GET IN TOUCH

- Please wait...

The application of technology in the front and back-ends of financial services has already brought unimaginable revolutions in the sector. The case of mobile financial services is a prime example in this regard- as of October 2022, around 187.3 million accounts were registered through 13 MFS providers which accounted for a total of BDT 30 billion worth of transactions every day [1].

However, the circumstances of the formal credit disbursement in Bangladesh present quite an opposite picture.

According to the World Bank’s Global Findex database, only 9.1% of people of the population have a history of borrowing from the financial sector, leaving the rest 90% completely unserved and underbanked [2]. The fact that majority of this population does not have access to traditional financial services such as banking, insurance, savings, credit, or pensions, raises a vital concern to the growth journey of the sector.

Thankfully, recent technological interventions offer substantial scopes of addressing this challenge of bringing the underbanked population of this country under formal financial services. Alternative credit scoring or ACS in short shows much potential of becoming a vital component of the digital lending system.

The following discussion will focus on why ACS has recently gained enormous popularity in some countries and how this technology can augment the lending ecosystem in Bangladesh.

Alternative credit scoring is the process of determining a person’s creditworthiness with the use of data that are not from traditional sources like debt repayment history or credit files, but rather, from non-traditional sources such as telecom payments, digital footprints, and so on.

For a farmer, the agency might want to look at his recent mobile financial services, mobile recharge amount and frequency, bank account messages on his phone, and so on.

Credit scoring agencies then run these non-traditional data through AI or ML-powered algorithms. After the score is produced, a bank would be able to assess the creditworthiness of this farmer.

In the case of the traditional scoring method, if the farmer is from the underbanked segment, he might not have any previous credit files at all that could reflect his financial discipline. As a result, he would face difficulties while trying to enter the credit system.

However, this issue could be resolved with the help of an alternative credit scoring method since non-traditional data are available even for first-time credit applicants.

Lenders or financial institutions use credit scoring which is a statistical analysis to determine the creditworthiness of individuals or MSME owners.

Well-known credit scoring systems such as Fair Isaac Corporation’s FICO score, VantageScore, and other models will take into consideration usually five factors – the individual’s payment history, current outstanding, length of credit history, new credit, and credit mix [3].

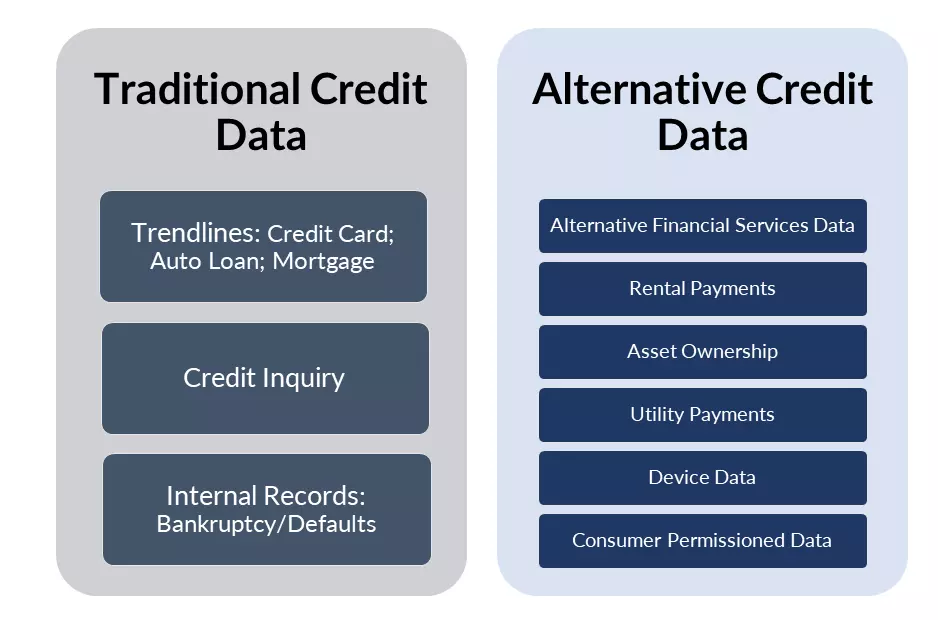

To get information regarding these mentioned attributes, credit scoring agencies or financial service providers need to have a look at data such as the individual’s loan or credit limit, credit inquiries, debt repayment history, and so on [4]. Based on these data points, the credit scoring agencies gather information for the five factors mentioned above.

For the final score, specific factors, their weights, types of the model of credit scoring, or the credit bureaus might vary, but usually (for instance only), the weight for the above-mentioned five factors will be: payment history-35%, amounts owed (current outstanding)-30%, credit history-15%, new credit-10% and credit mix-10% [5].

One issue, however, prevails in the case of this traditional credit scoring method. The data points that are used for this method, most of them usually are generated only after the individual has already used a particular formal financial product or service. For example, if someone has a previous record of taking loans and repayment, that can be a source of data for traditional credit scoring.

Unfortunately, when someone is trying to get a loan for the first time in his or her life, then a unique challenge arises. This first-time credit applicant cannot provide the lenders credit files that the lenders can use to assess the applicant’s creditworthiness. As a result, the chance of their loans getting sanctioned decreases to a great extent, and even if they do get the loan approval, that usually comes with the cost of paying higher interest. This creates a vicious cycle for these first-timers, relief from which is utterly strenuous.

However, alternative credit scoring techniques here offer some promising ways of taming this challenge. Instead of using previous credit history, which often is backdated and might not reflect various other creditworthiness-determining characteristics of the candidates, alternative credit scoring is an automated system that uses current and relatable data of the individuals that are easily available, such as digital footprints [4]. This enables people who don’t have a previous credit history to have their own credit scoring that mirrors their true creditworthiness and gain access to formal financial services.

Hence, Alternative Credit Scoring or ACS in short, can substantiate the financial situation of a person through non-traditional, and non-credit information to calculate his/her creditworthiness.

The majority of the Bangladeshi population is not habituated to formal financing facilities. Especially people belonging to grassroots communities such as farmers, and other vulnerable groups have almost no knowledge of or access to formal credit facilities.

The current strategy of the banks and NBFIs that depends on traditional credit scoring is not aligned with the unbanked and underbanked market of this country. As a result, there is an obtrusive market gap that has been existing for a long period of time.

Alternative credit scoring can be of great assistance in this regard. A well-structured alternative credit scoring method could be used by any bank to measure the creditworthiness of this huge unbanked and underbanked community.

According to the Association of Mobile Telecom Operators of Bangladesh, the total number of mobile phone users in this country reached 180.87 million at the end of November 2022 [7].

Such a massive community of mobile phone users is quite promising for digital lending facilities since alternative credit scoring can be successfully facilitated when people have access to mobile phones.

Now there are two types of mobile phone users – smartphone users and feature phone users. Even though smartphones are very common in the metropolitans, in the suburban and village areas, feature phones are more prominent.

47% of the total population of Bangladesh in 2021 has been under smartphone coverage according to GSMA [8], an alternative credit scoring model would be using primarily three types of data.

Firstly, personal level data would be collected from the individual such as age, profession, monthly income, and so on. The personal level data could be obtained from multiple sources such as automated validation through NID cards, or by employing assisted models, where assigned agents would communicate and collect the data from them. The users could upload the required information by themselves while using an app or through mobile devices as well.

Secondly, various types of transaction data would be fetched as well, such as, the types and times of transactions, what payment method is employed, etc. This information could also be made available when the banks or credit scoring agencies would be allowed to access the applicants’ bank account-related messages on their mobile phones.

Lastly, the model would call for data regarding economic activities conducted by the individual on various platforms. Combining all this information and putting various weights on different attributes, the system would be able to create a credit score for the individual. For this, no previous credit files would be required, rather, real-time, updated data would be used to create automated and instant results.

Even for the feature phone users, this system could be easily implemented, although in this case, agent assistance might be needed additionally, who would be responsible for manually visiting the credit applicants to gather information regarding how many assets they possess. The assigned agents would then incorporate this information in the model to generate the credit scoring of the individual.

As for the agents, they could be employed by the credit scoring agents themselves, or the agencies could assign agents from the MFS institutions such as bKash or Rocket, individuals working for NGOs, or other organisations from the development sector.

The bright side of this alternative credit scoring is that the more users there will be, the better the system would function as a whole. This ACS system enables banks to capture a whole new market of the unbanked and underbanked segments that have remained untapped for decades. Credit scoring in this way is more objective and reliable and less subjective and outdated.

Another arena to deploy ACS is the CMSME sector where significant demand for credit exists. Bangladesh’s CMSME sector thrives with the energetic participation from the young entrepreneurs, yet riddled with accounting, documentation, and collateral related issues to get credit for expansion.

The mismatch between financial institution’s requirements and the nature of operations of CMSMEs provides a space for ACS to add value. A similar scenario was observed in India [9] where ACS led the way for a more holistic approach while resolving the limitations of the MSME sector.

In addition to sectoral applicability, ACS holds the potential to reduce the processing time required for credit service delivery. The existing modality in Bangladesh practically takes 15 to 30 days for disbursement of loans due to the structured and bureaucratic steps. Since ACS relies on alternative data and Machine Learning algorithms, the overall time for disbursement can be reduced.

The whole ecosystem of alternative credit scoring would require stakeholders in three key areas: financing, credit scoring, and service delivery.

In this area, the stakeholders are the banks, NBFIs, etc., essentially who are supposed to provide the credit to the applicants. ACS can greatly enhance the existing credit scoring tools used by these organizations to cater to vulnerable, marginalized, and CMSME groups.

With the emerging popularity of alternative credit scoring facilities, various fintech companies, both from home and abroad, are coming up with this technology to implement this system. These institutions are in charge of facilitating the alternative credit scoring process of the applicants.

After the banks provide the credit and the fintech companies complete the credit scoring process, now the final task is to bring this service to the target market, as in the community at the grassroots level.

The banks can do the service delivery by themselves, assigning their own banking agents, or they can partner up with other entities. Organisations such as iFarmer, WeGro, and so on have been working very closely with farmers in remote areas for quite some time so partnerships with such organisations might be helpful for banks to have access to the grassroots communities.

Grameen Bank, BRAC, ASA, BURO Bangladesh, and other similar microfinance organisations have been involved in micro-credit lending activities for a long period of time. These organisations usually provide small and uncollateralized term loans (usually one-year) to the unbanked and underbanked population of the country [10].

Due to their course of activities, these institutions have a record of the rural people and a record of their loan repayment to the MFIs. Interestingly, in case the alternative credit scoring, agencies can access this record of their microfinance activities, the opportunity of determining the creditworthiness of a huge population could be unlocked since data from these MFIs’ databases could be incorporated into the credit scoring algorithm.

During FY 2021-22, 739 MFIs have been active in Bangladesh, disbursing BDT 191,883 crore to around 3.82 crore clients [11].

Very high proportions of credit invisible population, and the burden of cost of operations at the last mile makes ACS a suitable tool to make credit swiftly available to the unbanked and underbanked.

Combining the above-mentioned stakeholders could bring an enormous change in their lives. Not only that the vulnerable groups in the grassroots communities will access financing for their personal use or small to medium size business operations, but financial institutions will also be able to capture a completely untapped market.

This potential of bridging the gap between service providers and the underbanked population added with the scope of fast-tracking credit service delivery to demanding sectors, such as CMSME, indicates the time is of the essence for financial institutions to explore ACS.

Even though alternative credit scoring is immensely promising, implementing this in the context of Bangladesh comes with a unique set of challenges. Bangladesh Bank so far doesn’t have any relevant guidelines based on which banks can initiate their activities on alternative credit scoring. Also, no work has been done to create a consortium of banks that will be a part of the ACS ecosystem.

The fintech brands, while trying to assemble financial data to use for the credit-scoring of the individuals, would also have to work on the integration of online platforms (eCommerce shops, ride-sharing apps, social media platforms, etc.) with their own ACS engine, so that they can access the API data from the customers’ digital footprints.

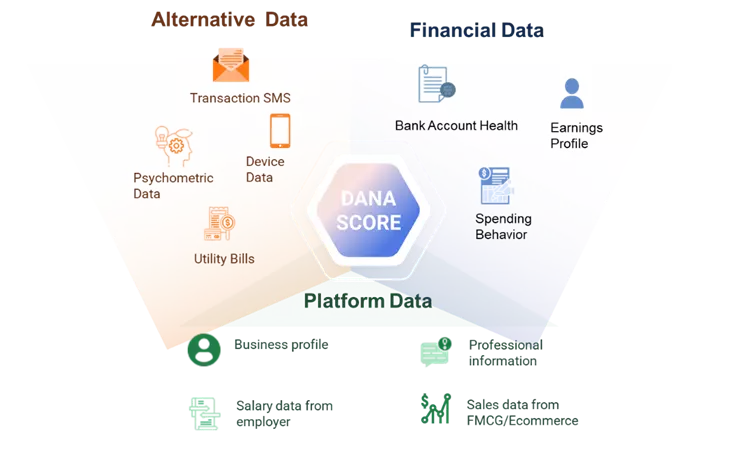

Dana Fintech is one of the pioneers of alternative credit scoring initiatives in Bangladesh. Founded by two ex-bankers, Gazi Yar Mohammad and Zia Hassan Siddique, the company has its alternative credit scoring engine that is powered by artificial intelligence and combines data from multiple sources such as device data, earnings profiles, utility bills, salary data from employers, sales data from eCommerce platforms, and so on [12].

To carry out the data scoring from alternative, financial, and platform data, the company uses machine learning and is capable of generating the credit score within only 3 minutes. Currently, it is working with 4 banks, financial institutions, and MFIs, along with 10 network partners including e-commerce, digital wallets, and digital platforms.

In the global context, alternative credit scoring has already gained vast popularity due to its adequacy and functionality. It is expected that this will soon be widely used in Bangladesh as well by eliminating the market gap between the lenders and the grassroots community. But for that, some steps are needed to be taken first.

A policy guideline and refinance scheme need to be designed that would encourage banks and NBFIs to offer digital loans based on alternative credit scores to PRA (personal retailer account) holders and women entrepreneurs.

Relevant authorities could focus on creating a consortium of banks in this country (similar to Paynow in Singapore or Promptpay in Thailand) so that open banking facilities become much more accessible. This would further facilitate instant payment and digital lending services and thus empower consumers and small businesses.

For the credit scoring algorithm to be more efficient, banks might also want to share the account APIs with the fintech companies.

Bringing all the stakeholders in alternative credit scoring together and constructing a stable and dependable credit scoring ecosystem can open doors to thousands of new opportunities for the economy of this country.

Partha Modak, a Content Writer, has prepared the write-up with Md. Mubassir Rahman, a Project Manager at LightCastle Partners. Expert consultation has been provided by Mr. Gazi Yar Mohammed, Co-Founder & CEO of Dana Fintech. For further clarifications, contact here: [email protected].

[1] Mobile Financial Services (MFS) comparative summary statement of September, 2022 and October, 2022

[3] What Is Credit Scoring? Purpose, Factors, and Role in Lending

[4] Traditional vs. Alternative Credit Data: What You Need to Know

[5] How Is Your Credit Score Determined?

[6] What is Alternative Credit Data?

[7] Mobile Phone Subscribers in Bangladesh

[8] Smartphone users will grow to 63% by 2025: Report

[9] How alternative lending models are facilitating better access to credit for the MSME sector

[11] Loan disbursement sees brisk growth

[12] Dana Fintech: Pioneering digital credit scoring for digital loans in Bangladesh

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights