GET IN TOUCH

- Please wait...

Bangladesh, home to about 170 million people, is one of the fastest-growing economies in Asia, with a constant annual GDP growth rate of around 6% over the last two decades. [1] It dominates the global RMG market in 3rd position, right after China and Vietnam, earning USD30 Bn (83% of total export earnings) as of 2018. [2] As the country develops, an additional 11 million jobs are expected to be established by 2025. [3]

Connectivity has reached its peak, with 97% mobile phone penetration (166 Mn) and 58% internet penetration(100 Mn)[4]. Consequently, startup activity has surged as local and global businesses emerge with innovation and new business models to satisfy unmet demand across the country.

The government of Bangladesh has also taken national and regional initiatives, such as boot camps, hackathons, co-working spaces, accelerators, and incubator programs, realizing nurturing innovation and entrepreneurship is an essential key driver of economic growth.

Over the last decades, the digital revolution has transformed how businesses operate with new business models creating new markets. Developed nations have leveraged innovation to accelerate economic growth through funding research and development, human capital development and talent management, improving manufacturing capabilities, and the concentration of high-tech public companies.

While there have been significant development prospects, Bangladesh is yet to catch up on innovation. As technology evolves to be cheaper and more efficient, the country’s current strategy to import innovation and technology from developed countries is imminent to become detrimental in the foreseeable future.

As Bangladesh endeavors to become an upper-middle-income country by 2031[5], we question, can Bangladesh leverage innovation to take its growth on to new heights?

To do that, we need to understand where the country stands right now in terms of innovation, the present barriers and hindrances in play, and how the ecosystem stakeholders can mitigate them in the future.

As of the Global Innovation Index 2019, Bangladesh ranked 116th out of 129 countries. [6] The index is a composite measure of 80 parameters categorized under human capital & research (ranked 127), institutions (124), business sophistication (120), creative outputs (115), market sophistication (96), knowledge and technology outputs (91) and infrastructure (86).

When compared with other 26 South East Asian countries, Bangladesh was ranked 17th right after Cambodia, Nepal, and Pakistan as one of the least innovative countries.

Despite the rank, over the last couple of years, multiple innovations and initiatives have taken place collectively or separately by various ecosystem members like the government & public sector, startups & private sector, academic institutions, and financial investors.

The government of Bangladesh deployed the National ICT Policy in 2009 to become Digital Bangladesh by 2021. The government defined a single vision, 10 objectives, 54 strategic themes, and 306 action items in the policy.

All ICT-based activities are led by the ICT Division, and the a2i (Access to Information) Programme, a whole-of-government program of the ICT division, supported by the cabinet division and UNDP.

For boosting entrepreneurship and innovation in the community, the iDEA project by the ICT division has formed co-working spaces, taken initiatives at the national and regional level of accelerators and incubators, and has given out seed investment in the form of government grants.

For the first time, the ICT division has also established a public-private venture capital entity called Startup Bangladesh, with an allocation of USD 6 Mn fund to invest in growth-stage startups and help them grow in terms of alternative investment.

Other feats from the government include improving infrastructure, such as the establishment of a Tier-III Data Centre; connecting 2,600 unions and 18,434 public offices to the internet through fiber-optic connectivity; implementing 4,176 digital classrooms & labs in schools and colleges; mandating ICT in school curriculum from grade six onwards; launching emergency hotline (999) and information (333) call center; launching Bangladesh’s first satellite in space – the Bangabandhu Satellite 1.

The initiatives and steps taken are quite remarkable for the country. Still, without having the proper people in place and the absence of local private sector and independent knowledge body partnerships, it makes it challenging to implement such robust programs and initiatives successfully and bring the required results within time.

A key solution would be to stop brain-drain from Bangladesh and bring the Bangladeshi foreign intellectuals back to the country. Countries like South Korea have grown into major technology hubs with government incentives that tackled brain-drain and also brought back their intellectuals from innovation economies like the US – most of whom formed companies in the country or joined universities like KAIST (Korean Advanced Institute of Science and Technology).

The age of Startups in Bangladesh dawned in the early 2010s, and the ecosystem is only beginning to spread its wings. Currently, there are over 100 active startups, with most of them situated in Dhaka, and (a handful in) Chattogram.

High-growth disruptive innovation companies in e-commerce, ride-sharing, and logistics sector have secured successful international investments, for example, Shohoz from Golden Gate Ventures (USD 15 Mn), Pathao from Go-Jek (USD 12 Mn), Chaldal from IFC (USD 5.5 Mn), Shopup from Sequoia and Omidyar Network (USD 3.1 Mn).

Disruptive innovation is a critical strategy that can lead to a country’s dramatic economic development, as proof, let’s take a look at Japan. [7] After World War II, Japanese companies like Nippon Steel, Sony, Toyota, and Canon started producing inferior quality products compared to those of their Western competitors but cheaper, enabling them to capture the low-end segment of the global market.

Soon, as their performance and quality of the products improved, they entered new markets and profitable segments. Ultimately, Japan captured most of the technology segments and pushed their Western competitors either out or to the very top of the market.

An example of a local disruptive innovation would be bKash, the pioneer mobile financial service (fintech), which currently has an active user base of 31 million in its ninth year of operation. With an undisclosed amount of investment from Ant Financial, an affiliate of Alibaba Group, bKash is driving the country towards a cashless economy.

As bKash grows, it empowers the ecosystem around it to grow as well. For instance, mobile financial services complement the rise of e-commerce consumption, which is also propelling the growth of the logistics industry. An increase in service demand helps businesses to cut on unit economics, delivering higher quality at a cheaper cost that drives repeat purchases.

Hence, it is necessary for startups to take bold targets of launching disruptive innovations. The online service marketplace, Edutech, and Agritech have been marked as the next forces to drive emerging innovations.

Decades before Bangladesh saw a glimpse of a startup, a venture capital firm called BD Venture was incorporated back in the early 2000s. Currently, there are 17 firms registered as alternative investments company under B-SEC (3 of whom have received the license to launch funds), asset management firms, multiple foreign investors, angel syndicates like BD Angels, corporate investors across RMG, ICT sector who are showing a growing appetite for equity and quasi-equity based investments.

Despite all efforts, Bangladesh-based startups have only raised USD 27 Mn compared to USD 4.2 Bn in India in 2018. [8] Even considering the difference in economies, the gap of 155X is quite disproportionate.

Though a growing number of international investors are interested in investing in the country, challenges to exit any profit out of the country continue to discourage the wider investor audience who are willing to finance.

As foreign investment starts pouring in, local investment firms are yet to match their risk appetite to fund Series A and above. To further propel innovation, investment is the key. Therefore, it is of utmost importance for the government to improve the investment climate that will not just attract more foreign investment but also more expertise and ideas.

While global spending on innovation is growing, Bangladesh allocated only USD 6 Mn for scientific research in its annual budget 2019-20. From this, the education ministry allocated a mere 4% for public universities for research purposes. It is unclear if the country lacks adequate funding options or a lack of motive to invest in research and innovation.

Adding to that, the lack of proper usage of funds and the shortage of experienced academicians to lead research programs create a shortage of platforms for students to participate and practice. As a result, they fail to deliver in the job sector, creating a massive challenge for the business ecosystem to access quality talent from the local market.

While there are many (53) public, (90) private, and (2) international registered universities in the country, the industry-academia disconnect means there is an absence of guidance for the right kind of innovation and resources for the market.

Moreover, fundamentally, universities in Bangladesh do not yet focus on developing entrepreneurial talent – nor do they have the right sort of incubation programs, access to funding, or R&D labs to facilitate Startup/SME growth.

Industry-academia linkage is imminent to set up the right kind of infrastructure to nurture innovation and talents at the school/university level as well as leverage knowledge remittances from all over the world through incentivized initiatives.

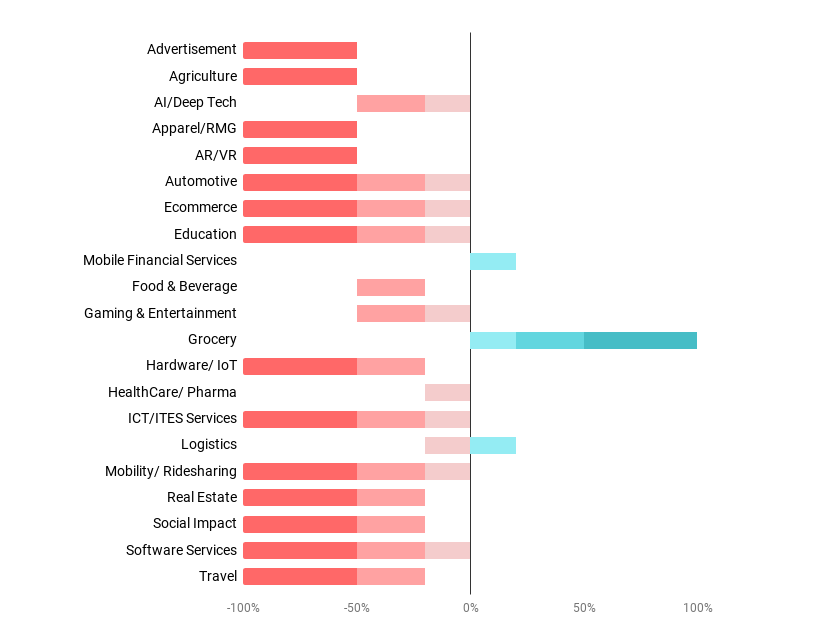

Recently, an internal survey on startups was carried out to realize the impact of COVID-19 on their business and collectively on the sectors wholly. For the complete nationwide lockdown to maintain social distancing – rideshare, e-commerce, and service-based startups are all out of operation.

Few sectors saw growth, like the ones citizens directly need, such as Grocery Delivery, which saw a steep increase in demand of over 200%-300%.

For logistics businesses, while most of their clients were out of business, others were operating and meeting the market demand, collectively showing slight growth. Mobile financial services also saw an increase in the need to transfer money.

As the world progresses and we adapt to newer technologies for innovation, there still remain many areas for improvement. However, with the combined effort of the Government, academia, and public and private sector, Bangladesh can very well be on the path to becoming a country that fosters the ‘culture of innovation’ at its core.

Authors: Mehad ul Haque, Senior Business Consultant, Ishtiak Mourshed, Trainee Consultant, LightCastle Partners

The LightCastle team has been analyzing the macro and industry level picture and possible impacts wrought about by the Covid-19 crisis. Over the following days, we’ll be covering the major sectors shedding light on the possible short and long-term ramifications of the global pandemic. Read all the articles in the series.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights