GET IN TOUCH

- Please wait...

With the objective of welcoming stakeholder feedback, the Ministry of Industries published the Draft Automobile Industry Development Policy in March 2020. The policy signals Bangladesh’s ambitions to become an automobile production hub, and eventually an export powerhouse. With the eventual enactment of this policy, the government also seeks to emulate the growth and success of the local motorcycle assembling and production industry. The publication of the Motorcycle Industry Development Policy in 2018 with a similar focus on progressive manufacturing had led to a remarkable growth in foreign investment into local production. The annual volume of motorcycle sales, as a direct result of the 2018 policy, increased by more than 340% from 90,401 units in 2014 to 401,452 units in 2019[1].

In comparison to other Asian peers, Bangladesh has always had a disproportionately small car industry, and one that has relied on reconditioned cars. However, the Draft Automobile Industry Development Policy, published last year, essentially aims to phase out the reconditioned cars from the market in the next five years to promote locally assembled cars, establish backward linkage and build a local components industry, and eventually progress to full-fledged vehicle manufacturing.

This ambitious draft policy contains nine broad categories of strategies with multiple provisions in each category[2]. Some of the key provisions and focus points of the policy draft are listed below:

The vision behind the Draft Automobile Development Policy is to encourage the setting up of local assembling plants for SKD and CKD imports paving the way for locally manufactured cars. The government’s fiscal incentives and tax rebates can encourage global brands to invest in the Bangladeshi market, creating a boom in the domestic industry and eventually having the scope to export into the global market.

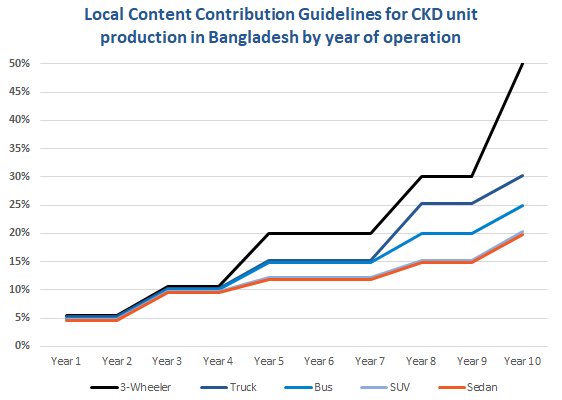

In order to benefit from the tax incentives, manufacturers and assemblers will have to have to utilize a certain proportion of local content in the manufacturing and assembling processes, and this local content contribution will increase over time to drive progressive manufacturing of automobiles. Figure 1 summarizes the local content contribution guidelines for CKD production as per the Draft Automobile Industry Development Policy 2020.

A local manufacturing industry will add value to the economy by bringing in foreign investments and creating jobs. Backward linkage industries, like parts and components production, the paint industry, and the leather industry will, in turn, see a rise in local demand. The policy will also incentivize investment in R&D and human resource development by establishing training facilities, and facilitating skills transfer from expatriates for development of local talent and technologies. However, despite the many commendable initiatives propagated by the draft policy, there remain several areas for improvement.

A policy serves as more than a formal instruction to the public sector. It signals the future direction of an industry and is absolutely essential in shaping the decision of foreign and local actors on whether or not to invest in a particular industry and the exact nature of that investment. Investors take a long-term view of an industry and hence it is important for any government policy to have foresight. A lack of foresight can inadvertently stunt the growth of an industry.

A case in point is the Motorcycle Industry Development Policy of 2018. Bangladeshi laws prohibit the sales of motorcycles over 165 cc in the domestic market, a restriction deemed to be arbitrary, illogical and contrary to the national regulations in most countries[3]. The Motorcycle Industry Development Policy did not seek to remove this restriction and it was only in 2021, that the government seriously contemplated removing the limitation and increasing the upper limit to 350cc, upon demand from lobby groups. However, although removing the 165 cc restriction could have opened up the avenue for increased foreign direct investment (FDI) to Bangladesh and exports of higher-cc motorcycles (higher-cc motorcycles are highly popular in the international market), the government was beholden to entrenched players who had invested heavily in low-cc motorcycle production in light of the long horizon of the 2018 policy, and the government recently decided to postpone lifting of the restriction until 2024. So, an oversight in the 2018 policy has effectively stunted the growth of the motorcycle industry and delayed investments into higher-cc motorcycle production by at least 3 years[4]. With better foresight and the engagement of industry experts and visionaries, experienced expatriates and potential investors in the motorcycle policy formulation process, perhaps this could have been avoided and serves as a lesson in the drafting of the automobile policy.

Large tax differentials and fiscal incentives offered for a minimal level of assembling in Bangladesh, in combination of mandating public sector to procure locally assembled vehicles presents the risk of patronizing certain vendors and creating a protectionist bubble that may not benefit the industry in a meaningful way. From interviews, it was learnt that with the enactment of the automobile policy imminent, many brands and importers are eager to set up SKD assembling plants in Bangladesh. Some of these importers will purposely disassemble CBUs from their country of origin and export the SKD products to Bangladesh, where their modest operations will carry out a very minimal level of value addition such as assembling the doors and tires in order to take advantage of tax benefits. Such operations are not likely to lead to the development of local component businesses that add any significant value to the local industry. The simple assembling processes can be performed by existing technicians with little training and will not create enough jobs for local talent and engineers or much scope for backward linkage, say industry experts.

Instead, the policy should seek to engage foreign brands and joint ventures on playing to the strength of Bangladeshi economy by involving low-cost labor, utilize the skill training facilities offered by the policy to produce cars that match the global standards and offer competitive price range. Supporting local small businesses to develop the parts and components where Bangladesh has competitive advantage like paint, tires, chassis, leather seat coverings etc. can make a meaningful contribution to the economy. To avoid over-exploitation of the government fiscal incentives using minimal assembling, the government should keep tightening the local value addition requirements in a progressive manner requiring consistent investments into automobile plants until full manufacturing is achieved. The government should also reward those investors who opt for the very highest level of local value addition from the very beginning with significantly higher tax incentives.

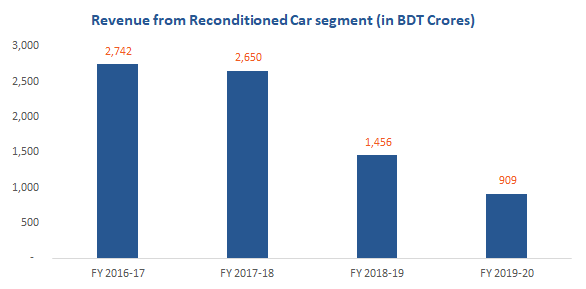

Aside from not leading to a long-term development of the sector, an industry dependent on minimal local assembly can also lead to a massive dent in the National Board of Revenue’s (NBR) tax receipts. The reconditioned car market contributed USD 17.13 million (BDT 1456.11 crore) in revenue for FY 2018-19 and banning the whole segment would mean a revenue loss in the thousands of crores of BDT for the government[5]. This could also put a strain on the trade relationship between Bangladesh and Japan as Bangladesh is one of the top buyers of used cars from them, fears one of the interviewees. Investments into local automobile manufacturing by Japanese investors can, however, help balance out this inconvenience.

Respondents are also rightfully concerned that the NBR, who are a key stakeholder to the automobile policy, have not been consulted during policy formulation, raising the specter of opposition from the NBR which could delay the finalization of the policy. The delay in finalization and enactment is creating policy uncertainty and is likely to stall the pace of investment into local assembling and manufacturing plants.

A premature phase-out of reconditioned vehicles can also dangerously shift the power dynamic to the assemblers and raise the possibility of oligopolistic exploitation of the market by setting unreasonably high price tags without failing to deliver any improvements in quality for customers. Bangladesh’s existing components industry does not have the capacity to supply international standard parts to the assembly plants and will need to gradually develop its technological sophistication. However, Bangladesh still has a long way to reach that goal and without specific measures and strict quality control initiatives, this can flood the market with low quality cars that will not be able to meet the global standards for export.

Although the policy outlines a plan to set proficiency tests and encourage R&D investments, it is vague about the standards and specifications it will advocate for. If emissions and safety standards, for example, are relaxed in the case of locally-produced vehicles, it will be local consumers who suffer from sub-par products. Therefore, the policy should specify a clear roadmap in terms of the product specifications and quality standards to be met by locally produced vehicles, borrowing from international standards and best practices.

The policy should also be precise in identifying a set of essential backward linkage and component industries to be prioritized and have in place measures to enhance the readiness of component manufacturers in these industries to meet international product standards in partnership with vehicle manufacturers. While the policy envisions setting up of the Bangladesh Automotive Institute (BAI) for mostly planning and research purposes, the institute should also emphasize heavily on specialized education and training for developing competent automobile industry technicians and professionals, thereby reducing the need for expensive expatriate hires as seen in several other manufacturing sectors of Bangladesh.

Finally, the draft policy also does not specify the amount of tax rebate and incentives for manufacturers and component importers. The absence of a clear tax and benefit structure, and specifications for components, emissions and safety standards, among others, creates policy uncertainty that is not conducive for investment. Interviews with assemblers also reveal that financial sector stability and consistent monetary policy is essential for giving confidence to investors. All of these outstanding issues make it unclear when the policy will be finalized and enacted. While the consensus is that the policy will be finalized and approved by 2022, one of the interview respondents feared that the policy will not become a reality for another two to three years.

In conclusion, the automobile policy is very much a step in the right direction and, if done holistically, has the potential to elevate four-wheelers as the next big manufacturing industry of Bangladesh. However, there remain several outstanding issues that need to be addressed before the policy is enacted to ensure that the automobile industry progressively leverages Bangladesh’s manufacturing prowess, while delivering high-quality international standard products to consumers at competitive prices, but at the same time not jeopardizing a major source of tax revenue for the government. Thus, the government should walk a tightrope in balancing the interests of multiple stakeholder groups as it finalizes this much-anticipated policy.

The next and final article in this series will present a picture – based on the opinions of industry experts and prospective buyers – of how the future of the passenger vehicle segment of Bangladesh may look like in the next five years.

This article was authored by Zahedul Amin, Director at LightCastle Partners. For further clarifications, contact here: [email protected]

1. Number of Registered Vehicle in Bangladesh – Bangladesh Road Transport Authority

2. Draft Automobile Industry Development Policy 2020

3. Motorcycle Industry Development Policy 2018 – Ministry of Industries

4. Wait until 2024 for high engine capacity bikes – The Business Standard

5. Automobile sector development in Bangladesh: Challenges and Prospects – Policy Research Institute (PRI), Bangladesh

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights