GET IN TOUCH

- Please wait...

The Investment Readiness (IR) Booster Workshop was delivered to participants from five key ecosystem builders in Bangladesh

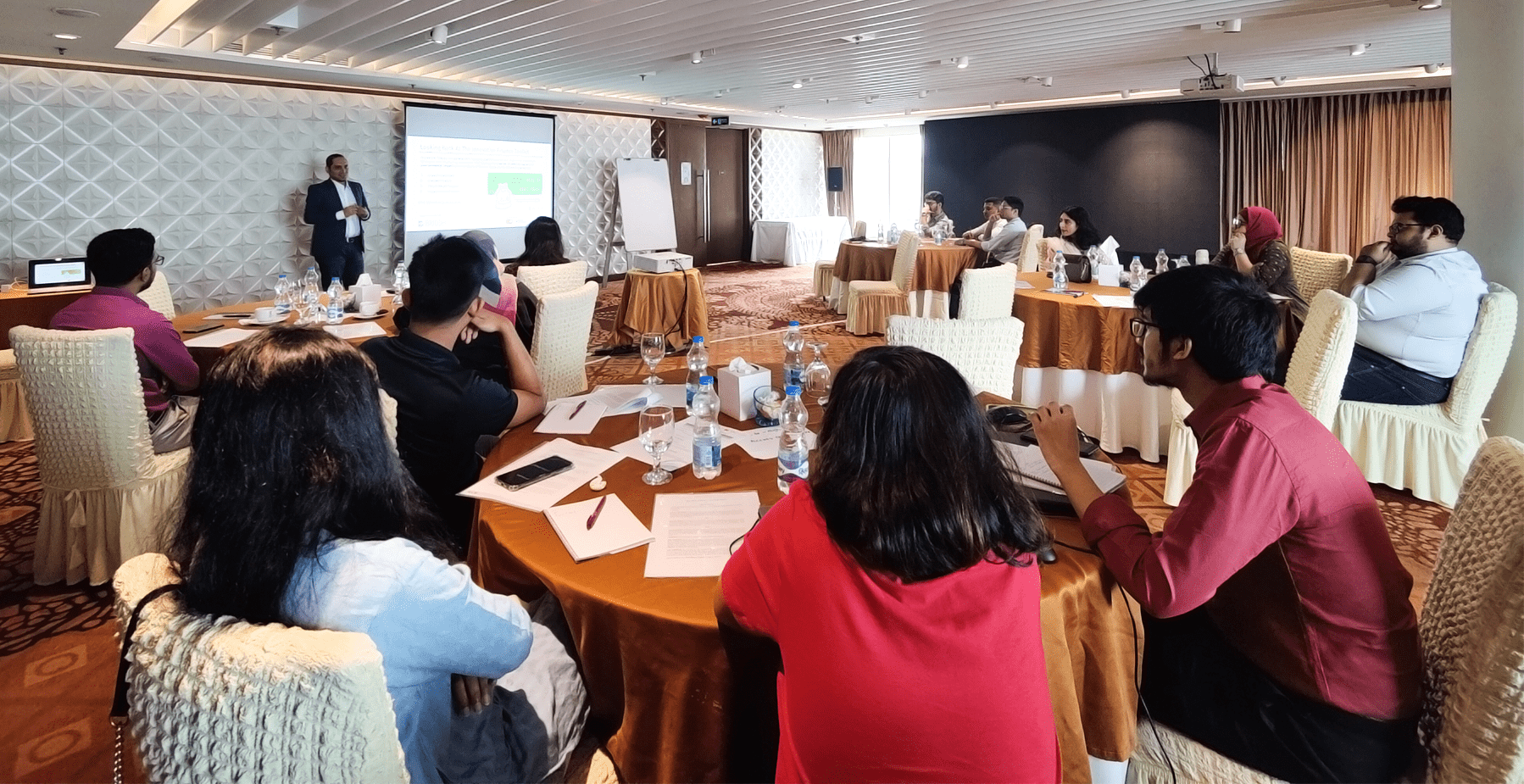

As a follow-up to the Impact Measurement & Management (IMM) Booster Workshop held in January, the Biniyog Briddhi (B-Briddhi) programme organized an Investment Readiness (IR) Booster Workshop to support the growing impact ecosystem in Bangladesh. The workshop was conducted with five key ecosystem builders on March 19, 2023.

The aim of the workshop was to refine and enhance the Investment Readiness knowledge and skills of the service providers, particularly in innovative financial instruments, deal structuring, and term sheet negotiation.

The workshop was attended by five key service providers: Bangladesh Angels Network, BetterStories Limited, Startup Chattogram with De Tempete Limited, Turtle Venture, and Truvalu.enterprises.

The workshop included two advanced-level sessions on financial instruments and deal structuring by Bijon Islam, Co-Founder and CEO at LightCastle Partners, which intended to build on participants’ existing skills in investment readiness from Biniyog Briddhi’s Train-the-Trainer programmes.

Based on the Innovative Finance Toolkit, participants delved into innovative financial instruments and their potential use cases at each stage of an impact enterprise. Additionally, there was an in-depth discussion around priced equity rounds and convertible instruments and various impact parameters. The sessions also included an analysis of SAFE agreements and common terms and clauses in a term sheet and investment agreement.

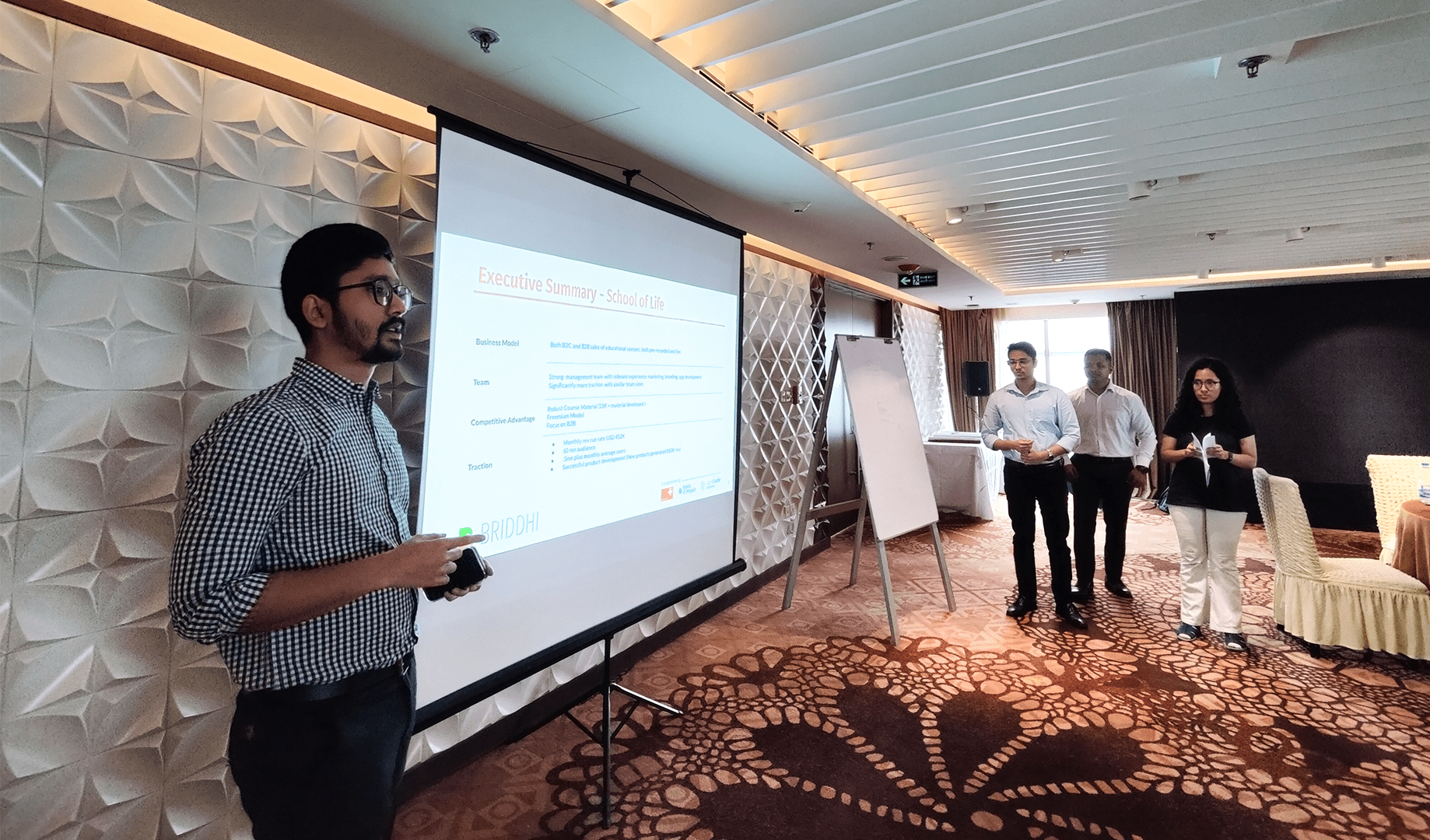

Participants were also tasked with an interactive group activity, in the form of an Investment Game, where they examined two education technology enterprises to determine which enterprise they would invest in, which financial instrument they would use, and what terms they would include.

To conclude the workshop, Mustafizur Khan, Partner at IDLC VC Fund I, Founder & CEO at Startup Dhaka, and Founder & CEO at Upskill, held a session on his experience and expertise from the perspective of an angel and VC investor.

Below are the five key takeaways from the IR Booster session:

This workshop underpins one of B-Briddhi’s key program pillars around Capacity Building. Through the workshop, key service providers in Bangladesh received crucial insights from prominent industry leaders on how to enhance and boost the local impact enterprise pipeline. Such capacity-building efforts will contribute towards Bangladesh’s budding impact investment landscape. To be part of this growing impact investing ecosystem in Bangladesh, stay tuned to www.sie-b.org!

Biniyog Briddhi is a multi-year program, supported by the Embassy of Switzerland in Bangladesh and implemented by Roots of Impact and LightCastle Partners. Set up as a public-private development partnership (PPDP), the programme strives to improve the financial, social, and environmental performance of impact enterprises by helping them to master investment readiness and impact management and get ready to access innovative finance to scale.

Our experts can help you solve your unique challenges