GET IN TOUCH

- Please wait...

The pharmaceutical industry, one of the few knowledge-based and technology-intensive sectors in Bangladesh is projected to have a compounded annual growth rate greater than 12% and surpass USD 6 billion during the 2019-2025 period. [1] Even during the pandemic in FY 2020, when all major sectors experienced a downward trend in production, the pharmaceuticals and medicinal chemicals industry had an accelerating growth rate. [2] With the upcoming LDC graduation of Bangladesh, coupled with supply chain disruptions amidst the pandemic, is the pharmaceutical sector in need to reorganize its production assets for achieving resilience?

Pharmaceutical manufacturing comes in two stages as outlined above. Here, the Active-Pharmaceutical-Ingredient, commonly referred to as API, is the core ingredient of every finished drug product. The APIs account for 30% of total drug costs in case of small molecules and can go up to 55% for generic products. [19] Currently, Bangladesh meets 98% of the demand for finished-form pharmaceutical products locally. Though nearly self-sufficient in the area of finished drugs, more than 90% of the API and raw materials have to be imported. Heavy reliance on import of raw materials makes the pharmaceutical industry vulnerable to supply chain disruptions and price volatility. Thus, the backward linkage has become a pain point for our promising pharmaceutical sector. [3]

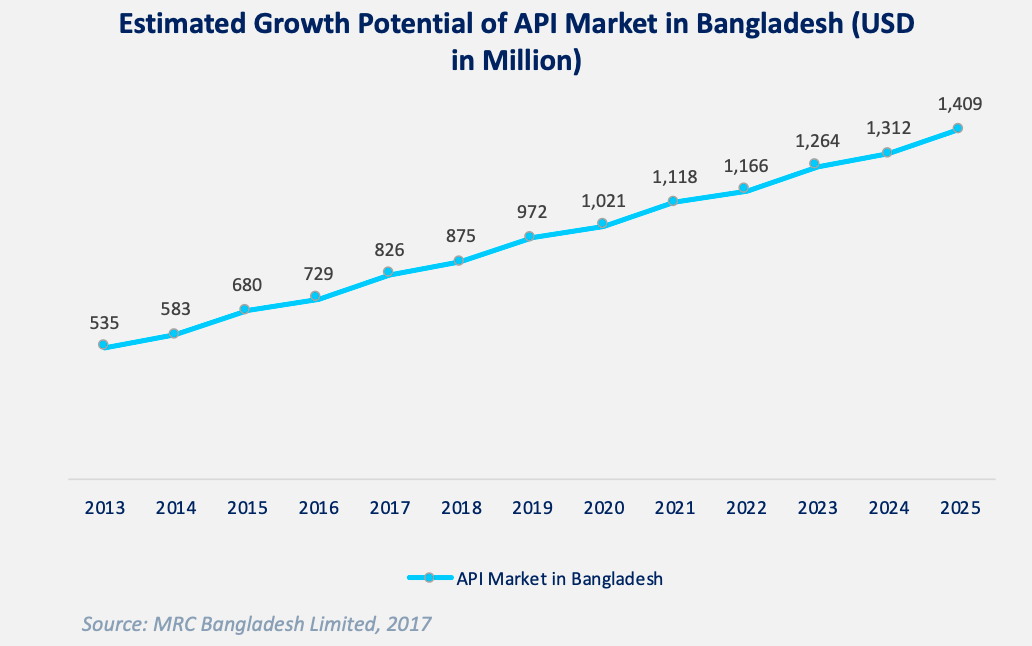

The global API market size in 2020 was USD 187.3 billion and is projected to reach USD 248.3 billion by 2025 at a CAGR of 5.8%. [4] In Bangladesh, the estimated market size of APIs in 2017 was around 730 million USD and it is expected to reach around 1,409 million (1.4 billion) USD by 2025. [5]

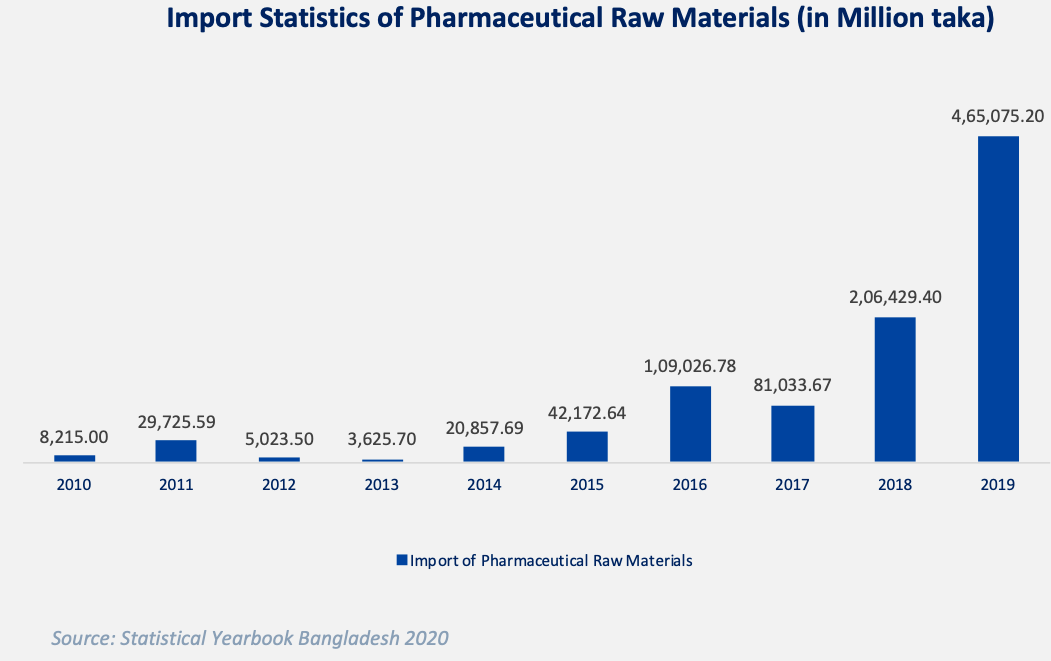

But the current API production is minuscule as Bangladesh had to import 46.5 billion worth of raw materials in 2019 as shown in the graph below. [6]

Although there are 2,804 valid sources for procuring pharmaceutical raw materials [7], most of the APIs are sourced from India, China, Italy, and Germany. Of them, approximately 40% of the raw materials come from China and 30% from India. [5]

15 local companies of Bangladesh including Square Pharma, Beximco Pharma, Active Fine, ACI Limited, Globe Pharma, Gonoshasthaya Pharma, Opsonin Pharma, Drug International and Eskayef produce around 40 APIs. Among them, only Active Fine specializes in APIs manufacturing, and does not produce any finished medicine. Gonoshasthaya Pharmaceuticals Limited (GPL) alone accounts for about 60% of APIs manufactured locally. [8]

The Government of Bangladesh is offering a host of incentives to encourage local manufacturing of raw materials for the pharmaceutical sector. Major drivers to incentivize local API production are the API policy, and the construction of API parks.

In 2018, the Ministry of Commerce formulated the National Active Pharmaceutical Ingredients (API) and Laboratory Reagents Production and Export Policy to incentivize API production. The API policy aims to produce 370 key API molecules for exports (41 locally produced API molecules in 2017) and cut raw material import reliance from 97% in 2016 to 80% by 2032. [3]

| Benefits under the API and Laboratory Reagents Production and Export Policy 2018 |

| Unconditional tax holiday to all local and joint venture APIs and laboratory reagents producers, for five years from 2017 to 2022. A producer manufacturing: at least five molecules annually will get a 100% tax holiday, and at least three molecules will get 75% tax holiday from 2022 through to December 31, 2032. |

| Waivers on VAT and VAT deduction at source on purchase and sales of locally made APIs, laboratory reagents, all raw materials, immovable assets, and services up to 2032. |

| A 20% cash incentive if producers add a minimum 20% value. The conditions of value addition are to be reviewed after 2026. |

| The tenure of term loans for factories and equipment is extended to 12 years instead of the previous 6 years. |

| Raw material manufacturers can retain 40% of their export earnings. |

| Single borrower cap will not be applicable for API and reagents producers. |

| API manufacturers are entitled to receive back-to-back letters of credit facility. |

| API and reagents producers will get priority in getting land at API parks and economic zones |

| Foreign currency support provided to API producers. Duration for late payment for import of raw materials has been extended to 360 days from the previous 180 days. In case of machinery import, the payment can be made within 360 days and will be extended up to 3 years in case of irregular payments. |

In May 2019, the National Board of Revenue (NBR) gave a 15% VAT waiver to local API producers till December 2025 with the condition of minimum 60% value addition to imported raw materials. [9] But since 60% value addition is not possible for all pharmaceutical products (many products require only 30% to 40% value addition) [8], on January 6, 2020, NBR reduced the rate of value-addition from 60% to 20%. NBR also reduced the number of molecules to be produced each year locally to 2 from the previous 5. [9]

In 2008, the Executive Committee of the National Economic Council (ECNEC) approved the construction of the API Park at Munshiganj. The park, to be built on 200 acres of land, has 42 plots. 27 companies including Square, Beximco, Incepta, and Acme have got plots in the industrial park. All infrastructural facilities like the Common Effluent Treatment Plant (CETP) and Waste Dumping Yard will be available in this project. Pharmaceutical companies are expecting to begin production in these factories by 2022. [10] The completion of API Park is expected to create employment for 25,000 individuals. [8] Two parks are also being built in Bagerhat and Khulna under private arrangements. A few local entrepreneurs produce APIs and third-generation medicines on a small scale. [11] The API Park will help Bangladesh to achieve price competitiveness in the Global Market by saving 70% of the import cost of raw materials. [8]

The WTO’s Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) of 1994 is the main international legislation dealing with intellectual property protection across member nations. The TRIPS agreement exempted developing nations from introducing product patents and served in preventing the ill of Bangladesh from having access to affordable essential medications.

Although the LDC flexibilities will continue to be in force until 1 July 2034, on graduation from LDC status in 2026, Bangladesh will cease to enjoy the World Trade Organization (WTO) waiver from the Agreement on Trade-Related Aspects of International Property Rights (TRIPS). The adverse impacts will be largely felt by our pharmaceutical industry with the intellectual property fees on imports of raw materials for drugs and APIs going up. Existing patent laws and license granting procedures, as well as Bangladesh’s Industrial Policy, Export Policy, and the National API and Laboratory Reagents Manufacturing and Export Policy will require adjustments to be WTO-compliant. [12]

To ward off some of the challenges of rising cost, the API Park must be put into full gear without delay. Simultaneously, Bangladesh should seek an extension of TRIPS flexibility for the graduated LDCs as permitted under article 66.1 of TRIPS. Opportunities to use the Maldives precedent for extension of the transition period exist as Maldives had received a two-year general extension from the TRIPS Council in 2005. [13]

The post-graduation element of the transition period extension is already under consideration under an LDC proposal on the agenda of the General Council [14] and Bangladesh should pursue a duly motivated request for the extension of the pharmaceutical transition period to be able to maintain its WTO flexibility. However, the country should also prepare for the post TRIPS regime by investing in upgradation of API facilities to achieve cost competitiveness.

Self-efficiency in producing quality API can aid the pharmaceutical industry of Bangladesh to sustain beyond the TRIPS regime. Sustainable local production of API requires modern skills and technical know-how; areas Bangladesh is lagging behind. Thus, to leverage external knowledge and improve R&D efficiencies, capacity building, public and private sector collaboration and partnerships with foreign firms are crucial.

The Government of Bangladesh has been highly emphasizing collaboration with foreign firms for the development of the pharmaceutical industry. The API Policy aims to ensure entry of new firms in the raw material producing sector and attract USD 1.0 billion in foreign direct investment. [15] Higher government grants for boosting R&D activities coupled with subsidies and investments can also help in attracting foreign players that can subsequently catapult the growth of the API market in Bangladesh.

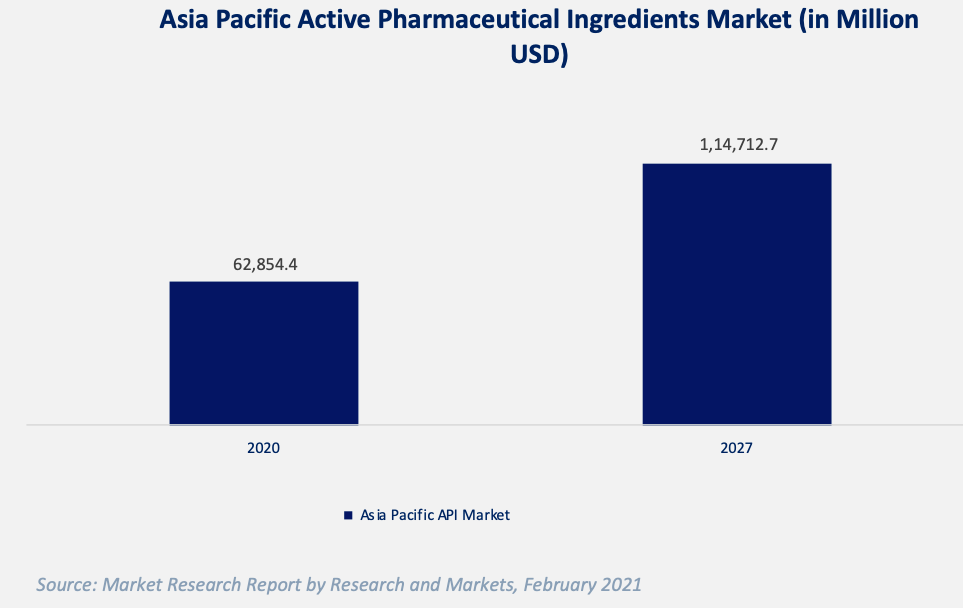

At the same time, the Asia Pacific active pharmaceutical ingredients (API) market has been rapidly growing with an estimated CAGR of 9.0% during 2021-2027 due to the rising need for medicine and pharmaceutical agents amidst the COVID-19 pandemic. The growing market provides potential partnering opportunities as well as a blueprint for entering global markets in Bangladesh as well. [16] China and India lead Asia both in terms of pharmaceutical and APIs market size. Other Asian countries, such as Taiwan and South Korea, have grown significantly over the past decade in terms of size and expertise due to their local government funding and joint ventures with MNCs. [17]

With Bangladesh building its own API base by setting up the API Park, there is a huge opportunity to build more business collaborations with Indian and other Asia Pacific pharmaceutical and related industries. The Pharmaceuticals Export Promotion Council of India (Pharmexcil) is already planning to partner with API manufacturers in Bangladesh and enter into MoUs, joint ventures and partnerships with the Bangladesh firms. [18]

To further strengthen the pharmaceutical sector of Bangladesh, it is very necessary to accelerate exports of APIs by manufacturing raw materials locally and reducing excessive reliance on imports. A dedicated backward linkage will not only enable the pharmaceutical manufacturers to produce world-class products at reduced prices but will also allow local consumers to buy high-quality medicines at lower prices.

Rahnuma Binte Rashed, Content Writer, and Tamanna Shahnowaz Sohanee, Business Consultant, at LightCastle Partners, have prepared the write-up. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights