GET IN TOUCH

- Please wait...

Bangladesh is home to a population of over 163 million (2019) people [1] and in addition, over 33% of the country’s total population represented youth, aged between 18-35 years, in 2017. [3] According to the Labor Force Survey (LFS) 2017, this age group has an average monthly income in the range of BDT 10,831 and BDT 15,446.[2] In addition, the demographic dividend is increasing in Bangladesh with a subsequent reduction in the dependency ratio. Demographic dividend is defined as the economic growth potential that arises from a change in the population’s age constitution, especially when the allotment of the working-age population is larger than the non-working-age of the population. On the other hand, dependency ratio measures the pressure asserted on the productive population. As demographic dividend is increasing, the dependency ratio is falling and according to World Bank data, from 1977 to 2018, this ratio has halved for Bangladesh. These two factors grouped together creates an advantageous consumer market, especially for products such as skincare, personal care items, etc. The market potential is further fueled by the rising middle-income class in Bangladesh, as it is expected that this category will grow by a CAGR of 10% from 2015-20. [4] Skincare industry, as a booming sector in Bangladesh, is highlighted, in this article.

Therefore, the market for consumer products, such as skincare and personal care items is growing, driven by socio-economic advantageous factors, and is also catering to the customized needs of clients. As a result, niche markets within the skincare industry have developed, and the market for natural skincare is one such example. As with many niche markets within the skincare industry, the market for natural and organic skincare relies on many several Cottage, Small and Medium Sized Enterprises (CSMEs) to cater to evolving consumer needs.

The local skincare industry is significantly import-oriented. Over 90% of the raw materials are imported from different countries including India, Singapore, Uganda, Thailand and China. Some of the renowned brands also import chemicals from countries like Germany, France, Malaysia, Indonesia, Italy, UK, and USA, which are used widely in skincare production. These imported raw material are used widely among the 7 firms who hold over 95% of the total cosmetics and chemical skincare market. It includes firms such as Unilever, Keya Cosmetics, Lily Cosmetics, Aromatic Cosmetics, Square Toiletries and Kohinoor Chemical Company [5].

In addition, Bangladesh also imports skincare items from India, Korea, China, USA, Singapore – to name a few countries. These imported skincare products are widely used and are available in different e-commerce sites. Despite the prevalent dependency on imported cosmetics, there is a paradigm shift to local organic skincare, hair care, and personal care brands. This emerging market mostly focuses on organic skincare and use of remedies that are labelled as clean or green.[14] For example, Ribana, a leading soap brand, makes organic goat milk soap with raw goat milk enriched with alpha-hydroxy acids (AHAs), thus reducing the use of harmful chemicals found otherwise.

Another contributing factor of the emerging skincare industry is the soaring active male customer base. E-commerce such as Daraz, BanglaShoppers, Shajgoj, Othoba.com, EnvieBD have dedicated sections for Men’s skincare and grooming options. But even though the number of male consumers is increasing, this market is highly dominated by females. Additional factors such as societal and behavioral changes, increase in female labor force participation and empowerment are leading the revolution in consumer change behavior in the skincare industry.

As more women in Bangladesh, both in rural and urban areas, join the labor force or attain higher levels of education to become economically and socially empowered, they start to challenge the traditional notions of attractiveness. The change in consumer perception of personal care and attractiveness, consequently, has and continues to revolutionize the demand for consumer products, such as skincare and cosmetics items.

For example, for decades, colorism has been a widely prevalent social phenomenon that women have to constantly struggle against in the country. Previously, many female consumers used resort to harmful fairness creams and treatments. Some of these renowned products have been tested clinically in 2020, by the Bangladesh Standards and Testing Institution (BSTI), which revealed excessive use of harmful chemicals. The BSTI collected product samples of 13 skincare brands and over 8 of the brands were found to use mercury and hydroquinone at least 200 times higher than the permissible level in their products. These brands include Goree, Chandni, New Face, Due, Golden Pearl, Faiza, Noor, and White Pearl Plus.[6]

However, beauty conceptions have been evolving over the past few years and there is an increasing debate among the youth of the nation regarding the ever-reigning colonial beauty standards. More and more people are questioning the validity of being fair means beautiful. Globally, the widely praised 2005 Dove Real Beauty campaign challenged socially set beauty standards in order to be relatable to a younger group of audience.

Rising internet penetration and usage of social media means more and more consumers are being aware of the side effects of using chemical-intensive products. Besides, improved access to reviews by beauty bloggers or peers in community groups encouraged more and more people to switch to natural skincare. Hence, there is an increasing demand for organic, herbal beauty, or clean-label beauty products among the urban consumers, especially the youth of the region [13].

The practice of using natural ingredients, such as medicinal and aromatic plants, in skin and hair care can be dated back to the ancient times in South Asia and interestingly, contemporary trends have been meaning to shift back to the practice of the old. Hence, many businesses in the local market are following through these trends.

Most of the natural skincare brands promote specialized benefits of each of the products. Commonly, their product lines include soap, hair mask, face mask, hair oil, serum and so on. Besides, some of the key ingredients include use of neem, turmeric, aloe vera, sandalwood, fuller’s earth clay and so on. The firms usually choose to target specialized benefits of the products ranging from prevention of hair loss to removal of pigmentation. Given the growth in demand for natural and organic skincare, both large market players and CMSMEs are entering the market and expanding product portfolio to cater to client needs.

Large Market Players: Prominent natural skincare brand Meena Herbal by Bengal Herbal Garden Limited of Gemcon Group has been in the market since 2007. Moreover, large local companies like ACI also acquired Neem Laboratories (Pvt.) Limited in 2013 and launched Neem Original, a natural skin care product line in 2016.[8] Even Unilever Bangladesh realizing the potential of natural products launched Lever Ayush in Bangladesh in late 2018. [9]

Furthermore, British natural cosmetics brand Body Shop partnered with Bangladeshi conglomerate Quest Holdings Bangladesh to open its first-ever flagship outlet in 2020 [10]. Adding to that, the recent launch of Aarong Earth, under the tagline “Come Back to Nature,” by Aarong (a brand of BRAC Bangladesh), confirms the immense potential of this sector [11].

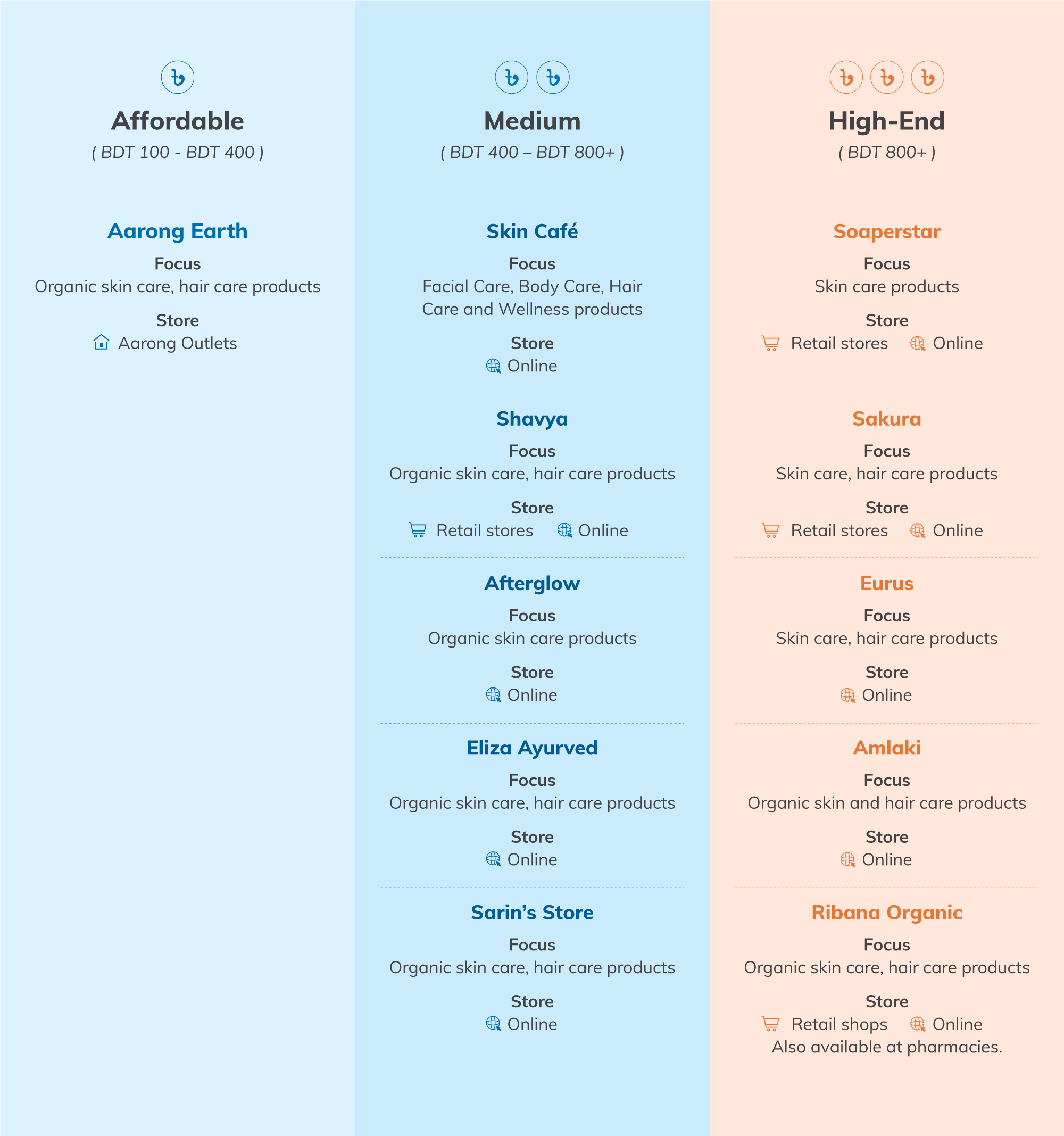

Small Market Players: Many Cottage, Small and Medium sized enterprises (CSMEs) are also emerging to serve the niche. Traditionally unlabeled herbal and natural personal care products are now being labelled and packaged under brand names. Some of the popular brands include Skin Cafe, Ribana, Amlaki, Afterglow, Sarin’s Store-Embrace Nature and so on.

The pricing strategies vary from premium to competitive pricing. While majority of the brands like Meena Herbal, Neem Original, Lever Ayush, Aarong Earth, Sarin’s Store and, Afterglow have a price range starting BDT 200 to BDT 600, brands with more premium positioning like Ribana, Eurus, SAKURA and so on offer products with prices usually starting from BDT 800+.

As per Persistence Market Research, the global natural and organic skincare market is expected to grow at 8-10% over the next five years [12]. Globally, established companies like Unilever, Colgate-Palmolive Co., and Proctor & Gamble Co., have taken over multiple small businesses to establish their own natural skincare wings. A 2019 report by Grand View Research, projects that the natural and organic personal care industry will be worth as much as USD 25.1 million in 2025 [15]. Over the past decade, companies like L’Oréal, The Body Shop, and Estée Lauder have continued to launch new lines of organic products in order to stay relevant to emerging consumer needs.

Moreover, neighboring countries like India have also shown shifting consumer preferences to natural skincare leading many brands to flourish in the industry, both locally and globally. Biotique India by, Bio Veda Action Research, India Biotique has been growing at a rate of 30-35% annually over the past few years with its ‘affordable premium’ positioning.[13] Interestingly, it has never advertised its products on TV and its key promotional activity includes providing consultancies on beauty and skin, both online and offline. Within around 25 years, today Biotique India has 15,000 points of sale and 4,000 multi-brand outlets.

Researchers found that factors like country of origin, consumer values, distribution channel, and pricing significantly affect the choice of cosmetics in Bangladesh. [18] Another study [7] in Dhaka suggests that the primary factors affecting choice of personal care products include price, quality, and quantity, the secondary factors constitute ingredients, specialty, innovation, and manufacturer’s reputation. Many consumers have cited advertisement and word of mouth communication as the leading sources of their knowledge when choosing organic products [19]. Subsequently, there are recurring themes of consumers considering product origin, specialized benefit, price, accessibility and perceived quality (based on firsthand experience, word-of-mouth and advertising) as the factors primary to their choice of personal care cosmetics.

As awareness of skin care and beauty standards are changing perceptions, along with the propelling growth of the organic skincare industry, Bangladesh needs to ascertain a few policies, if it wants this industry to thrive.

Organic and Natural skincare items can be used to diversify Bangladesh’s export basket and boost earnings, while generating employment. According to an interview with UNDP Bangladesh, the CEO of Ribana, Mohammad Wahiduzzaman Sadi, believes that Bangladesh would also be a crucial contributor to the international organic skincare market. He believes that the current valuation of the Bangladeshi market is at BDT 2 billion, but this can improve and compete with hefty markets such as India.[16] Assistance to companies like Ribana, can be provided by reducing red tape towards attaining standardization certificates that can help these companies enter the international market.

Another arena with significant room for improvement is the branding, marketing, and packaging of natural skincare products. Exclusive packaging grouped with proper branding [15] will allow this this market to add significant value, especially if they want to compete with countries, such as India and South Korea. Marketing through social media such as Facebook, Instagram allows a greater reach among the demographic dividend – primarily millennials and gen z. Besides, local brands can use the potential of the rising popularity of Instagram influencers and vloggers in Bangladesh, who have a high reach distinctly towards the youth. However, companies also need to bear in mind that in order to achieve the comparative advantage, both domestically and internationally, these items need to be priced fairly and ensure quality and sustainability to meet consumer requirements.

The skincare industry has always been, and continues to be, in a flux, and it constantly needs to evolve to cater to constantly evolving consumer trends. It is therefore crucial for businesses in the industry to constantly be on the lookout for changes. Given Bangladesh’s advantageous demographic dividend, rising income and internet penetration, the skincare industry, and niche markets within the industry, e.g., market for organic skincare, are clearly on an upward trajectory to growth. Therefore, implementation of export and standardization support policies, will facilitate domestic and international growth of the natural skincare industry in Bangladesh.

Justita Musrat, Content Writer, Radya Yousuf Khan, Business Analyst, and Farah H Khan, Senior Business Consultant, at LightCastle Partners, have prepared the write-up. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights