GET IN TOUCH

- Please wait...

The COVID-19 pandemic has reshaped the business landscape concocting harsh ripples across industries. On the contrary, the reality has been different for the e-commerce industry, as it witnessed enhanced dynamism during the crisis. With worldwide restrictions being imposed to curb infections, people limited their outside exposure even for daily necessities, which turned out to be a blessing in disguise for the e-commerce industry. Fuelled by the pandemic, the share of e-commerce in global retail sales increased to 17% from 14% in 2020.[1] Things look promising for Bangladesh, too, as the consumer behavior shifted rapidly during this time. Facebook has over 2,000 eCommerce sites and over 50,000 eCommerce pages, making it a popular platform for advertising and selling things. The sector has seen strong growth in previous years, but after the emergence of the COVID-19 pandemic in 2020, growth has increased as more consumers are inclined to shop online. According to Statista, the industry expects to grow from $1.6 billion in 2019 to around $2 billion in 2020 and $3 billion in 2023. However, even with such promising growth, the real concern is whether the numbers are sustainable to carry forward into the future and provide enough incentive for innovation.

From the early 2010s, the e-commerce industry of Bangladesh took off, particularly with the introduction of online banking from Bangladesh Bank. Later, after further relaxation of restrictions on usage of credit cards for international purchases, the sector is now growing faster than ever. With a 9.3% annual growth in revenue and a 72% annual growth in market size, the industry is set to reach greater heights in no time.[2] Daraz, one of the largest market shareholders in the e-commerce of Bangladesh, is a perfect representation of the industry’s growth. In the past four years alone, the company went from dispatching 500 parcels daily to 120,000 parcels in a single day. In recent times, new startups are popping up in different market segments, drawn by greater aggregate demand. The likes of Chaldal, the leader in the e-grocery segment, and ShopUp, a startup enabling SMEs to go online, are spearheading innovation in the e-commerce industry.[3] The growth potential is drawing a large volume of foreign direct investment as well. In 2018, Chinese giant Alibaba Group acquired Daraz, which worked as a gamechanger for the market leader. Currently, e-commerce is the third-highest funded sector in terms of startup investments.[5]

The macroeconomic consumer behavior following the post-pandemic has also significantly been reliant on e-commerce. While 59 commercial banks in Bangladesh only account for 60% of the total population, the introduction of Agent Banking and Mobile Financial Services (MFS) has been dramatically successful to cater to the remaining 40% of the unbanked population. The recent initiatives to manufacture smartphones locally and make 4G more accessible across the country have further accelerated digital inclusion for e-commerce across the country.

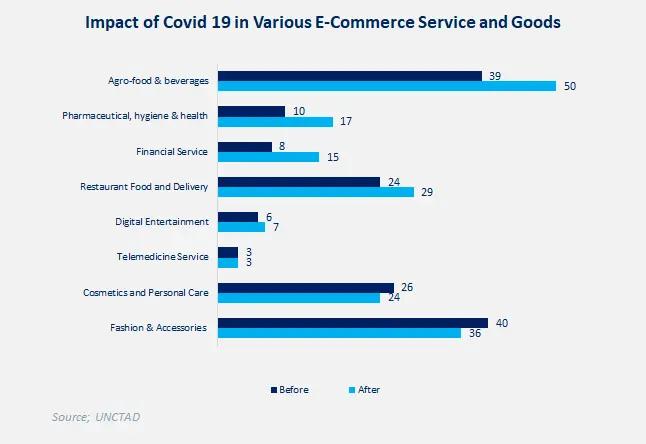

The turning point for the e-commerce sector has been induced by the dramatic shift in consumer behavior since the coronavirus outbreak. The pandemic has forced people to shop online, which effectively removed the consumer hesitancy for e-commerce. On the other hand, the pandemic has led to a higher tendency to save, acting as a counterweight keeping the growth leashed. Personal savings across the country increased up to 11% from 2019, cutting down pre-pandemic spending across entertainment and leisure activities.[17] Nonetheless, Bangladesh still has substantial e-commerce growth to show going into the second year of the pandemic. The following figure summarizes the impact of Covid-19 on e-commerce goods and services of developing countries, according to the United Nations Conference on Trade and Development (UNCTAD).

In terms of categories, agro-food and beverages have seen the steepest rise in terms of sales. After that, we can see a significant increase in the usage of financial services, pharmaceutical products, and food delivery. On the contrary, fashion and apparel product sales have gone down during this time, according to UNCTAD. [6]

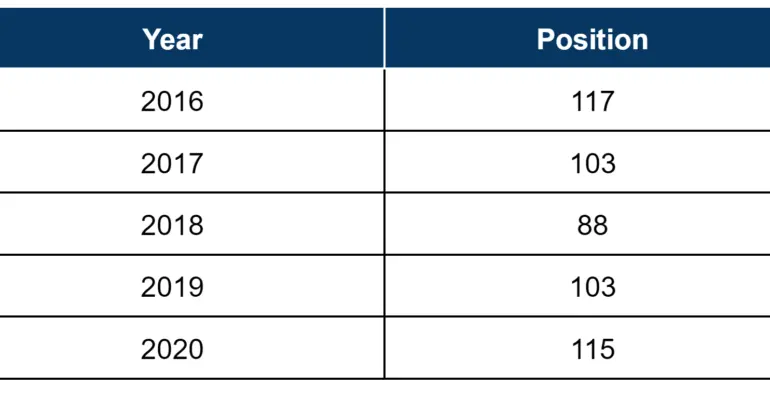

Although the Bangladeshi e-commerce market has registered substantial growth recently, it is still not at par with global development. Despite the shift during the pandemic, Bangladesh slipped to 115th in 2020 in the worldwide e-commerce index ranking by UNCTAD.[6] The index considers factors like internet and postal reliability to measure the readiness of an industry to adopt e-commerce. Compared to the global engine, Bangladesh’s faltering performance raises the concern on whether we are on the right track.

The infrastructural limitations account for the undesired slip in the climb. As mentioned earlier, the country’s under-developed payment infrastructure is a barrier to the sector’s forward momentum. This has led to the popularity of the cash-on-delivery model in Bangladesh, as 90% of customers are more comfortable with this method.[7] However, this is not taken into consideration for the UNCTAD index. As a result, the e-commerce readiness of Bangladesh might be underestimated by this measure.

From the height of its inception, Evaly has been a household name in the e-commerce market of Bangladesh with lucrative deals from 50% to up to 100% cashback. With such massive discounts, gift cards and offers, the catch as Evaly pointed out was longer than usual deliveries, about 45 days officially. However, it was later revealed that there was more to it behind the closed doors. From several complaints of the customers, most of the delivery delays stretched for over months, the refunds were often provided through post-dated cheques, which had to be rectified over even longer periods. After a staggering number of complaints from both merchants and customers, it was established that Evaly was indeed running a Ponzi scheme.

Ponzi Schemes are fraudulent investing scams where high returns are promised with very little risk. In reality, it works by generating the supposed returns to the earlier investors/customers with money received from later customers. At one point the lucrative deals with 100-150% cashback created a staggering difference between Evaly’s assets and liabilities. [12] According to a report by Bangladesh Bank, Evaly boasted Tk 4.04 billion of liabilities to its customers and merchants while having only Tk 651.7 million in their current assets. [12]

All of this resulted in a general distrust among the consumers. While lucrative offers from sites such as Evaly, Dhamaka, and E-orange (all running some form of Ponzi schemes) attracted temporary customers, this allowed a drop in sales for the regular e-commerce platforms such as Ajkerdeal. The burgeoning customers hence now have a skewed perception, regarding the reliability of these e-commerce companies. [13]

Despite the promising panorama offered by the e-commerce industry, many barriers stand in its way. Factors such as unregulated markets coupled with infrastructural hindrances make the economy a tough terrain for e-commerce businesses. Below, we discuss some pain points for the industry followed by the way forward from the challenges:

High Population Density: For e-commerce businesses with central warehouses, operating in densely populated areas is a massive challenge. The country’s capital city is infamous for hosting the world’s worst traffic. According to the World Bank, the average traffic speed in Dhaka is 7 km/ph which is just over the average walking speed.[8] In such difficult terrain, delivering goods as promised is incredibly challenging. To overcome these problems, startups are coming up with disruptive models such as Chaldal’s MicroWarehouse approach. Instead of a centralized warehouse, they are capitalizing on many small warehouses spread across the city to enhance customer experience.

Demand Imbalance: Although the aggregate demand for e-commerce is on the rise, there is a large disparity in terms of locations. The growth of e-commerce businesses has mostly been limited to the urban areas, whereas semi-urban and rural areas have been virtually overlooked. According to e-CAB, 80% of online shoppers are from Dhaka, Chattogram, and Gazipur.[9] This imbalance indicates the presence of untapped opportunities to capture across the country. However, due to infrastructural limitations, the market players are not being able to capitalize on them.

Newly Enforced Regulations: According to the Commerce Minister, the e-commerce sector would undergo future regulations to monitor the industry after the recent fraudulent incidents. According to the recent meeting discussing the e-commerce industry and its revised policy, there is an established urgency of creating a legal framework through a separate regulatory body and central complaint cell to ensure reliability and accountability. Existing laws including the Digital Security Act and Money Laundering Act would also be amended against fraudulent e-commerce platforms. [14]

Payment Issues: The country’s low financial inclusion is a threat to the retail e-commerce industry. Due to low credit card penetration, cash-on-delivery is preferred by most. However, many online vendors are not inclined to offer cash-on-delivery to customers outside Dhaka. As a result, the imbalance portrayed earlier condenses. However, the rise of MFS has brought some stability in the financial ecosystem in Bangladesh, which has hitherto been a clumsy arena. During the pandemic, Mobile Financial Services (MFS) adoption in Bangladesh has risen to extraordinary levels to support transactions that require digital payments. Spearheaded by BKash, the MFS sector in Bangladesh is showing a way around the financial inclusion challenge to the e-commerce industry.

Global e-commerce has displayed tremendous resilience amid the major upheavals around the world due to the pandemic. Fuelled by some major shifts in consumer behavior, the industry swelled manifold. The Bangladeshi industry has somewhat followed the same path registering healthy growth amidst the crisis. However, Bangladesh is not in a position to afford complacency as the industry is still riddled with problems on many fronts. As long as this difficult terrain for e-commerce businesses continues to face these issues, keeping the excitement at subsistent levels looks like the wiser choice.

Faiyaz Uddin Ayeshik, Content Writer, and Kaishary Islam, Content Writer, at LightCastle Partners, have prepared the write-up. For further clarifications, please reach out to: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights