GET IN TOUCH

- Please wait...

Like elsewhere across the globe, the COVID-19 pandemic has ushered in an economic crisis for Bangladesh. The World Bank has forecasted the country’s GDP growth rate to come down to 2 to 3%. Similarly, the International Monetary Fund (IMF) has projected the growth rate to go down to 2%.[1]

The government has imposed a nationwide public holiday since March 25. The two major sectors of the economy – the cottage, micro, small, and medium enterprise (CMSME) sector, and the Ready Made Garments (RMG) sector have mainly halted operations since then.

On the other hand, the agriculture sector, considered the lifeline of the nation, has seen farmers selling products at below market price.

Thus, the shutdown of economic activities risks creating unemployment and poverty in the future. Therefore, to offset the economic repercussions occurring now and in the future, both the government of Bangladesh and Bangladesh Bank have embarked on a series of economic policies that are timely and much-needed.

The COVID-19 crisis has affected all sectors of the economy. With businesses shut down and individuals having low to zero income, the fiscal and monetary policies taken so far in Bangladesh have been to help businesses and individuals. Since March, the government and Bangladesh Bank have taken the following measures for mitigating impacts of Covid-19:

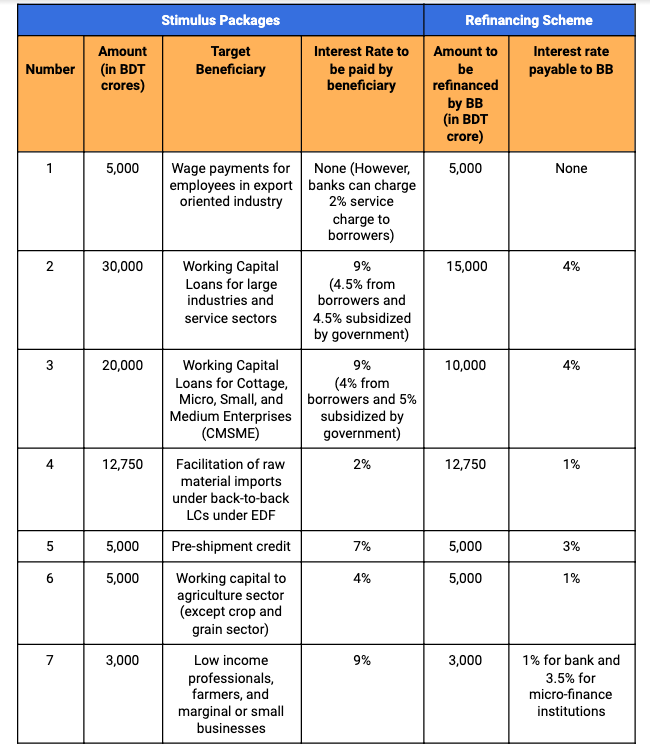

As of the end of April 2020, there have been seven (7) stimulus packages launched by the government to tackle the impacts of COVID-19. The total amount of the stimulus packages amounts to BDT 1 trillion which represents 3.6% of the national GDP.[2]

In addition, the country’s central bank also launched refinance schemes under the seven stimulus packages to ensure bank liquidity.

The BDT 5,000 crore stimulus package for wage payments for employees is applicable for export-oriented industries that export 80% or more of their production, B and C type industries of Export Processing Zone (EPZ), Special Economic Zone (SEZ), and Hi-Tech Park.

Eligible factories will apply for loans to commercial banks who will then disburse the wages of employees. The loans will be used to pay a maximum of three months’ salary and the salaries will be paid using the mobile financial system (MFS).

The working capital for large-scale industries and service sector packages is a BDT 30,000 crore loan/investment for the operation and retention of the workforce. Businesses affected by the pandemic crisis will apply for loans to banks/NBFIs (Non-bank financial institutions).

Both existing and new borrowers can apply for the loan whose benefit will be for a maximum of one year. Default borrowers and borrowers who have been rescheduled more than three times will not be eligible for the loan. The government will not provide a subsidy on the interest that a borrower will fail to pay within the stipulated time.

For the Cottage, Micro, Small, and Medium Enterprises (CMSME) sector, a stimulus package of BDT 20,000 crore as a loan/investment has been formulated. Businesses qualifying under the CMSME sector can apply for loans from banks/NBFIs to meet their working capital requirements.

Bangladesh Bank formulated two refinance schemes to help banks continue to provide credit to the agriculture sector under the stimulus packages. One of them is for providing working capital loans for farmers and traders working in the horticulture, fisheries, poultry, dairy, and livestock sectors (except the crops and grain sectors). The other package is aimed at beneficiaries that include low-income farmers.

Besides, according to a Bangladesh Bank policy, banks have allocated a BDT 14,500 crore loan target for the crop and grain sector.[3] Furthermore, Bangladesh Bank has also cut interest rates for agriculture loans to the crop and grain sector to 4% from 9% effective from April 1, 2020, till June 30, 2021. The central bank will subsidize the rest 5%.[4]

The last announced stimulus package of BDT 3,000 crore is aimed at supporting low-income professionals, low-income generating individuals or enterprises, farmers, ultra-small businesses, and people from deprived communities.

The fund for this stimulus package will be generated by Bangladesh Bank. Bangladesh Bank will then distribute the funds to commercial banks who will then distribute them to micro-finance institutions (MFI). Eligible borrowers will then borrow funds from MFIs.

The BDT 5,000 crore pre-shipment credit stimulus package is to facilitate exports of locally manufactured goods to foreign countries during the COVID-19 crisis.

On the other hand, the stimulus package under the Export Development Fund (EDF) is to facilitate raw material imports under back-to-back LCs (letter-of-credit). The size of the fund has been increased to USD 5 billion to facilitate such imports.[5]

Besides facilitating imports and exports under the above-mentioned stimulus packages, Bangladesh Bank has also loosened restrictions on certain trade rules and regulations including:

The responsibility for distributing loans under the stimulus packages lies mainly with commercial banks. They have suffered last year due to their liquidity shortage caused by the rise of non-performing loans (NPL). There is a concern for the rise of NPL again due to default by borrowers who will take loans under the stimulus packages.

Therefore, Bangladesh Bank has taken steps besides the refinance scheme to ensure bank liquidity:

To allow individuals to have sufficient money and credit during the crisis, Bangladesh Bank took the following responses:

The policies taken by both the government and Bangladesh Bank for mitigating impacts of Covid-19 are worthwhile to save the economy.

However, the initiatives being carried out can spell problems for the banking sector and the upcoming national budget. Fortunately, it will be the policies and actions taken by the two policymakers that can assuage the two problems.

The implementation of the stimulus packages has been mainly shouldered to the banking sector. To avoid experiencing a new liquidity crisis problem, Bangladesh Bank initiated the right moves.

However, the guidelines for the stimulus packages mandate that the entire risk for distributing loans will lie on commercial banks. Moreover, the refinance scheme guidelines separate the banks’ payment under the refinance schemes to the central bank from the borrowers’ payment of loans and interests to the banks.

In addition, Bangladesh Bank has allowed borrowers who fail to secure a minimum rating to still be eligible for loans under the stimulus package for large industries and service sectors and the CMSME sector.[15] Such measures will increase banks’ risks, who might then be forced to increase their interest rates once the pandemic is over.

The government’s stimulus package will undoubtedly create pressure on the upcoming fiscal year 2020-21 annual budget. It is expected that with the announcement of the stimulus packages, the budget deficit will rise due to increased government expenditures.

The World Bank predicts the budget deficit to rise to almost 7.7%.[16]

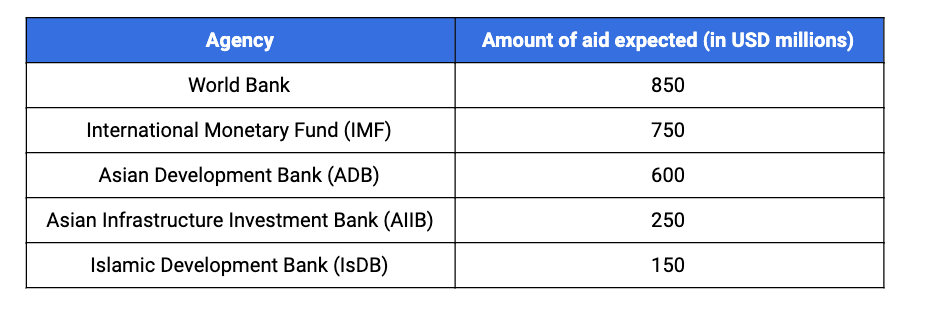

Fortunately, the government has taken the right steps by requesting funds from various international development partners for financing the deficits.

To date, it has got a USD 100 million loan from the World Bank (WB), and a USD 600 million loan from Asian Development Bank (ADB).[21][22] In total, the government expects USD 2.6 billion in funds from various international development organizations.[23]

The policies taken so far may not be the last for both the government and the central bank. Uncertainty lurks for the times ahead as there is no sign for the pandemic to end soon.

Even if the situation improves, there is still uncertainty as to whether economic activities will recover or not. As a result, the government of Bangladesh and the central bank need to design policies that will address a wide variety of possible outcomes.

Moreover, the International Monetary Fund (IMF) predicts the world will head into a long recession worse than the 2008-09 recession due to the pandemic.[24]

The government of Bangladesh and Bangladesh Bank will, therefore, need to anticipate such a prolonged recession and use all its powers to mitigate the effects of such an outcome.

Farhan Uddin, Content Writer at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected].

The LightCastle team has been analyzing the macro and industry level picture and possible impacts wrought about by the Covid-19 crisis. Over the following days, we’ll be covering the major sectors shedding light on the possible short and long term ramifications of the global pandemic. Read all the articles in the series.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights