GET IN TOUCH

- Please wait...

LightCastle Partners collaborated with Auto Rebellion to conduct a study on the automotive industry of Bangladesh, with a particular focus on the passenger vehicle segment, which encompasses sedans or private cars, sports utility vehicles (SUVs), and microbuses or multi-purpose Vehicles (MPVs). LightCastle conducted a number of interviews with exclusive automobile importer-dealers which covered brands that captured more than 70% of the market share for new passenger vehicles, as well as a number of reconditioned car sellers. LightCastle also conducted a rapid online survey of prospective customers who intended to purchase a passenger vehicle.

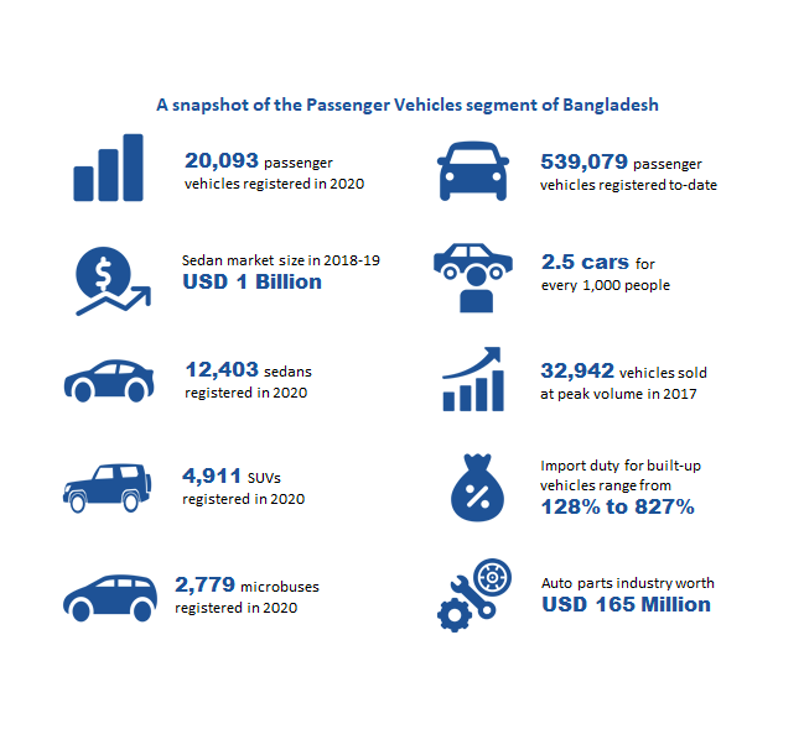

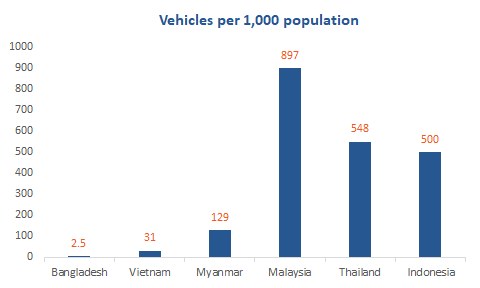

Despite its growing affluent middle-class population and increasing purchasing power of the general mass, Bangladesh’s automobile industry has remained somewhat of an anomaly. The size of the country’s automobile industry, in particular the passenger vehicle segment, remains modest compared to other Asian peers, with only 2.5 cars per 1,000 population. The market has grown multifold over the years and has become an industry worth USD 1 billion (BDT 84,969 million) [1]. Passenger vehicle sales are dominated by the sales of imported reconditioned cars, which contribute a significant percentage of import duties for the Bangladeshi government.

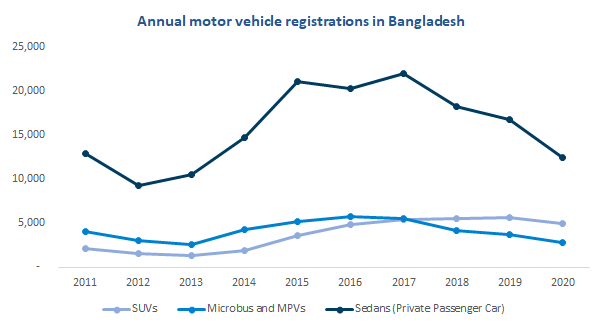

According to Bangladesh Road Transport Authority (BRTA), 377,660 vehicles were registered in Bangladesh in 2020 and only 20,093 of them belonged to the passenger vehicle segment, covering merely 5.3% of the automobile industry volume, while 82% of the automobile industry volume was dominated by motorcycles. Passenger vehicles include sedans or private cars, sport utility vehicles (SUV) or jeep, and microbus or multi-purpose vehicles (MPV). Within the passenger vehicle segment, sedans (also referred to as private cars) accounted for almost 55% with 12,403 units registered in 2020. The remainder of the passenger vehicles segment was captured by SUVs and microbuses with 4,911 units and 2,779 units respectively[2]. These numbers have also changed over the last few years, where SUVs and MPVs have mostly recorded a gradual increase in demand, while the registration of sedans has at times been stagnant or even decreased.

The automobile market in Bangladesh has seen significant growth in the last decade, especially between 2015 and 2017. At the peak of its trajectory, BRTA had reported 32,942 registered passenger vehicles in 2017 has since been on the decline. Between 2018 and 2020, the number of registered passenger vehicles has declined by almost 39% [2].

2020 marked the advent of the Covid-19 pandemic and the ensuing spells of country-wide lockdown have adversely affected the sector at a precarious time. BRTA has reported a 21% fall in the number of registered passenger vehicles in 2020. In fact, 2020 marked the lowest number of annual vehicle registration since 2013[2]. It is expected that the decline will be prolonged until at least 2021, as the effect of the government moratorium on vehicle purchases announced in July 2020 takes hold. The fulfillment cycle for government vehicle orders can be as long as 1 year and although there had not been a major dip in government procurement in 2020 as companies fulfilled orders from 2019, the full effect of the 2020 moratorium will be truly felt in 2021. Many dealers and brands make a substantial share of their annual sales from government purchases for large-scale projects or courtesy of various special loan facilities extended by the government to high-level government officials and defense personnel. In light of the second wave of Covid-19 in the second quarter of 2021, assemblers and importers remain wary of a glut in the market until the effects of Covid-19 fully dissipate.

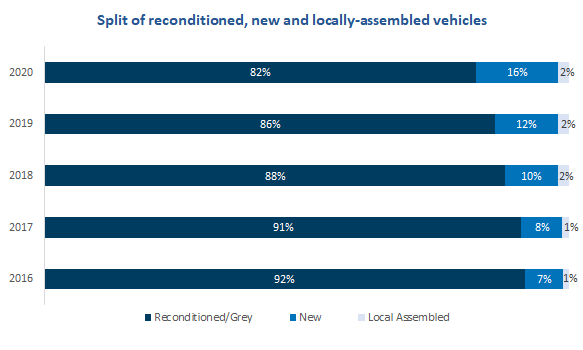

Historically, the Bangladeshi car industry has been heavily dependent on reconditioned cars. In 2020, imported reconditioned cars accounted for 82% of all passenger vehicle sales[4]. Japanese imports, in particular, are highly valued by customers over any other cars. Even though there are options from China, Germany, India, Malaysia, South Korea, Thailand, the UK, and the USA, the brand reputation and recognition of Japanese cars make them the most desired in the reconditioned market. However, industry insiders have noticed a perceptible shift in customer mindset. Interest in brand new cars has risen exponentially in recent years driven by young purchasers and purchase influencers. Although imported brand new cars accounted for only 10% of volume in 2018 and contributed 27% to the total import value of all passenger vehicles (including reconditioned imports of sedans and microbuses) in FY 2018-19[1], by 2020 their market share by volume had risen to 16%[2]. LightCastle interviews also confirm this trend, with interview data showing 78% of brand new car dealers recorded higher sales in 2020 than the year before. This suggests that reconditioned sellers have borne the brunt of the decline in sales from Covid-19. The share of locally assembled vehicles had somewhat at around the 2% mark between 2018 and 2020.

The reduced price difference between brand new and reconditioned cars due to the differential import duty structure is one of the prominent reasons for this shift in preference towards brand new cars. Reconditioned car prices imported from Japan are calculated based on their Yellow Book price set by Japan Auto Appraisal Authority. But the National Board of Revenue (NBR) imposes a tax on the base value instead of the depreciated value, which values the car at substantially more than it is worth. In contrast, brand new cars are taxed based on their importer-declared value.

However, the popularity of reconditioned cars remains strong, and entrenched players believe the reconditioned segment to remain competitive and relevant as long as they can offer a varied range of options to the customers and the duty percentage does not increase further.

SUVs have always been available in the Bangladeshi market, but their sales have been heavily overshadowed by sedans. But most brands are now bringing in more of their SUV models into the Bangladeshi market as demand continues to rise in line with a globally-evident trend. Interviewees point out the desire for a sporty look by the younger generation of customers, the higher ground clearance and ease of driving in Bangladeshi road conditions, and increased availability of affordable options as some of the rationales driving this shift in customer preference. SUVs in 2020 held 24% of the market share among all passenger vehicles, growing from 16% just three years ago in 2017 [2].

Along with SUVs, roads in Bangladesh are now seeing a growing number of hybrid cars and importer-dealers believe that their continued growth in the next five to ten years may replace much of the fossil fuel vehicles. Fear of technical difficulties, perceived challenges in maintenance, scarce after-sales service, and the lack of trained technicians in regular service stations contributed to customer hesitation in adopting hybrid cars in Bangladesh. But with time, acceptance has increased due to a lower tax rate making it a much more affordable option for the customers compared to fossil fuel vehicles. Consumers are beginning to understand that hybrid vehicles can offer them the best of both electric power and fossil fuel worlds. Industry professionals note that most importers are now bringing in hybrid models, both in reconditioned and brand-new markets, while both individuals and companies are leaning more towards hybrid cars for cost savings and ease of maintenance.

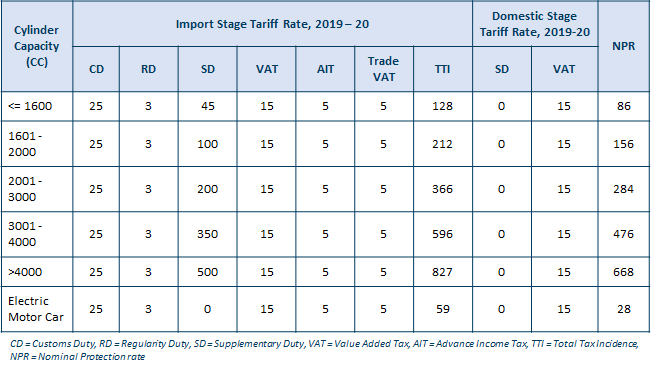

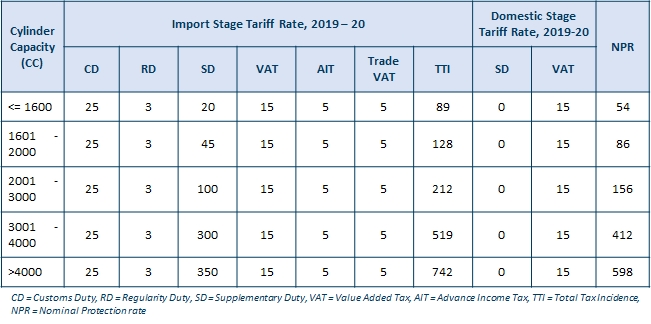

Following the lead of hybrid cars, electric vehicles (EVs) are also entering the Bangladeshi market. Electric motor cars already have the lowest TTI among all imported vehicle categories at 59%, which is less than half that of the lowest TTI for imported CBU fossil fuel cars[1]. Although EVs are yet to reach the early adoption phase, professionals see potential for massive growth in five to ten years’ time. However, the majority of respondents expressed concern about whether Bangladesh is ready to embrace EV technology yet. Unavailability of charging facilities on roads, inadequate power supply, unavailability of spare parts, lack of technicians to match the sophistication of the technology, and poor quality of roads are some of the road bumps ahead in the adoption of EVs.

These demand-side trends are expected to shape the future of the automobile industry going forward. However, even larger tectonic shifts are expected from the supply-side as well, since the government has signaled its ambitions through the drafting of the Automobile Industry Development Policy, which aims to turn the country into an automobile production hub, and eventually an export powerhouse. The next article in this series will discuss the essence of the automobile policy while emphasizing the strengths, critiques, and recommendations for improvement of the policy.

This article was authored by Saif Nazrul, Senior Business Consultant at LightCastle Partners, Asif Hossain, Founder of Auto Rebellion, and Samira Rasul, Trainee Consultant at LightCastle Partners. Advisory and editorial support was provided by Zahedul Amin, Director at LightCastle Partners. For further clarifications, contact here: [email protected]

1. Automobile sector development in Bangladesh: Challenges and Prospects – Policy Research Institute (PRI), Bangladesh

2. Number of Registered Vehicle in Bangladesh – Bangladesh Road Transport Authority

3. Sun rising for Bangladesh Automotive Industry – The Business Standard

4. Customs Data – National Board of Revenue

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights