GET IN TOUCH

- Please wait...

Agriculture has contributed 11.66% to the country’s total GDP in 2021-22; with 5.64% [1] coming from crops and horticulture. According to the latest provision labor force survey 2022, the proportion of the population employed in Agriculture (of total employed) is 45.3%, up by 4.7% from that of 2017 [2]. On top of that, most farmers in Bangladesh come from lower-income segments, which makes strengthening the agricultural value chain a crucial step for fostering inclusive growth.

Agri-mechanization is the process of integrating modern machines and equipment in farming to increase productivity and reduce farmers’ vulnerability to labor shortages and natural calamities [3]. Bangladesh has gone through phases in terms of mechanization. Per a study in 2019, operations that are most heavily mechanized (over 90%) are Land Preparation, Irrigation, Threshing and Pesticide application [4]. The rates of mechanization during Planting and Harvesting are below 2%; that of Fertilizer application and Weeding are higher, but still below 10% [5].

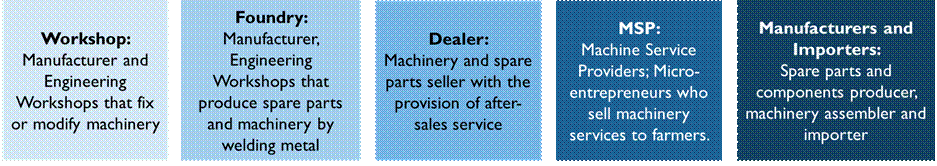

Figure 1: Agri-machineries of the Domestic Market

Although the 2022 labor force data shows a recent increase in the proportion employed in the agriculture sector, in the past three decades, rural labor has been migrating to the cities of Bangladesh as a significant portion of unskilled agricultural laborers has switched to working in the service sector, as well as in the RMG sector, catering to the high demand for cheap labor.

As a consequence, there has been a shortage of agricultural laborers in the rural areas, particularly in times of manpower-intensive work like planting and harvesting. The labor crisis and high prices of labor have increased the cost of production. Since these operations are very time-sensitive in nature, the unavailability of laborers often leads to late planting or harvesting, exposing farmers to further risks of natural calamities or low yield.

Agricultural mechanization generates higher productivity, efficiency and prevents the loss of crops. Manual planting in Bangladesh requires around 123-150 man-hour/hectare while mechanical transplanting with a four-row walking transplanter would take 9-11 man-hour/hectare[6]. A delay of one month in transplanting can reduce yield by 25%; that of 2 months can reduce 70% of the total crop yield[7]. A study titled “On- and Off-Farm Mechanization in Bangladesh: A Sustainable Approach to Ensure Food Security” conducted by the Bangladesh Agricultural University on rice cultivation has shown that using seed planters, transplanters and harvesting machines, the cost of each operation could be brought down by at least 50%[8].

The annual market size for agricultural machinery in the country is Tk3,000 crore, according to industry experts. However, the market for small machinery manufactured by local entrepreneurs is only 10-12% of the total agri-machinery market size[9]. Ready to use, agricultural machinery of competitive quality is not being produced domestically. The product portfolio of local foundries and agricultural machinery manufacturing industries majorly consists of spare parts and small machines like rice milling machines, sprayer machines, threshers, and vertical pumps.

At present, domestic manufacturers lack the technology to fully manufacture larger machines like threshers, planters, combine harvesters, etc. Qualified manpower with knowledge and skills related to designing, drawing, reverse engineering, and maintaining quality control is also one of the reasons for this. Other factors include the absence of modern machine manufacturing machinery, high price, and dependency on imported raw materials [10].

The impact of COVID-19 and the ongoing Ukraine-Russia war has increased raw material prices and utility overheads for these foundries and workshops, affecting their profitability even more.

Both supply and demand side players currently face certain barriers to accessing finance. The GoB has provided 70% and 50% subsidies on selected machinery but even after the assistance, farmers struggle to bear the rest of the cost. A major machinery manufacturer opined that Banks need to grant farmers better-suited loan schemes in order for them to purchase the machinery [11].

Lack of access to finance from traditional financial institutions in the agriculture machinery market and the agricultural sector in general also leads to many farmers borrowing from informal money lenders or loan sharks, who typically provide faster disbursement but at a much higher cost of funds, making it harder for farmers to save money for adopting mechanization in the future[12].

Most agri-loan products in the formal financing sector in Bangladesh do not consider the cultivation period of crops. Many farmers take additional loans at higher rates to pay off-season financial condition of farmers, hindering further mechanization efforts. Lack of working capital financing for manufacturers leads to limited supply during peak demand[14]. Banks and NBFIs require certain documentation like sales ledgers, audited financial statements, environmental and health certifications to give out loans. Small machinery manufacturers often don’t have these documents prepared and therefore do not get approved for loans.

From the Financial Institutions’ side, the policy-dictated interest rate for agricultural loans (8%) does not justify the credit risk of lending to small-scale machinery manufacturers or farmers. As a consequence, most institutions are averse to approving loans from these applicants. Ultimately, the gap in access to finance persists.

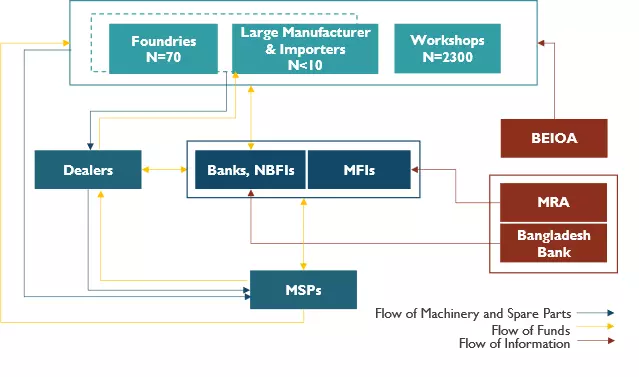

There are a total of 61 scheduled and 5 non-scheduled commercial banks in Bangladesh, 34 NBFIs, of which 3 are Government owned. More than 1000 MFIs operate in the domestic landscape, although 87% of the market is captured by the top 10 institutions.

Despite the large number of players in the financing landscape, the formal MSME finance gap is 67.3 percent. In Bangladesh, Foundries access formal finance through banks (public and private), NBFIs, and MFIs. Agricultural credit disbursement targets are set by the Central Bank to encourage banks to venture into this sector. They also provide refinancing facilities to the participating banks. The agricultural credit disbursement target has been set at Tk 30,911 crore for FY23, which is 8.88 percent higher than Tk 28,391 crore targeted in FY22.

Banks in Bangladesh provide specialized agricultural loans to farmers at an average interest rate of 4-8%[15]. Krishi Bank, the only government-owned bank specialized for farmers, offers a credit program for farm and irrigation equipment[16]. Non-Banking Financial Institutions (NBFIs) also offer agricultural financing products, at an average interest rate of 5-7%. However, the loan approval process is reportedly more stringent in the case of NBFIs. Institutions like IPDC and Midas have their own lease financing program specialized for equipment purchase with tenures ranging from 1 to 5 years [18] [19].

Microfinance Institutions (MFIs) in Bangladesh provide agricultural loans, though the interest rate is often 3 times as high as that of banks. On average, it has been estimated that farmers pay nearly 25% in interest to MFIs for loans that they would not have received from any other institution[20]. BRAC offers a dedicated loan scheme for smallholder farmers to adapt to farming technologies called “Borga Chashi Unayyon Project (BCUP)” [21].

Large machinery companies provide credit facilities to small service providers and farmers, but they require a down payment of around 40% of the remaining amount after subsidy coverage[22]. This means that the machinery companies are taking on the burden of recovery for the remaining 60%, which hurts their cash inflow. On the other hand, this loan is usually to be repaid in a year with monthly installments which affects farmers or machine service providers due to the seasonality impact on their business, making monthly repayment impractical.

To promote mechanization in the agriculture sector, the Government of Bangladesh has provided subsidies starting from 50% (70% in coastal regions) on the purchase of specific machines. The machines under this scheme include power tillers, reapers, rice transplanters, and combine harvesters.

According to finance minister A H M Mustafa Kamal, the Government has taken up a project at a cost of Tk 30.2 billion titled ‘Mechanisation of Agriculture Work through Integrated Management’, targeted to distribute 51,300 units of agro-machinery from 12 categories between 2020-2025,” [23].

In FY21, the government distributed 2,300 different agri-machinery, including 1,762 combine harvesters, 379 reapers, and 34 rice transplanters at a cost of Tk 208 crore among farmers under the agricultural mechanization project. In FY 2021-22, there was an allocation of Tk 680 crore in this regard.

In FY 2021-22, Bangladesh Bank set a monetary policy to reduce the interest rate cap on agriculture from 9% to 8% and started providing loans at 4% interest rate for crops and the harvest sector. Most Foundries and Workshops fall under cottage, micro and small enterprises, to whom Banks and NBFIs have been instructed to provide 50% of SME loans by 2024. These initiatives have been taken with the aim of increasing agricultural production and consequentially, the income of rural people. Improved access to finance for cottage, micro, small and medium enterprises (CMSMEs) will also lead to farmers gaining access to tools that will enhance agricultural productivity [24].

The government also plans to withdraw the advance tax (AT) levied on the import of rice transplanters, agricultural drier machines, all types of sprayers, and potato planters in the upcoming national budget aiming to modernize the agriculture sector.

The cost of larger agri-machineries is often too high for farmers or small machine manufacturers to pay upfront. Hence, they seek financial assistance. Adoption of machines would increase profitability but both end users and manufacturers will typically need multiple seasons to earn back the capital expenditure from their revenues.

Loan provisions for agricultural machinery purchase by commercial banks, NGOs, NBFIs should have a specialized low interest, long repayment periods and alternative risk mitigation schemes in order to improve the mechanization status of the country. Given the rising pressure on imports, and supply chain disruptions affecting industries across the board, mechanization of the agricultural sector, to raise productivity and reduce import dependency, is of paramount importance.

Priyo Pranto, Business Consultant at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected].

[1] Bangladesh Bureau of Statistics, 2023

[2] BBS, 2023, Quarterly Labor Force Survey 2022 Provisional Report

[3] J.C. Negrete, Research Trends and perspectives of mechanization and agricultural machinery in Mexico for the 21st century, J. Agri. Crop Sci. 1 (2018) 29–38, https://doi.org/10.31872/2019/JACS-100105

[4] M.A. Hossen, Mechanization in Bangladesh: way of modernization in agriculture, Int. J. Eng. Trends Technol. 67 (9) (2019) 69–77.

[5] S. Seraj, Agricultural Machinery: where Is Bangladesh Heading? the Daily Star, 2020. https://www.thedailystar.net/country/news/agricultural-machinery-where -bangladesh-heading-1927969

[6] A.K.M.S. Islam, M.A. Rahman, M.T. lslam, M.I. Rahman, Techno-economic performance of 4-row self-propelled mechanical rice transplanter at farmers’ field in Bangladesh, Progressive Agric. 27 (3) (2016) 369–382,

[7] M.V. Rao, S.N. Pradhan, Cultivation Practices, Rice Production Manual, ICAR, 1973, pp. 71–95.

[8] Dr. Saha, On- and Off-Farm Mechanization in Bangladesh: A Sustainable Approach to Ensure Food Security, https://postharvestinstitute.illinois.edu/bangladesh-virtual-workshops/

[9] https://www.tbsnews.net/economy/farm-mechanisation-awaits-investment-boom-326182

[10] M. A. Hossen, Mechanization in Bangladesh: Way of Modernization in Agriculture, International Journal of Engineering Trends and Technology (IJETT) – Volume 67 Issue 9- Sep 2019

[11] https://www.tbsnews.net/economy/farm-mechanisation-awaits-investment-boom-326182

[12] https://www.newagebd.net/article/70388/loan-sharks-prey-on-people-affected-by-disasters-in-bangladesh

[13] Shawkat Hossain, Zunaed Rabbani, and Shahran Ahmed, 2021, Increased Access to Finance Stakeholder Consultation Workshop

[14] Alam, M. M., M. I. N. Khan, C. K. Saha, A. Rahman, and M. G. K. Bhuyian. 2017. Manufacturing of agricultural machinery in Bangladesh: opportunities and constraints. Agricultural Engineering International: CIGR Journal, 19(1): 122–135.

[15] The Business Standard, 2022, Banks urged to speed up disbursing agricultural loans

[16] https://www.krishibank.org.bd/core-business/credit-programs/farm-and-irrigation-equipment-loan/

[17] https://www.bb.org.bd/fnansys/interestlendingfi.php

[18] Lease Finance, IPDC. https://www.ipdcbd.com/home/sme#book1

[19] https://www.mfl.com.bd/index.php/home/lease_financing

[20] High Interest Hurts Farmers, The Daily Star

[21] Agricultural loans, BRAC. http://www.brac.net/program/microfinance/agriculture-loans/

[22] https://un-csam.org/sites/default/files/2020-11/1.%20Country%20Presentation_Bangladesh_Mr.%20Alam.pdf

[23] Agro-machineries get increased subsidy in budget FY23, The Financial Express

[24] Monetary Policy FY 2021-22, Bangladesh Bank.

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights