GET IN TOUCH

- Please wait...

The FY2024 National Budget has been released as the country is passing through a period of economic uncertainty and dwindling macroeconomic conditions. With the upcoming national election, ensuring economic stability appears to be the top priority of the government. This article aims to critically examine how the FY2024 Bangladesh budget addresses the macroeconomic challenges currently facing the country, with a specific focus on the impact on key sectors such as healthcare, power and energy, and education.

Over the past few years, the government’s efforts to implement substantial tax reforms have been insufficient, resulting in a constrained ability to generate tax revenue. Despite introducing ad-hoc tax measures during budget seasons, the impact on resource mobilization has been minimal. Regrettably, this trend is expected to continue with the FY2024 Budget.

The proposed budget sets an extraordinarily ambitious goal of increasing tax revenue to BDT 4,500 billion in FY2024, compared to the estimated tax revenues of BDT 3,296 billion in FY2023. This represents an astounding 37% increase, casting doubt on its feasibility. Analysis of historical data reveals that the average annual growth in tax revenue over the past six fiscal years was only 10%.

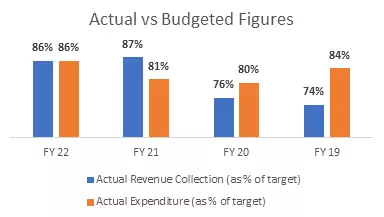

A look into the past figures of budgeted revenue and expenditure against the actual figures realized reveals that the utilization of both heads has remained below 90% for the past 5 years. It is interesting to note that the utilization of expenditure targets has been higher than that of revenue targets, except for the last two fiscal years, possibly due to the pandemic. For countries operating on a budget deficit, this pattern poses a greater concern, as it increases the gap between revenue and expenditure, putting pressure on the government to manage more funds to finance the deficit.

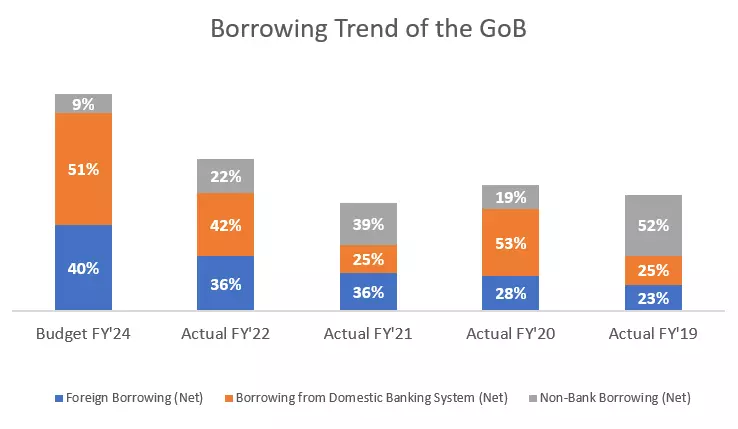

Most of the gap is plugged in by borrowing from foreign sources and the domestic banking sector. Due to the decreased reliance on National Savings Certificates, the FY ’24 Budget shows a substantial relative increase in the proportion of financing coming from the banking sector.

While the introduction of new tax measures in the budget may contribute to a modest additional increase, the projected 37% surge appears unrealistically optimistic. Consequently, there is a high likelihood of a substantial shortfall in actual tax revenues. According to the budget, a 41.8% growth is required in private investments, compared to that of FY23. However, If macroeconomic instability continues, attracting fresh private investment will be difficult.

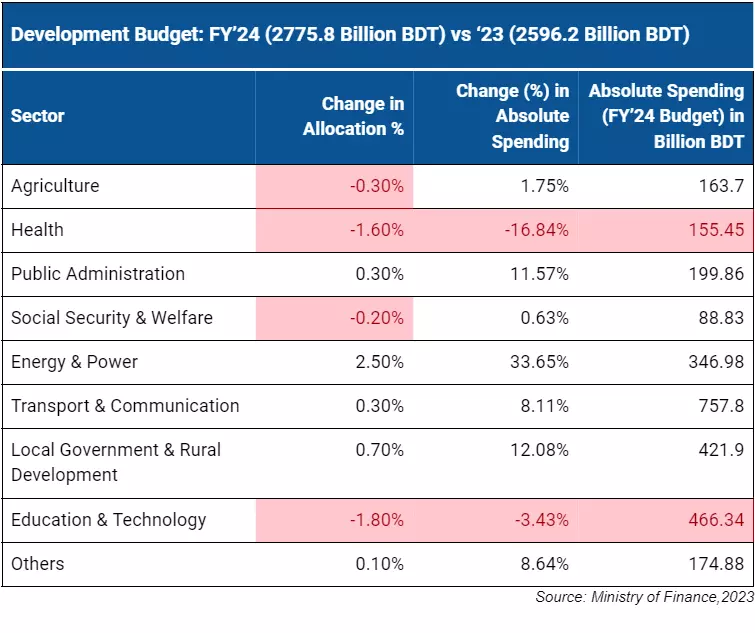

A comparative analysis of the previous development budget and this year’s sheds light on the sectors receiving increased or decreased spending.

The development budget is related to long-term investment within the framework of a long-term plan like the Five-Year Plan (FYP), mostly in activities like building infrastructure and additional facilities for production and services. Unlike the revenue budget, development budget allocations are made based on the annual allocations shown in each project document and resource realities. New and ongoing projects get the full allocations as shown in the Project Proforma (PP). In May 2022, the Prime Minister issued a number of directives to stop non-essential procurement and conservatively consider taking up new development projects.

A circular published in July 2022 titled ‘Prioritisation and Sustainable Implementation of Annual Development Programme Projects for FY 2022-23’ states that in the current global economic situation, projects have been categorized into A, B and C according to priority under the Annual Development Programme to ensure proper utilization of limited resources. Projects in the ‘C’ category, will not receive additional funding for the time being. Such austerity measures are assumed to have been factored in while developing the budget for FY ‘24.

Receipts in the development budget are grouped as public and private receipts. Public receipts are the revenue surplus (revenue receipts minus revenue expenditures), incomes through new measures (such as new taxes), net domestic capital, and extra budgetary resources. A special form of public receipt is foreign aid (project aid, counterpart funds from commodity aid, and net food aid). Receipts under the private head for the development budget are generated through direct private investment, borrowing from the banking system and foreign private investment. The agency that prepares the development budget is the Planning Commission.

Education & Technology and the Health sector have been allocated less funds for development compared to the previous year. The development budget for Social Security & Welfare has slightly increased in terms of absolute spending but has received a decreased percentage allocation. The Energy and Power sector has exhibited the largest increase, owing to multiple ongoing and prospective projects within the sector. Being followed by the LGRD and the Transport & Communication sector, it is evident that infrastructure development will continue to be in focus for the upcoming fiscal year.

It is no secret that in the past year, we have come across causes for concern amidst the country’s macroeconomic scenario, which had experienced sustained growth in the past decade. The macroeconomic stress can be seen through:

Turning to the FY2024 proposed Budget, it sets ambitious targets of 7.5% GDP growth and a 6.0% inflation rate. The budget also projects a fiscal deficit of 5.1% of GDP and plans to utilize 3% of GDP for bank financing. These targets closely resemble those of the previous year’s budget, indicating a continuation of the growth-oriented approach. On the contrary, the ADB expects 6.5% GDP growth for FY ’24. The slower growth projection reflects the economic slowdown in Bangladesh’s major export destinations, driven by global uncertainty over prolonged geopolitical tensions.

Inflationary pressures have been a persistent issue since the Ukraine-Russia war started in February 2022, with a spike of 9.5% in August 2022, and hitting a record high of 9.94% in May 2023. While it may be convenient to attribute this sustained inflationary spike to global inflation and the Ukraine War, it is important to note that while external sources did contribute to the initial rise in domestic inflationary pressures, their persistence can be attributed to the absence of sufficient demand management policies.

Evidence suggests that countries that have implemented demand reduction policies, such as interest rate hikes, have successfully reduced inflation. For instance, Thailand experienced a 65% decrease in inflation, falling from 7.7% in June 2022 to 2.7% in April 2023. In the European Union, inflation dropped to 7% in April 2023, a 34% decrease from its peak of 10.6% in October 2022. India also witnessed a 40% reduction in inflation between April 2022 (7.8%) and April 2023 (4.7%), while Vietnam also successfully managed to curb and contain its inflation rate within the 2-3% range.

There appears to be a limited emphasis on addressing macroeconomic stability concerns through measures like reducing the fiscal deficit or slowing down the growth of domestic credit by minimizing bank financing of the budget deficit. However, bank borrowing leads to the crowding out effect, leading to lower private sector credit growth and investment; which might be a blessing in disguise during times of high inflation. The FY2024 proposed budget finances 50.6% of its deficit from bank borrowing.

Nonbank borrowing, which is probably the least inflationary, is projected to decline, driven entirely by reduced use of national savings certificates to Tk18,000 crore, 10% less than the FY23 revised target. Reduced reliance on NSCs is understandable for future growth as it is the largest single interest payment item in the budget.

The FY2024 Budget maintains a focus on growth, but there is a need for greater attention to macroeconomic stability. Balancing growth objectives with measures to address inflationary pressures and promote stability will be crucial for achieving sustainable economic development.

The recently published monetary policy, accordingly, attempts to adopt contractionary measures. New policy measures like lifting the interest rate cap to move to a market-based lending rate, increasing the repo rate by 50 basis points to increase the cost of borrowing and lowering the target for private sector credit growth aims to contain the currently soaring price pressures. However, experts have opined that SMART (six-month moving average rate of treasury bills) is not necessarily entirely market based, as The Central Bank will still be able to manage treasury bill rates.

The FY2024 Budget includes several measures aimed at supporting and promoting various industries in Bangladesh. The extension of VAT exemption for locally manufactured home appliances until June 30, 2025, is a positive step that will benefit import substituting industries. Similarly, the extension of VAT exemption for computers and ICT until June 30, 2026, acknowledges the growth potential of this sector.

To support domestic industries, the budget also includes VAT exemption beyond 5% at the production stage of optical fiber cable until June 30, 2024. This exemption will help boost the local production of optical fiber cables and contribute to increasing national coverage.

The increase in specific duty on cement clinker by BDT 200 for both manufacturers and importers, although aimed at revenue generation, could potentially impose an additional burden on the cement and construction sectors.

The increase in the VAT-free threshold for handmade biscuits and cakes is a positive move that will benefit small-scale producers. Furthermore, the higher tariff on cashew nut imports, with the TTI (Turnover Tax and Import Duty) increasing to 43% from 15.25%, aims to protect domestic producers and promote local cultivation.

In terms of customs duty, the budget introduces higher rates for imports of elevators and escalators, with customs duty raised from 5% to 15%. This move aims to expand revenue sources. The budget also introduces higher customs duty rates for certain items to support import substitution industries. This includes an increase in customs duty on low-capacity electric panels from 1% to 10% and an increase in customs duty on imported bicycle parts from 10% to 15%. While these measures offer protection to local industries, they may raise costs for assembly plants.

The impact of proposed changes in the duty structures on some other sectors is shortly summarized in the table below:

| Sector | Proposed Change | Possible Impact |

| Housing & Real Estate | – Increased tax rate on gain from transfer of properties. -Increase in the amount of specific duty by BDT 200 per metric ton on the import of cement clinker, implying a rise in import duty of BDT 10 per bag – VAT reduction from 15% to 5% on hot rolled stainless steel in coils used as raw materials by steel rolling mills, construction companies, and shipbuilding companies – Cancellation of concessional rates for importing tiles and consumable products – Increase of customs duty on imports of Lifts from 5% to 15% | – Increase in prices of properties and registration cost; – Although, some relief can be expected in the cost of construction due to the VAT reduction on hot rolled stainless steel and the cancellation of concessional rates on the import of tiles. |

| Consumer Staples | – 15% regulatory duty imposition on adhesive used in sanitary napkins and diapers – Imposition on 20% regulatory duty on the import of face washes | – Prices of sanitary napkins and diapers might increase due to the increase in duty; – Duty imposition on imported face washes might generate positive impact for domestic producers |

| Healthcare | – Three additional raw materials for diabetic drugs given concessional facilities – 100 more raw materials of cancer medicine to get duty relief | Prices of diabetic drugs and cancer medicines might remain stable |

| IT | – Imposition of 5% VAT on software production and customization process – Imposition of 25% customs duty and 15% VAT on the import all kinds of software – VAT exemption in excess of 5 percent at the production stage on optical fiber cable | – IT firms developing softwares to face increased duty; – Corporations/Individuals required to use legally licensed softwares to incur increased cost |

| Energy | – 7.5% VAT imposed on iron or steel used in LPG cylinder production during local manufacturing, up from the current 5.0% – Subsidized rate benefits on the import of raw materials required to manufacture LPG cylinders withdrawn | Cost of LPG cylinders to increase, and likely be passed on to consumers in terms of gas price |

| Agriculture | – Advanced Tax exemption on import of rice transplanters, dryers, all types of sprayer machines, potato planters used in agriculture. – VAT exemption on Coconut/Copra Waste at manufacturing stage which is used as animal feed | – Increased mechanization, boosting agricultural productivity; – Feed prices might experience decreased growth |

Overall, the FY2024 Budget introduces several measures aimed at supporting domestic industries, promoting import substitution, generating revenue, and reducing production costs. While some measures are commendable, there is room for further evaluation and revision of certain duty rates to ensure a balanced approach that fosters industry growth, while considering the impact on businesses and consumers.

The operating budget allocation for the health sector in the FY2024 Budget shows a modest increase of only 0.3%, albeit amounting to a 23.6% rise in absolute expenditure. Although there has been an increase in actual expenditure, which rose by 16% from BDT 21,647 crore in FY21 to BDT 25,028 crore in FY22, budget utilization has seen a decline over the past decade.

The total budget utilization has decreased from 94% in FY12 to 78% in FY22, indicating a concerning trend of underutilization of allocated funds. Development budget allocation has fallen from 7.2% in FY23 to 5.6% in FY24. While the operating budget allocation for health as a share of the total budget has slightly increased, it is worth noting that Bangladesh’s government expenditure on health as a share of GDP ranked the 4th lowest among 44 Least Developed Countries (LDCs) in 2020. Only Djibouti, Benin, and Gambia spent less on health than Bangladesh.

Furthermore, the budget allocation for health per person per year has seen a minimal increase of only BDT 70, from BDT 2,158 in FY23 to BDT 2,228 in FY24. This suggests that the increase in the allocation is not substantial enough to adequately address the gaps in the healthcare system. In terms of out-of-pocket expenditure on health per capita at purchasing power parity, Bangladesh ranked the 7th highest among 44 LDCs in 2020, indicating the burden placed on individuals for healthcare expenses.

These figures highlight the need for a more substantial increase in budget allocation for the health sector to improve access to quality healthcare services for the population. The current budget falls short in addressing the persistent challenges faced by the healthcare system in Bangladesh, including inadequate funding, infrastructure gaps, and low government expenditure on health compared to other countries. A more significant investment in the health sector is essential to enhance healthcare infrastructure, strengthen healthcare delivery systems, and reduce the burden of out-of-pocket expenses on individuals.

The Power and Energy sector in the FY2024 Budget has been granted a higher allocation of Tk. 34,819 crore, indicating a 28% increase compared to the previous year (RFY23). This allocation constitutes 4.6% of the total FY24 budget, surpassing the 4.1% share in the revised FY23 budget.

Within the Power division, there has been a notable 33.65% rise in absolute spending, in light of the Development budget. The current plan of the Bangladesh Power Development Board (BPDB) outlines the addition of 85 power plants, contributing a total generation capacity of 26,153 MW to the national grid in the upcoming years. However, it is worth mentioning that approximately 40% of the current capacity remains untapped, as confirmed by BPDB in May 2022. This raises concerns about the efficient allocation and utilization of resources.

Although the allocation for transmission and distribution has gradually increased, it is still deemed insufficient, with a notable emphasis on generation in the budget. Project aid in the Power division has experienced a significant boost of 51%, of which the majority has been directed towards developing transmission, followed by generation. It is imperative to further augment the allocation for transmission, both from government finances and project aids, to effectively harness the existing generation capacity. Simultaneously, there should be a gradual reduction in the allocation for generation, both from government finances and project aids.

The government has proposed the elimination of the current 15% VAT and 5% advance tax on the import of 13 oil and petroleum products. However, specific duties have been imposed at fixed rates on all types of petroleum products and fuel oils to ensure a consistent revenue stream amid fluctuating global prices. The policy mainly aims to mitigate any disruptions in revenue collection caused by the periodic formula-based price adjustment mechanism, expected to be introduced in September 2023. Given that the import of diesel, furnace oil, and other fuels contributes to a significant proportion of taxes from international trade and transactions, the National Board of Revenue (NBR) intends to maintain its stability.

Nevertheless, if the adjustment negatively impacts the financial position of the Bangladesh Petroleum Corporation (BPC), it is likely that the burden will be shifted to consumers. Hence, while the imposition of specific duties on petroleum products helps ensure revenue generation for the NBR, it may not necessarily guarantee consumer welfare.

In summary, the FY2024 Budget demonstrates positive developments in the Power and Energy sector, such as increased allocations and a focus on transmission. However, concerns remain regarding resource utilization, the need for further investment in transmission, and the potential impact on consumers due to specific duties on petroleum products.

The education budget in the BFY24 has witnessed a slight increase as a share of the total budget, rising from 10.67% in RBFY23 (Revised Budget) to 11.57% in BFY24. Similarly, the education budget as a percentage of GDP has also seen marginal growth, increasing from 1.59% in RBFY23 to 1.76% in BFY24. However, despite these improvements, the education budget falls short of the targets set in the 8th Five Year Plan, which aimed for a budget of 3.0% of GDP by FY25. In fact, in FY24, the education budget was not even 2% of GDP.

Comparatively, Bangladesh’s average education expenditure as a percentage of GDP from 2016 to 2022 was the 5th lowest among 41 LDCs. On average, at least 35 LDCs allocated 2% or more of their GDP to education during the same period. Additionally, there has been a decline in budget utilization, decreasing from 95% in FY19 to 87% in FY22. The growth in total actual expenditure has also experienced a decline of 12% between FY21 and FY22, while development expenditure as a share of the total has decreased from 34% in FY21 to 29% in FY22.

In terms of specific measures, while Bengali medium schools have been exempted from VAT in the FY24 budget, English medium schools continue to be subject to a 5% VAT, which adds an additional burden on middle-income households. Moreover, the total tax incidence on imported books stands at a high of 73.96% in the FY24 budget, posing a challenge to the achievement of SDG 4, which focuses on inclusive and quality education for all. As the proportion of children receiving education grows, the allocation for stipends for secondary, higher secondary, and madrasah education students has witnessed a substantial decrease of 43% in FY24.

In summary, although there have been slight increases in the education budget as a share of the total budget and GDP, it falls short of the targets set in the Five-Year Plan. The budget utilization and allocation for development expenditure have shown signs of decline, and specific issues such as VAT on English medium schools and high tax incidence on imported books hinder the progress towards inclusive and quality education. Furthermore, the decrease in stipend allocation raises concerns about support for secondary and higher secondary education students.

The FY2024 Bangladesh budget presents a mixture of ambitious goals, macroeconomic challenges, sectoral impacts, and areas requiring further attention. While the budget sets high targets for tax revenue increase, GDP growth, and inflation rate control, doubts arise regarding their feasibility. The need for comprehensive tax reforms, demand management policies, and greater emphasis on macroeconomic stability is evident.

The budget introduces measures impacting local industries, with some positive steps to support domestic sectors, but careful evaluation and potential revision of certain duty rates are necessary for a balanced approach. However, the budget falls short in providing a comprehensive plan for economic recovery and sustained growth, particularly in the healthcare and education sectors. Adequate investment, infrastructure development, and resource allocation are crucial for addressing the challenges faced by these sectors. To achieve sustainable economic development, a holistic approach that balances growth objectives with stability measures and prioritizes key sectors is imperative.

Priyo Pranto, Business Consultant at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: [email protected].

Our experts can help you solve your unique challenges

Stay up-to-date with our Thought Leadership and Insights