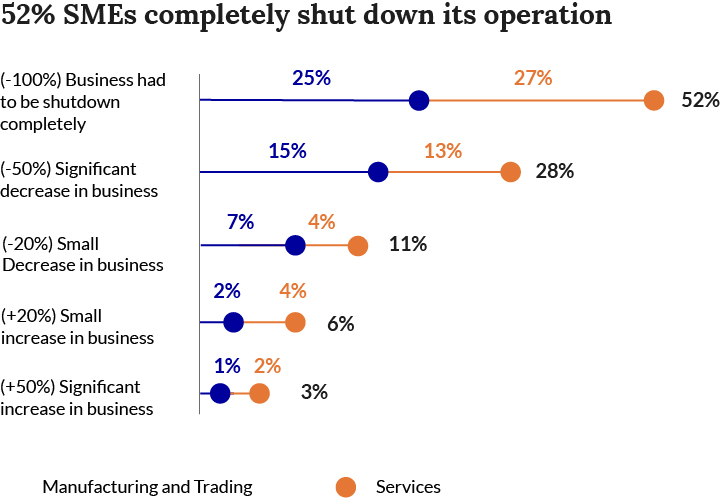

Hardest punch received by the SMEs as they are dependent on a short cash cycle which has been affected as a result of supply chain disruption and loss of sales

To gauge the gravity of the crisis, LightCastle Partners and Sheba.xyz joined hands to conduct a study of the SME landscape in Bangladesh. Primary research spanning 230 respondents was conducted across all eight divisions. Major industries include agriculture, poultry, dairy, fisheries, jute diversified product, retail stores, food processing, & services (tailoring, electrical, laundry, mobile recharge & MFS shop). From the research, some insightful responses are presented below:

42% of enterprises have cut back their marketing expenditure while 23% have done the same in distribution. This implies businesses are taking initial cuts on these two fronts to save some funds. It is also worth mentioning that 32% of the enterprises operated on their own facility – hence did not incur any rental expenses.

With respect to salary, 24% have cut down either to 0 or less than 10%. This indicates employees are already being laid off. This engenders concern as SMEs are one of the biggest employers in Bangladesh — they going down this route could end up with thousands of people becoming unemployed in a matter of months.

Due to the current lockdown, enterprises not related to emergency food and medicine are suffering immensely. SMEs related to services and production of generic items such as jute, handicrafts, light engineering among others have been hit the hardest as they are unable to maintain liquidity and operational activities. According to the survey, 68% of SMEs reported that they will have to permanently shut down their business if the lockdown persists for more than 4 months.

Before delving deeper into the current state of Bangladesh, let’s take a look at what our neighboring countries are doing. India has unveiled a $34 billion aid stimulus package, the primary focus has been to back workers in the informal sectors who have experienced a steep decline in income or have lost jobs. Malaysia has pledged a $2.31 billion aid package for small businesses including startups. Indonesia cleared an aid package worth $8.7 billion, providing for a range of fiscal and non-fiscal incentives in addition to a special stimulus for startups and small and medium-sized (SMEs) businesses. Thailand unveiled an aid stimulus package worth $15.4 billion that will be used for helping SMEs, especially tourism-related businesses; allowances worth $305 million are already approved.

In a ramped-up effort with stimulus packages, Bangladesh has allocated a total of Tk 93 thousand crores (USD 10.9 BN) as a stimulus package to revamp the economy. As part of this, small businesses in rural areas will get subsidized loans of Tk 3,000 crore under the Tk 20,000 crore stimulus package announced by the government to support SMEs. Moreover, on April 12, a new stimulus package was unveiled worth Tk 5,000 crore to provide financial assistance to small and medium farmers in rural areas for boosting agricultural production facing the fallout of COVID-19. To this end, agro loans were reduced to 4% from the previous 5% interest rate.

To further help the daily wage earners, GoB has allocated Tk 760 crore (Tk 2,000 in cash to each of about 40 lakh families whose breadwinners have lost jobs because of lockdown), for day laborers, rickshaw or van-pullers, mechanics, construction workers, newspaper hawkers, hotel workers.

“Prevention is better than cure” — is a quote familiar to most of us. To date, there is no cure for COVID-19 and the only way left for us is prevention. The lockdown is mandatory for our survival — with the current healthcare infrastructure it will be painstakingly difficult for us to fight and win against this virus at a mass scale level.

Keeping this into consideration, what should be the way forward for the government? We propose some concrete recommendations.

Concessional financing: From the current international practices as well as our study we observed that 70% of the respondents asked for soft loans/working capital loans to survive the crisis. Banks and financial institutions may sanction up to BDT 25 lacs to women entrepreneurs against the personal guarantee. Entrepreneurs’ credit limits may be ranged from BDT 50,000 to BDT 50 lacs.

However, current stimulus packages that are applicable through banks depend on existing relationships with SMEs which many of the smaller players won’t have. That means they might not be able to avail these concessional loans. Moreover, the banking sector is going through a liquidity crisis with many of them having stretched NPLs (Non-Performing Loans); hence they might not be able to fully disburse the stimulus. Furthermore, they would be more willing to fund their existing clients rather than SMEs which require the most. Here again, we need a more ecosystem-centric approach, where MFIs whose current portfolio consists of 37% SME loan [5] and has a wider reach, can come into play.

Tax reductions and grants: The government should be reducing the tax rate and offering grants to businesses in hard-hit sectors in an effort to help reduce costs and boost the bottom line. Moreover, specifically for SMEs, VAT exemption on revenue and expenses for the current and next fiscal year, exemption [or deferral] of withholding tax payments can be a timely initiative. By lowering/exempting tax and providing grants, the impact of plunging aggregate demand as a result of the recession could be minimized.

Digital Transformation: Within the scope of the government’s financial assistance, SMEs should try to digitize their business operations to the best of their ability. Since the lockdown is forcing people to stay inside homes, it is imperative that businesses switch to online channels. Linking up with mobile wallets, MFS (Mobile Financial Service), DFS (Digital Financial Service), and Digital Supply Chain Management will help towards achieving medium-term solutions to tackle the extent of the crisis.

In the short term, e-commerce giants like Chaldal, Daraz, Pickaboo have been experiencing tremendous growth due to the lockdown; sometimes to an extent that leaves them unable to fulfill demand because of a supply shortage. Therefore, this brings great opportunities for rural SMEs; those who will be able to adapt will survive.

SMEs create livelihoods and if they fail we will go into deeper economic shock with more and more people coming below the poverty line. Hence we all need to work together to support and uplift the sector. On the off chance that there is one thing that COVID-19 has shown unmistakably is that interest in digitization is not a luxury. Innovation is not only to survive this crisis but it is to create a sustainable business, which will be resilient and evolve in the ‘new normal.

Authors: Omar Farhan Khan, Business Consultant; Asif Newaz, Business Analyst; LightCastle Partners. For any queries, you can reach us at [email protected]

This study would not have been possible without our collaborating partner Sheba.xyz. Special thanks to the wonderful people from Sheba.xyz, Adnan Halim Imtiaz, CEO; Md. Samiul Kabir, Chief Strategy Officer; & Md. Abdur Rahman Tanmoy, AVP, Head of Micro Small Medium Enterprise (MSME). Thanks to our colleagues from LightCastle Partners, Bijon Islam, CEO; & Silvia Rozario, Business Consultant. Sheba.xyz and LightCastle have come together to develop the COV19 SME Impact and Way forward series.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights