GET IN TOUCH

- Please wait...

Over the last decade, the payments landscape in Bangladesh has undergone a structural shift. The digital payment landscape is showing promise in Bangladesh.

With the change in consumer behavior, the landscape is becoming digital —moving towards contactless and cashless transactions. Meanwhile, COVID-19 has accelerated the growth of the digital payments landscape.

The Bangladesh economy has withstood the adversaries of the global pandemic and is experiencing an excellent growth trajectory across all its major sectors. Over the years, the middle and affluent class (MAC) population has been growing, the per capita income is increasing, more than 62 percent of the population consists of youth and the government is on the mission to digitalize the country. The country has made notable improvements in many development areas – recording a 57 percent increase in financial inclusion between 2013 and 2018, and a 31.5 percent internet penetration as of the beginning of 2022.

As a result, the country is experiencing tremendous growth in digital services as the current generation is tech-savvy and relies on online services for convenience. More businesses are shifting online and this has opened the digitization and diversification of the payment systems. The Covid-19 pandemic has further triggered the surge of digital payments as Mobile Financial Service (MFS) transactions increased by 7% in the third quarter of FY 2019-20.

Bangladesh has significant growth opportunities in its digital financial services and payments landscape. Banks, Non-Bank Financial Institutions (NBFIs), MFS, Micro-Finance Institutions (MFIs), and Fintech companies together consist of over 170 million accounts, and the number of MFS users has grown by 159 percent between 2018 and 2021.

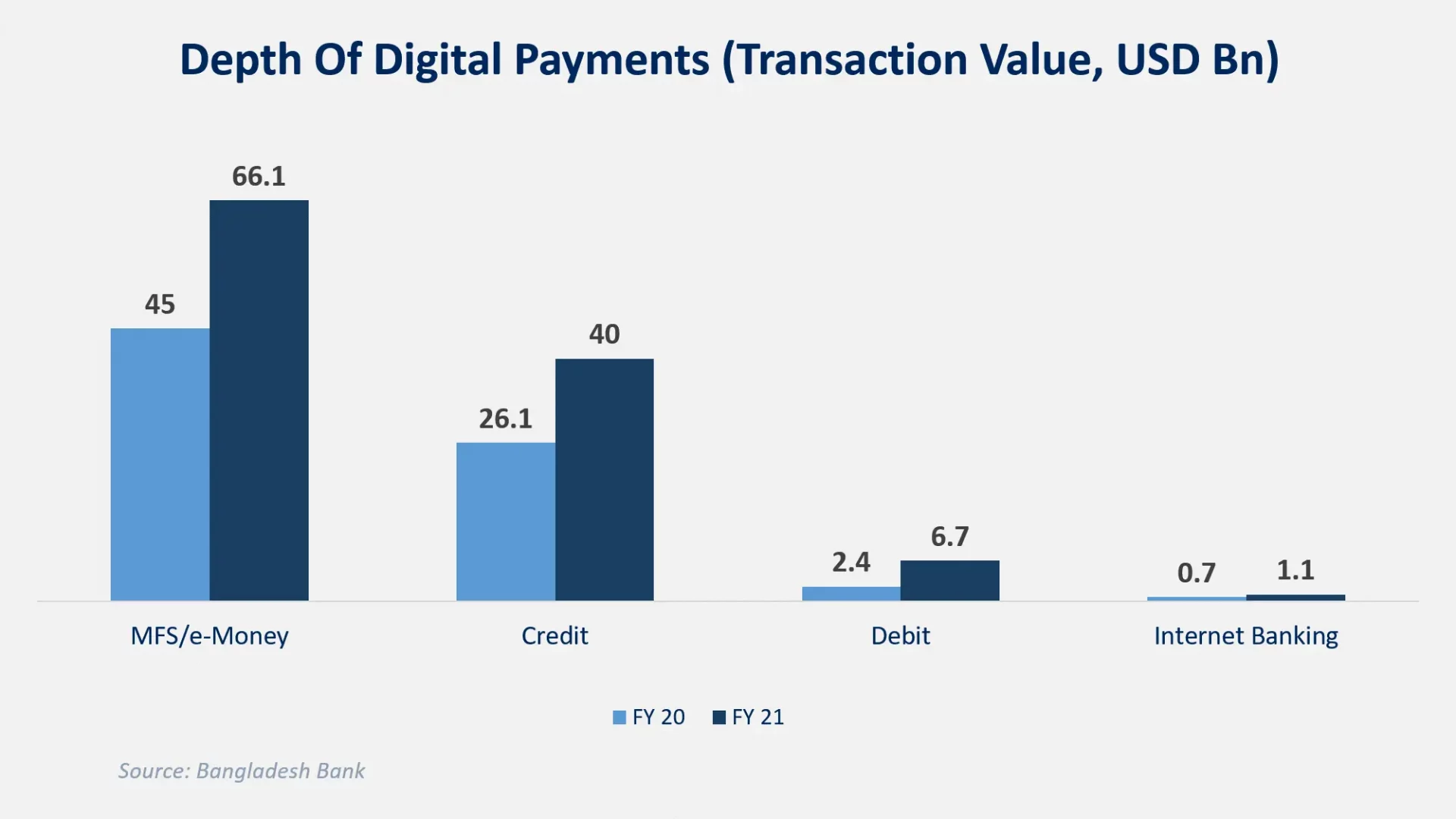

There has been significant growth in digital payments in the last two years. This is evident in the increase in MFS, payments cards (debit/credit), and e-banking transactions from FY 2020 to FY 2021. Within two years, MFS transactions grew more than 46 percent while the transaction values in internet banking have increased by 59 percent. At the same time, credit card payments have increased by 53 percent and debit card transactions surpassed a whopping 175 percent.

However, a significant gap in the financial market has left around 30 million of the population unbanked (The Global Findex Database 2021) causing imbalanced impacts among the lower-income groups. Digital payment services, especially through MFI, MFS, and agent banking can reduce this gap – MFI and MFS initiatives have led to a 30 percent increase in financial inclusion of the underbanked in FY 2021.

According to Bangladesh Bank, the payment system holds the key to the proper functioning of the country’s financial system. The mandate of Bangladesh Bank Order 1972, allows the promotion of new payments, clearing, and settlement systems. To facilitate this and ease the financial transactions, many regulations and initiatives have been set in place:

BEFTN is the country’s first paperless electronic inter-bank funds transfer system which facilitates both credit and debit transactions. The network handles credit transfers such as payroll, foreign and domestic remittances, social security payments, company dividends, bill payments, tax payments, person to person payments among others. In the same way, it accommodates debit transactions such as utility bill payments, insurance premium payments, EMI payments, and others.

NPSB establishes interoperability among participating banks for their account and card-based transactions. Currently, this system is available for interbank Automated Teller Machines (ATM), Point of Sales (POS), and Internet Banking Fund Transfer (IBFT) transactions while interoperability among MFS services is under active consideration.

To promote internet banking, Bangladesh Bank has also raised the limit for interbank daily online transactions which allows more users to make secure online transactions from their homes and ultimately widens the scope of online banking in the country.

According to Bangladesh Payment and Settlement Systems Regulation-2014 (BPSSR-2014), companies can avail of PSP and PSO licenses to operate a settlement system for payment activities between/among participants of which the principal participant must be a scheduled bank or financial institution (example: payment gateway, payment aggregator). This enables e-payment gateways such as IT Consultants Ltd (PSO), SSL Commerz Ltd (PSO), and Pay Systems Ltd (PSP) to ease the electronic payments system and support the growth of essential online services.

The RFFO was established as a preliminary step to create a supportive environment for Fintech and digital financing initiatives in the country. Fintech companies are working under the Bangladesh Bank’s RFFO sandbox to develop explicit regulations and licenses. This enables such innovators to enter the market and promote digital financial services to the mass.

IDTP’s primary objective is to bring the customers online to deliver digital financial services and promote financial transactions. The IDTP serves as a bridge between a variety of financial service providers, including banks, non-banking financial institutions, merchants, enterprises, and customers. Through its Application Processing Interface, customers can access various financial and payment services under one umbrella. IDTP is currently in the testing phase by Bangladesh Bank and will be launched soon for all customers.

To know more about the initiatives, visit Bangladesh Bank Payment and Settlement System

The pandemic and the increasing digitalization have forced all stakeholders to rethink the payments ecosystem. Traditional financial institutions are adapting to new digital products and services while Fintech players are emerging to innovate the structure. Such initiatives are enabling the inclusion of the unbanked and underserved populations while easing payments for the customers.

Mobile Financial Services (MFS):

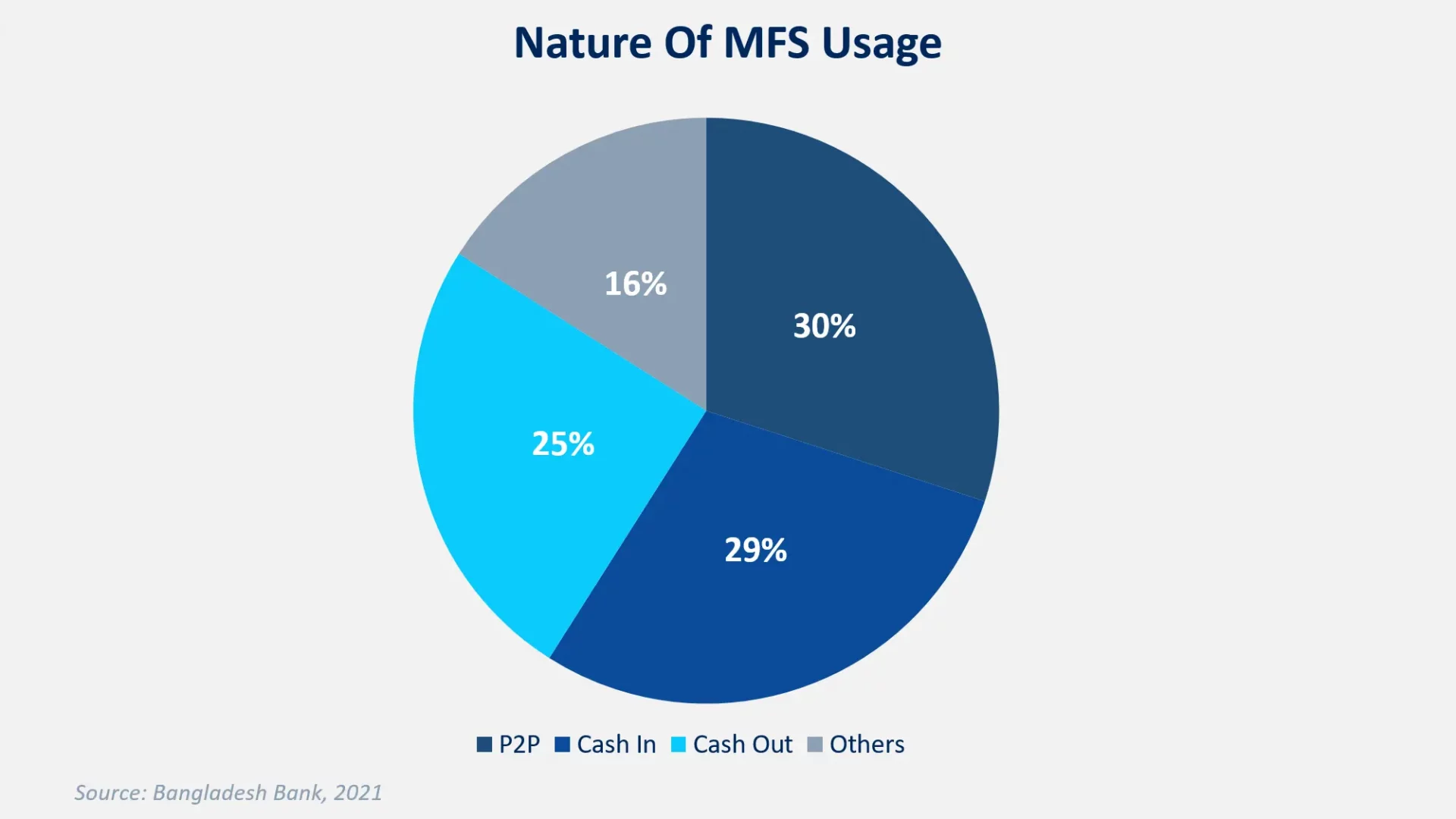

MFS has enabled new ways of contactless payments- integrating all kinds of services within one platform. In the past, such platforms have focused on promoting their uses through the introduction of digital payments using QR codes, interoperable payments facilities for e-commerce services, and money transfers from financial institutions.

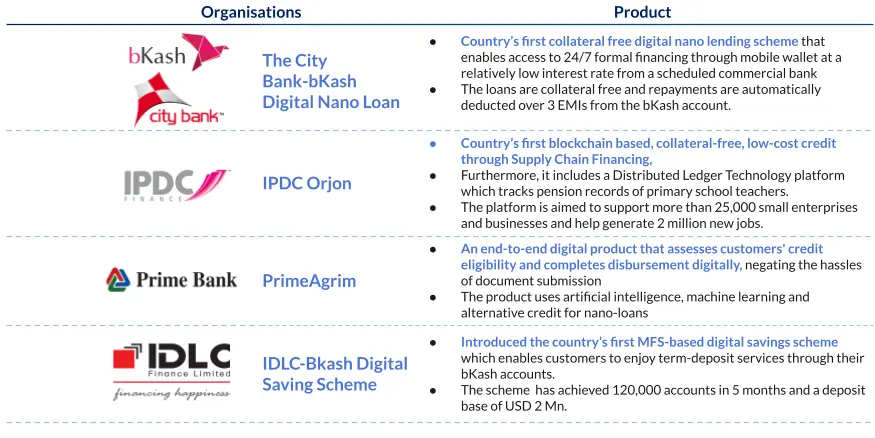

With digital payments being established among the customers, MFS operators such as Bkash have partnered with banks and non-bank institutions to launch nano lending and micro saving facilities for its customers. This enables consumers to use the mobile wallet beyond payments and access formal financing at acceptable interest rates and without collateral.

Banks and Non-Bank Financial Institutions:

Besides the continuous initiative from the Bangladesh Bank, local banks and other financial institutions adapted new technologies to embrace digital financing. Apart from introducing easy-to-use websites and mobile applications, financial institutions collaborated with MFS platforms to ease the payment method.

Fintech, E-Commerce, and More:

In the past two years, most large and medium-sized shops have quickly adapted to digital POS systems. Almost all e-commerce websites and social media sites have integrated the use of digital payments through debit/credit cards, bank transfers, and MFS payments. Payment gateways systems such as PSO and PSP have further eased the payment procedures for online merchants.

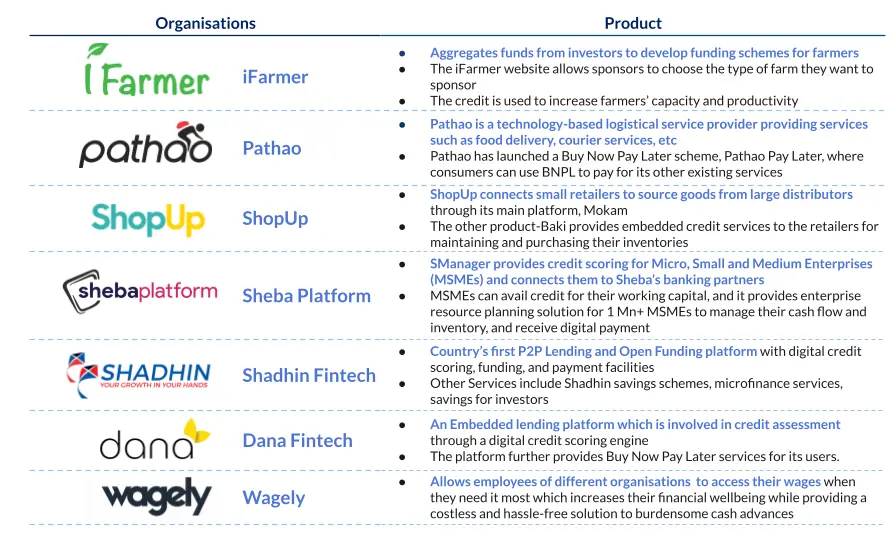

Different startups are providing embedded financial services to digitize their payments and introduce innovative financial products such as Buy Now, Pay Later (BNPL). Companies such as iFarmer, Sheba Platform, ShopUp, and Pathao provide digital credit services to their customers which can be used to avail of their products and services. Apart from providing credit, Fintech players such as Dana and Shadhin are introducing digital credit scoring, funding, and payment facilities.

Despite the new opportunities coming in the payments system landscape, there are many impediments to overcome:

According to a survey by the Policy Research Institute of Bangladesh (PRI), one in every ten MFS users in Bangladesh has faced financial fraud. MFS frauds and scams are very common in the country and this reduces the credibility of the MFS providers and forces customers to stick to traditional payment methods.

A major reason for MFS fraud stems from the knowledge gap among MFS users. More than 60% of the MFS users rely on others to operate their accounts which disrupts data privacy and breaches security, according to a BRAC Institute of Governance and Development (BIGD) survey.

There is limited accessibility to formal digital payments for a large segment of the population as the majority of the ATMs and POSs are located in urban and semi-urban areas which exclude the rural population. Moreover, perceived complexities, a lack of trust, and an understanding of credit cards limit their usage in Bangladesh.

As of 2020, 41 percent of all mobile users in Bangladesh are smartphone users, and 1 in 2 adults use a smartphone, reports GSMA. This along with poor internet connectivity create a maldistribution of digital infrastructure, especially in the rural areas, which constrains everyone from availing of digital financial services.

By recognizing the current opportunities and challenges of the payments system landscape, ecosystem stakeholders should focus on the following:

To increase access to payment services, customers need to better understand how these services work. Enabling financial literacy among the mass will increase their understanding of the payment methods, encourage customers to use the available digital services, and protect them from scams and frauds.

Digital financial services have a major role in promoting financial inclusivity. Active collaborations among the financial institutions, MFS providers, and fintech innovators can bridge the gap and bring formal financing to the underbanked and underserved communities.

Reducing complexities and easing the usability of payment services such as credit cards and internet banking can increase consumer confidence.

More Public-Private Partnerships should be established to develop the financial service landscape.

To test out different financial service innovations, regulatory sandboxes can be established for the new and existing fintech. Expert advocacy from external organizations can help to develop these sandboxes as well as new regulatory frameworks.

So far, Bangladesh has made remarkable progress in developing payment services such as MFS. However, there is room for improvement, and increasing access to financial services for the masses is key. By overcoming the impediments and recognizing the opportunities, the payments system can be improved significantly. Going forward, active partnerships and catering to inclusive payment services are a must to bolster this ever-growing payment system.

Fairuz Joyeeta, Business Consultant, at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected]

|

If you are interested to learn about the Digital Financial Services in Agriculture and

MSME Sectors

|

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights