GET IN TOUCH

- Please wait...

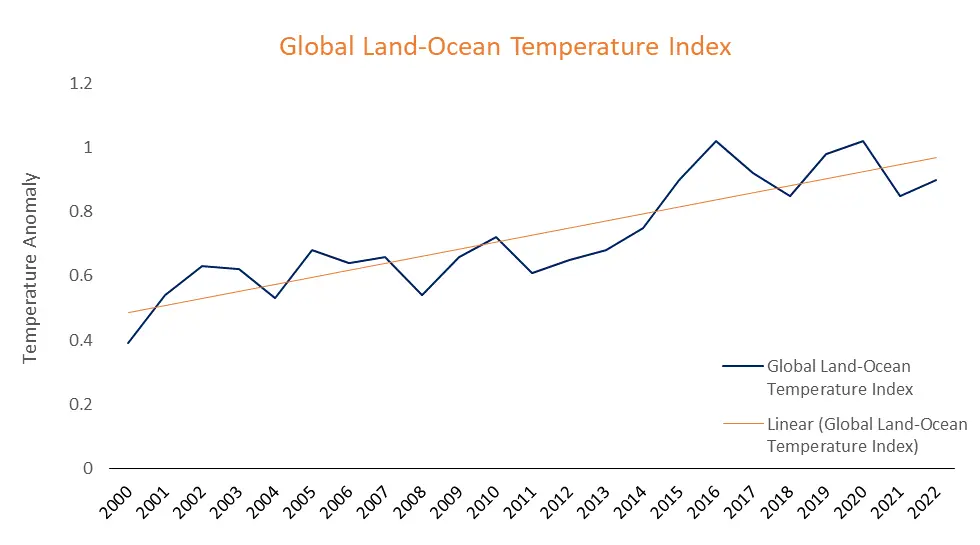

Changes in the Earth’s climatic conditions and the significance of human intervention that has propelled this outcome are undebatable. The global annual temperature has increased by a little more than 1 degree Celsius since the Industrial Revolution. It increased on average by 0.07 degrees Celsius (0.13 degrees Fahrenheit) every 10 years from 1880—the year that accurate record keeping began—till 1980. However, the pace of growth has more than doubled since 1981.

In the last 40 years, the yearly global temperature has increased by 0.18 degrees Celsius (0.32 degrees Fahrenheit) every decade. Furthermore, nine of the ten warmest years to date have all occurred since 2005, and five of these ten warmest years have all happened since 2015.

In order to avoid a future marred by extreme droughts, wildfires, tropical floods and storms, and other disasters that will wreak havoc around the globe, it is imperative that global warming be limited to 1.5 degrees Celsius by the year 2040. [1]

Undoubtedly, the emission of carbon dioxide (CO2), among other greenhouse gases and air pollutants, is one of the main drivers of climate change. Therefore, a rapid and sustained reduction in greenhouse gas emissions and reaching a net zero carbon dioxide status is imperative to stabilizing global warming.

As part of the initiative, a concept of trade in carbon credits was introduced in 1997 as part of the Kyoto Protocol, the first international decision to cut carbon dioxide emissions. This further raises questions about what carbon credit stands for and how the mechanism is devised to reduce emissions of carbon dioxide, which will in turn reduce global warming. [3]

Since the Kyoto Protocol was signed in 1997, carbon has been considered a commodity that can be traded. Today, carbon can be traded internationally in exchange for carbon credits.

A certificate known as a “carbon credit” allows a business to release one ton of CO2 or other greenhouse gases (GHG). However, businesses aren’t allowed to release an infinite amount of GHGs into the atmosphere because of the schemes’ quotas.

The emission trading system, also known as the “cap and trade” system, is a mechanism where the price of carbon changes over time. A maximum level of pollution known as the cap is defined, and the price of the license increases gradually as the emission approaches the cap.

Companies get a set number of credits, which decline over time, and they can sell any excess to another company. Carbon credits create a monetary incentive for companies to reduce their carbon emissions. [4]

The cap’s total is divided up into allowances. A corporation is allowed to emit one ton of emissions with each allowance. The allowances are given by the government to the businesses either for free or at auction. Nevertheless, the government decreases the total emissions cap each year by issuing fewer permits. As a result, the permits are now more costly.

Companies have the incentive to invest in clean technology and lower their emissions more effectively over time as it becomes more affordable than purchasing permits.

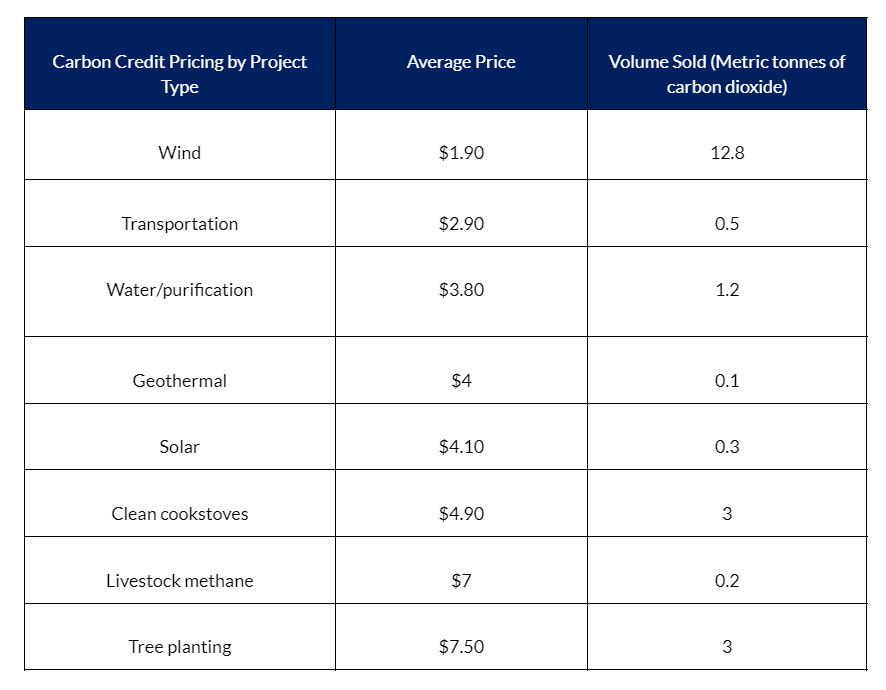

Furthermore, carbon is priced differently in the two markets as well. Under the voluntary market, one ton of carbon dioxide on average can be around $10 to $100, whereas in the CER market, the price is over $300.[5]

The prices of carbon credits are determined in two main ways: internal pricing and external pricing. Under the internal pricing method, organizations set internal carbon credit prices that guide their investment decisions. Their internal mechanism for determining carbon credits is based on various factors, such as identifying risks and opportunities from conducting emission reduction activities, etc. On the other hand, under the external pricing method, carbon credit prices are controlled by market forces and the overall regulatory environment.[6]

However, the valuation of carbon credits is not limited to the use of market dynamics but also depends on the project type, size, location, and other determining factors.

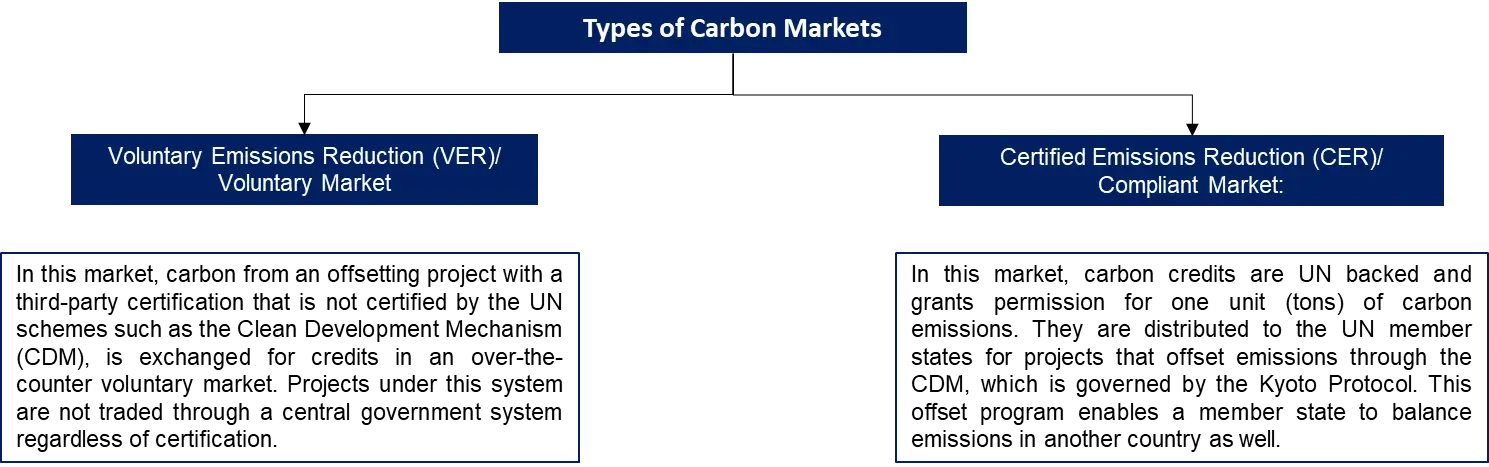

The chart below depicts a basic scenario of the types of credits within the marketplace.

Apart from using carbon credits as a mechanism to control emissions, carbon taxes are also used, where a price tag is put on fossil fuel emissions in order to disincentivize their use. Both mechanisms facilitate the promotion of greener energy sources. However, both taxes and credits represent indirect emission reductions and do not tackle the core issue directly. Therefore, a blend of both strategies is required to reduce emissions in the long run. [7]

Among the ‘cap and trade’ systems present, the European Union’s Emissions Trading System (EU ETS), which was introduced in 2005, is the most well-known. As of 2020, some other countries that have ETS are Canada, the United States, Norway, Sweden, Spain, Portugal, France, Ireland, Italy, the United Kingdom, Greece, Iceland, Kazakhstan, China, South Korea, New Zealand, etc.

Around 12% of emissions in 2020 came from nations or industries with a carbon tax, and the trading system only covered 6% of the market. This indicates that a carbon price has to be paid for 18% of all emissions in the world.

When China began its national emissions trading scheme in 2021, this coverage significantly increased, reaching 25% of world CO2 emissions. Moreover, China’s emission cap is based on the intensity of the emissions. [8]

In 2021, the pricing in the EU ETS ended at more than 80 euros per ton, which is double the price at the end of 2020. A tighter market resulted from a more aggressive EU climate goal of decreasing emissions by 55% by the year 2030. The Western Climate Initiative and Regional Greenhouse Gas Initiative, two regional carbon markets in North America, both had 6% growth last year.

The three main ETS around the world at present are

With 194 countries signing the Nationally Determined Contributions (NDCs) under the Paris Agreement in 2015, developing nations have been accelerating their actions towards climate resilient steps.

Countries such as Jordan, Ghana, Chile, and a few South American countries have developed digital infrastructure to enhance their access to the carbon market. [10] However, as developed countries do not have a compliant market within their system, their reliance lies heavily on the voluntary carbon market.

A marketplace that is dominated by bigger nations causes difficulties for new entrants to get access to buyers. The carbon trading market has been prevalent for over 15 years, and developed nations have created schemes that foster institutions to participate both in the compliance and voluntary markets.

On the other hand, developing countries have started taking green solutions seriously after the Paris Agreement, making them fall behind in the market space. While the majority of countries have started building a market system, developed nations have flourished in the voluntary market with carbon credits, causing its value to go down and making it less lucrative for emerging market players.

As for South Asia, India has been a major contributor to the voluntary carbon market for the last 12 years. From 2010 to 2021, the country has issued nearly 17% of the world’s carbon credits, which is equivalent to 35.94 million carbon credits. However, the country plans to ban international carbon trade to foster the domestic market, as the country has established an NDC to become net zero by 2070. [11]

Recently, India has made important strides towards the development of a domestic-compliant carbon market. A blueprint for the phased introduction of the cap and trade system has been drafted that includes an increase in voluntary demand for carbon credits domestically, facilitate the development, registration, and validation of emission reduction projects to increase carbon credits, and evolve the voluntary market into a compliance cap and trade system. [12]

The country is also deploying a stabilization fund to purchase carbon credits and reduce pricing volatility in the market. This will incentivize green solution investors to actively participate in the journey to reduce carbon emissions. [13]

Bangladesh has been heavily involved in exploring renewable energy opportunities in the country. The country aims to supply 30% of its energy demand from renewable and clean sources by 2030 and 40% by 2041.

As per the updated NDC, Bangladesh aims to reduce carbon emissions by 22% within 2030 and the energy sector will have a 96.1% stake in the achievement. [14] A total of 958.45 MW is being generated from renewable sources, comprising on-grid and off-grid solutions. As of now, the installed renewable energy sources have reduced carbon emissions by 4 MN MT CO2 and are expected to further reduce them by 9 MN MT CO2 over their lifetime.

However, investing in renewable sources is expensive, and its adoption becomes even more difficult when industrial players have access to cheaper captive power plants operating on gas.

The recent global energy price hike and Bangladesh’s depleting gas reserves have had bigger organizations shift to solar energy solutions for futureproofing their energy sources. However, the high initial investment required is making many reluctant to take the step. In general, a solar project requires 5-6 years to reach break-even. Hence, if the market gets access to carbon trading, the proposition to invest in renewable energy will become lucrative.

Recently, Infrastructure Development Company Ltd. (IDCOL) sold 2.53 million carbon credits worth 16.25 million USD. These carbon credits have been accumulated since 2006, and the revenue generated comes mostly from Improved Cook Stoves (ICS) and Solar Home Systems (SHS).

The price IDCOL received varied for different regions and organizations, from less than a dollar to 7 dollars per unit. Since a domestic carbon market has not yet been established and clean production has been in demand overseas, it is advisable for manufacturing-based industries, especially the apparel sector, to become the primary curators of domestic demand for carbon credit, as it will help them attract more value-added orders. [15]

On the other hand, it is also important to generate quality carbon credits that are backed by proper baseline evaluation, project auditing and verification, and approvals from established bodies. This will allow for better negotiating power in the market and also strengthen the real impact of the initiative. [16]

After the establishment of a voluntary market driven by domestic demand, the country should take the necessary steps to create a compliant market. This would make conglomerates become aware of their carbon footprint and propel them to take the necessary steps to reduce it through renewable energy interventions and the purchase of carbon credits.

Since Bangladesh is heavily investing in renewable energy to reduce its dependency on fossil fuels, rigorous policies should be developed to incentivize investors in the sector. It may include properly pricing fossil fuels, initiating carbon taxation, and facilitating a carbon trading market. [17] This will give renewable energy initiatives a cost-competitive advantage over other captive power solutions. Additionally, carbon taxation will increase the country’s revenue, which can be further used to introduce clean technology and infrastructural development.

The article was authored by Sutopa Ahmed, Business Analyst at LightCastle Partners, and Fahmid Kaisar, Business Consultant at LightCastle Partners. Advisory and editorial support was provided by Sanjir Ali, Senior Business Consultant and Project Manager at LightCastle Partners. For further clarifications, contact here: [email protected]

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights